From ValueResearchOnline data we build asset allocation matrix of the top-performing mutual funds for last 1 year and select the fund that matches right asset allocation.

Last week I selected DSPBR Tax Saver Fund as the best tax saving fund for 2017 along with the process as to as to why I think the fund has the potential to outperform other ELSS tax saving funds in 2017.

Readers wanted me to come up with the best midcap and the best large cap funds. I chose to write about the best midcap fund of 2017 first because money is in the midcaps and I always prefer investing in a midcap fund over a large cap fund.

Why Midcap?

I prefer midcap fund because when you are investing in a large-cap fund, you prefer not to loose but when investing in a midcap fund you prefer to gain.

My investment philosophy is to gain and make profits with educated risks.

If you have been following my portfolio, you will notice that I started with large cap stocks like Tata Steel, L&T and Infy and it was because market was down and there were opportunities but I was investing openly and wanted to make sure I avoided losses.

Slowly moved over from large cap companies like Tata Steel, L&T, Infosys to midcaps like Pidilite and Britannia Industries.

So will definitely share my best large cap fund soon but let me first select the best midcap fund of 2017.

The Top Midcap Funds Of 2017

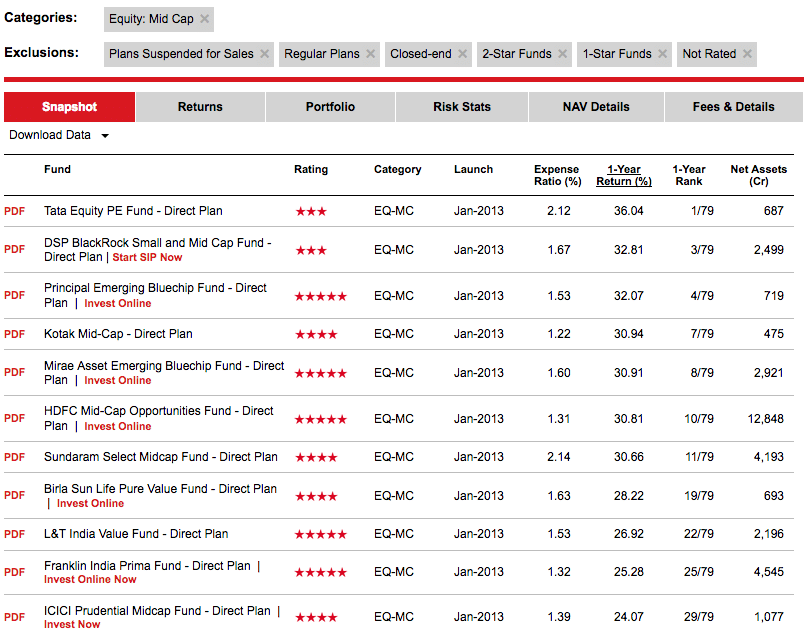

We select equity midcap direct funds that are rated as 3,4 and 5 star on ValueResearchOnline and has given more than 25% return in last 1 year.

The process to select ELSS fund was different where we only chose 4 and 5 star rated funds but here we also added 3-star funds because there are few 3-star rated mid-cap funds that have performed really well in the past 1 year.

The process is not rigid of only checking 4 and 5 star rated funds and we remain flexible when selecting.

Also note we are using direct funds instead of regular funds and it is because when we prefer investing for very long term, we can save on the additional expense ratio of 1%. Check Direct Vs Regular Funds. With ELSS I selected regular funds because I don’t invest for very long term and only for 3 years which is the locking period to save tax.

We have 10 funds as top midcap funds to invest in 2017 and so let us select the best midcap fund among them.

The Best Midcap Fund of 2017

Benchmark is always the first criteria to weed out any fund that is not benchmarked against our preference.

| Fund | Benchmark |

| Tata Equity PE Fund | S&P BSE Sensex |

| DSP BlackRock Small and Mid Cap Fund | Nifty Free Float Midcap 100 |

| Principal Emerging Bluechip Fund | Nifty Free Float Midcap 100 |

| Kotak Mid-Cap | Nifty Free Float Midcap 100 |

| Mirae Asset Emerging Bluechip Fund | Nifty Free Float Midcap 100 |

| HDFC Mid-Cap Opportunities Fund | Nifty Free Float Midcap 100 |

| Sundaram Select Midcap Fund | S&P BSE Mid Cap |

| Birla Sun Life Pure Value Fund | S&P BSE 200 |

| L&T India Value Fund | S&P BSE 200 |

| Franklin India Prima Fund | Nifty 500 |

Some value, opportunities and bluechip funds may be categorized as midcap fund but are benchmarked with BSE Sensex or BSE Sensex 200. So we only select the funds that are benchmarked against midcap index of Nifty or Sensex.

From ValueResearchOnline data we build a matrix of asset allocation towards capitalization for each of the fund.

| Allocation | ||||

| Fund | Giant Cap | Large Cap | Mid Cap | Small Cap |

| DSP BlackRock Small and Mid Cap Fund | 10.05 | 4.59 | 58.85 | 26.51 |

| Principal Emerging Bluechip Fund | 14.73 | 26.69 | 41.60 | 16.98 |

| Kotak Mid-Cap | 6.91 | 18.74 | 57.70 | 16.65 |

| Mirae Asset Emerging Bluechip Fund | 13.70 | 20.44 | 51.78 | 14.09 |

| HDFC Mid-Cap Opportunities Fund | 3.83 | 27.16 | 54.56 | 14.45 |

| Sundaram Select Midcap Fund | – | 13.37 | 76.04 | 10.59 |

Principal Emerging Bluechip Fund has very low exposure to midcaps and has high exposure of more than 40% to large cap and so not necessarily a midcap fund though is benchmarked with Nifty Free Float Midcap 100.

DSP BlackRock Small and Mid Cap Fund

The best performing fund is DSPBR small and midcap fund and it is because it has more exposure towards small cap companies. It means they have done their due research in much more detail to invest in those companies and so fund is performing exceptionally well but it also means you are exposed to lot more small cap companies.

Sundaram Select Midcap Fund

Sundaram Select Midcap Fund has most exposure to midcap companies and may be a better midcap fund with no exposure to giant cap stocks in its portfolio. The only issues I see is the expense ratio of this fund, it is quite high.

Kotak Mid-Cap

Has right blend of low exposure to giant cap, and large caps, good exposure of more than 50% to midcap and some small cap to boost the performance with low expense ratio. The only negative is it manages under 500 Crore of net assets.

HDFC Mid-Cap Opportunities Fund

&

Mirae Asset Emerging Bluechip Fund

Both the funds have low expense ratio, manages thousands of crores of net assets, has the right blend of exposure to the giant cap, large cap, mid cap and small cap stocks. Both the funds can be the right choice of midcap fund to invest in 2017.

Final Thoughts

This is not an endorsement that you should invest only in the above funds but the emphasis is on the process that I followed to choose the best funds and why only the performance of the fund should not be a factor to select a mutual fund.

We select the fund based on what kind of exposure we need and how it can get us the right kind of exposure and diversification to our investments. If we want less exposure to small caps, we can select a small cap fund instead of choosing a midcap fund that has lot more exposure to small caps.

Why we need best fund to invest for every year? If we switch investments between funds every year we loose power of compounding effect. More over the analysis is on which fund performed better last year, it is past year data. There is no guarantee that this funds will perform the same way this year. So stopping investment is existing funds is not a good idea I think. What is your opinion on this.

True. The idea isn’t to switch but let the other investment remain and if one wants to start new, he can do it in better funds.

why L&T MIDCAP FUND WHICH LAUNCHED IN 2004 WITH A GREAT PERFORMANCE, HAS AUM OF JUST 1300CR COMPARING IT WITH HDFC MIDCAP WITH 17000CR AUM OR WITH RELIANCE SMALL COMAPNIES WITH 5000CR AUM !!!! FURTHER I WANT TO KNOW WHICH FUND I SHOULD PICK BETWEEN

1)L&T MIDCAP FUND

2)RELIANCE SMALL COMPANIES FUND

3)L&T EMERGING BUSINESSES FUND

KEEPING IN MIND THE INVESTMENT FOR 20YEARS

Why the AUM of some companies is smaller than others is because more people prefer to invest in the later funds and so they have more asset under their management. New fund launched now will have more money to manage than launched in 2008 crash time for sure. What I mean is there can be lot of factor for that.

Regarding choosing the right fund, I have shared the process I have used and you can follow the same process to choose the fund or can create your own process.

Most of the fund as 2 things direct and normal , Which one to invest Shabeer .For example :-Franklin India Smaller Companies Fund (G) , Franklin India Smaller Companies Fund – Direct Plan (G)

Direct always. See https://shabbir.in/direct-mutual-funds/ and https://shabbir.in/direct-vs-regular-plans/

This is a great article of 2017 on MFs.

Would you also explain similar on selecting one large-cap?

Sure. I am in process of writing the same and so stay tuned.

Dear Sir

Tks a lot for sharing your thoughts on MIDCAP category.Its my most favorite category for investment.

Yours way of explaining gives insight for selection of funds.I really loved the way of explanation.

I liked both funds you have selected and I am also investing in them.

Pl give some idea for Large cap also.

Regards.

Pravin glad you liked it and I will try similar comparison for large cap funds as well but you can use similar approach to large cap funds as well.

Definitely Sir.

But not sure to choose index for LC.SENSEX or NIFTY?

BSE 100 or BSE 200?

Lot of divergence for all four index.Specially BSE 200 covering mid caps gives best return among all four index.

Regards

If you are adding a midcap along with large cap fund, opt for the index funds or even an ETF. ETF Vs MF here – https://shabbir.in/etf-vs-mutual-fund/

So for large cap funds if you are only opting for one fund, opt for a BSE 200 fund but not otherwise.

Hi Shabbir, Quite an

informative article. How abt commencing SIP in mirae assets emerging or hdfc mid cap opportunities fund for a duration of 10 yrs. Pls advise

Good decision I must say.

Dear Shabbir,Thanks for article on midcaps.As dsp midcap fund looks better,it has got overlapping issue wih two out performing funds from DSPBR.

DSP Microcap and DSP mid cap funds have 29%(23)common stocks.

DSP Taxsaver and DSP mid cap funds have 22%(22)common stocks.

Then I did other exercise with Mirae asset emerging blue chipfund

DSP Microcap and Mirae asset E bluechip funds have 6%(5)common stocks.

DSPTexsaver and Mirae asset emerging bluechip funds have 18%(15) common stocks.

This exercise was done the fundoo.

Your comments are awaited.

Dear Jawaharlal,

DSPBR is not my choice of fund and it is because it invest too much in small cap stocks and so it has performed well. My choice is HDFC and Mirae funds and you can read them in article why.

Again there will always be stocks that are common in many funds and there is no way to have completely non intersecting portfolio and that is not the aim either. What I did try is choose a purely midcap fund and then have a large cap and small cap fund to add diversity instead of choosing DSPBR which has high exposure to small caps.

great Article. what about DSP black rock Micro cap fund ? this give more return than DSP Small & mid cap fund

If you want to select small cap funds, you should opt for those fund but these are midcap funds.

Shabbir,

I am getting a large amount of cash as inheritance and I want to invest this amount in the market through MF.

My investment horizon is at least 15 years, so that my 5 years old daughter can use this amount when she will need it.

So, how do you suggest me to invest it in the market? Should I invest everything in one go, or should I invest few lakhs a month in SIP and invest the entire amount over a period of 12/18 months?

Please suggest.

Utpal,

My suggestion will be to divide the whole amount into 4 to 6 tranches and invest them in a period of next 12 to 15 months. Wait for some dips to deploy them.

You can start some amount in SIP and add 10% of your total amount you want to deploy for every 5% correction.

Again once you have identified the right time, you should also deploy them in right funds. Best would be to keep 50% in midcap and small cap funds and rest in balanced or large cap funds.

Hope it helps.

This is quite informative article Shabbir and I always thought DSPBR small and midcap fund was better choice as it was performing and now I know why it performed so well. Thanks once again for sharing

Glad you liked it Suresh.

Good artcle. So far I never iever invested in mid cap other than IDFC premium equity( which is not performing well) but now i will start. with DSP.