I did share my views and experience with Religare, AnandRathi, Reliance Money, Indiabulls, HDFC Securities, Motilal Oswal, ICICIDirect and today I will share my views and experiences with ShareKhan.

![sklogo[1]](https://d1ip8y7yws0fph.cloudfront.net/wp-content/uploads/sklogo1.gif)

and today I will share my views and experiences with ShareKhan.

Positives

- Brokerage – If you have an account with some other broking house they will offer you better brokerage rate. Brokerage depends on your ability to negotiate.

- Very sound Online platform as well as the Windows application “Trade Tiger”. You can do everything using the online system or Trade Tiger application.

- Integrates well with your existing bank account and you do not need any extra bank account to maintain.

- Mutual Funds / IPO all can be done online without any hassle.

- Mutual Fund Fees is NIL. Yes you heard it right. There is no fees to transact in mutual funds online with ShareKhan.

- If you have a portfolio of over 500k you can get a Relationship Manager which is as good as Motilal Oswal’s Offline account facilities.

There is hardly any negatives that I am experiencing and this is one of the main reason to move all my equity based investment and trading into ShareKhan.

If you have more to share please do share them in comments. Your views not only help me with my decision to move everything to ShareKhan but also help other fellow readers.

Update 4th December 2016

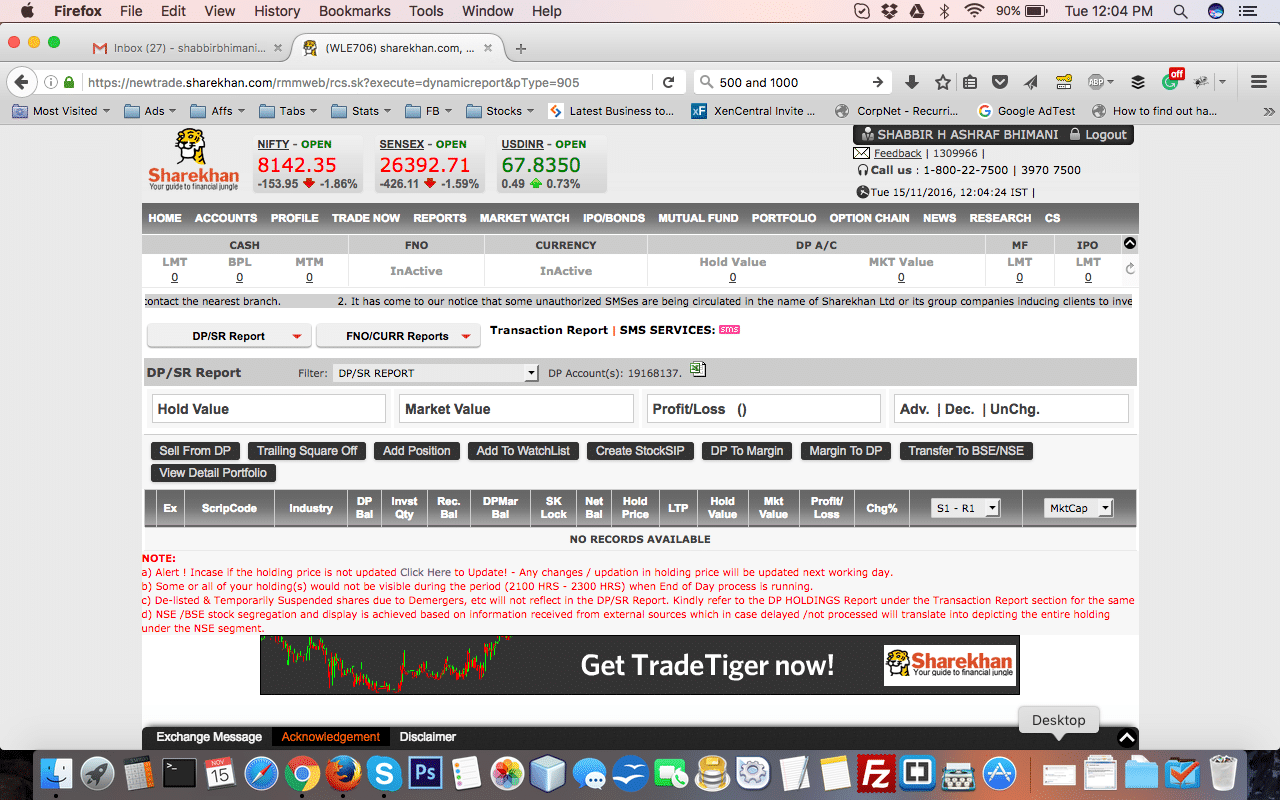

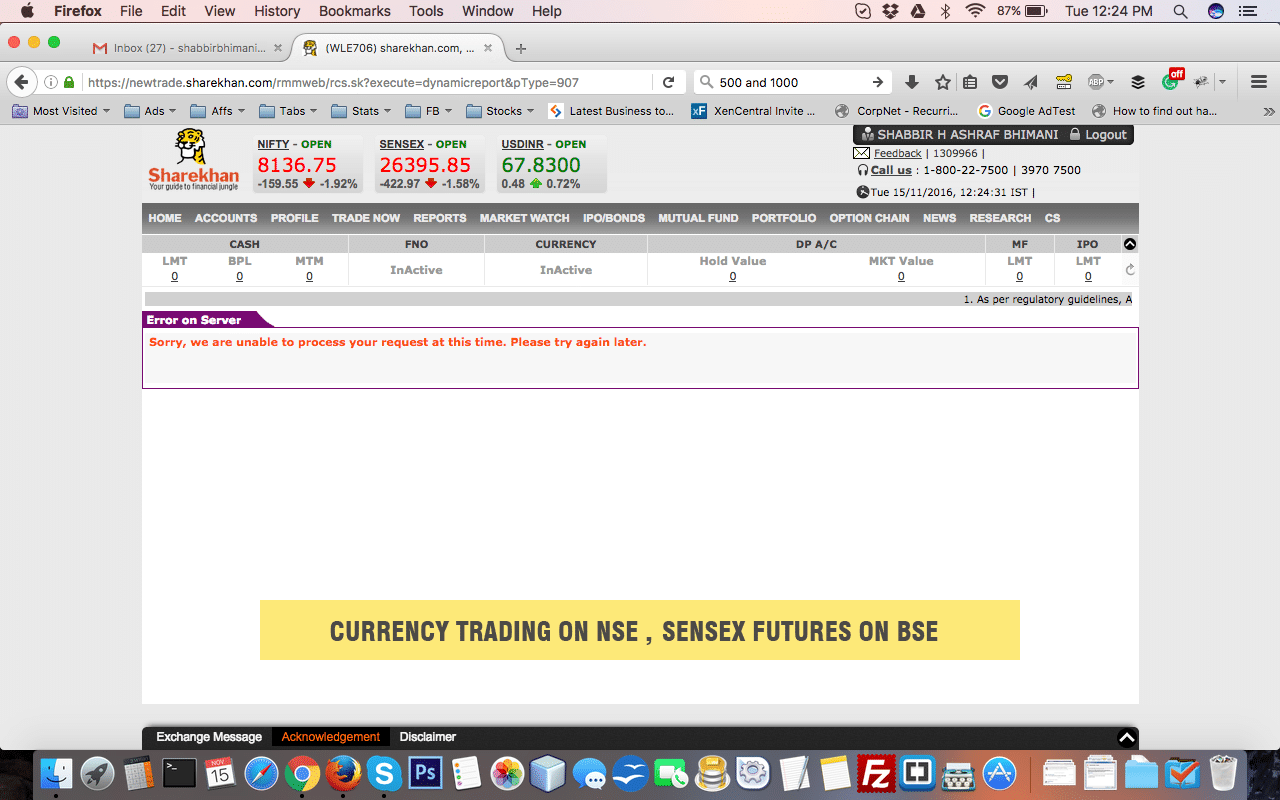

In my December portfolio report, few readers noticed that for the first time I invested and shared the contract note of Zerodha as opposed to Sharekhan it is because ShareKhan on 15th of November had a horrible day.

I was blocked out of the market for a complete day.

I could not view my portfolio, could not place orders and could not trade for the full day.

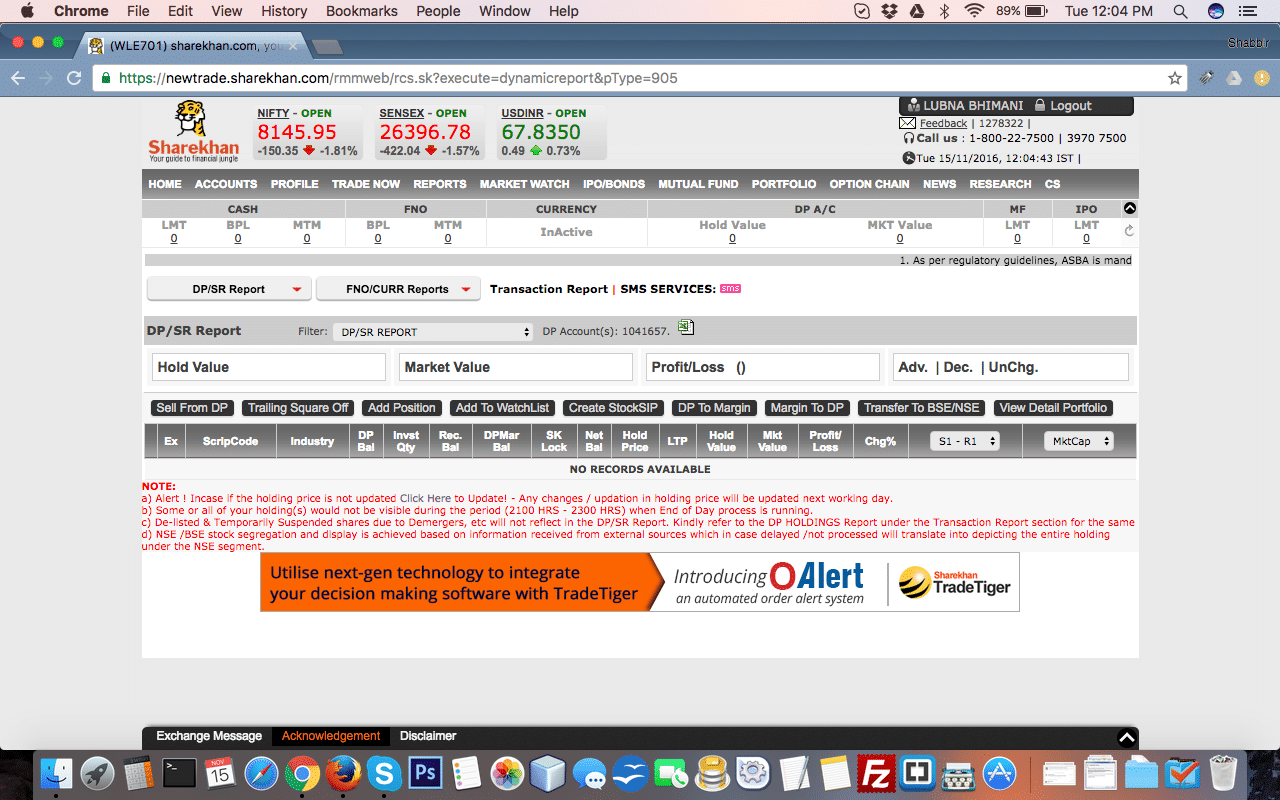

This not only happen to my account but it also happened with my wife’s account as well.

This happened not only on the web end but my relationship manager could not place orders and told me it is system issue and Mumbai has been notified about it.

I just saw my stock falling and getting at levels I always wanted to buy and tried and tried and tried but all in vain.

I even transferred funds but just could not do anything after that and the funds did not reflect into my account till next day.

Few of my friends who have ShareKhan account had a similar issue.

This happens on the back of when I have invest 15Lakh Rs in a year and they have earned handsome brokerage for my investment.

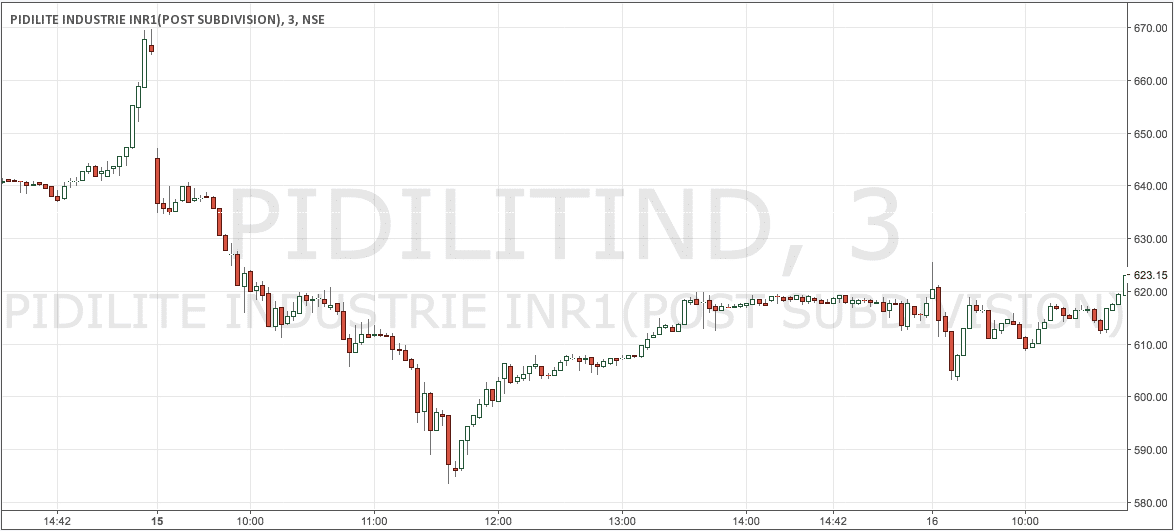

It was a day when Pidilite hit a low of 585ish and I wanted to place an order to buy as close as possible to my lower band of my buying range which was 620 to 580 for me.

After such a horrible experience and not being able to trade for a complete day, ShareKhan management did not bother to email about what happened.

This is when I decided to switch back to Zerodha.

Zerodha had similar hiccups in the past but for few hours and not for the complete day and are brave enough to accept they had issues.

When you are charging 30 times more brokerage (Yes ShareKhan brokerage is 30 times more than Zerodha), you expect much better technical services and cannot have days when you just are blocked out of the market.

I was willing to add more to my portfolio but imagine those who are stuck in positions and want to square off as soon as possible to minimize losses?

Sir, I have just started trading via sharekhan, & Today i bought 2 shares of LICHOUSING (NSE} at Rs 565 each (total 11304Rs}, the buy order was GFD. but only 169 Rs i.e. the cost of 2 shares got deducted from equity balance. And in the Sharekhan App it shows the INTRADAY MARGIN CASH is 169

AFTER 2 DAY THIS SHARE WILL BE IN DEMAT ACCOUNT AUTOMATICALLY?

THIS MARGIN IS ADJUSTED OR NOT?

Yes it will be. They deduct the margin amount on the order being executed and once you are to get the shares in the demat account, rest will be deducted from your account.

Sir, I have just started trading via sharekhan, & Today i bought 20 shares of TRIDENT (NSE} at Rs 84.7 each (total 1694Rs}, the buy order was GFD. but only 508.2Rs i.e. the cost of 6 shares got deducted from equity balance. And in the Sharekhan App it shows the INTRADAY MARGIN CASH is 508.2. can you pls explain this ?

Birendra, normally when you trade, the day you purchase the stock, it only debits the amount of margin money needed for the stock. So if you square off the position on the same day or even the next day, you don’t need the full amount.

If you don’t square off and if you take the delivery of the shares in your DP, that is when the full amount will be debited from your account. So you are seeing the credit balance in your account despite you have purchased the shares.

Hello. I bought 4 shares of Yes bank through limit order via sharekhan website. The order is fully executed but I cannot see it in my portfolio tab. It is visible in my order report but why not in portfolio. Also, if the order is fully executed, I can hold the shares for more than one day right? It was GFD when I bought but the order is fully executed.

Anne, they will be available in your DP after 2 working days.

Hi Shabbir,

Could you please let me know how to place intra day order in Share khan thru WEBSITE??

There is no difference in trade execution for Intraday or Delivery. Just execute the trade with right options and try avoiding margins for intraday.

Hi

Shabbir,

Thanks, but the query is not yet clear. Intra day

thru sharekhan website, we would place order from trade now Tab. Could you

please explain with one example to get me a clear picture.

What role is played by Stop loss trigger price,

limit price, & Place cover order option in share khan website under Trade

now tab?

I Have attached screen shot of same so that you and

me will be on same picture for understanding.

Hi Samar,

Those options are pretty basics for any trading platform and there is nothing specific to Sharekhan or intraday.

I will try to provide a brief explanation for them

Stop loss trigger price is the level of stop loss you want for your order. For a buy order at 100 Rs, you can have a stop loss price of 95 or 98 and it will be triggered if the stock is below that level.

Limit price is price at which you want to limit your order.

Hope it helps.

Thank you Shabbir for explaining it with simple words.

One last question If I want to place intra day order For eg. Voltas CMP is 306, my target is 311, stop loss is 303. How would I place the order in attached screen shot. I mean where would I enter the price in given web based option.

Samar,

You should place a limit order where the limit price should be 306, and stop loss trigger price should be 303.

If you want to also place your cover order, you can add those as well using your stop loss.

Thanks

Shabbir

Thank you shabbier for giving your precious time.

I forgot to tell you one thing, while placing intra day order thru website, it says first order to be place on market order, not on limit order.

Could you please call me on 9819846436 or provide your number so that I can clear all intra day doubts at one go about share khan website.

Regards

Samar Shinde

Samar, my name is Shabbir and not Shabbier.

I tried calling you but there was no response and so you can call me back on any weekdays between 9AM to 9PM.