My review of Upstox and why it is my favorite broker in 2020. Step by step to open your account digitally and answer common FAQs

I am not a fan of changing brokers, but some brokers make their product so enticing that I have to change. Upstox is one such broker where I liked their interface so much that it has become my favorite broker in 2020. Let me share my review of Upstox with you, and then you can decide for yourself.

My Criteria of Good Broker

There are specific criteria that I like to judge my brokers on. Lower brokerage is one of them, but it is not the prime reason to choose a broker.

So my view of a good broker and select Upstox is as follows:

1. Better Charts

The first and the most important criteria for selecting a broker are they should have the best charts within the trading terminal.

If charts are subpar, there is very little that I look further when selecting my broker.

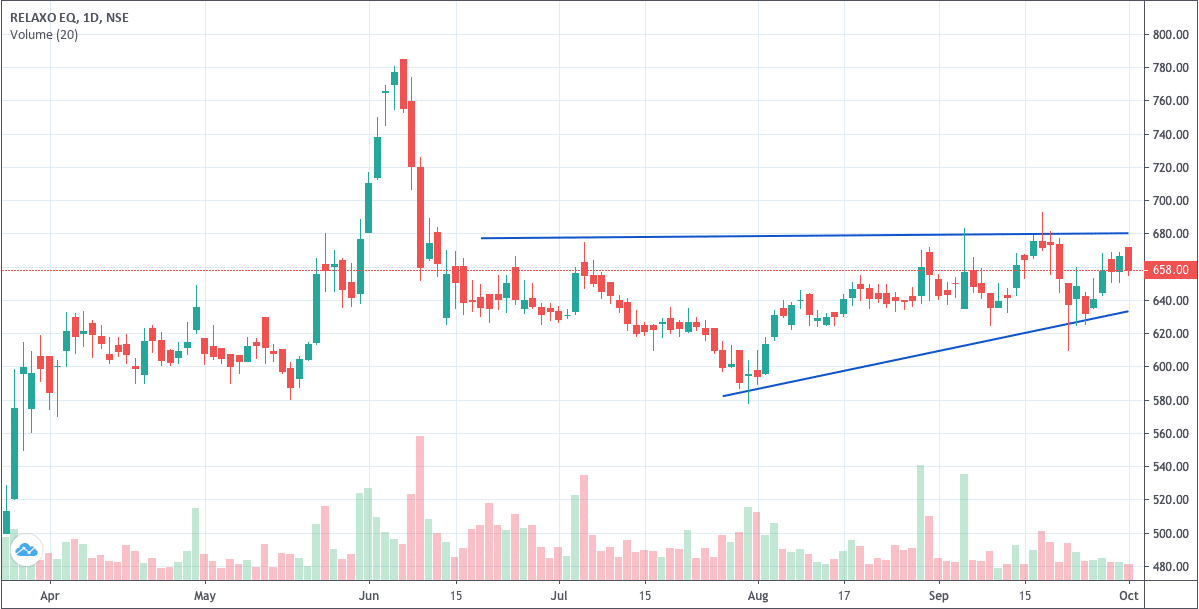

One of the most important criteria to select Upstox as a broker in 2020 is their charts are integrated with Tradingview – which is the app I use for charts on my blog and in my Right stock at the right price for the right time book.

2. Clean Web Interface

When the broker’s web interfacing requires a learning curve, I like to avoid using them. One of the main reasons I moved away from traditional brokers is that they had a very clumsy web interface.

The move from Motilal Oswal to Sharekan to Zerodha and now to Upstox has a specific criterion. The web interface has to be simple enough that a 10-year-old boy can also use it with ease.

Because I use Mac and not windows, I prefer to be using the web interface. Motilal Oswal at that time only had a Windows application, and the web interface was almost non-existent.

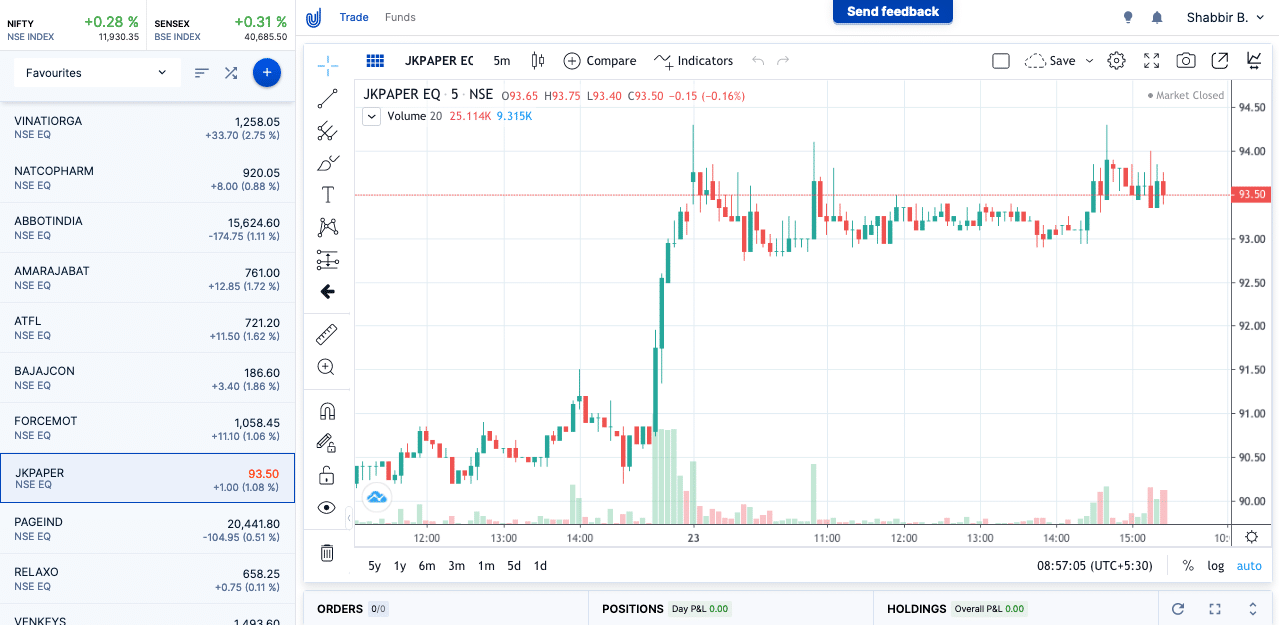

The interface is much similar to Zerodha and with charts of TradingView well integrated.

3. Cleaner Mobile App

Though I use WeBull for the mobile apps to check the stock price, I use WeBull because it doesn’t require me to log in. Moreover, I don’t execute trades from mobile.

However, Upstox mobile interface is as simple as its web interface.

4. Good Reports for Taxation

The next critical criteria for me is to have taxation reports handy. Though Upstox doesn’t have reports like Tax-loss harvesting like Zerodha, it still has all the reports one needs to file the income tax returns quickly.

The only caveat is, there is no way to move from the web interface to the reports interface, and one has to login to the reports interface separately. However, when you open an account, they will guide you and let you know about it.

5. Low on Brokerage

In my Upstox review, I am sure you can sense that the cost is the last criterion to select a brokerage.

Still, a penny saved is a penny earned.

When one can get the same quality of services at a low brokerage cost, one should consider these low-cost brokerage services.

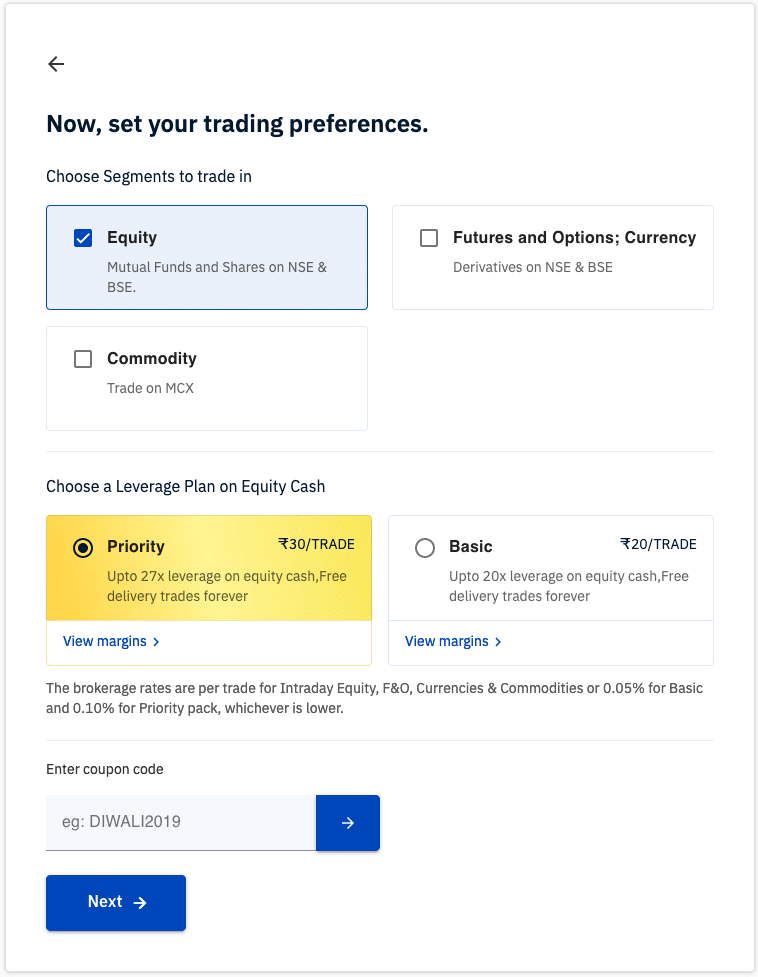

Upstox has a very low brokerage of ₹20 per trade or 0.05% (whichever is lower), and as usual, the delivery trades are free. As an investor, I prefer delivery-based without margins, and so for me, it is all free.

Totally Online Account Open Process

The best part I like about opening my Upstox account that I want to share with you in this review is opening a fully functional demat account without signing a single document. Everything is very well-integrated digitally.

So let me share the complete process with you to open a new demat and trading account with Upstox.

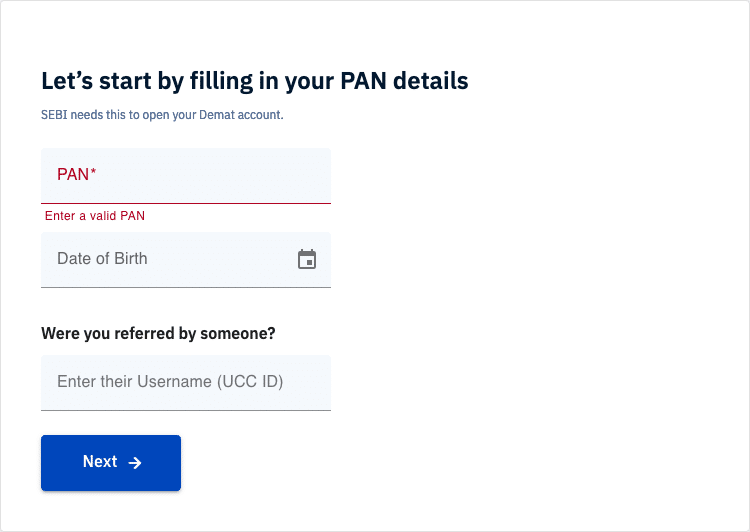

Start by entering your PAN number along with your date of birth. You can enter my username EE4816 for a surprise gift.

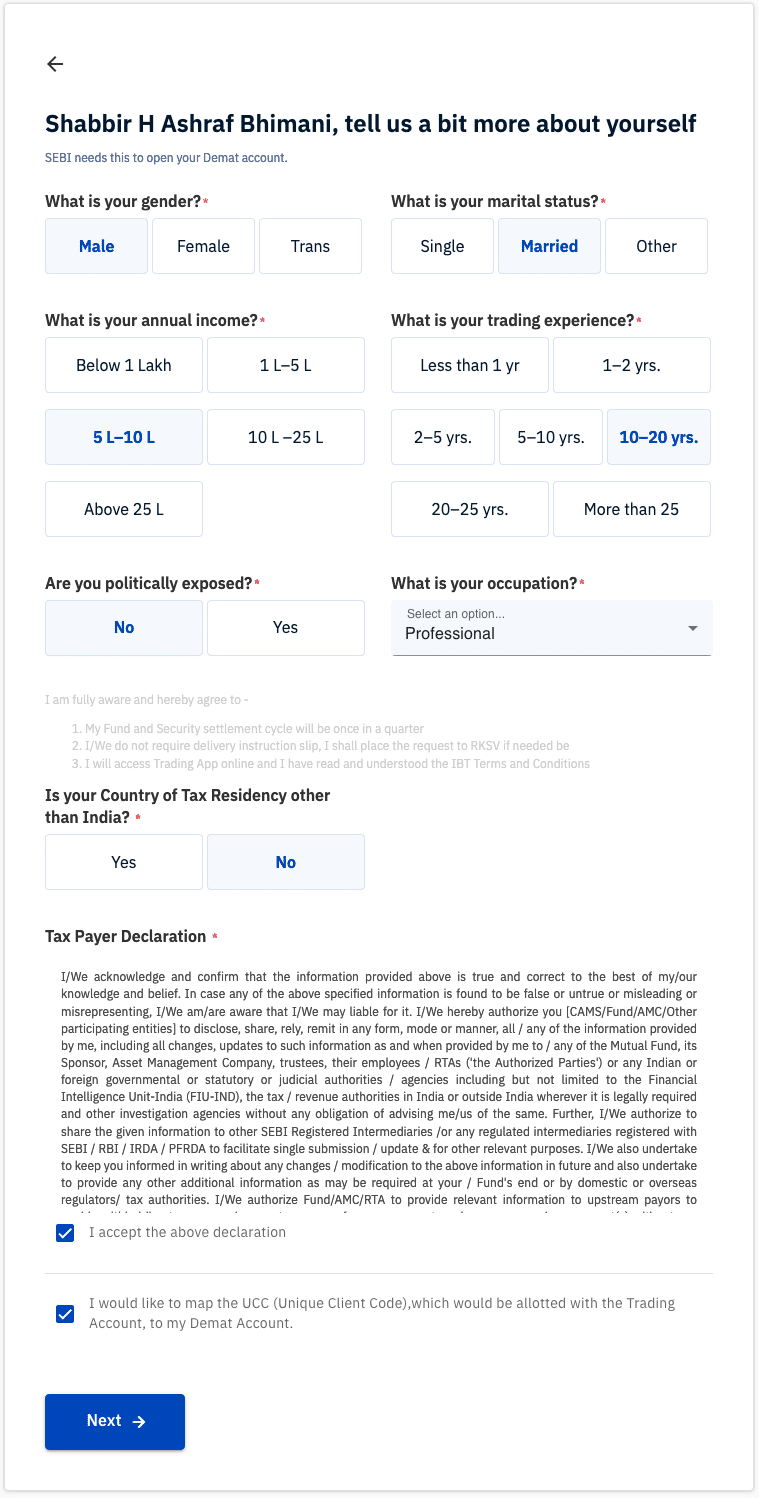

Upstox will fetch all the details from your PAN card, so you don’t have to enter them again. Only a few necessary information and one can proceed further.

I always avoid futures, options, and commodities, so my preference is only equity.

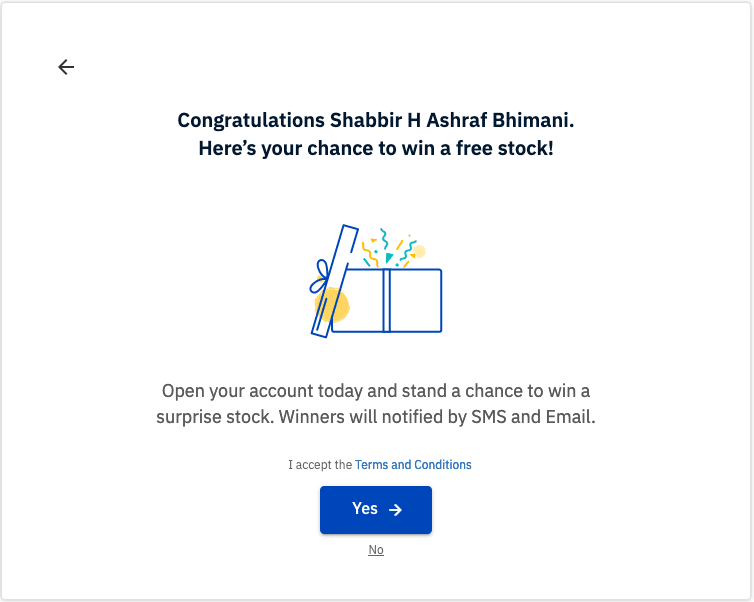

Voila. This is where you will get the chance to win a free stock completely free provided you have entered my referral ID in step one. However, the gift can vary from time to time. Currently, they are offering one free unit of any one of the shares.

Make sure you click YES to proceed.

Note: The one share will be purchased on your behalf, and it will get credited to your demat account. The amount will show a negative balance, but it will be reversed in a day or two.

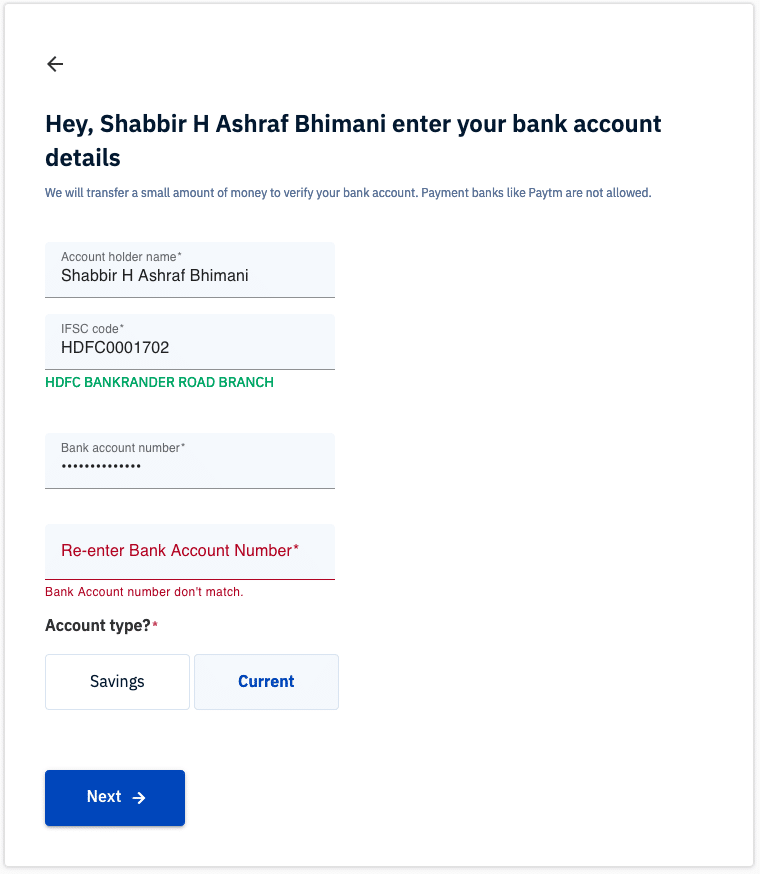

The next step is to add bank details. Add these details with care as the fund transfer will be from this bank. Moreover, the dividend that companies declare will also be credited into this bank account.

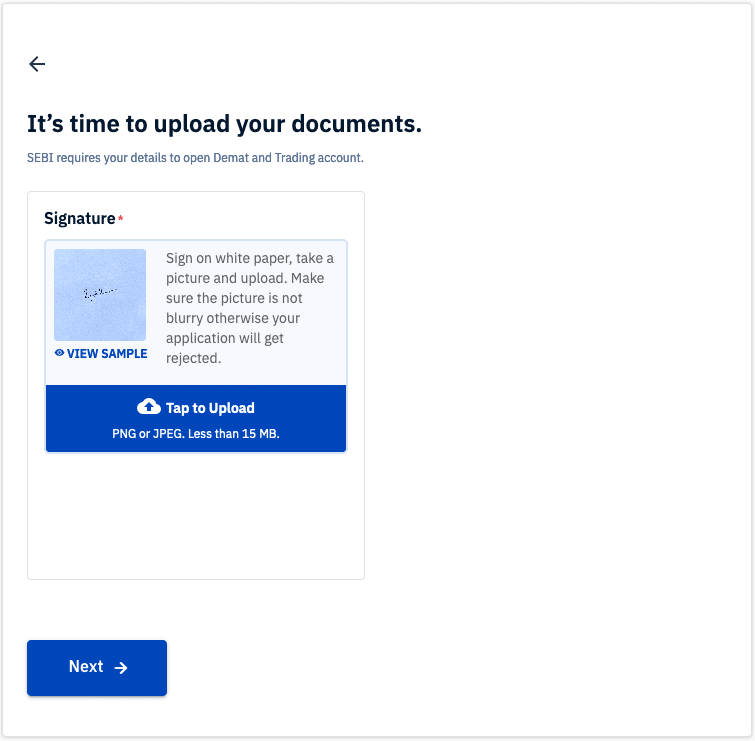

Now upload your sign. If you don’t have a scanner, use the Adobe Scan Android App to convert your mobile phone camera into a scanner.

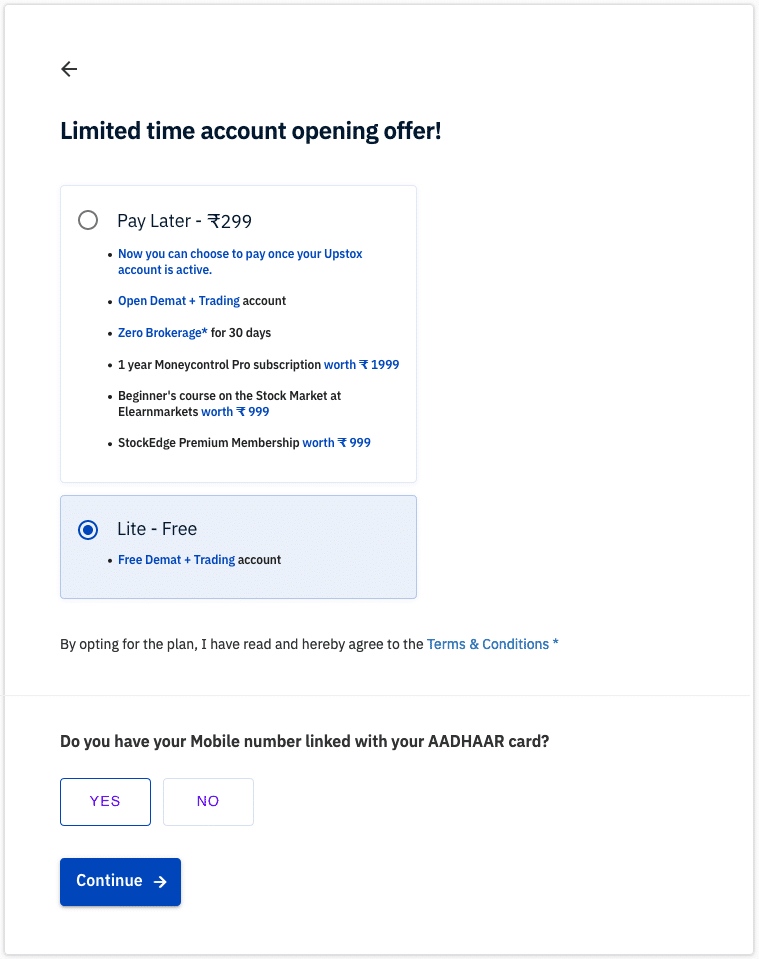

Choose the demat account plan. Lite – Free account is an excellent choice to start with.

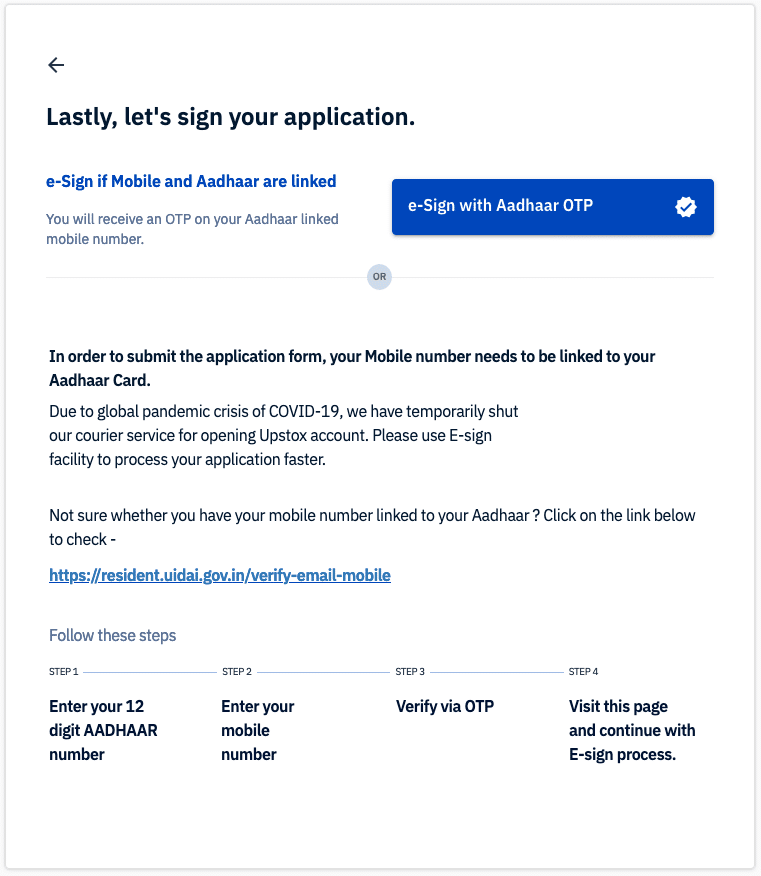

Finally, e-sign the documents. You will need the mobile number linked to your Aadhar card.

The process to e-sign the document is relatively simple.

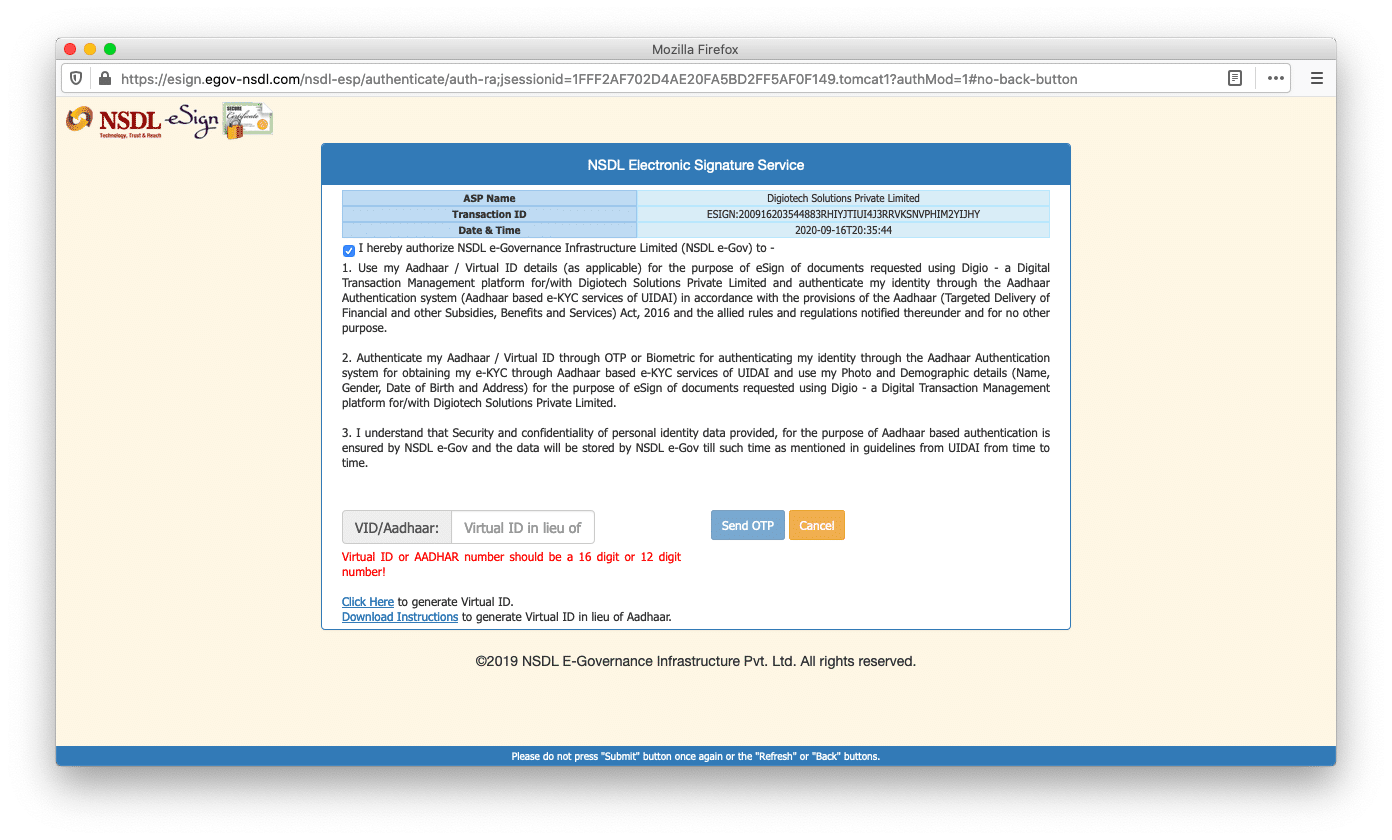

Once you start the e-sign process, you will receive OTP from Aadhar on your registered mobile number. Enter the Aadhaar number as well as the OTP, and your application will be e-signed.

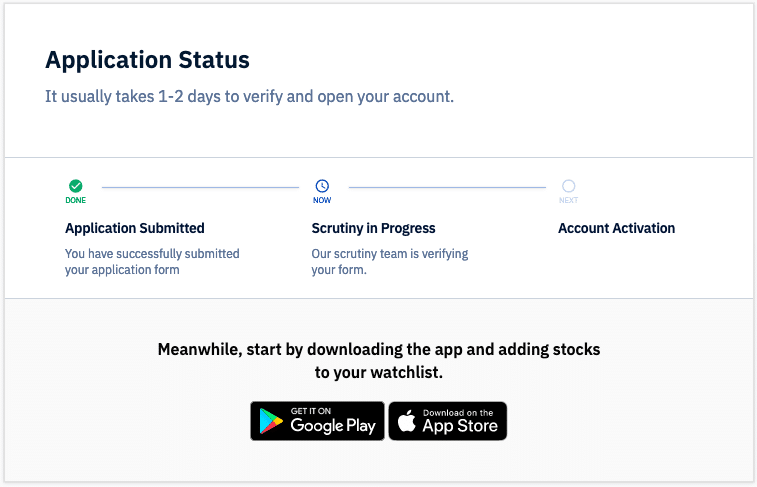

Once the e-sign process complete, you will see the following message.

Someone will verify your account in a day or two, and you will get the username and password to start trading in your demat account.

The process is relatively simple and all digital.

Frequently Asked Questions About Upstox

How to Deposit Funds into the Upstox Account?

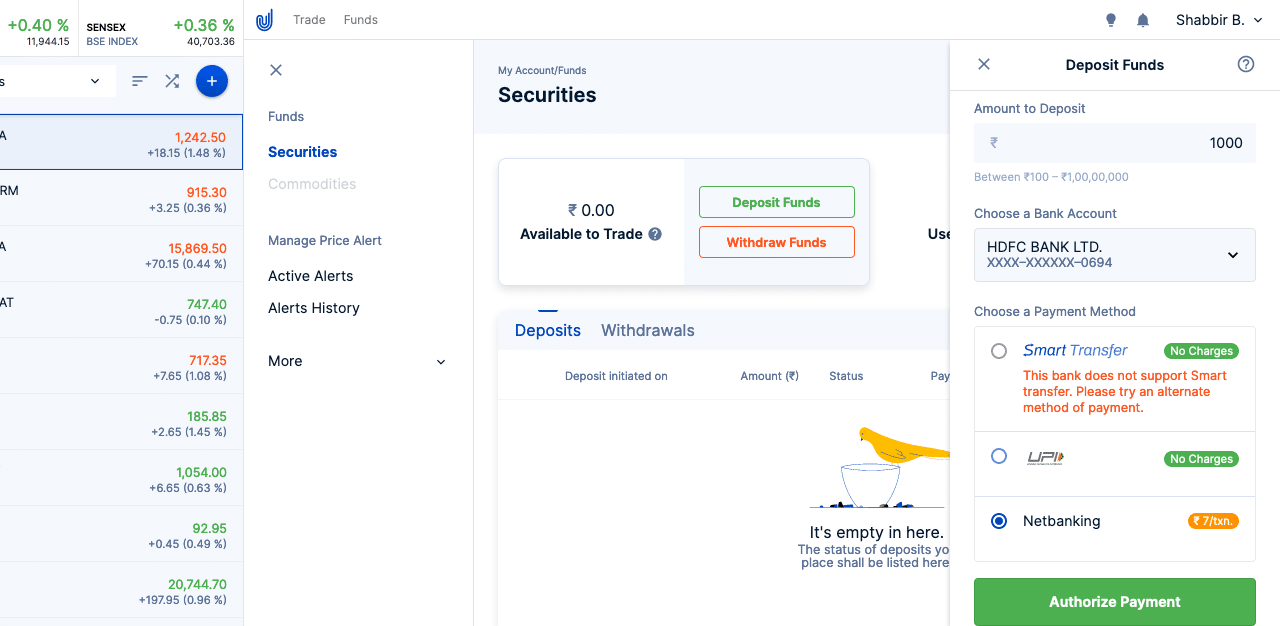

Once your account is operational, one has to deposit money into the account to start trading. The process is relatively simple and under the Funds Tab, click the Deposit Funds button.

Enter the amount you wish to deposit and choose a payment method. I prefer using Netbanking even if it costs ₹7 per transfer.

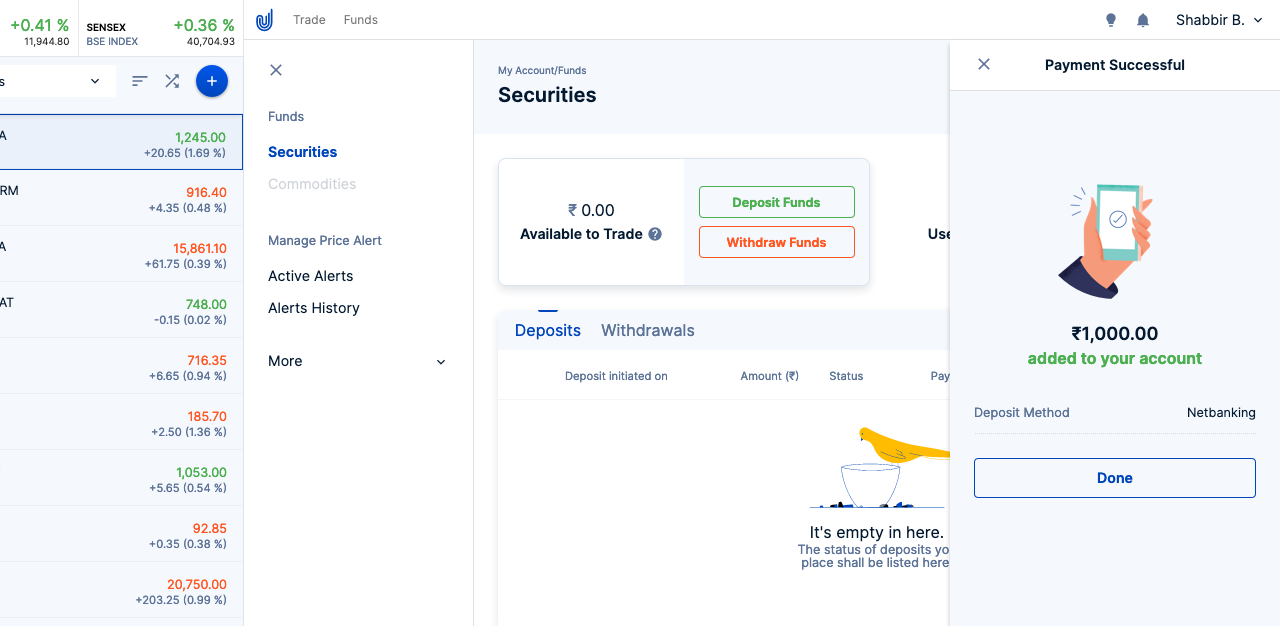

The interface will send you to the bank interface. Once you make the payment, the amount will reflect in the Upstox interface.

Refresh the page, and the amount will become available to trade.

How to Buy Shares in Upstox?

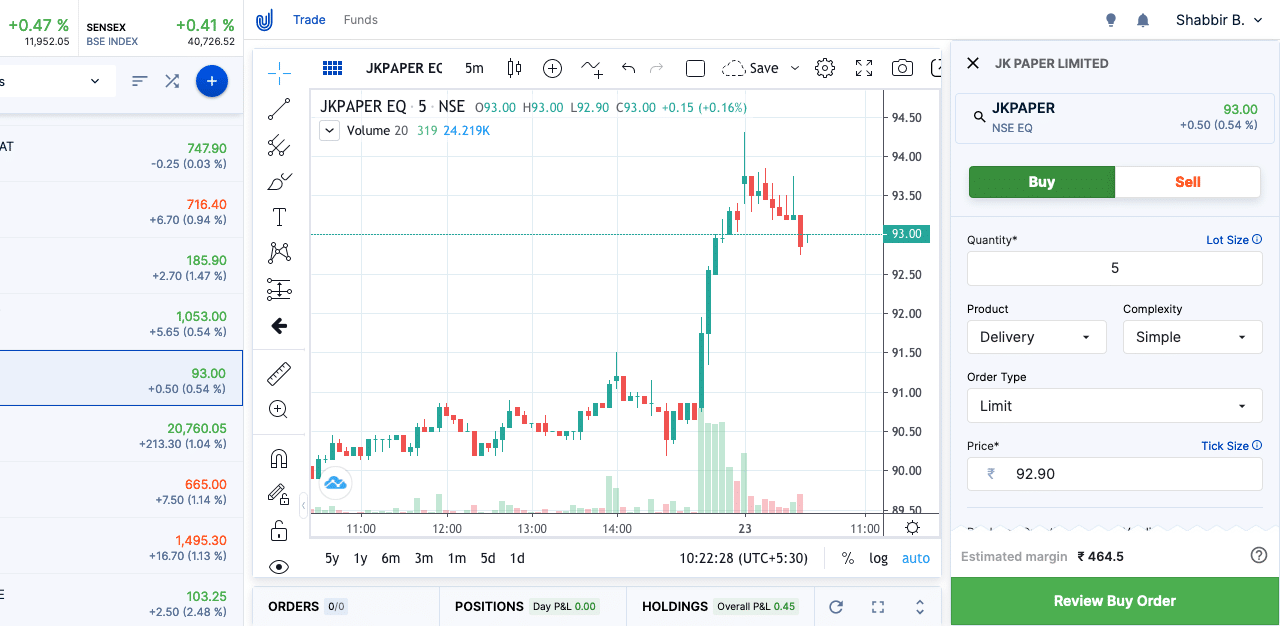

To buy a share in Upstox, hover your mouse on the left panel’s stock name and click the B button.

Enter the number of units you want to buy. Make sure you select the right product for either intraday or delivery. Like margins, I don’t recommend intraday trading either.

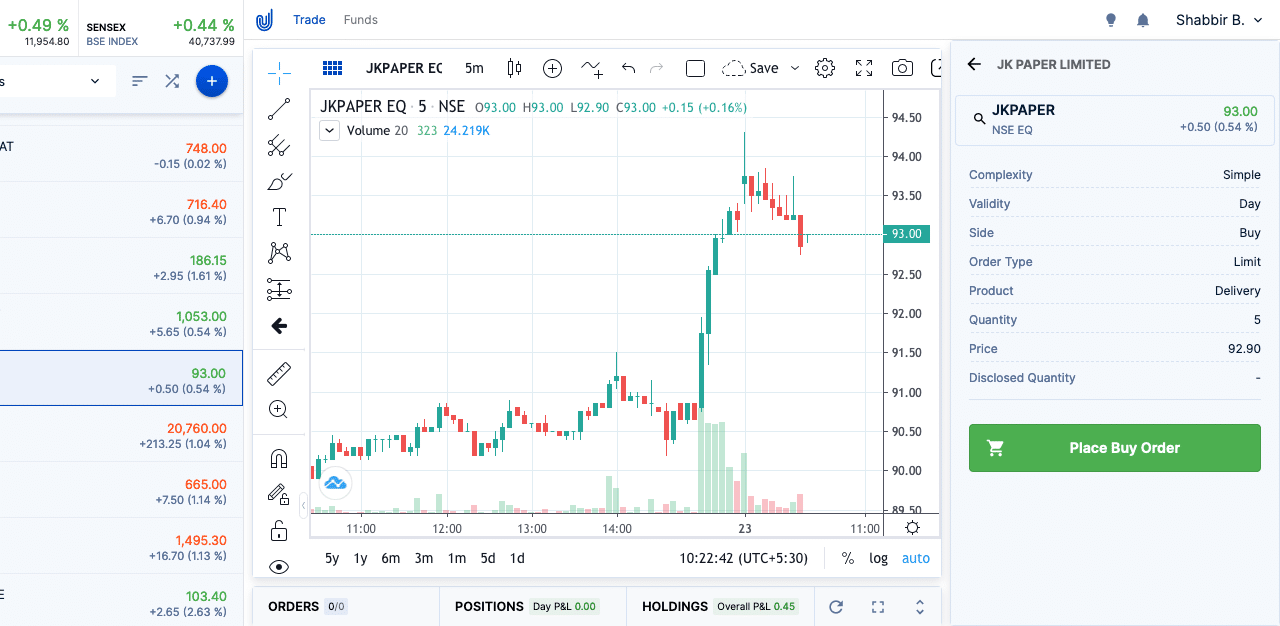

Confirm and place the order.

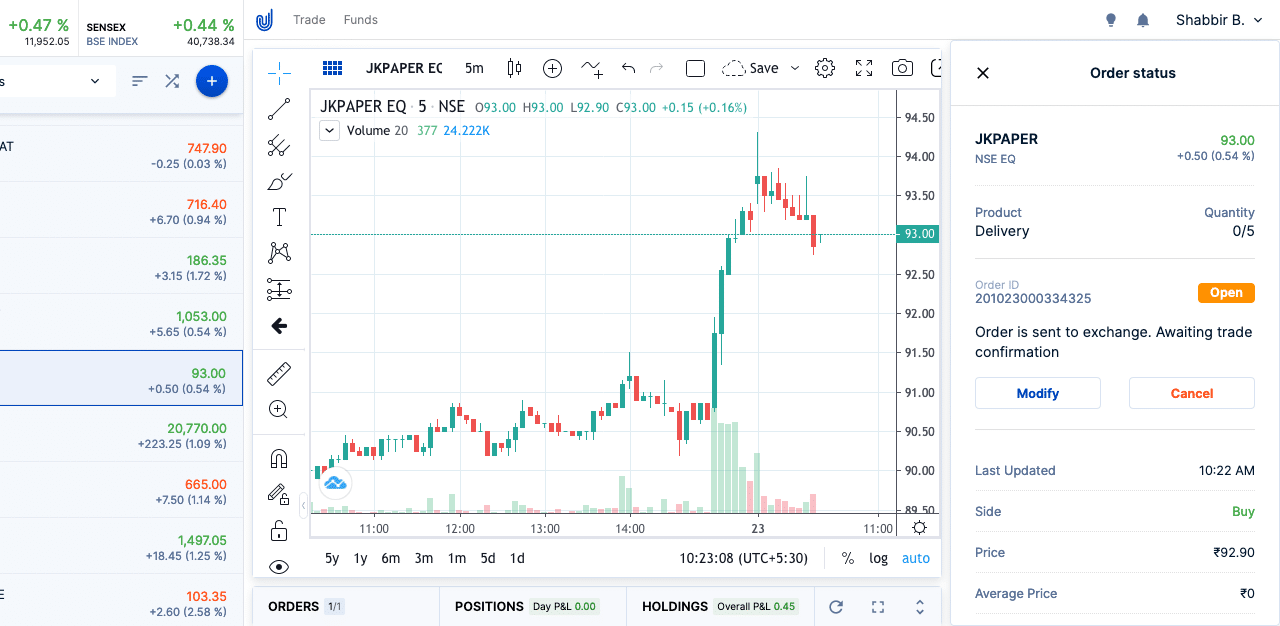

If you have selected the limit order with a buy price lower than the current sellers, your order will be under the pending state.

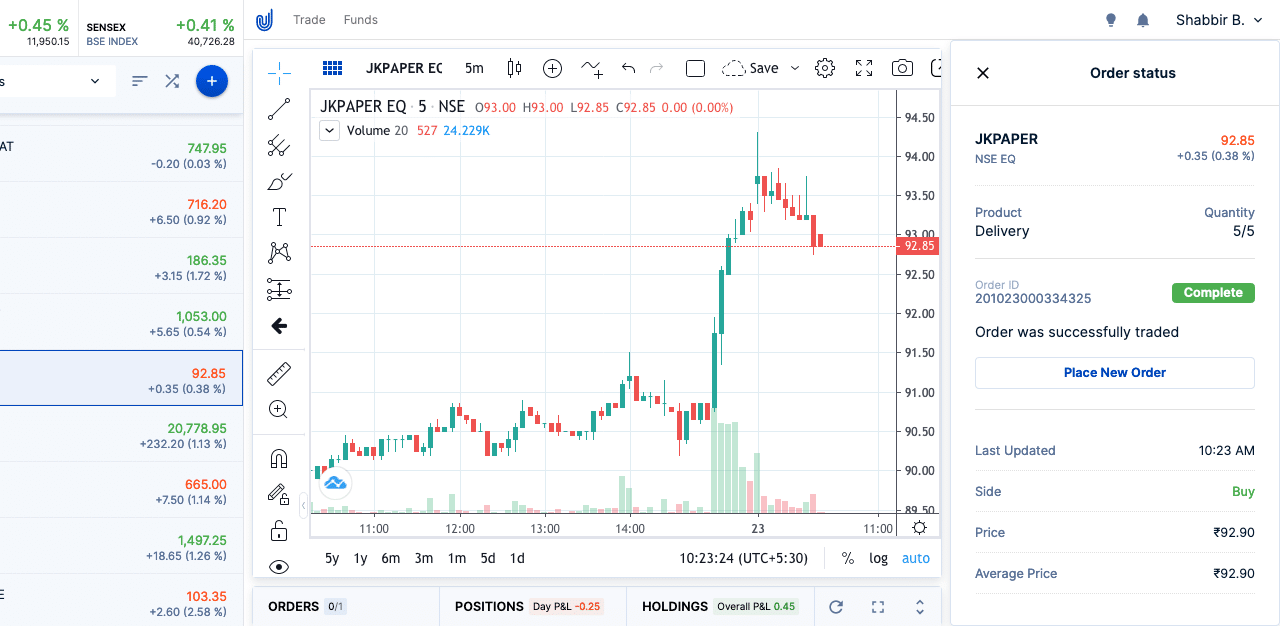

Once all the quantities are purchased, the order will automatically complete.

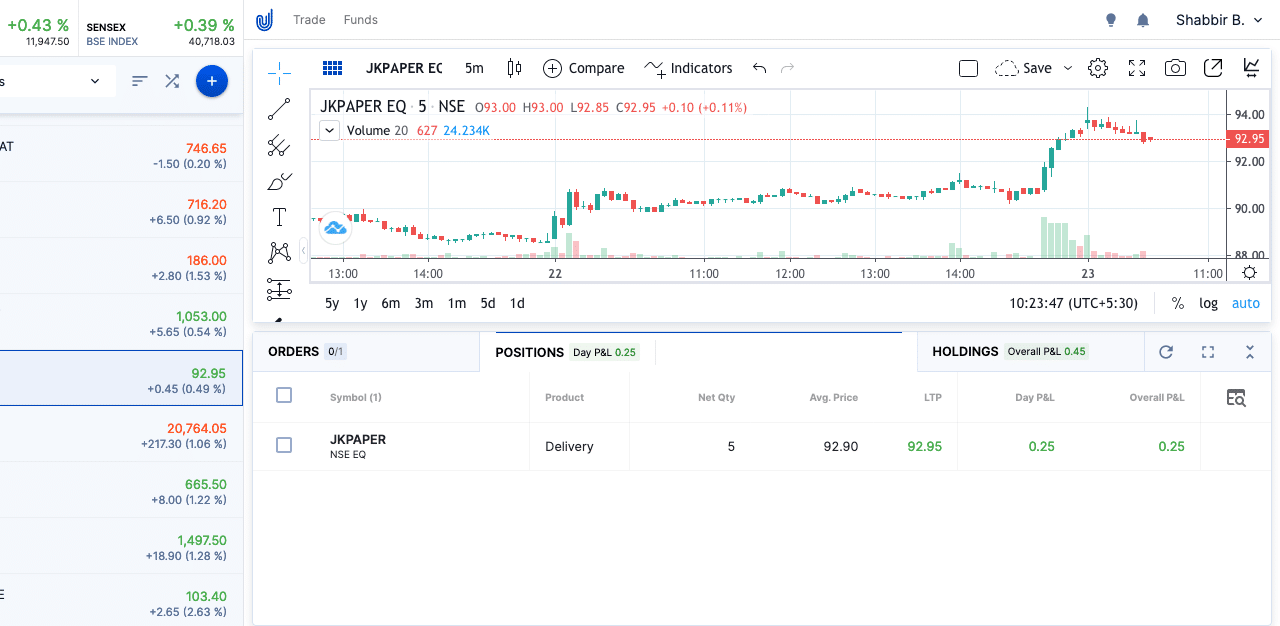

And you will see the shares under the open positions. The option to open the positions option is in the bottom right corner of the web interface.

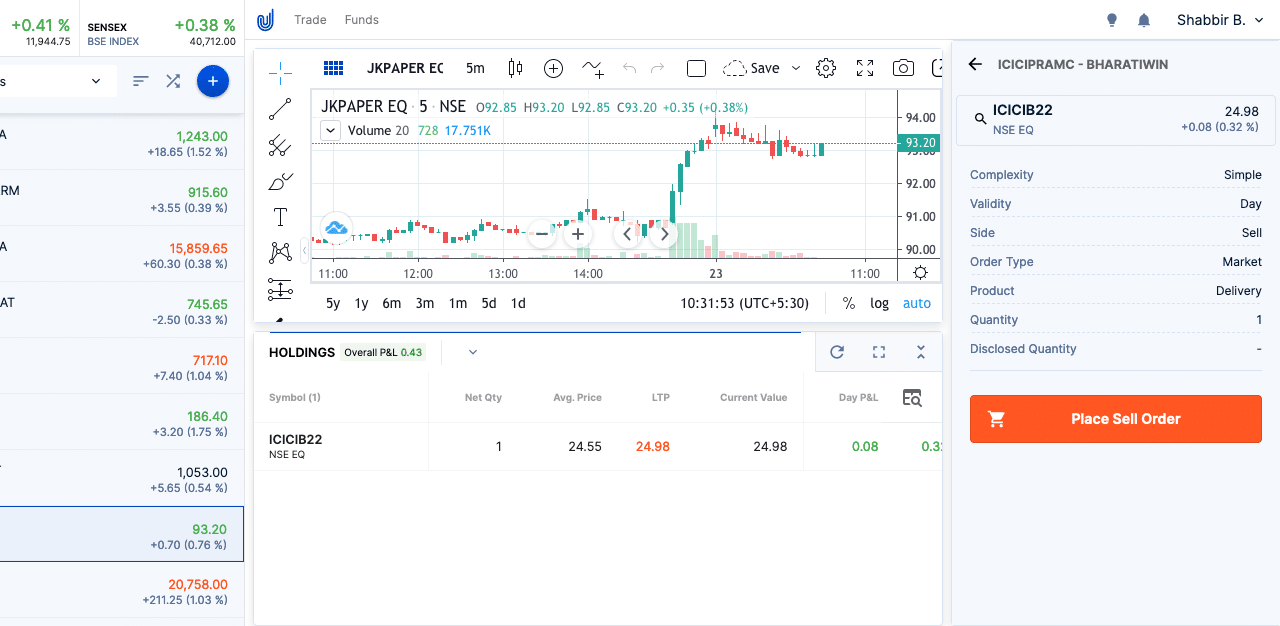

How to Sell Shares in Upstox

Selling shares in Upstox requires CDSL permission to debit the shares from your account.

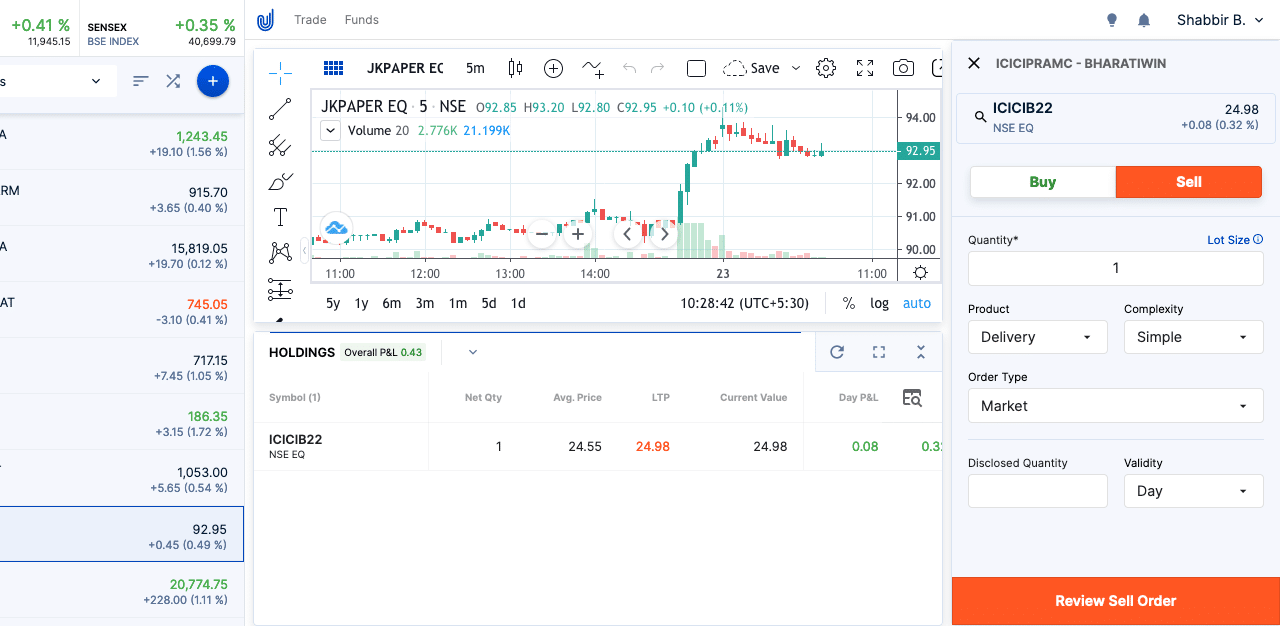

To sell a share, hover your mouse on the left panel’s stock name and click the S button.

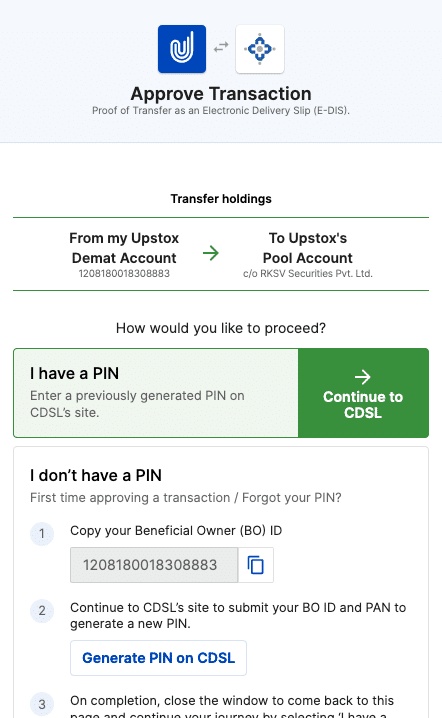

The next screen will help you generate the PIN from the CDSL website, and then one can place the sell order on Upstox.

It is a new mandatory process for new accounts, so brokers can’t move the stock out of your demat account without your consent.

First, follow the instructions under. I don’t have a PIN. Copy your BO ID and click on the Generate PIN on CDSL.

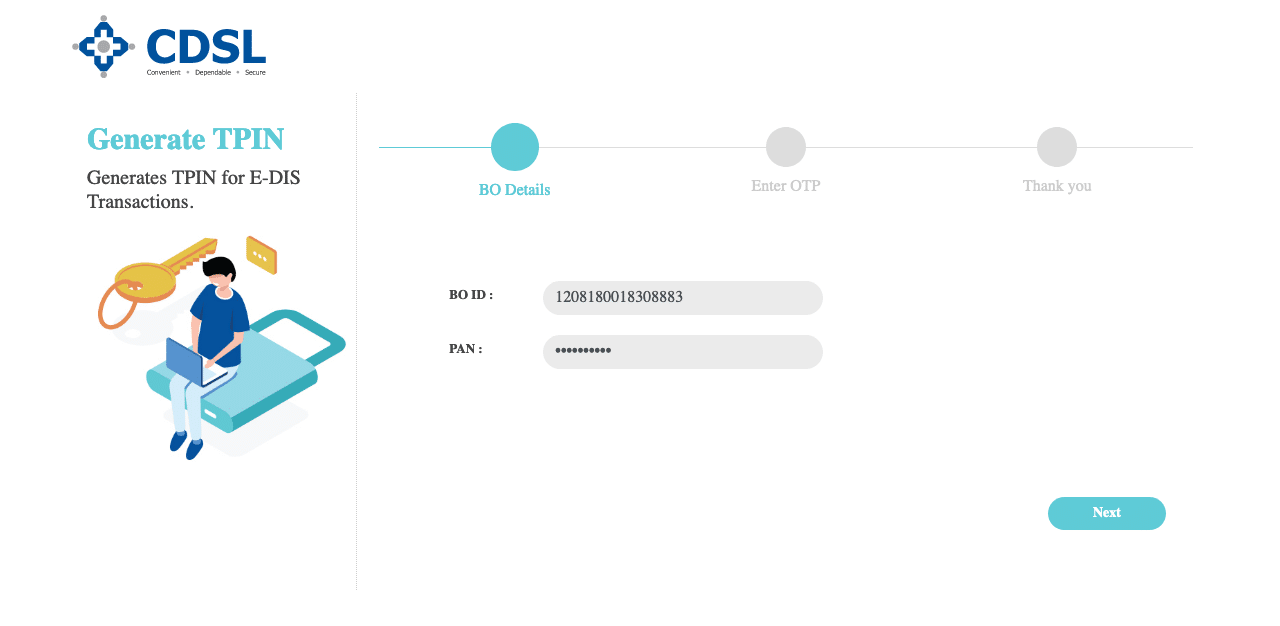

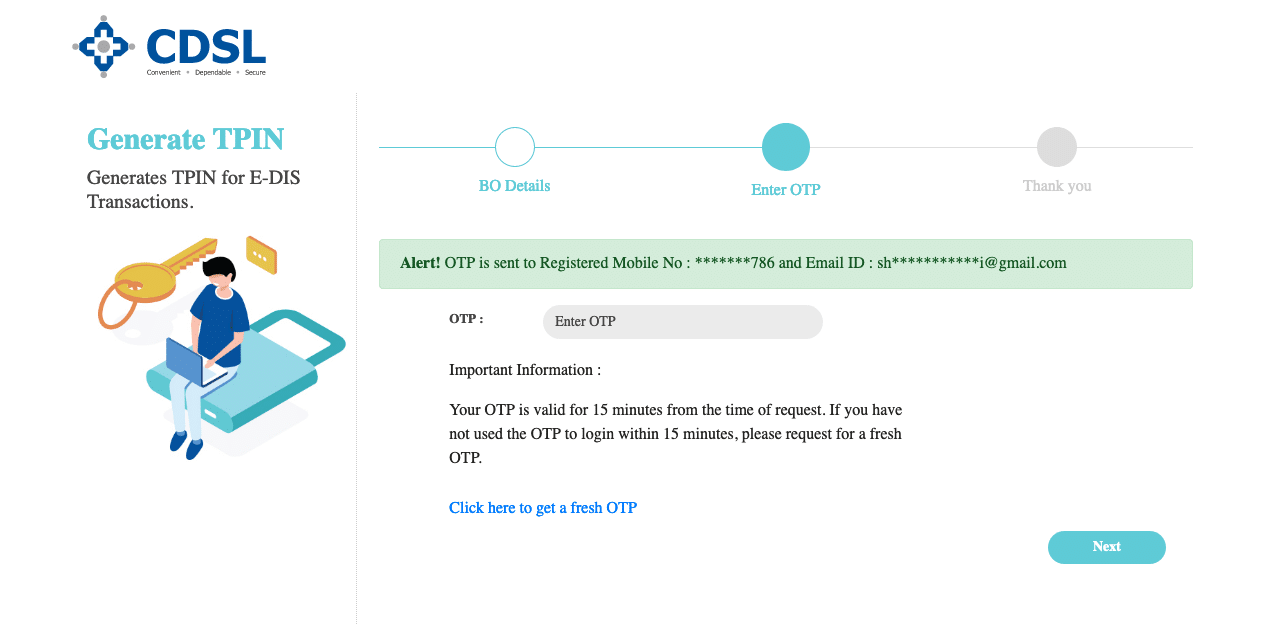

You have to enter your BO ID and PAN number on the CDSL site. They will authorize the process with an OTP.

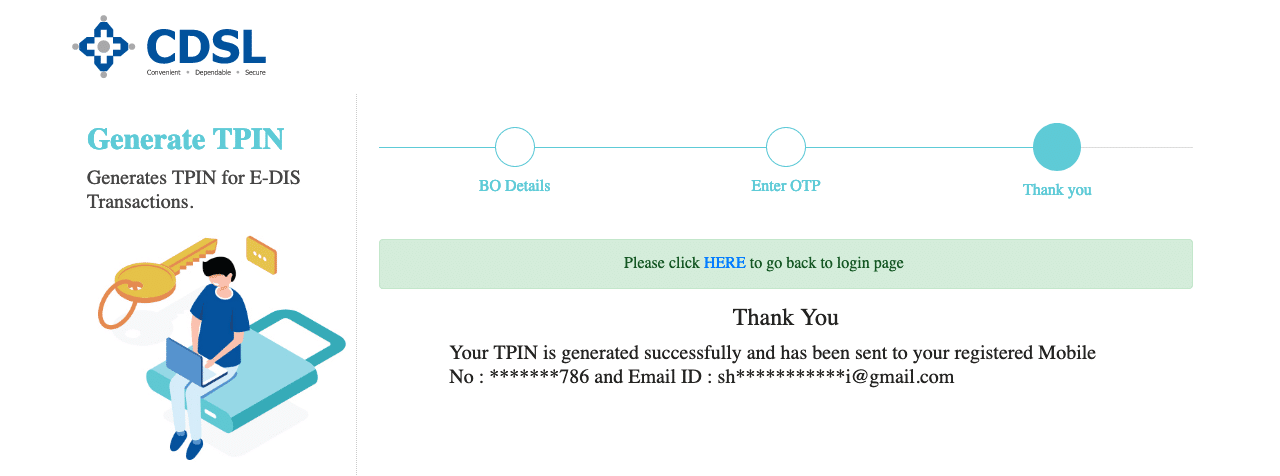

Enter the OTP to generate the PIN to sell shared on Upstox.

Now revert to the Upstox screen and continue on the process of I have a PIN

You will enter the PIN on the CDSL website and return to Upstox. Then you will have an option to review the sell order and send the order to the exchanges.

Is Upstox Registered Broker with SEBI?

Yes, Upstox is a registered stockbroker with SEBI. Their SEBI Registration No. is INZ000185137 (as RKSV Securities India Pvt Ltd).

Upstox is also a member of NSE, BSE, and MCX stock exchanges and CDSL and NSDL central depositories.

Is my Investment Safe with Upstox?

Definitely. Any SEBI registered brokers mean your investments are safe with them. Moreover, your demat account is with CDSL, and so your shares are in the demat account with CDSL, which means your investments are safe.

Final Thoughts

Finally, I like to mention that Upstox is going global. It means we will have an option to invest in US-based companies as well. However, it is not yet live, but they assured me it is coming soon.

Y a negative balance is showing in funds ?

Which funds is showing negative balance?

Just curious.. What is the surprise stock you got?

The one that you see me selling in the screenshot above. ICICIB22 the Bharat 22 ETF version of ICICI Bank.