Find the best small-cap fund for 2021 along with the selection process and review the performance of the best small-cap fund of 2020

Let us find the best small-cap mutual fund to invest in 2021 and review the performance of our choice of best small-cap fund of 2020.

So let’s begin.

The year 2020 was quite different because it saw complete pessimism in the first four months and real optimism in the second half. So it was even more challenging for small-cap stocks and predominantly small-cap funds.

In the end, the Sensex and the Nifty did well in 2020, but one can’t say the same either for the small-cap index.

Investing in the right stocks and funds in 202 made sure there is joy in the end. Still, I believe the SIP amount invested in the first half of 2020 in a small-cap fund will give its share of pleasure and benefits over time for many passive investors.

The Top Small-Cap Funds for 2021

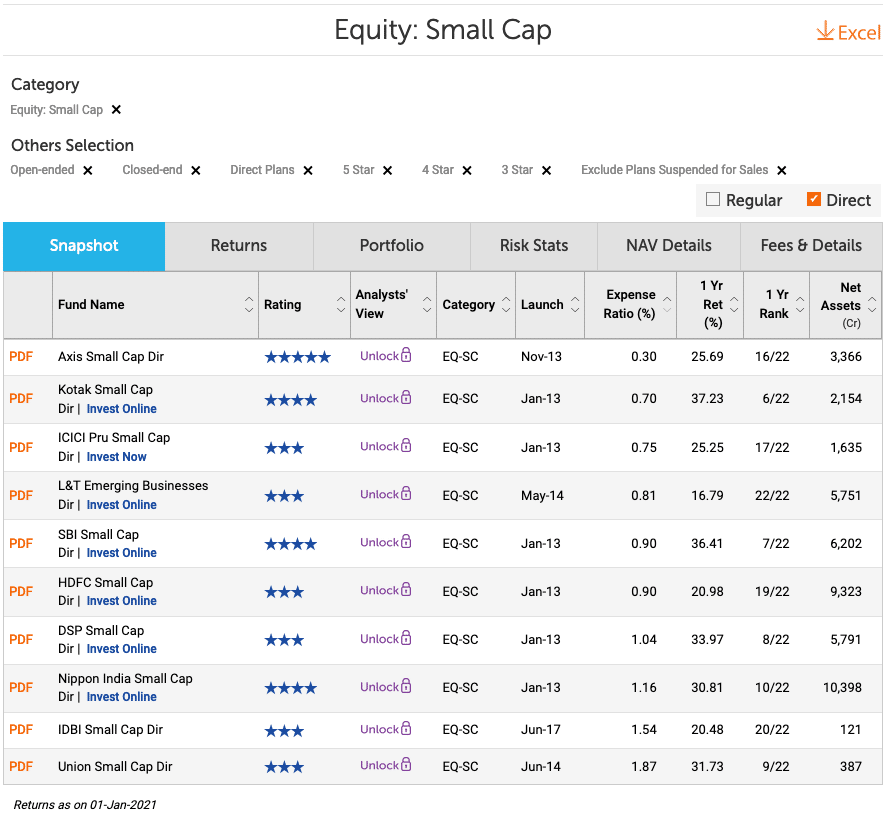

We will use the process to come to the best small-cap fund for 2020 is – from the 3, 4, and 5-star rated small-cap fund by ValueResearchOnline, we will compare the performance for the past year along with expense ratio to get the best small-cap fund.

We use 3,4, and 5 star rated funds instead of only 4-star and 5-star rated funds because there aren’t many funds rated as 4 and 5 stars — only four funds in total.

Best Small-Cap Fund To Invest in 2021

Small-cap performance depends mainly on selecting good and quality small-cap stocks that can become mid-cap and large-cap over time.

Averagely good expense ratio and right allocation to the small-cap stocks can mean the fund can outperform in 2021 when the Nifty and Sensex consolidates and the broader market outperforms. At least that is the view I have right at this moment. However, it can change as 2021 unfolds new surprises.

Axis Small Cap

Axis small-cap fund has everything one needs to outperform.

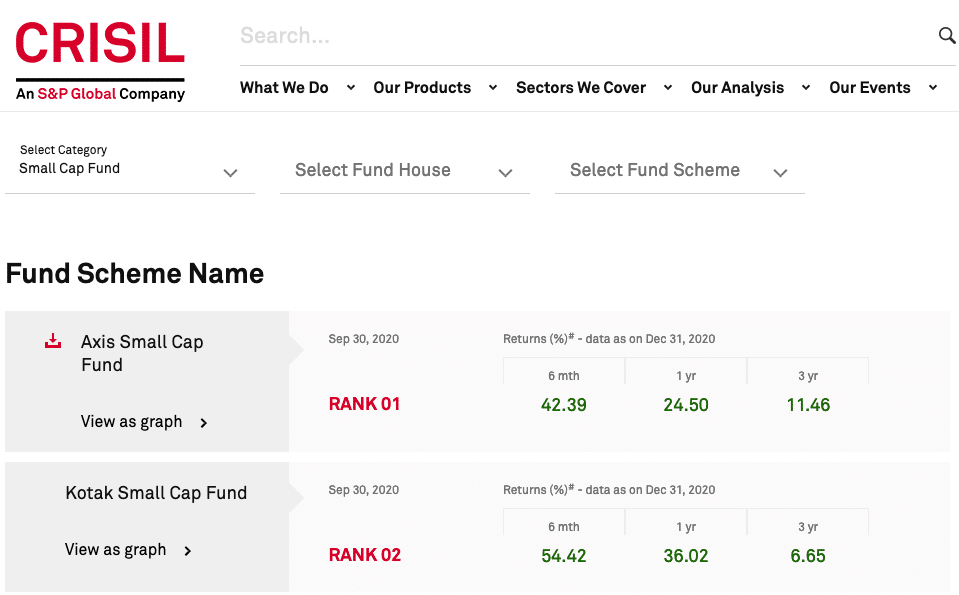

Moreover, CRISIL also ranks Axis Small Cap Fund as the best small-cap fund for 2021.

One more point which needs a mention is the outperformance of the Axis fund house.

- Axis Bluechip Fund is the best Large Cap fund of 2021.

- Axis Midcap Fund is the best Mid-cap Fund of 2021.

Kotak Small Cap

Small-cap fund performance can vary a lot, depending on the stock selection process. So if one wants to opt for diversification, one can opt for more than one small-cap fund.

As the best small-cap fund of 2021, the second fund has to be Kotak Small Cap, which is also CRISIL’s small-cap fund choice.

How Well The Best Small-Cap Fund of 2020 Performed?

I share the series of best funds because we evaluate how we have done in the past. It means either we do well investing or we learn from the selection process.

The best small-cap funds of 2020 were:

- Axis Small Cap Fund

- HDFC Small Cap fund.

Both the funds have returned 25%, and 21%, respectively, which I don’t think is bad at all. Now I can be a little more confident that the process we are using to choose the best small-cap fund for investing is working.

However, HDFC small-cap fund isn’t part of the 2021 best small-cap fund because we have another excellent fund to invest in.

Final Thoughts

Small-cap investment is all about investing in future leaders. It doesn’t mean HDFC small-cap fund can’t choose better funds.

In case you have not selected a better performing fund earlier or want to move to a new fund for any other reason (move to regular to direct funds). Don’t exit the investment in the old fund. Just stop the SIP and let the invested amount remain and grow over time in the past funds. Create a new SIP in the new funds.

As always, this isn’t an endorsement of any fund. The emphasis is on the process. The funds may be doing well now, but when you want to be investing, use the same process and find the best fund at that time to invest. Use ValueResearchOnline and CRISIL as and when you want to invest in 2021.

Thanks Sir. So Axis small cap seems best. I have already stopped in Franklin and will be starting in this. But I have a query, is this good to invest in small cap or multicap as I have already heavy investment in small and running sip in large, mid, mid-large.I hope, market will be doing good in 2021 assuming this my inclination is towards small but considering already investment thinking about Multics..please suggest..

Thanks

Mukesh

You should allow some diversification in market cap based on your required returns. SmallCap means more volatility but chances of higher returns.

I will suggest you should consult a financial advisor and not take decisions randomly. I am not a financial advisor but an equity investor only.

Thanks Sir!