I hardly could find any information or review about the portfolio management services online and so I was only left with doing the experimentation myself. In my recent review about stock brokers my top pick was ShareKhan and so I thought let us experiment a PMS with them and see.

Being from a non-finance background I always look for making more money in equity and so I thought of going for a portfolio management service or PMS. I hardly could find any information or review about the portfolio management services and so I was only left with doing the experimentation myself. In my recent review about stock brokers my top pick was ShareKhan and so I thought let us experiment a PMS with them and see.

The process started when I called up the ShareKhan customer care numbers and left the message that I am interested in doing a portfolio management service with ShareKhan and soon the sales team gave me a call. I verified that this call is directly from the ShareKhan team by asking some details about my account in Sharekhan and I was certain that I am talking directly with the Sharekhan in-house people and not to any sub-broker. You will soon realize why I mentioned this here.

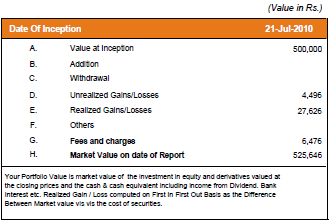

I will share with you all my numbers and account statement as I think I should be as transparent as possible.

To start with Sharekhan offers 2 PMS products –

- Fundamental PMS – Brokerage of 0.5% with 20% profit sharing after 15% profit hurdle is crossed and a 2.5% per annum AMC charges.

- Technical PMS – Brokerage of 0.05% and flat 20% profit sharing.

Now looking at the fees I was certain that by no means I will opt for fundamental PMS. If I opt for fundamental PMS I need to pay AMC of 2.5% but will save 20% on the 15% profit. So doing the maths 15% profit on 5 lakh is 75,000. Now assume that if I make a profit of 15% then for technical PMS 20% of 75,000 is what they will charge me i.e. 15,000 and for fundamental PMS I will pay 14,375 (roughly as charges are deducted quarterly) AMC charges no matter what I gain. Market was at 5400 Nifty and I was not sure if the correction was on the cards and so I opted for a technical PMS where they assured me that charges are only on profit sharing and for losses they charge nothing and you loose just the small brokerage amount.

Apart from the fees fundamental PMS has high brokerage because it mainly deals in delivery based whereas technical PMS is more of a trading PMS. As I had the feeling of market correction I thought of trading PMS will be a better option than an investment based PMS.

So there was no doubt in my mind that I will opt for technical PMS and on July 21st 2010 my account started and as expected I started to see major issues and things told by sales people were all wrong.

Issue 1. Wrong Information

The sales person who visited my house (and including the customer care people who gave me a call from Mumbai after my interest in PMS) told me that I will be given a username and password to see my portfolio online. After everything is done I got a welcome email with only userid and no password. After calling every possible number I could I realized that this facility is not available for technical PMS account type and is only available for fundamental PMS.

I confirmed the same with the person who visited my house for account opening procedures and she confirmed that in training she was told that customers are given username and password for all PMS type. The more experienced guy explained to me everything on why username and password cannot be given for trading PMS and though I could not agree much to it I was left with no choice.

The only service they could provide me was to change my technical PMS to fundamental PMS if I insisted on having a login details but I was more than certain that I will never opt for fundamental PMS and so finally I settled without login details. Can you imaging I could not check what is happening to my money.

Issue No 2. No one knows the product in detail

The sales people who visited my house told me that I will be able to give my inputs as to which sector and stocks I am more inclined to but then as expected nothing like that happened and when I asked the answer was same again – this facility is not available for technical PMS and is only available for fundamental PMS.

The sales people even told me that I will be able to meet the fund manager in a month’s time and I never expected that to happen but this made me to believe that my inputs may be taken. The only concern I had here is I wanted to avoid investing in companies dealing in alcohol and tobacco but I could not control that by any means.

Issue No 3. Lock-in Period

My account started on July 21st and in few days I had all sorts of issues and wanted to close my account the next day but I was told that this is not possible and you have to be with us for next 6 months (read: forced to be with us) as there is a lock-in period. I had idea about the lock-in period before hand but I think having an exit load is better option than a lock-in period. I was ready to pay anything at that time to close on my account but I just could not.

Issue No 4. No Clarity with Charges and Deductions

Sharekhan PMS web page clearly tells that ShareKhan books profit on quarterly basis but sales person I talked with emphasized that Sharekhan charges 20% whenever I withdraw my profit. When I told about the statement they have online is not matching with what they telling I got variety of answers. One was that this is new product (actually not true because technical PMS sub products are new but not technical PMS as a whole is new) and other was that it is after every 3 months from the inception of your fund you will be charged but the actual fact is they charge you fiscal quarterly i.e March, June, September & December

One more thing which I think I should mention is that you can only withdraw in multiples of 50% of 25k profit but they charge every quarter on total profit.

Issue No 5. Double Demat Account

With the kind of issues I had with my PMS account I found that for fundamental PMS you have to have a second demat account and you cannot use your existing trading account linked demat account.

Issue No 6. Performance of PMS

The 5 issues I mentioned above could have been easily digested by me provided I got good returns, but to my surprise I could do better than what they could do for me.

Let us take some actual numbers and deal in some maths.

The above screenshot is from the official Sharekhan PMS report and you can also look at the complete report here.

I invested 5 lakh Rupees on 21st July 2010 and the on 30th September 2010 it is 525,646. So I got an absolute return of 5.13%.

Now let us compare the same with Nifty and Sensex returns.

| Indices/Performance | 21st July 2010 | 30 Sep 2010 | Gain |

|---|---|---|---|

| Nifty | 5400 | 6030 | More than 10% |

| Sensex | 18000 | 20050 | More than 10% |

Aren’t the numbers speaking for themselves? A 50% less return than the index but yet let us see what I could have got if I invested in my preferred (or diversified) mutual funds.

| Mutual Fund/Performance | Nav on 21st July 2010 | Nav on 30 Sep 2010 | Gain |

|---|---|---|---|

| DSPBR Small and Midcap | 17.258 | 19.2 | 11.25275235 |

| Fidelity Equity | 33.968 | 37.639 | 10.80723033 |

| Canara Robeco Infrastructure | 22.5 | 24.42 | 8.533333333 |

| Sundaram BNP Paribas Select Small Cap | 146.9 | 164.0462 | 11.67202178 |

| Birla Midcap | 111.61 | 119.72 | 7.266373981 |

| Fidelity India Special Situation | 17.985 | 19.779 | 9.974979149 |

| HDFC Top 200 | 198.468 | 224.764 | 13.2494911 |

| Reliance Growth | 470.2571 | 509.5282 | 8.350985025 |

| Reliance Vision | 271.1358 | 298.7151 | 10.17176633 |

*Nav are taken from Historical Date from AMFIIndia for growth option

All of my preferred funds outperforms the PMS numbers by a big big margin and guess what; they charge you 20% of your profit for this crappy services and performance.

Drop a comment if you have any queries or questions and don’t forget to share your views and feedback.

I hope this will help lot of fellow investors and blog readers.

Hi Shabbir Sir,

I have invested in Motilal Oswal PMS with on 15 may’17, but still the amount increased to with 10% only in six months. I had invested in other equity like DSP Black Rock and LnT it’s giving a return of 25- 30% in same or less time frame. I had discussed it with Motilal people, they are saying the stock will definitely increase in 3-4 month and at the end you will get a return of 25%.

Then what’s the point in investing through these experienced finance people if I can get the same return by selecting good equity fund on my own. Now feel trapped, I can only withdraw the amount after one year of period, before that the charges are too much to pay. Can you suggest any way?

Thank you

Promila

Promila, PMS aren’t able to beat the mutual funds and this has been my experience in 2010 and many of my blog readers still say the same. Now you have done the exact same comparison and it hasn’t changed much as yet.

The best option is to wait your time out and hope that market doesn’t take a nose dive. Also take this to the extent possible and see if you can get out of it by giving away your profits only and recover the capital.

Hi Shabbir, Even I have experienced that the product knowledge of this company executive not much. It does not even touch basics. Probably, there are very less people in India who wants to probe. So might be they don’t have exposure. Article is very insightful. Thank you.

in the present scenario, none is interested to earn money for you rather they want your money to earn money for themselves and their pay master.If u want to earn spend your time and manage your portfolio yourself. I remember few years back someone recommended not to buy nestle when it was quoting 2400 and wait was recommended. I followed the advice and did not buy. Today it is quoting around 6000 /share. So it your own study and hunch which will help you in long term and especially for long term investors.

Completely agree with you. I was holding Nestle at around 2400 but then

sold as I wanted to purchase a flat. The investment in Nestle would have

been much better.

Hi Shabbir, I too had similar experience, and since then I gave the money to Aditya Birla group broker, and he played with my money and converted it from 1 lac to 7000, and I was like awe…what a fool I am. Then I thought either I will invest through MFs or directly, and so far so good.

Learnt the lesson the hard way but better late than never @kinshukchandra:disqus

Yeah 🙂

Hi Sir is kyc necessary for trading

Yes.

Hi Shabbir

I have a similar experience, but for my company’s money.

The PMS people only earn money for themselves and rarely for their client.

The experience that I am sharing is how the PMS people reduced the investment of a company of multiple crores to a few crores.

The investment of Rs 6.00 crores cost value was reduced to less than 3 crores.

Similar is the experience of other persons.

We pay from our hard earned money to feed these fattened suited/booted & sleek talking guys.

Sadanand

Thanks for sharing your story Sadanand and sad to see a huge chunk of the money was lost. Taking control of the finance in ones own hand is the only solution.

Hi Shabbir

I have a similar experience, but for my company’s money.

The PMS people only earn money for themselves and rarely for their client.

The experience that I am sharing is how the PMS people reduced the investment of a company of multiple crores to a few crores.

The investment of Rs 6.00 crores cost value was reduced to less than 3 crores.

Similar is the experience of other persons.

We pay from our hard earned money to feed these fattened suited/booted & sleek talking guys.

Sadanand

Thanks for sharing your story Sadanand and sad to see a huge chunk of the money was lost. Taking control of the finance in ones own hand is the only solution.

Thanks for the review. W also had the same bitter experience with Sharekhan PMS services.5L invested in2010 was reduced to 2.544L by 2013 and we closed the account taking the 50% heavy loss of our hard earned money.All our mutual fund investments performed far better. It is from my first hand experience I am advising : Do not go for Sharekha PMS at all , but invest in good fund houses like ICICI , TATA ,AXIS MF etc.

thanks

ligi

Sorry to here that ligi but glad you shared your experience here and I am sure it will help others make that decision of not investing in the PMS again.

Thanks for the review. W also had the same bitter experience with Sharekhan PMS services.5L invested in2010 was reduced to 2.544L by 2013 and we closed the account taking the 50% heavy loss of our hard earned money.All our mutual fund investments performed far better. It is from my first hand experience I am advising : Do not go for Sharekha PMS at all , but invest in good fund houses like ICICI , TATA ,AXIS MF etc.

thanks

ligi

Sorry to here that ligi but glad you shared your experience here and I am sure it will help others make that decision of not investing in the PMS again.

Thanks! A lot of good info…Really appreciate it. Keep up the good work!!

The pleasure is all mine Indraneel.

Hi,

I work for a magazine and am writing a story on PMS

If you would like to share your insights, it would take my story to another level.

Let me know what insights you want me to be sharing with you for your magazine. Will be more than happy to help.

According to me what I know is PMS is very risky asset and you can expect always high return. I agree for your views about sharekhan service. Since you selected trading PMS the cost incurred is high so they charge you high brokerage.

I think instead of going to PMS I would have prefer you to go for mutual fund opprtunistic schemes which will give you high returns with less cost compared to PMS.

Shabbir Sir,

Its fact known to all internal guys that originally all brokerage houses do really believe the opposite from what they recommend , means when they say buy , originally they have already bought and mentioning you to buy so that your induced liquidity can lift the prices some more and also that they have normally big position , so unwinding(selling) it may not make a big toll.

Similar is the case in case of sell recommendation.

For brokerage houses there institutional desk is more important than any retail/PMS/ASSET MANAGEMENT department, as only one client there does more turnover then 1000 of retail customers , so rather than selling there idea to 1000 retail customers , its better to sell there idea to one institutional customer and also institutional customers have bank account linked to there account which is debited/credited on the evening when the trade is done. While in case of retail, there person has to do followup for payments.

. Also that institutional customer will only trade more when it sees profit in trading with you so the brokerage house ensures that, that institutional customer makes profit when it trades on there recommendation.

Only dependable trade recommendation r those which are generated by U.

Zohar Batterywala

Quite true to an extent Zohar.

Dear Mr.Shabbir,

Nice analysis, MF have done better with no charges.

Regards

Rajendra

I am a new investor in share market.i reached sharekhan .com at indore centre for details and how to start it. the sales persons told me that we can give you traing online how to do it and sms alert .he told that you can open your account with 10,000with brokrege of 0.03%and cant explain proper tax deduction.in equity he told me two market INTRADAY and DELIVERY . in your block you told TECHNICAL PMS and FUNDAMENTAL PMS . i couldnt understand.so give me proper guidence and what can i do .go with sharekhan or not.give me some more details about it.

PMS is portfolio management system and ShareKhan PMS is a complete shit and you will loose money. Having an account is something different. Read this

so prefer me another company for marketing .in which type i am having an account something different. i don’t understand.

can i go trough angel broking PMS account. what you can say about angel.its good for less investor because persons told me that it concentrate on big investor.

PMS according to me are bound not to work and you can read about it here – http://shabbir.in/pms-review/

I wanted to check with you the recent perfromance of ShareKhan Nifty thrifty PMS. They are claiming they give absolute returns whatever the market conditions may be.

Since inception (Feb 2006 to Feb 2013) they claim to give Abs return of 163.4% whereas Nifty return is around 88% only.

Also every year it has given returns in the range of 9% to 25%. During the market crash in 2008-2009 they gave 28% whereas nifty was minus 37 (-37%). However when market bounced back in 2009-2010 it gave only 15% whereas nifty gave 73%.

What is your opinion about this PMS. They are saying they have another PMS called Trailing returns. But Trailing returns PMS has given good returns around 50% (May 11 to Feb 2013) whereas Nifty is given around 2% only. I dont know the difference between the two. Looks like Trailing returns is more promising.

Minimum investment they are saying is 25lacks as per new SEBI norms for PMS.

They say profit booking is possible. Partial withdrawal of capital is not possible. If you want to wihdraw you need to withdraw completely.

COuld you give some insight about this product and is it receommended. Is there any other broker providing such PMS.

Tell them to share those numbers in writing and you will see the true colors of those grand looking numbers.

There is no SEBI norms for minimum investment for any such products and if it is there ask them for the official SEBI document as well.

I think this is yet another sales junk and nothing more.

Hi,

i have experienced Nifty thrifty and Trailing stops.

i have invested in oct 2010 when market is ~6300. till next 1.5 yrs till feb 2012 i got 1.4L profit from this. its great till that time.

after that for the last one year no profit and finally i have to close the fund last week with 3%(15000) loss. in last one year first 6months i have put in NIfty thrifty and no profit loss 5%. last 6months Trailing stops profit +2% . so overall -3%. IN short for the last 1yr 2 months there is no serious profit with sharekhan pms protech. may be they have changed the fundmanager or algo for “automated” stuff…

Conclusion. NO Profit for the last 1 yr.

Further go to google.com/finance and find a market up/down case and ask them numbers for that period in last one year. you can see the performance. its “no longer” a good PMS. I feel at some point they used to give ~10k/month/5L , which is good returns.

One more thing i want to say is, with PMS Protech niftythrifty/trailingstops. you dont loose your money like others (5L to 2L). Loss would be ~50k/year max. And for the last 2.5yrs i can say minimum number i have seen is 4.45 and that was recovered to 4.8L in 2months. So you dont loose your corpus but you might not gain as such ;-). if you want to go for PMS anyway nothing to loose in this scheme.

But Pro prime is seriously dangerous, no matter what you earn or not fixed costs, 2.5% brokerage for every investment decision. not only this any scheme which is having this type is bad, and in this forum everybody cries the same thing.

inshort, high risk items like futures/options based protech makes you loose less, compared to equity based Proprime schemes which are less riskier but you loose more 😉

Atal, good to see that you made some money from PMS at some point of time though but still I think the risk with PMS is much higher no matter what product you opt for because the focus from brokerage house which is to generate more brokerage

See below the returns which Trailing stop (TS) has given since its inception in May 2011 compared to nifty and sensex.

Seeing the performance it has given pretty decent returns. ALmost 50% when compared to Nifty performance of 2.56%.

And if you draw a curve for the performance it is pretty much linear upwards.

Looks impressive. Is it beefed up ?? any thoughts or people having experience investing in this pls. advise.

Month Returns (%)

TS Nifty Sensex

May’11 * -2.44 0.16 -0.33

Jun’11 1.45 1.57 1.85

Jul’11 -0.66 -2.93 -3.44

Aug’11 7.97 -8.77 -8.36

Sep’11 2.41 -1.15 -1.34

Oct’11 -3.19 7.76 7.60

Nov’11 4.05 -9.28 -8.93

Dec’11 8.76 -4.30 -4.15

Jan’12 9.14 12.43 11.25

Feb’12 3.83 3.58 3.25

Mar’12 -4.43 -1.66 -1.96

Apr’12 -0.50 -0.90 -0.49

May’12 5.84 -6.17 -6.35

Jun’12 -0.92 7.20 7.47

Jul’12 3.10 -0.95 -1.11

Aug’12 2.45 0.56 1.12

Sep’12 3.77 8.46 7.65

Oct’12 -1.37 -1.47 -1.37

Nov’12 1.83 4.63 4.51

Dec’12 0.68 0.43 0.45

Jan’13 -0.40 2.20 2.41

Feb’13 1.46 -5.66 -5.19

Since Inception 50.73 2.56 1.79

I see the returns pretty much close to what FD or bank savings account would give you. Nothing to get excited about.

Hi Shabbir,

Have faced every single one of the issues you mentioned and more. Having invested 5,00,000, my investment today stands at Rs.2,00,00 only. Inspite of having completed devalued my portfolio, charges deductions are prompt. I cant even find an option to withdraw my money.

PLEASE DONT EVER INVEST WITH SHAREKHAN, THEY CHEAT LEGALLY. – wish I had a way of sharing this with more people somehow.

Francis, sad to hear about your losses but if you would like to share your experience on my blog, I will be more than happy to have it.

How about Angel PMS – minimum investment is 25 lacs .

They say they are the best in this industry & they just do invesment no trading.

Hi Shabbir,

I fully agree.

I will request to all people who are thinking to invest in India via PMS route then forget about it. They will loot you. I had opted for HDFC PMS services. They are pathetic.

So only if you want to get looked with your consent then please go ahead.

I am sure you can do better then what they will do you. IF you do not have time please go via Mutual fund. You will be in much better shape.

Good Luck !!!

try theequitydesk.com basant-ji has a very good pms service. read the details on that site. he has been there fro several years. plus very good info on the equity market. never trust the brokers like sharekhan, icici, ing etc

what abt prabhudas liladhar pms a/c? will it be reputed in market?will it be benefit for new user?

Cannot comment on them Anant as I have not tried them but in general I am yet to see good PMS service.