I don’t recommend trading against the trend unless you understand it completely. So let me share my trades against the trend and explain the rules to trading against the trend.

I don’t recommend trading against the trend unless you understand it completely. So let me share my trades against the trend and explain the rules to trading against the trend.

Let us first identify a trend in a stock.

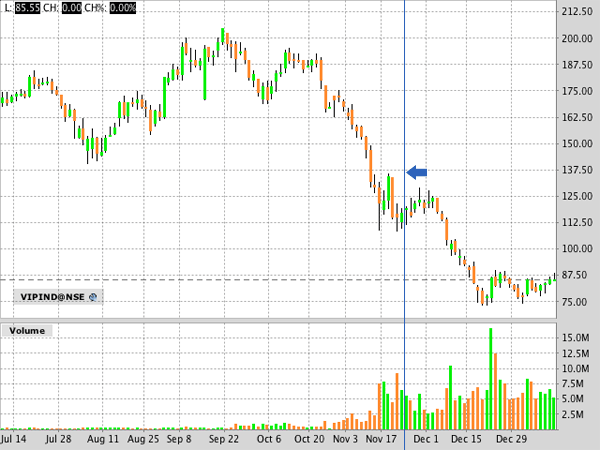

In VIP Industries, you can spot a downtrend easily.

Stock went from 175 to 110 in pretty much a straight line. At 110 some buying or short covering was seen and then again it was back to 110 in couple of days time clearly suggesting down trend. The important thing was it did not break 110 and I anticipated that 110 could prove to be a pivot of trend reversal. This is when I took a trade against the trend.

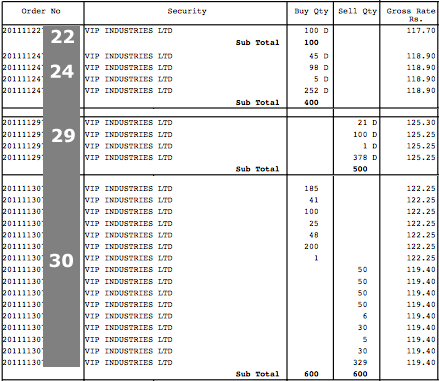

Here are my trades.

Nov 22 2011 is when I took a small position of 100 shares in VIP Industries at a price of 118ish. 24th Nov is when I was convinced that bounce is evident and so I added to my initial position.

Stop loss was 110 with a target of 130 odd. The ROI for the trade was I would either make 12 Rs per share or loose 8 Rs per share i.e. a ratio of 1.5 is to 1 for target versus stop loss.

I saw a peak in VIP Industries at 128 and not at 130, which was my target and so I sold of on 29th Nov 2011 at around 125 odd levels.

On Nov 30 I took up yet another position at around 123 levels. I actually rushed into this trade but as I was trading against the trend I had a strict stop loss of 120 that was previous days low. As the stock broke 120 I was out of it with a small loss.

3 Golden rules when trading against trend

- Don’t rush – When you are trading against trend, wait for the support (resistance if shorting) to be created and tested more than once before you even think about trading against the trend.

- Follow strict stop loss – Genius of a trader can be wrong and there is no harm in accepting you were wrong but trying to prove you were right and holding on to a position can prove more fatal. I could loose 33 % of my investment from 120 to 80 if I would not have followed the stop loss.

- No trade is good trade – Don’t trade if you are not sure because it is better not to trade against the trend. Wait for the trend reversal. You may miss the sharp bounces from support but that means you are trading with more conviction.

I hope this helps fellow traders trade with more conviction in market.

TITAN IND,SUN TV,ICICI BANK,RELIANCE,RELIANCE CAP,BHARTI AIRTEL,INFOSYS,TCS,

So whats the question or suggestion if any?

Great. So you are basically tracking few good scripts which you are monitoring on a daily basis. Got it. Thanks for the prompt reply.

The pleasure is all mine Rajendra.

That was wonderful trade against the trend. My question how do you keep track of which stock is will be at the right level for trading opportunity? Most of the time I realise that I missed a trading opportunity many days later. It is not physically possible to track so many stocks of bse/nse.

Brgds/Raj

You don’t need to track all of them and have a list of your stocks that you think will be good and just track those ones. You will see me telling a lot about only a set of stocks and not all of them.