From ValueResearchOnline data we build sectoral allocation matrix of the top-performing large-cap funds and select the fund that can outperform the benchmark.

Last week I selected the best midcap funds for 2017 along with the process as to as to how to select the funds that can provide you the right amount of exposure to mid-caps.

Many readers in comments and emails expressed interest in knowing the best large-cap fund as well so here is my process of selecting the best large cap fund for 2017.

The Top Large Cap Funds Of 2017

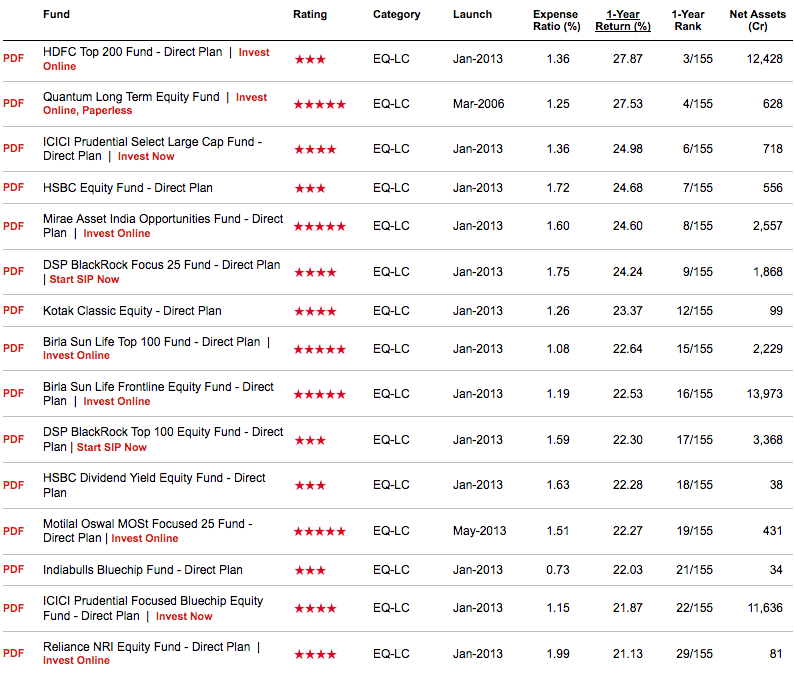

As always let us start with the top performing large cap funds. We select large cap direct funds that are rated as 3,4 and 5 star on ValueResearchOnline and has given more than 20% return in last 1 year.

Though all of the funds are large caps, they don’t have same benchmark.

| Fund | Benchmark |

| HDFC Top 200 Fund | S&P BSE 200 |

| Quantum Long Term Equity Fund | S&P BSE TRI-Sensex |

| ICICI Prudential Select Large Cap Fund | S&P BSE 100 |

| HSBC Equity Fund | Nifty 50 |

| Mirae Asset India Opportunities Fund | S&P BSE 200 |

| DSP BlackRock Focus 25 Fund | S&P BSE 200 |

| Kotak Classic Equity | Nifty 100 |

| Birla Sun Life Top 100 Fund | Nifty 50 |

| Birla Sun Life Frontline Equity Fund | S&P BSE 200 |

| DSP BlackRock Top 100 Equity Fund | S&P BSE 100 |

| HSBC Dividend Yield Equity Fund | S&P BSE 200 |

| Motilal Oswal MOSt Focused 25 Fund | Nifty 50 |

| Indiabulls Bluechip Fund | Nifty 50 |

| ICICI Prudential Focused Bluechip Equity Fund | Nifty 50 |

| Reliance NRI Equity Fund | S&P BSE 200 |

| IDFC Equity Fund | Nifty 50 |

| Franklin India Bluechip Fund | S&P BSE Sensex |

And we select the one that can help us with better diversification which is S&P BSE 200.

The Best Large Cap Funds Of 2017

We are left with following large cap funds.

| Fund | Benchmark | Net Asset |

| HDFC Top 200 Fund | S&P BSE 200 | 12,428 |

| Mirae Asset India Opportunities Fund | S&P BSE 200 | 2,557 |

| DSP BlackRock Focus 25 Fund | S&P BSE 200 | 1,868 |

| Birla Sun Life Frontline Equity Fund | S&P BSE 200 | 2,229 |

| HSBC Dividend Yield Equity Fund | S&P BSE 200 | 38 |

| Reliance NRI Equity Fund | S&P BSE 200 | 81 |

Large cap direct funds has similar expense ratio. S now we remove funds with under 100 Cr net assets because they may not be able to afford the best fund managers.

We are left with 4 funds.

So let us do sectorial comparision to S&P BSE 200 and see which fund has more exposure to sectors that can outperform in the future and has less exposure to sectors that may underperform.

| Fund | Auto | Tech | Pharma |

| HDFC Top 200 Fund | Less | More | Less |

| Mirae Asset India Opportunities Fund | More | Less | Less |

| DSP BlackRock Focus 25 Fund | More | Less | Less |

| Birla Sun Life Frontline Equity Fund | Less | Less | More |

I am only considering auto, tech and pharma sector for this analysis because I think 2017 will be an year of auto, tech and pharma as a sector.

My view is bullish on auto sector because I see a lot of new innovations coming up in the auto sector and expect some disruption as well.

I am not bullish on tech and pharma sector due to high dependency on the USA.

Funds that has more exposure to auto and less exposure to tech and pharma compared to S&P BSE 200 can outperform the benchmark.

So I select

- Mirae Asset India Opportunities Fund

- DSP BlackRock Focus 25 Fund

As the best large cap funds of 2017.

Final Thoughts

Again this is not an endorsement that you should invest only in the above funds but the emphasis is on the process that I followed to choose the best funds.

You can add other sectors like the metal or energy that you are bullish on and choose a fund that best suits your views. Apply your own creativity and investment instinct to find a best large cap fund for your investment.

Hi Shabbir,

What should be the allocation in all mutual funds. Let’s say I have Rs 100 to invest, how much amount in large cap,small cap, balance, diversified.

Depends on your risk appetite Rahul and there is no one rule for all. I am a equity investor and completely fine with the risk involved and so I don’t prefer a balanced fund but others, this may be completely wrong. Apart from your risk appetite, the time when you are looking at the market for investing . So at 10k+ Nifty, you should consider more allocation towards safer investing bets like balanced fund but if there is a correction, you should consider more allocation on large cap fund.

Small cap funds should be in range of 20 to 30% depending on your risk appetite. Similarly midcaps should also in the same range but if you are considering both small cap and midcap, both shouldn’t have high allocation in your portfolio combined.

HI Shabbir,

Which of the Following large cap stock would you recommend for a time frame of 5yrs –

1) Motilal Oswal MOSt Focused 25 Fund – Direct Plan (G)

2) DSP BR Focus 25 Fund – Direct (G)

3) Mirae Asset India Opportunities Fund – Direct (G)

4) Kotak Select Focus Fund – Direct Plan (G)

Also, is it good time to invest in Small cap Funds with time line of 5yrs, or should i wait till market correct.

Await your reply and thanks for your time.

Regards

Saurabh

Saurabh, somehow I missed your comment and so delay in response. I will say you should do the research and come up with the best fund as there is no general rule of 1 best fund. I have shared the process I followed and you can do your own research and see where this funds invest the majorly and if your views align with the fund, go with it.

Market correction is expected and this wait can be a long one and so you can do some of your SIPs now and when correction comes, you can add more to your SIPs

Thank you very much for the excellent exercise.

Any article if you can suggest on Micro-cap MF too, I am looking to invest in all 3 forms – Large, Mid, Micro?

Puru ji,

Have best fund for cap funds now and refer them here.

Best small cap fund https://shabbir.in/best-small-cap-funds-2017/

Best mid cap fund https://shabbir.in/best-midcap-fund-2017/

Liked the process once again and selection of mirae fund certainly acceptable.

Glad you like it Pravin.

Thanks for the article, very well written.

The pleasure is all mine.

Thank you so much for sharing this article Shabbir and your every article is to select the best fund of 2017 use a different process and that is the best part of it. Now we know 3 process to find 3 kinds of best funds.

Will love to read more if you have more coming up.

Glad it was helpful.