Do you find companies like Pidilite Industries overvalued? Do you want to invest in good companies but always find them overly priced?

As an investor, I am sure you may have the question if Pidilite Industries is overvalued or undervalued?

Let us try to understand the concept of overvaluation and undervaluation. Let me clarify I am not recommending to invest in Pidilite Industries. Pidilite Industries is one of my favorite stocks and is part of my portfolio. So we are using this company as an example to understand the process if the company is overvalued or undervalued in the current market condition?

Sectorial Overvaluation and Undervaluation

The first step is to understand if Pidilite Industries overvalued or undervalued is to understand the concept.

How every market participant determines overvaluation or undervaluations off the stock price. I have explained it in detail here, but let me re-iterate in brief again.

Earnings help in valuations. So earnings per share or EPS and price to earnings or PE ratio can help determine if the stock is overvalued or undervalued.

So if the stock has an EPS is ₹10. If the stock is trading at ₹300, the PE ratio is ₹300/₹10 or 30 if the average PE ratio of companies in a similar business gives us a sectorial PE ratio or industry PE ratio.

Typically if the company is available at a discount to the industry PE is considered to be undervalued otherwise overvalued.

Flaws in Overvaluation and Undervaluation Calculation

The above method of considering the overvaluation and undervaluation has a couple of significant flaws. It doesn’t take into account:

- Growth of the company

- Future Opportunity

To overcome the shortcomings, investors add both the option to determine if a company has a big opportunity ahead of it. Moreover, if they can continue to grow faster than their peers, then investors value the stock at a much higher PE ratio.

Again, there is a significant flaw in it as well.

What if there aren’t any peers?

Some companies don’t have any peers in the market. Even if they exist, then they are not big enough to consider as peers.

Asian Paints can have peers as Berger Paints and Kansai Nerolac. Similarly, Page Industries can have peers as Lux Industries.

But I don’t find any peers for Pidilite Industries. There aren’t any listed company producing adhesives.

Similarly, there are many such companies as Pidilite Industries, where one can’t find peers producing the same products.

- Nestle’s Maggie (ITC maybe but it is a tobacco company)

- Gillette India (P&G along with Gillette India)

So, I am not sure if the peer-based comparison of overvaluation or undervaluation, at least for Pidilite Industries, is the right approach.

Historical Price to Earnings

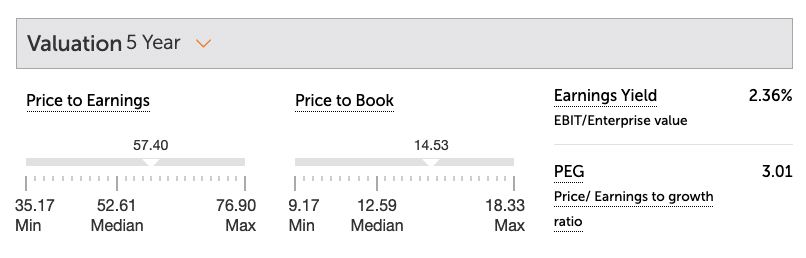

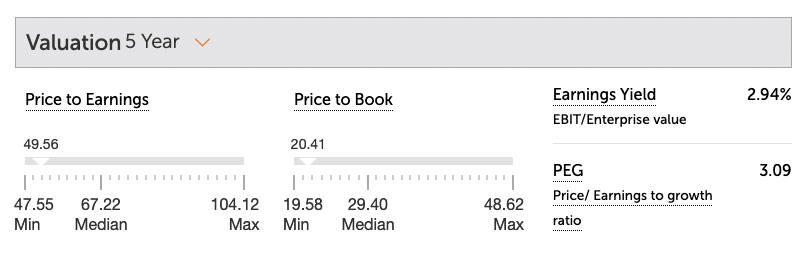

If we look at the Historical Valuation of Pidilite Industries, which has corrected from its peak of ₹1700 to ₹1200, one finds it is still not below its 5year median value.

As the market stabilizes, I am not sure it will stabilize as well. However, can an investor wait for so long to invest in it?

Furthermore, if those investors who consider historical valuation, do they consider Page Industries as cheap?

I doubt.

Why the Heck we Calculate Valuation?

In the article for calculation of undervaluation and overvaluation, I used the calculation as:

When can the company reach an EPS equal to the price I am paying today.

Are you willing to hold the stock for that long?

If yes, why the heck do we need to calculate valuation?

Why we, as an investor, want to be a wise investor?

Why can’t we be a dumb investor and invest in a great business?

I like to be a dumb investor for sure. If every wise investor on the planet could have made money from the market, we may have had many Warren Buffett. Because we have only one is because no matter how intelligent you are, you have to invest and then have the patience to sit on your investments for decades.

Whatever method we use for the valuation of Pidilite Industries at any given point in time, it will look overvalued. When the market corrects, it will correct less and so will be overvalued with respect to others. As the market runs up, it will run and become overvalued based on its current earnings.

When I purchased at ₹700, in my open portfolio, it was overvalued. If I am planning a purchase now, it is overvalued.

The argument of it being overvalued at ₹1700 for sure because now we know it has corrected. However, we don’t say the same for ₹1000 because correction has made it reach ₹1200.

In the next correction, if we see the price hit ₹800, those experts will say I told you it was overvalued. And if there isn’t a correction, the same expert will come and speak; it was our buy recommendation.

Final Thoughts

There will always be someone who will say Pidilite is overvalued. Or, for that matter, any great business will still be overvalued.

However, they may not be telling a lie.

As an investor, your job is not to invest in the most undervalued stock to make money. You want to invest in a great business. Remove the valuation part and consider investing in a great business that you know for sure will exist after three decades and is more likely to pay the dividend equal to your investment. Here is a list of companies that I think will surely exist after three decades.

Leave a Reply