The best multi-cap fund for 2017 with consistent outperformance history for a decade. If you had to invest only in one fund in 2017 it should be a multi-cap fund

We have

- The Best Small Cap Funds to Invest in 2017

- The Best Midcap Funds to Invest in 2017

- The Best Large Cap Funds to Invest in 2017

This is the final post in the series best mutual funds of 2017 to invest in.

What is Multicap?

Mutual funds that can invest in stocks across market capitalization are known as multicap funds. In simple terms, a fund that can invest in large cap companies as well as in mid and small cap companies is known as multicap fund.

The biggest advantage of a multi-cap fund to large cap or midcap fund is – it doesn’t have a limitation to the amount of exposure it can take to midcap stocks in a rising market or a limitation of mid-cap fund that can’t move to large-cap stocks in a falling market to limit its fall but a multi-cap fund can change its nature according to the situation.

Why Multicap Funds?

Multicap fund is the best choice of fund for Indian retail investor who is looking to invest a small amount of money in the market every month through SIP. If one has to choose only one fund to invest in the market, his choice of a fund should always be a multi-cap fund.

Let me explain why.

1. Asset Allocation

Let us assume that you want to invest ₹5000 per month as SIP. What will be allocation plan in large-cap, midcap and small-cap funds?

The choice will be one of the following allocation to large cap, midcap and small cap fund.

| Kind of Investor | Large Cap | Midcap | Small Cap |

| Very aggressive Investor | ₹1000 | ₹2000 | ₹2000 |

| Aggressive Investor | ₹2000 | ₹2000 | ₹1000 |

| Not So Aggressive Investor | ₹3000 | ₹1000 | ₹1000 |

I can add few more rows by making few more kind of investors but the disadvantage to such an allocation is, it is based on a risk appetite of the individual investor and not on the based of growth potential of companies based on capitalization.

2. Less volatility High Returns

Historically multi-cap funds outperform large cap funds and at par with small and mid cap funds.

Midcaps provide better returns but are more volatile as well. So a midcap fund will show more volatile when compared to large cap fund. Multi-cap funds can dampen the volatility of the fund by investing in large-caps stocks and allow it to grow with midcaps stocks.

So a multi-cap fund is for those who don’t want to take the trouble of asset allocation to right cap funds or for those who are new to equity mutual funds and don’t want to be seeing too much volatility and yet want best returns.

Top Multicap Funds

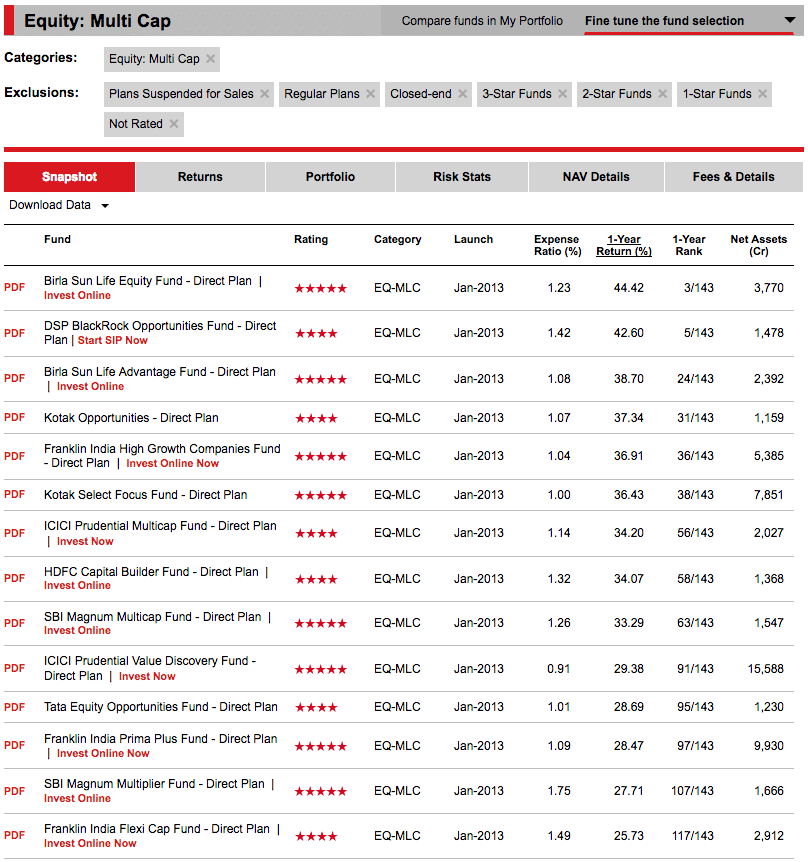

We start with the 5 and 4 star rated multi-cap funds from ValueResearchOnline and select funds that manage more than 1000 crores of net assets. We avoid small funds as those small funds can have an issue hiring the best fund managers to manage the fund. The performance of multi-cap fund will depend on a lot more on the fund manager.

Let us start with the benchmark of each fund.

| Fund | Benchmark |

| Birla Sun Life Equity Fund | S&P BSE 200 |

| DSP BlackRock Opportunities Fund | Nifty 500 |

| Birla Sun Life Advantage Fund | S&P BSE 200 |

| Kotak Opportunities | Nifty 500 |

| Franklin India High Growth Companies Fund | Nifty 500 |

| Kotak Select Focus Fund | Nifty 200 |

| ICICI Prudential Multicap Fund | S&P BSE 200 |

| HDFC Capital Builder Fund | Nifty 500 |

| SBI Magnum Multicap Fund | S&P BSE 500 |

| ICICI Prudential Value Discovery Fund | S&P BSE 500 |

| Tata Equity Opportunities Fund | S&P BSE 200 |

| Franklin India Prima Plus Fund | Nifty 500 |

| SBI Magnum Multiplier Fund | S&P BSE 200 |

| Franklin India Flexi Cap Fund | Nifty 500 |

And select funds of broader benchmark as they have more stocks to outperform. We select Nifty 500 and S&P BSE 500 as the benchmark and avoid other funds.

The Very Long Term View

Multicap fund provides stability of large-cap stocks and returns of mid-cap making it take advantage of both the scenarios but it can also mean they can suffer when the call of the fund manager goes wrong.

The long term consistency of the fund is more important because performance of the fund becomes highly dependent on the fund manager. So let us analyze the returns of funds for more time frame.

| Fund | 1Year | 3Years | 5Years | 10Years |

| DSP BlackRock Opportunities Fund | 41.20 | 25.20 | 17.38 | 12.31 |

| Kotak Opportunities | 35.53 | 24.46 | 16.57 | 12.46 |

| Franklin India High Growth Companies Fund | 35.21 | 29.86 | 22.32 | NA |

| HDFC Capital Builder Fund | 32.54 | 22.71 | 16.85 | 13.74 |

| SBI Magnum Multicap Fund | 31.85 | 27.35 | 19.23 | 9.43 |

| ICICI Prudential Value Discovery Fund | 27.72 | 28.58 | 20.96 | 16.87 |

| Franklin India Prima Plus Fund | 27.01 | 24.75 | 17.66 | 13.27 |

| Franklin India Flexi Cap Fund | 24.73 | 22.79 | 16.26 | 12.28 |

The Best Multicap Fund of 2017

The above matrix leaves us with the only best multi-cap funds.

ICICI Prudential Value Discovery Fund

The only fund who has been able to provide a return of more than 15% for the last decade in the multi-cap category. Clearly a consistent outperformer and justifies more than 15 thousand crores worth of net asset under management.

Vinay pointed out that ICICI Prudential Value Discovery Fund has not been a multicap fund but I could not find anything related to it in Google and so asked it in our FB group and this is when I found a reference to this article. The final verdict is ICICI Prudential Value Discovery Fund is not the best Multicap fund to invest in 2017 because it has performed well enough as midcap fund but not sure if it can perform as multi-cap fund as well. The 15k crore of Net asset may have forced them to move from midcap to large cap fund and so may have opted for a change in benchmark.

Franklin India High Growth Companies Fund

It was launched on Jul 26, 2007, and so in next few months it will complete 10 years and this fund has shown a good promise for the last 5 years. Still when we have a clear stand out performer in the name of ICICI Prudential Value Discovery Fund and so there is no point to opt for the second best fund.

Final Thoughts

It is not an endorsement that you invest only in the above funds but the emphasis is on the process that I followed to choose the best multi-cap funds for 2017 where I selected funds based on the consistent performance history.

Why Tata P/E fund has not been considered when it is giving stellar returns,with comparartively lesser risk

Tata PE is classified as a midcap fund and not a multicap fund. Check https://www.valueresearchonline.com/funds/newsnapshot.asp?schemecode=2267

ICICI Prudential Value discovery Fund used to be a midcap fund till recently. The cagr of 15% over 10 yrs is delivered being a midcap fund. Hence it’s not fair to compare it with other multi-cap funds. Your article is misleading investors. And @ AUM of 15000 crore, it is difficult to give same kind of returns. Many schemes suffered after crossing 10000 CR AUM

Vinay, thanks for pointing it out and can you tell me how much time it was midcap and when it became multicap? I did not found any article when I searched in Google. Found this http://indiatoday.intoday.in/story/investment-multi-cap-funds-large-cap-funds-risk-reward-profile/1/866780.html and it also says ICICI Pru Value Discovery is a multicap fund only giving awesome returns.

It was launched in 2004. It is a midcap fund till end 2015 based on its allocation. Then it started taking exposure to large caps as well due to large AUM. Yes, today it is a multi-cap fund, but the good returns are due to its midcap nature from 2004 to 2015. Hence, suggesting the scheme as best multi-cap fund is not justified as it gave those returns as a mid-cap fund but not as multi-cap. If from today, it gives good returns for next 10 yrs, then you can say its best multi-cap fund

Totally agree with you on that part if it was midcap from 2004 to 2015 but now how do I know it was midcap fund in that time frame. Can I get some reference or it is you know because you track this fund?

Vinay, has updated the article about the fund as well as found the reference to the change in its benchmark. Thanks for pointing that out to me.

Nice conclusion.Some mutual funds experts recommend to invest only in multicap funds to avoid risk in small cap and mid cap funds.

Agree but remember returns are in the midcaps only.