Why strong Nifty support is around 4700 along with what is an expected roadmap ahead in market with action items for each type of investment objective.

Every broking house will have Nifty support levels around 4700 but very few broking houses will explain why the support for Nifty is around 4700 and what could be an action item for your investment objective. Let me first try to explain why there is strong support for Nifty around 4700 and an expected roadmap ahead with action items for each type of investment objective.

Why Nifty Support is at 4,700?

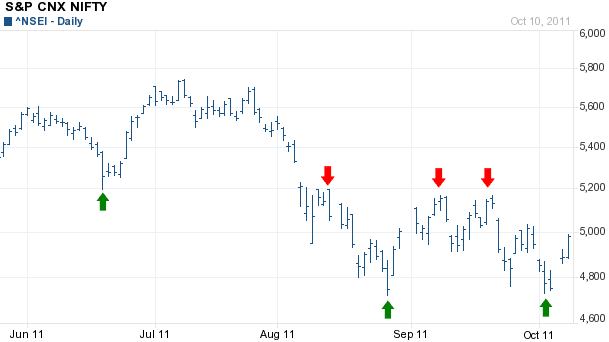

Let us first look at the Daily Nifty chart for last few months.

Charts by Yahoo Finance

Let us observe the chart of Nifty for last few months. We see a low of around 4,750 on 26th September, which was above the August low of 4,720 indicating W formation or a double bottom formation. This clearly suggests strong support for Nifty’s around 4700.

Very detail explanation of understanding double bottom or W bottom is in Chapter 12 of my Technical Analysis eBook.

The Road Ahead

We already know from Signals of Market Crash that Nifty has a strong resistance around 5200. I have shown the same here again in the above chart with red arrows.

Nifty has support around 4700 and resistance around 5200 and so according to me this should be the range for the nifty for next few trading sessions and Nifty should consolidate for a elongated period of time in range of 4800-5200.

Depending on the news flows, RBI action and inflation number we may either see a breakout or break down. Important point to note here is – Don’t assume either breakout or breakdown. Let them happen and then go for it unless you know how to play the anticipated trades.

I expect more positive news on the back cooling OIL in the world market but the bad news will be on the result front where some companies can miss on the result expectation – giving Nifty a tight range.

Action Items

Depending on your investment objective you need to play the market.

- Investors can buy around the support zone of Nifty i.e. around 4,700 and 4,800.

- Positional long traders can initiate long positions around 4,800 with stop loss at 4,680.

- Positional short sellers can initiate short positions around 5,150 with stop loss at 5,250.

If you are not a Nifty trader, you can still invest in stocks that have similar kind of support formation in a downtrend or have already shown a breakout above the resistance level.

What is your view for the Indian Market? Share your views in comments below.

Dear Shabbir

I wish you a happy new year 2012. I would like to your precious advice on the following query. I would like to gift a policy on my Son’s 1st b’day next month. Kindly suggest if u can go for the following

1) a Fixed deposit of 50,000> which bank, the tenure ?

2) a LIC policy on my name and as a gift to him

3) a PPF on my Son’s name

4) a NSC on my Son’s name

5) any other policy which you find best suitable

Kindly adivce. Awaiting reply.

my best regards

noor ahmed khan

Hi Mr Khan, I am not a financial expert and so will not be able to suggest what would be best in you or your son’s interest but one thing that I know from my experience that equity linked items perform really well in longer term and so if you can have any investment with at least 10-20 % linked to equity that would be good.

Hi Shabbir….Tata motors stuck crossed Rs. 200 mark today. Thanks for the advice yaar.

What cue should i take from the market now? Since the Greece debt crisis is resolved atleast on paper, can we expect the market to rise steadily from here on.

Should I hold the tata motors stock for some more time or sell them off now?

Hi Vinay, Sorry I was on a weekend holiday and could not respond to your comment earlier but I see that Tata motors has shown a mini breakout pattern and so according to me you should be holding the stock with a stop loss.

Tnks…

The pleasure is all mine Vinay

What does a red tick mean Shabbir?

It means in the given timeframe the close is below the open.

Hi Shabbir,

I hold 75 shares of Tata motors now. It hit a high of Rs. 188 and now its value is Rs. 181. Should I sell or hold?

Hi Vinay, when you purchased it and what was the objective of the purchase. Did you invest into it or traded and if it was trading call what was your target?

I purchased it to gain around 20 to 25% in 6 months.

But it increased by 20% in a month. If there is scope for further increase, then i will hold it for some more time. otherwise i want to sell it.

But I don’t know which way the share price moves from here.

The stock is in upswing and so you should let the profit ride and sell at the right point i.e. when the stock sees a red ticks for consecutive 2-3 days.

K Shabbir….Does red tick means downtrend or uptrend??

Just one red tick does not mean anything.

Salaam Shabbir Bhai,

Now Nifty Future calls daily for free on http://www.fancystock.blogspot.com

Please check

Thank You

From Team fancystock.blogspot.com

Hi Aasif, I am not a fan of providing tips and so will not be able to comment much on your blogposts but yes I never prefer a blogspot blog and you can see why here