Can an Indian retail investor invest like Warren Buffett? The answer is YES. Here is the process to cherry-pick stocks during the tough time for the Indian economy.

How to Invest in Auto Sector in 2019 In the Midst of EV Disruption

Why not invest in these Indian auto sector companies in 2019 in the midst of upcoming EV disruptions who are sure to pass making it a risk-free investment?

When is the Right Time to Exit a Stock?

When is the Right Time to Exit a Stock? 1. When Management takes Rash Decision. 2. When Business Environment isn’t Stable. 3. Other Better Investment Opportunity +3 more

The 3 Attributes of Stock That Fall the Most in Corrections

The current market correction has taught me some good lesson I like to share with my blog readers. And ask your best investment lesson learned in this correction?

How I Value a Stock For Investing Using Financial Ratios?

One has to identify at what valuation one is comfortable investing and then invest in the right stock at the right price and for the right time to make the most returns from the investment.

How to Read Critical Information in the Annual Reports Faster?

What critical information to look in the annual reports before investing in any company and how to judge the management and the future outlook of the company.

The Type of Stocks I Avoid Investing Now and Why?

Understanding the current market correction, the stocks and sectors to avoid now but more importantly where to look for next market leaders and multi-baggers

How I Use these 7 Sites For All My Fundamental & Technical Analysis

How I use these 7 websites Screener, Investello, ValueResearchOnline, MoneyControl, BSEIndia, ChartInk, TradingView to quickly reject not so good investment opportunities

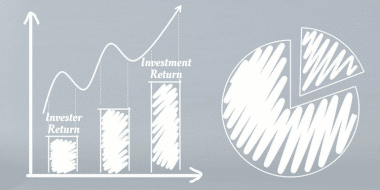

Investment Return Vs Investor Return – Why Investors Earn Below Average Returns?

The average retail investor isn’t able to create wealth in the market despite markets doing so well. Why there is so much gap between investment return and investor return?

How to Know if A Stock is Overvalued or Undervalued?

Is there any process to judge if the company is overvalued or undervalued? The answer is yes. I share my complete process to find out if the company is overvalued or undervalued.

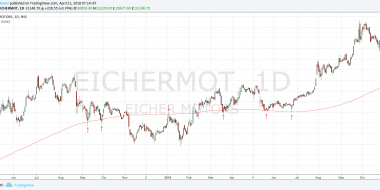

Why Companies like MRF / Eicher / Page Industries Don’t Announce Stock Split?

5 of the most common reasons I see why companies like MRF Ltd, Eicher Motors or Page Industries don’t announce bonus shares or stock split.

What Are Some of the Good Stocks To Buy in Current Market Conditions of 2018?

I have been getting this question in my inbox and on Quora often. So I will answer the question but don’t expect a list of stock in the article to directly invest into.

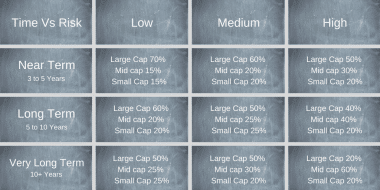

What is Ideal Asset Allocation (Market Cap Wise) For Buy and Hold Investor?

This article is not about the asset allocation into debt and equity but it is about the right mix of market cap allocation to your equity part of the investment based on your risk appetite and the time horizon for your investment.

Why I Avoid Investing in Mutual Funds but You Shouldn’t?

I don’t invest in mutual funds to the extent a retail investor should be investing. This is against my own view where I recommend every retail investor should invest in mutual funds.

200 Day Moving Average – It’s Importance and the Magic That Keeps Happening

The 200-day moving average commonly expressed as 200DMA is a very popular and widely accepted technical indicator among traders to analyze the underlying trend.

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- 6

- …

- 11

- Next Page »