Understand US banking crisis. What Happened to SVB Bank? How Safe Are Indian Banks? Can This Lead to 2008 Like Financial Crisis?

Let’s understand the US Banking Crisis.

- How does an increase in bond rates impact banks?

- What happened to Silicon Valley Bank or SVB?

- How safe are Indian banks?

Finally, the most important question is Can the 2023 US Banking Crisis lead to 2008 like situation for equities?

So without much ado, let’s begin.

How does an increase in bond rates impact banks?

Let’s understand this with a straightforward Indian FD example.

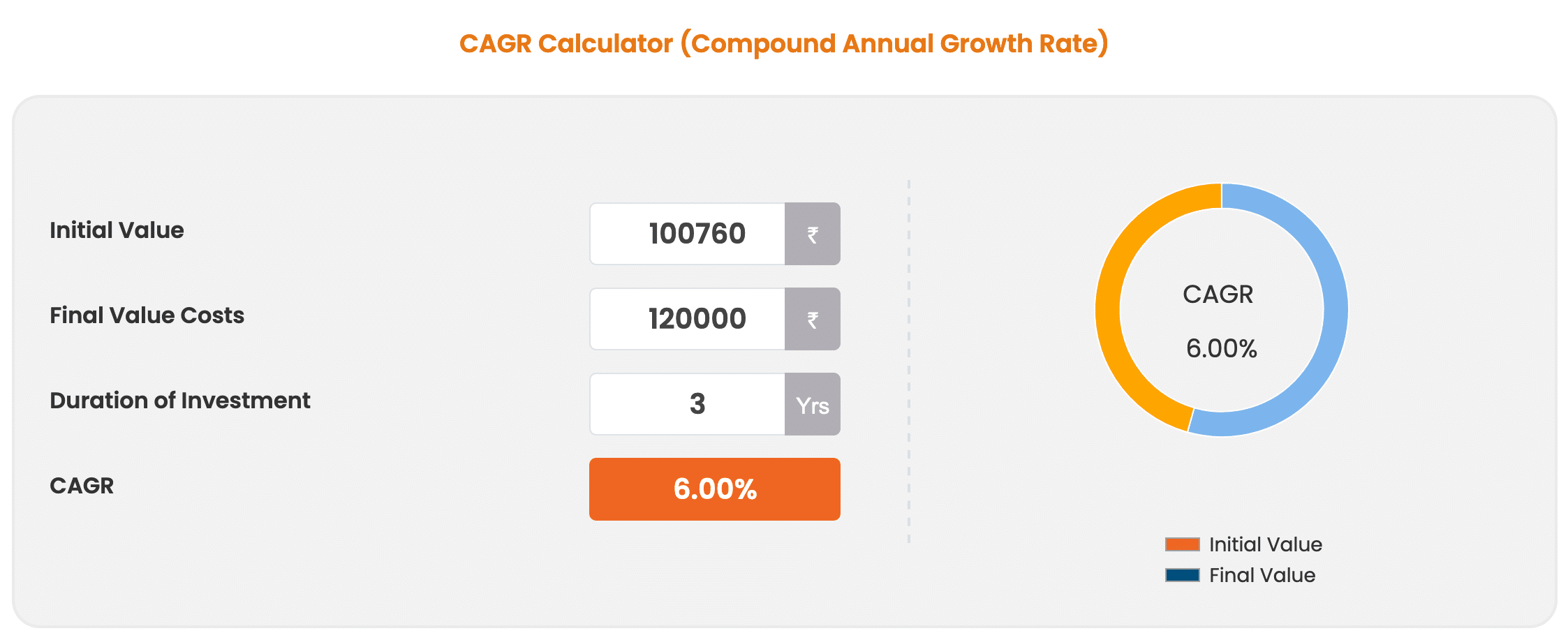

I have one lakh rupees, and I go to my HDFC bank and deposit the 1 lakh Rupees at six per cent FD rates.

So I deposit the money, and they give me back a certificate worth 1.2 lakh rupees or six per cent for three years, it comes down to 1.2 lakhs. So I take that certificate go home, and sleep well.

I know my amount is secure HDFC bank is very secure, and there is nothing wrong with it.

Now three or four months down the line, RBI has increased rates, so the FD rates in India increased to nine per cent.

So the banks are now giving more rates on FDs. It doesn’t matter because I can get 1.2 lakh Rupees at the end of a three-year tenure.

Suddenly there is some emergency, and I require money.

In India, if an individual requires money, he can break their FD with the Bank, but in the case of government bonds, you can’t break the bond.

You can’t return the bond certificate to the government and ask for money. So what happens is you have to sell it in the market.

So we will use a similar example for our FD. Now I need to find a third party ready to purchase this certificate.

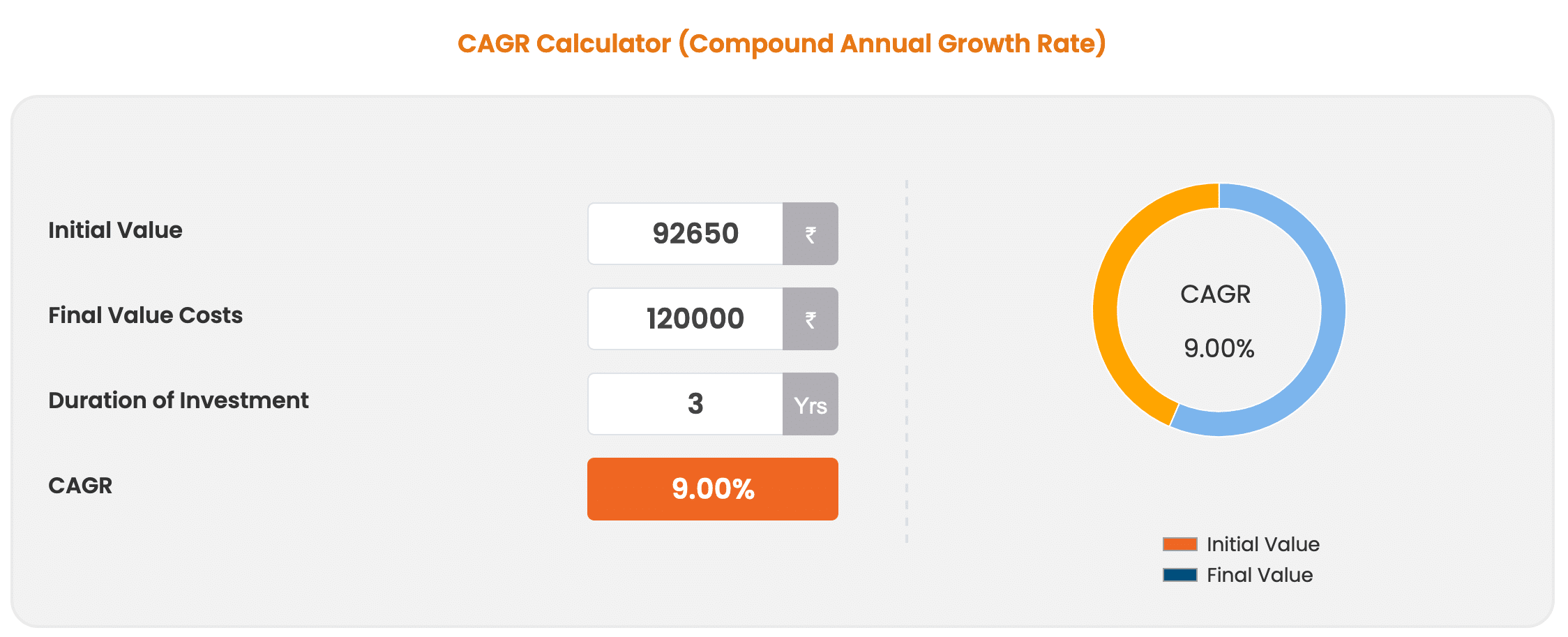

He will tell you that though you have a certificate of 1.2 lakh rupees, it doesn’t matter what you have invested in, but if I go to an HDFC bank today and deposit 92,000 rupees, I will get a 1.2 lakh rupees certificate.

The reason is that now the interest rate is nine per cent.

So I will not buy this 1.2 lakh rupees certificate for 1 lakh rupees, but I am ready to buy it for 90,000 or 88,000.

I invested one lakh rupees, and now if I want to sell that certificate, I’m getting 90,000 or less depending on the demand.

Now, I have to take a loss of 10,000 rupees or 12,000 rupees.

If I am not booking it, this loss is notional, but if I need the money, I must book it.

Remember, there is no issue with the deposit quality; people will get the money at the end of the tenure.

So because the same amount of money in the future can be achieved with less capital, the increase in bond rates decreases the value of a bond held by banks.

What happened to Silicon Valley Bank?

Let us understand what happened or Silicon Valley Bank and why it is being termed a US banking crisis.

Banks typically work in such a way that they lend for the longer term by taking short-term deposits.

In a Bank, depositors deposit money for the short term, including bank accounts. Then, the Bank lends that money out for a long and keeps a certain amount of cash for day-to-day transactions.

Let’s say I deposit 10,000 rupees in my savings account; the Bank uses the money for lending. So if it is given as a home loan to a person, I can still withdraw the amount as well.

So a bank keeps a certain amount of money for day-to-day transactions.

What happens if everyone comes and tries to withdraw the money?

In such a situation, any bank can have a problem, however, if the Bank is well-capitalised for day-to-day activities. So even if 10 to 15% of the people withdraw the money and everyone gets paid, the nerves automatically settle down.

The Silicon Valley Bank targeted startups as their customers. As a result, they offered higher interest rates for bank deposits.

Startups were funded with enormous sums of money and did not need the total cash. So they preferred SVB bank because of the higher interest rate.

A win-win situation for both.

Because the bond rate was rising, the startups were not getting new funding.

So startup’s balance was depleting. So Silicon Valley Bank was losing the adequate ratio to keep withdrawals processed.

Now, the SVB bank decided to sell the bonds and book the national loss. First, however, they had to raise the capital because the balance sheet was reduced for the loss booked.

Once they wanted to raise the capital, everyone thought they had booked a loss and wanted to raise capital, so now the Bank is not well capitalized, and everyone went to the Bank to withdraw the money.

This is how the Bank collapsed.

US Banking Crisis

Once a large bank collapsed, everyone understood how a bank could collapse.

The working of a bank has to be in such a way that they should have adequate Cash Cash levels for day-to-day operations.

Every publicly listed Bank’s balance sheet is open, so once the Bank doesn’t have a good amount of cash, everyone starts withdrawing money from such smaller banks.

Then, FED calmed the depositors by making them as safe. Once the nerves calm down, people will not withdraw money from the Bank.

There is one more piece of news: Some planes have landed in Omaha, and Bank CEOs will meet on the weekend of the 19th of March with Warren Buffett.

Once he comes into the picture in any bank, the sentiments will improve

How safe are Indian Banks?

Indian banks are very safe. We don’t function like a U.S Bank.

RBI doesn’t allow a bank to fail, but FED say that only the depositors are safe; the investors in the Bank are not safe.

In India, we had an issue with YES Bank. The depositors were safe, but the shareholders were also safe.

I mean that RBI will not pay you ₹300 or 400 as the share price of YES Bank, but the Bank didn’t go out of business. The Bank continues its business; you can get out of the stock.

Indian banks operate in a very safe environment, so there are no issues with any Bank whatsoever in IndiaHowever, the share price of Indian banks is falling, which is just a Sentimental effect.

Can US Banking Crisis lead to 2008 like situation for equities?

The current news flow doesn’t suggest anything like it was in 2008.

2008 was a domino effect, and we still don’t see any domino effect coming up. Even a fall of such a large bank as Credit Suisse had a little ripple effect.

No one knows about the future, but right at this point, we don’t see any domino effect.

Moreover, if Warren Buffett invests in one or two banks, that can lead to a different scenario.

I hope this helps you understand the US banking crisis. Let me know your views and thoughts in the comments below.

Leave a Reply