Bitcoin has been one of the fastest growing asset class for years now. No asset class in the world has ever performed better than BitCoin and it seems there is no stop to it.

I shared an article about What is BitCoin in August 2017 and the price of Bitcoin has doubled since then. It has been one of the fastest growing asset class for a couple of years now. No asset class in the world has ever performed better than BitCoin and it seems there is no stop to it.

This is how all-time chart of BitCoin is.

The question is Why is Bitcoin worth so much?

I am afraid of writing an article on it because I schedule my articles few days in advance and you never know how things will pan out when the article goes live. BitCoin may have crashed or skyrocketed to new highs. Still, I will give it a try and answer why is BitCoin is more than $7,500.

The answer is simple, there is more demand for BitCoin than supply. The simple reason for the demand is:

- Is considered an investment – The reason for the higher demand is, it is used as an asset class and considered an investment opportunity. So investors are stocking BitCoin in their digital wallet. The rise in prices gives more and more investors confidence that it will keep on rising but actually, it is creating the bubble.

- Some Countries have made it legal – Investors are considering BitCoin as an asset class because it has limited supply. There can only be 21 million BitCoins and Japan, a technologically advanced country, and a major economy made Bitcoin a legal payment method nationwide and the Philippines is following soon. So investors are in a hope that more and more countries will follow and so the price of BitCoin will keep on rising from here.

But I see the demand to be too strong for only investors interest.

A Threat to Central Bank’s Existence

BitCoin is not only a threat to worldwide banking system but also to the currency system as a whole. Yes, you read it right, it is a threat to the currency system. Currencies have evolved in the past 100 to 150 years from being printed by central banks against gold deposits to what we have now where central banks can print their currency to the extent they have demand for it.

Any country where transactions occur in Bitcoin, the country’s central bank will have no takers for its currency – Printed or even if they come with their Digital currency. BitCoin is a bigger threat to the US because dollars is more of a global currency and if people start using BitCoin means there will be no use of USD.

What if some country wants to own a large chunk of BitCoins?

High demand for an ongoing basis for BitCoin can be due to some central bank of a country may be piling up BitCoin to make sure when they announce it to be legal, they have enough in the reserve.

Quite a possibility but we may never know it for sure.

Some central bank (China, Russia, Korea, US or even India …) may be considering to own most of BitCoins. America has the largest stock of Gold and is estimated to hold roughly 2.3% of all the gold ever refined throughout human history. Gold reserves were the sign of richness in the 19th century but you never know the next superpower of the world may be the country that owns most BitCoins.

The transactions can’t be monitored and controlled due to blockchain technology but a country can definitely own a large chunk of it to dominate its power going forward.

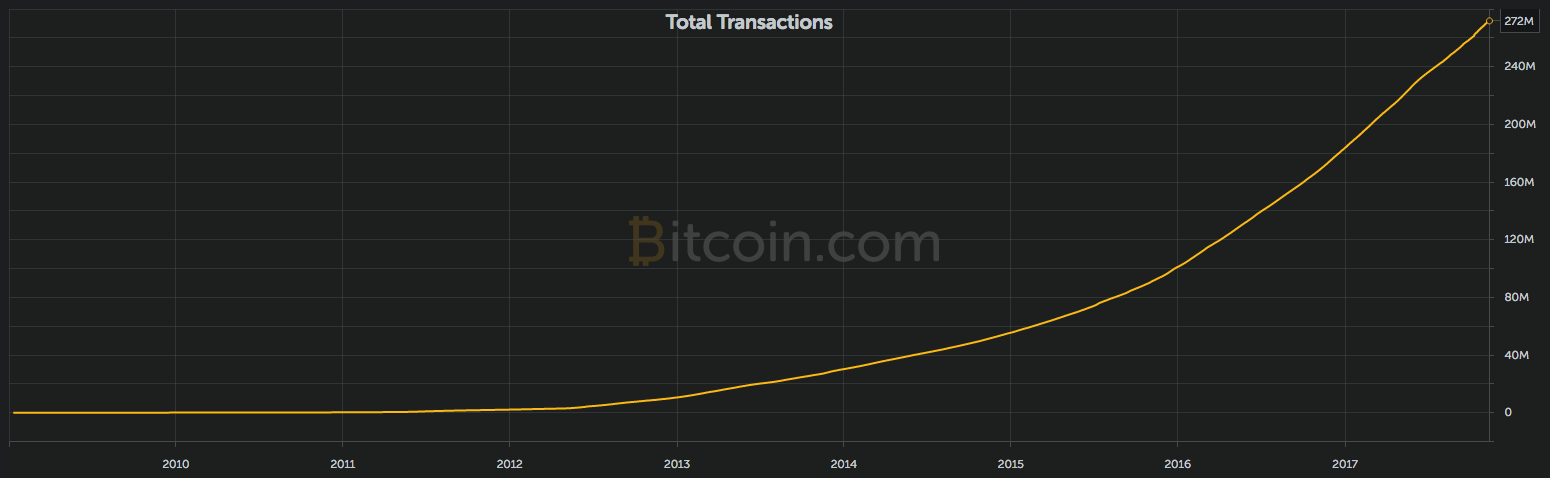

It is not the price of BitCoin that is the only thing that is rising. The total number of transactions are also on the rise.

Quite likely some deep pockets are behind BitCoin to own it.

What if Bitcoin becomes too costly?

In INR terms, it costs 5Lakhs to own one bitcoin but why do you want to transact in integral numbers greater than 1. In the world of BitCoin and Cryptocurrency, the number 1 can be the next infinite and we can go as low as (1/$10,000) as the price which is like ₹50 as on today.

Why can’t we change how we write the price tags.

Final Thoughts

I don’t predict the price of BitCoin but it means this will be a good phenomenon to keep a watch on and see how things pan out but I will only be watching and not put my hard earned money in it for sure. Seems too volatile for me to handle it.

Though bitcoin have suffered some major hiccups in form of ban in China and Korea. Its value has only increased reconfirming its strong future and the blockchain technology on which it is based.