If I invest at any one point in few of the selected good funds, I have seen Midcap funds perform better as expected but also when it comes to crunch times they fall less.

I always prefer Midcap funds because of better comparative performances. By comparative performance I mean my personal experience on returns like – If I invest at any one point in few of the selected good funds (like here), I have seen Midcap funds perform better as expected but also when it comes to crunch times they fall less. Yes you read it right.

FALL LESS.

This is something which contradicts from what you hear on some of the best business channels. Isn’t it? I have a complete section in my book about how you should be using the business channel information (read as news).

Now instead of doing all the talking let me show you some numbers. Few days back I got this email from Motilal Oswal (Read my review on Motilal Oswal here) which I quote.

Although individually, the midcap stocks show higher volatility, when invested as a basket, the midcaps show very favorable investment characteristics.

Here are a few interesting observations:

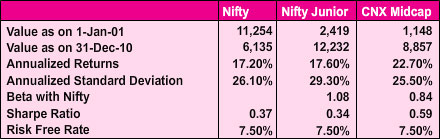

- Over the last 10 years, CNX Midcap index has delivered superior risk adjusted returns (Sharpe of 0.59, annualized returns of 22.7% at a standard deviation of 25.5%) when compared with Nifty ( Sharpe of 0.37, annualized returns of 17.2% at a standard deviation of 26.1%)

- The top 5 sectors of CNX Midcap index are financial services, healthcare, FMCG, engineering and chemicals while that of Nifty are financial services, oil & gas, information technology, engineering and metals. This results in CNX Midcap index having a low co-relation with Nifty of 0.84 and helps in increasing portfolio diversification.

- The CNX Midcap index is less concentrated when compared with Nifty. Top two decile contributes a weight of 26.8% and 16.1% in CNX Midcap Index while they contribute 37% and 19.2% in Nifty. Lower concentration helps in reducing the volatility of the index.

Key Statistics

Source: IISL and Internal Analysis. Data as of December 2010

My Investment

I am sure you would be eager to know my investment in Midcap segment. I have invested close to 15% of my total portfolio in one of my favourite midcap fund – DSP Black rock small and midcap fund.

Click on image to Enlarge.

What is your preferred investment area in this market scenario? If you also prefer Midcap Funds like me check out the list of best midcap funds

My friend told me to invest midcap. I will share this information to my friends. Thank you for your guidance.

Yes if you know what you are doing you can go for it. At times midcaps can also go wrong. So remember to take the stop losses when dealing with midcaps.

I am confident that by following your recommendations, I will not be

disappointed. I sincerely thank your efforts for making us knowledgeable people.you have mentioned very useful and profitable message message for us

Thanks