Answer to question – I can make X% in FD and am able to grab a loan at much lower interest rate. Should I Opt for it?

I get this question quite often where the underlying idea of the question is: Can make X% in an FD deposit and am able to grab a loan at much lower interest rate making few thousands per year. Should they opt for it? What is my view on this?

Let me share my views on it taking all the aspects that I think are important.

First let us look at the scenario and check if it is at all possible or not?

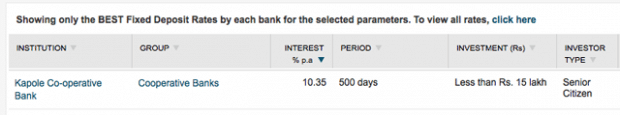

Checking the interest rate charts of each bank at money control I see the higher rate of interest is 10.35% currently.

Home loan for most banks is in range of 9.85% to 10.15% and indicating that interest rate question that I get in comments and email can be answered with some numbers.

When putting numbers in the above scenario, even if you grab a personal loan and put the money into an FD, you can grab a profit.

Surprised!!!

So lets look at it.

1. The Loan Arbitrage

We all want to be making some money without doing anything. So lets put some numbers into the scenario first and see how much can we make.

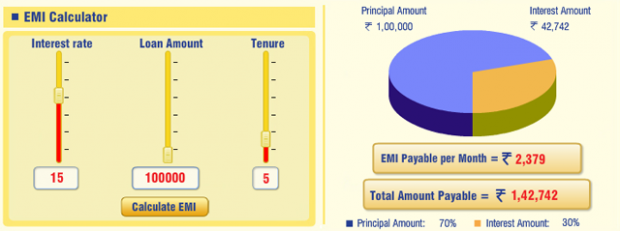

Borrowing 1L as personal loan at 15% rate of interest for a period of 5 years with no processing fees. The EMI and the total sum that we pay back taken from DHFL EMI Calculator is shown in the figure below.

An EMI of 2379 for 5 years and we pay back the principal of 100,000 and an interest of Rs. 42,742.

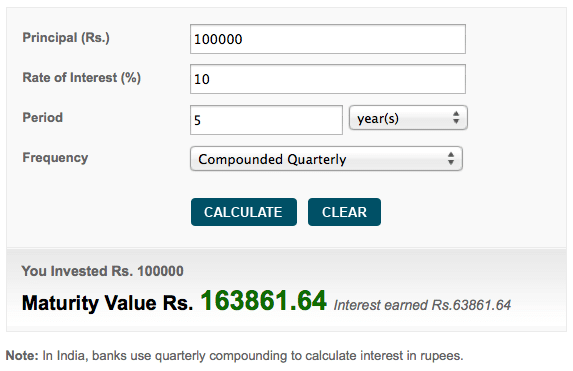

Now we put the same 1L into a fixed deposit for 5 years at 10% quarterly compounding interest.

Whoa!!!

A profit of Rs 21,119.

Look’s awesome isn’t it?

So have we found a system where we can make infinite sum of money?

No, you cannot make infinite amount of money because there is a tax on the income from fixed deposits but one can always take an FD for parents and assuming they are not making any taxable income you can save the tax part but the income will not be infinite. 😀

2. The Question How It Happens?

The question that may be bugging your mind is how can one make more money at a lower rate of interest?

The answer lies in the way EMI works.

When you pay your first EMI, you are actually paying back some part of the principal as well (though very little). So each month as you are making a payment, you are actually reducing your principal. In a tenure of 5 years, the prepayment for your principal (though very little) as you start your EMI is helping you grab some profit at the end of 5 years. The way I look at it is yet another reason to be investing in a loan as early as you can.

3. Should you opt for it?

You know that there is profit to be made. You know how you are making a profit. So now the last and the final question – should you opt for it?

Let’s look at practical aspect of it.

We saw a profit of Rs 21,119 over a period of 5 years or 4223.8 Rs per year, or 350 Rs per month or 11.7 Rs per day.

Is managing 2 more accounts, a personal loan account and an FD account worth Rs 11 per day? Couple more accounts means lot more managerial hassle that gets added in our life.

Investing in an FD and grabbing a personal loan is just few clicks away these days but what happens after you have opted for both. Each month you have to make sure the bank account is funded at the right time for an EMI. Each year you have to submit the tax forms to avoid TDS deductions. If there are any TDS deductions, you have to claim a refund. And to get all this done correctly you are being paid 350 Rs per month.

Is 350 Rs per month worth the hassles? I don’t think so because I prefer spending my time doing something better than earning Rs 350 per month. Something like learning more about better ways to investing or starting a new business or writing a blog post for my readers (like this one) or may be even reading few books on marketing, finance, entrepreneurship, programming … and the list continues of things that I want to be doing in my free time. I am sure there is a long list for you as well.

What if you just use the same time with your family, kids or parent or may be even an outing with friends. Something that is priceless and cannot be compared to monetary returns anyways.

Final Thoughts

What would you opt for? Working for such Rs 350 per month investment option or educating yourself for smarter investment opportunities? Share your views in comments below.

So here I think you missed one thing if I am not wrong..Maybe I am wrong, request you to please correct me if I am wrong..So, you should also calculate the interest which you might have received on the EMI amount which you are depositing..That EMI amount can again fetch interest if you have sone an RD for that amount..So conclusively, we end up making no profit..Whats ur say on this?

Could make few more paisa per day as well Ronak but using your time in more fruitful way is better choice.

I think you misunderstood me. I am actually trying to say that the profit amount which showed there around 20K is actually not that much.

I explain you how..

You are giving an EMI of approx 5K towards your personal loan. You should also count interest on that amount. Right? You are giving that money. Consider, we deposited this 5K monthly in RD of 5 years, that could have also generated around 20K. So overall we are in no profit at all.

I hope you understood what I mean to say. Please share your views..

Yes I misunderstood your views. Yes you can think it that way but then you got the money by taking a loan and so you should not consider the returns from the EMI but that can be one view on it and there can be different views as well.

So here I think you missed one thing if I am not wrong..Maybe I am wrong, request you to please correct me if I am wrong..So, you should also calculate the interest which you might have received on the EMI amount which you are depositing..That EMI amount can again fetch interest if you have sone an RD for that amount..So conclusively, we end up making no profit..Whats ur say on this?

Could make few more paisa per day as well Ronak but using your time in more fruitful way is better choice.

I think you misunderstood me. I am actually trying to say that the profit amount which showed there around 20K is actually not that much.

I explain you how..

You are giving an EMI of approx 5K towards your personal loan. You should also count interest on that amount. Right? You are giving that money. Consider, we deposited this 5K monthly in RD of 5 years, that could have also generated around 20K. So overall we are in no profit at all.

I hope you understood what I mean to say. Please share your views..

Yes I misunderstood your views. Yes you can think it that way but then you got the money by taking a loan and so you should not consider the returns from the EMI but that can be one view on it and there can be different views as well.

I can share one more good website where one can check all about Fixed Deposit, Interest rates, Duration as well as maturity amount after a period of time etc. Visit: http://www.bankbazaar.com/fixed-deposit.html

I can share one more good website where one can check all about Fixed Deposit, Interest rates, Duration as well as maturity amount after a period of time etc. Visit: http://www.bankbazaar.com/fixed-deposit.html