Investments are meant to make money but there are investments where every one of us has invested and lost money. Do you want to know where?

Investments are meant to make money but there are investments where every one of us has invested and lost money. Some may argue that they have not lost money mathematically but financially everyone has lost money.

1. Investing In Insurance

Insurance is all about getting insured period. It is an expense that you need to bear depending on your lifestyle, assets and liabilities. If you try converting your insurance expense into an investment you end up nowhere and I have explained that time and again. Check out Can you Afford Investment Linked Insurance?

There is an interesting poll in the above article and the result of the poll is amazing.

My views about Is Insurance an Investment Option triggered discussion by members leading to Is Insurance an Investment Option? Reader’s Viewpoint where the poll has very interesting results.

People agreed that they made the mistake of investing in insurance but not any more. So what’s your take on insurance as investments?

Have you lost money investing in insurance?

Is the answer to the above question yes, great. But if you haven’t lost money investing in insurance you are calculating things mathematically and not financially. Investing 1L and getting 4L after 20 years is mathematically not loosing money but financially you have not gained anything.

2. Inflation

Let us continue the discussion from the first point. You invested 1L and got back 4L after 20 years. Mathematically you have gained 3L on your investment of 1L but have you actually gained anything?

So let me first explain in simple terms how mathematical returns differs financial returns?

Financially the calculation is such that if you have 1L Rs at any give point of time, you could buy list of items. Let us call this list as “List A”. After 20 years if you have 4L Rs, so now if you could buy the same list of items in our original list A, you have not gained anything. If you could buy less items, you have actually lost money and ideally you should be able to buy lot more items then we had in our list A.

The rate at which prices in our original list A increases should be less than your rate of return on your investment or else you will not make any return on your investment.

The rate at which prices of list A increases is termed as inflation.

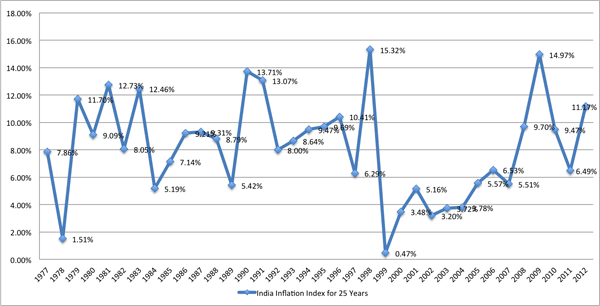

Let us put the Indian average inflation index for last 25 years.

If we analyze the rate of returns on our investment, we got compounded rate of interest close to 7% which is what the average return on investment being offered by most of the non market linked insurance policies. Now the simple average inflation rate for last 25 years is above 7.5% and so every one of us who have some money lying idle in banks or any other such non-market linked insurance has lost money due to inflation at some point of time.

3. Equity Markets

If you are in markets, you possibly know about stop loss. Stop loss as I prefer to put it is; When you plan any trade or investment, you are ready to take a position in market because you see an opportunity but if your trade does not go as you expect then you are ready to loose the amount you have kept for stop loss and come out of the position. At some point of time, everyone in markets looses money but it is the overall time period or overall portfolio of our stock that actually helps you to make money from the market.

I lost money, I loose money and I will continue to loose money in market but I also make money and I continue to make money from market as well and so the aim is to make more money in profits than losses. So overall I can say I am making money from the market. If you are in market where you think you can make money without loosing it, you are making one of the biggest mistakes of being in the market.

Hello Shabbir,

I would like to take some insurance policy.

Iam 25 years world and i came across this link

http://onlinesales.reliancelife.com/onlinetermlanding3.aspx?&utm_source=MoneyControl&utm_medium=CPM&utm_term=Page_Take_Over&utm_content=FKF&utm_campaign=FKF

which says 15Rs/day.Is it a good thing to Invest.

Any other plans which are good.

Thanks

sekhar

I would suggest you not to look at the cost per day and then decide your insurance but insurance amount is decided based on your assets and liabilities and the amount you think would be needed post retirement or your family needs after you are gone.

So I would say avoid those 15 Rs per day ads

Thanks shabbir ,the Ad was more tempting but i thought i need an advice.So i came across u r website and posted my question.

My plan is to get some returns in 15 years for my children higher eucation and after 25 years for their marriage and also for my retirement .My current salry is 40k .

Can u pls gude me in taking wise nvestment decisons and what insurance policies or any other ways of investing, i can take for above mentioned requirements

Yes why not Sekhar, but I need to be knowing lot more before suggesting you the best option forward like if you have plans to buy any real estate or if you have plans for getting married or if you are married and so on and so forth. Get in touch with me here and so we can talk about it.

Hello Shabbir,

I would like to take some insurance policy.

Iam 25 years world and i came across this link

http://onlinesales.reliancelife.com/onlinetermlanding3.aspx?&utm_source=MoneyControl&utm_medium=CPM&utm_term=Page_Take_Over&utm_content=FKF&utm_campaign=FKF

which says 15Rs/day.Is it a good thing to Invest.

Any other plans which are good.

Thanks

sekhar

I would suggest you not to look at the cost per day and then decide your insurance but insurance amount is decided based on your assets and liabilities and the amount you think would be needed post retirement or your family needs after you are gone.

So I would say avoid those 15 Rs per day ads

Thanks shabbir ,the Ad was more tempting but i thought i need an advice.So i came across u r website and posted my question.

My plan is to get some returns in 15 years for my children higher eucation and after 25 years for their marriage and also for my retirement .My current salry is 40k .

Can u pls gude me in taking wise nvestment decisons and what insurance policies or any other ways of investing, i can take for above mentioned requirements

Yes why not Sekhar, but I need to be knowing lot more before suggesting you the best option forward like if you have plans to buy any real estate or if you have plans for getting married or if you are married and so on and so forth. Get in touch with me here and so we can talk about it.

sir, you r right, i am 29 years old, i want to invest regularly in 5 stock of NSE listed company(Named IOB, CAIRN, BOB, LNTFH, IDFC), by monthly bases, for 10 to 12 years. I want to just collect this stocks for 10 t0 12 year, for my retirement.

Not ideal because such long term investment in particular stocks can be risky and so opt for mutual funds because you tend to invest in bunch of stocks rather than those few in particular sector.

thank you sir, i am also investing in three mutual fund, BSL FRONT-LINE EQUITY, DSP BLACK ROCK EQUITY, and ICICI PRU DYNAMIC PLAN, (GROWTH PLAN, 1000pm). from last three year, and return is also good, i continue same up to 12 years is it good. Also for investment in share market for long time which strategy i follow. also give me title name of your books.

Sapan, investing in market based on SIP works the best to begin with. Details of my ebook can be found here

Sir,

You are absolutely right. I have lost more than 4Lakhs by trading in F&O. I have subscribed to so many advisory service but they never delivered what they promised. I have learnt the lesson in the hardest possible way. Every time when I make effort to recover the lost money, I end up again loosing. Now I never trade & could not recover the amount.

Manjunath, I think you are trying things without actually knowing. Analogy could be that you are jumping into a sea without knowing how to swim and you need to understand things first before trying yet another attempt to gain in market.

Sir,

I never used to trade earlier. My broker suggested me to trade in options since it requires less margin. I tried & in the first month itself I lost more than 60,000. After that my broker suggested me trade in futures. I tried & again I incurred loss. Since 1 year I have been trying to recover the lost amount. It is so unfortunate that in my 12 months trading, not even 1 month was profitable. I was holding shares worth more than 4 Lakhs at very attractive prices such as Tata motors @ 144, Gitanjali Gems @ 300, TTK Healthcare @ 270, La Opala @48, PVR @ 170, Wockhardth@270, Jubiliant Foodworks @ 750 etc.. I sold all these shares for trading. I feel very bad. Just 1 mistake has ruined me. Now I don’t even a single share. Being greedy & trying to make quick money has brought me so far.

Manju, I have been telling everyone to avoid margins for quite sometime now and you can see why here.

I think you have made the mistake of believing your broker who is more interested in brokerage than anything else.

One positive thing that I see now in you is, you have realized your mistake.

Yes Sir,

a mistake that will haunt my rest of my life. I also learnt that without professional advise one should never trade on his own ideas. Trading on ones own ideas may lead to success only 2 out of 10 trades. So trading on ones own ideas is a sure & easy way for financial disaster.

No you are wrong. You should trade on your own ideas only but then you should be able to generate and validate those ideas and not jump into market without the understanding of market.

I also feel that by intraday trading also one can loose money much more quickly than the above reasons.

But every investor does not loose money on Intraday Trading.

Hey Manjunath,

I think what you are pointing to could be rather called gambling than Intraday trading and that could never be called an INVESTOR loosing money. Calculated intraday trading usually results in positive results By usually I mean a fairer chance at least. But the points mentioned in this article seems to be more of not being an informed investor, i would call and not referring to someone who are not that professional enough and gambling with an intention to make a quick buck. And what i sadly find is that many people do get scared away from these great opportunities of investments and portfolio building and even mutual funds, merely hearing these tragic rather comic incidents of their friends or relatives which propagates anything like fire. The next thing is that many are unwilling or not open towards good financial advices but lend all their senses to such idiotic lessons very much.

Just a thought. 🙂

Hey Shabbir,

You are absolutely right in all three points and I totally agree with your views.

Again well said, and one ridiculous, fantastic thing is that a major chunk of the so called educated Indians are least bothered about these things. They dont know, how they are making fool of themselves and are least cared of basic financial management. To make people aware of these things is such a hard thing that you can be almost sure that none will change their view rather are blind to any such view. I’ve shared your article on my facebook profiling hoping that at least one from my 25 friends would just go through these wonderful illustrations. Great commendable thoughts and well demonstrated Shabbir, and thanks for doing this wonderful job of educating or making people think about their hard earned money from a larger and different perspective altogether. Many are ready to save money for achieving something without second thoughts. DIY is the best domain name for your website, that you could have had thinking in this way. Over the years what i could comment on your work is that,Most of your articles throw light in some good directions and definitely all would have some very good points as take aways. Keep up the good work.

Thanks.

Regards,

Naveen Natarajan

Naveen, thanks for those wonderful comments and I am sure it will be eye opener for many Indian investors as well as your FB friends. Do let me know if any of your friend needs any further help from me and I will be more than happy to help to the extent I can.