The best ELSS tax saving mutual fund to invest In 2023 and How I get full tax saving benefit without investing a single penny

Let me share the best ELSS Tax Saving mutual fund to invest in 2023 and a secret that I use, so I don’t need to invest any fresh Capital into the ELSS mutual fund and still get the full tax benefit.

You may find the title click-baiting but believe me, and it’s not. I don’t need to invest any fresh capital into the ELSS mutual fund now, and still, a completely legal and ethical way to get the total tax saving for me.

Let me explain how I do it.

Total Tax Saving Without Investing Fresh Capital

In 2019 I invested in fund one ₹1.5L. So check out the Best ELSS fund for 2019.

In 2020 I invested in fund two ₹1.5L. So check out the Best ELSS fund for 2020.

In 2021 I invested in fund three ₹1.5L. Check out the Best ELSS fund for 2021.

Now in 2022, I don’t need to invest any fresh capital.

I can withdraw the money from fund 1 (because it is available for redemption after the lock-in period of 3 years) that I invested in 2019 and invest 1.5 lakh in, say, fund 4.

My total invested amount in 2022 is 4.5 lakhs.

I can withdraw fund one and invest in the current year to get the tax benefit for this year.

Further, the invested amount of 1.5 lakhs can become two or even 2.5 lakhs. And if there aren’t any other long-term capital gains profit, I don’t need to pay any tax either. However, I may have to pay the tax if there is.

Further, I can withdraw up to 1.5Lakhs only from the first fund one and invest in the current year.

Why I Do it Like This and When You Should too?

I know this is not a very efficient way of investing in the market, but if I can beat returns from mutual funds, I will not be investing in them.

So if you can get better than ELSS returns, you should do the same, but not otherwise.

So my purpose in investing in an ELSS fund is to keep it for three years, get the tax benefit, and then take the money out. Then plough that money into the following year’s ELSS fund and keep the rest with me.

The same 4.5 Lakhs gives me benefits yearly because of some appreciation, and the capital remains invested in the market for tax benefits.

Do I need a separate fund each year?

No, you don’t.

You can do it in the same fund as well.

In the same funds, you will only have units available to withdraw that were invested three years back.

So once the 365 times three number of days pass, only those units become free to redeem.

However, I choose the same or different one depending on the best fund I find for that year to invest in.

It can be the same fund or a different one as well. For example, Mirae Asset Tax Saver Fund was one of my best fun in one or two years, so it has more than one year of investment.

So you don’t need to have three different funds. You can have the same fund as well. But generally, I prefer to use a different one, but there is no General rule that you should use a separate fund for my process and not invest any fresh capital.

The Top ELSS Mutual Funds for 2023

I am a very lazy investor, so if I have a tool that allows me to sort the mutual fund based on specific parameters or provides me with a ranking of mutual funds, I tend to use it and don’t reinvent the wheel.

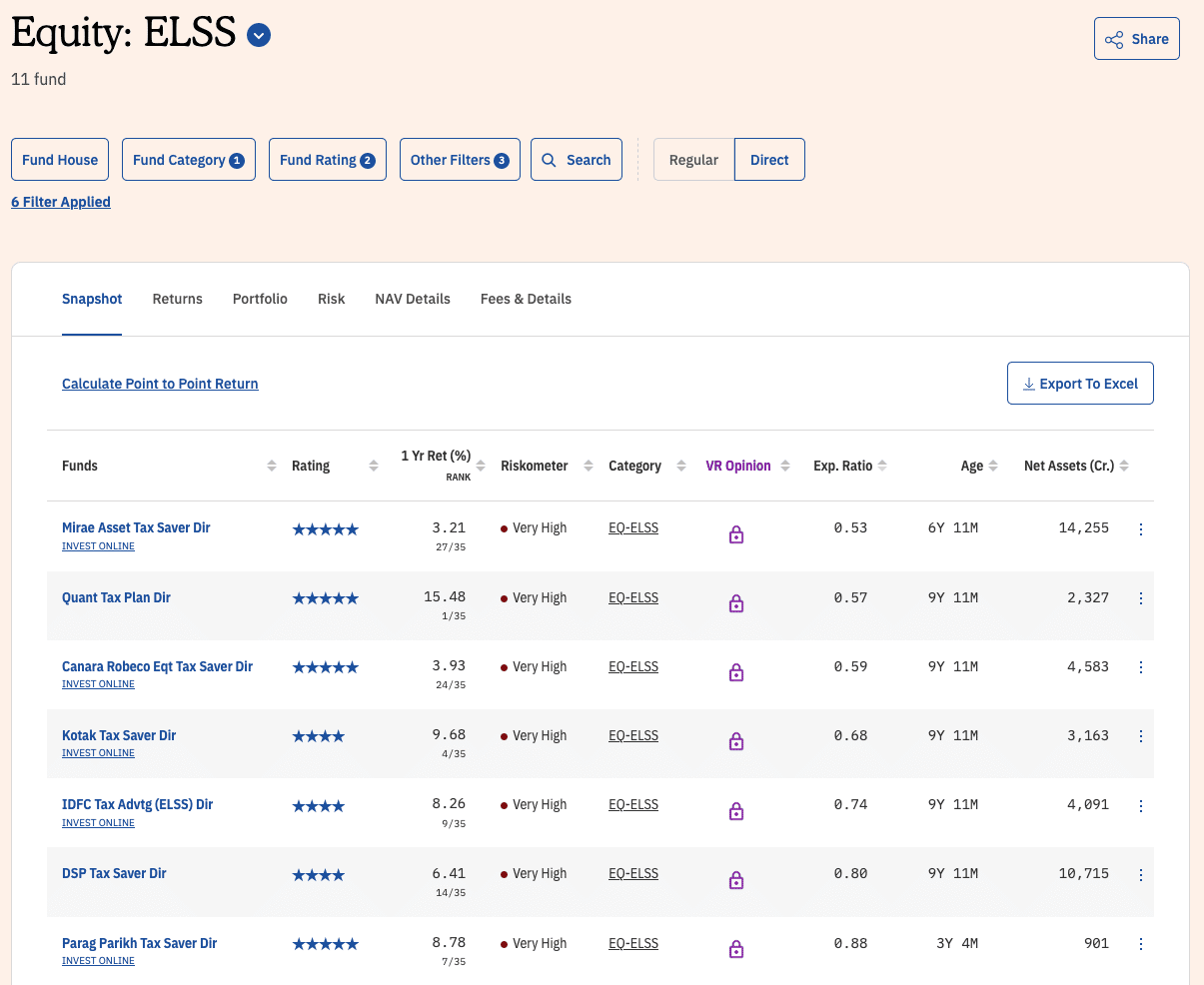

We start with ValueResearchOnline’s four and 5-star rated direct ELSS funds. Arrange them in decreasing order of the expense ratio. Now we have the ELSS tax-saving funds as follows:

You will find that the screenshot doesn’t match the video because the screenshot was taken on a weekend when I was writing the article, but the video was shot over the weekdays.

Best Tax Saving ELSS Mutual funds for 2023

We see that the Mirae Asset Tax server direct fund has an expense ratio of only 0.5 per cent, and it has a good asset under management, but its past year performance is not very good.

Quant Tax Plan

The quant tax plan has a meagre expense ratio and has generated 20 per cent returns in the last year.

It was my best tax saving fund for 2022 and had been performing well for the past year.

The performance has been stellar in one year, and I think this will continue in the challenging times ahead.

The AUM for this fund is increasing daily and has gone up from 500 Crores to over 2000 Crores. 4x in one year, and it is pretty impressive.

So it’s one it’s the better funds to invest in 2023 for sure.

Kotak Tax Saver

IDFC tax advantage fund and Kotak Tax Saver Fund have also generated good returns for the past year. So these two funds are also the best mutual fund to invest in 2023.

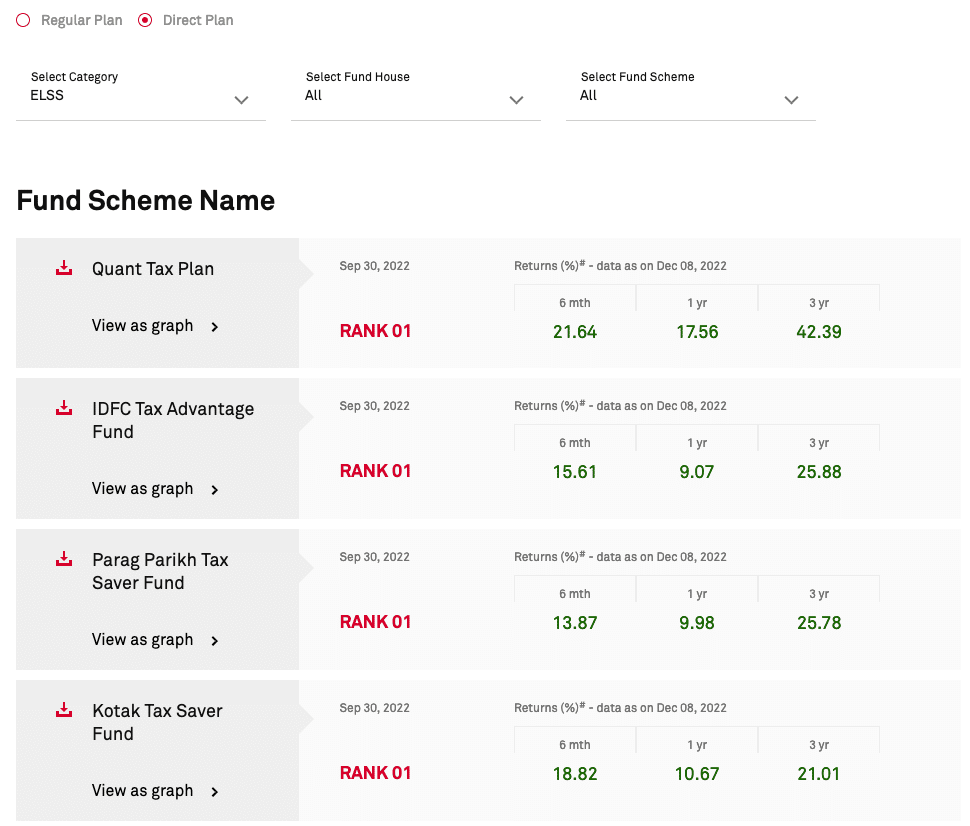

When we check CRISIL, they are ranked as the best funds.

Final Thoughts

This review is neither a sponsored one nor an endorsement that you should invest only in the funds mentioned above.

I have shared the complete process to find the best-performing ELSS tax saving fund for 2023. Feel free to apply your choice of criteria that gives you comfort while investing, like using three or 5-year returns to judge a better-performing fund.

Make sure to invest in direct funds. And finally, don’t invest in mutual funds because someone has recommended it to you, including me. Instead, always apply your investment logic to each of your investments.

Hello Sir

Thank you so much for writing so beautifully content about ELSS Tax Saving Mutual Fund to Invest in 2023.