My intraday shorting strategy to understand when to short a stock with Morning Panic and Afternoon Fade chart pattern using chart of Infosys on Friday the 13th

We will use the Morning Panic and Afternoon Fade pattern on Infosys on Friday the 13th ( 😀 ) was a perfect setup to make truckload of money. Let me explain my intraday shorting strategy to understand when to short a stock with Morning Panic and Afternoon Fade chart pattern..

Infosys results were not as per market expectations and so morning panic was expected in the stock. The stock opened 10% gap down from Thursdays closing and then we see the following for the whole day.

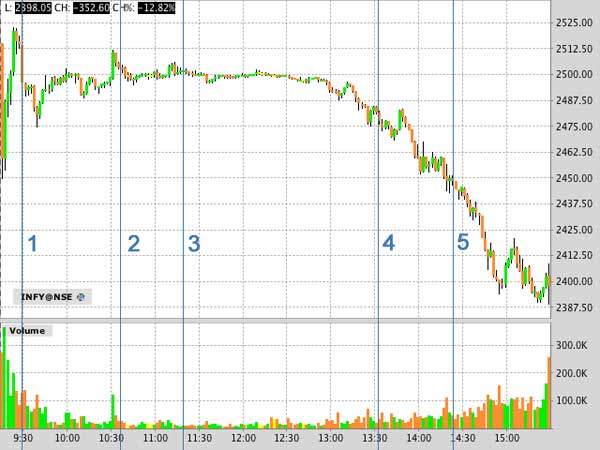

Infosys Chart on Friday April 12, 2012

Few things to note in the above chart.

- Morning panic is followed by spike. We saw it in the first few minutes of trade.

- The Spikes are never very strong.

- Few Shorting opportunities in the spikes as well as when morning low cracks.

So let us understand morning panic and afternoon fade chart pattern once again with Infosys.

The gap down is clear indication of morning panic and then it becomes a waiting game to verify the pattern formation and trade accordingly.

In the above chart I have marked 5 vertical blue lines from point 1 to point 5. Each of those points can be an entry point for going short on Infosys depending on your risk appetite. So let us understand what each point signifies.

Point 1: 9:30 AM

Gap down opening followed by a spike which we see fading at around 9:30 AM. Things are happening very fast in the stock and it is not able to make sustainable rally after the gap down. This could be your first chance to go short in the stock. The spike after Gap down could be mainly because of short covering from people who are short on stock from the previous day.

The first spike is very risky position and is recommended only for active traders. Shorting at point 1 is more of an anticipatory pattern (pattern not actually formed yet but is giving signals that it may form soon). So we can take position early for more gains. You can either take small position or play the waiting game. Management interviews in news channel can create spikes in the stock and can even start a recovery process and if you see recovery you should be ready to take a stop loss.

Point 2 and Point 3: 10:40 AM to 11:20 AM

We see management views are not very positive and so there will be no hope for intraday recovery for this stock apart from short covering and so we move to point 2 where we see yet another spike which is not very long lasting and so you can go short here or add more to your initial position. Even if you are not convinced at point 2 you can go short at point 3 because now you can clearly see that spikes are all fading too fast and so there is not much buying happening in the stock.

Point 4 and Point 5: 1:30 PM and 2:20 PM

Even if you missed the above shorting opportunities there are couple more sure shot ways to make money from Infosys. 2450 was a morning low and 2475 was a low after the morning low and so stock below 2475 can be yet another level to go short in the stock. Even if you missed 2475 crack, you can go short when 2450 cracked. Crack of morning low means afternoon fade to follow which is one of the safest patterns to make money.

Final thoughts

Such perfect setups are very rare but when you get them you should be ready to cash on them because even if you shorted at 2445 i.e. after cracking the morning low of 2450 you can easily target for 2410 or 2405 because 2400 may or may not crack the same day and you are taking position after 2 PM.

Note that this post is about what could have been done and same thing may not repeat on Monday because there may be more short covering. Trade when you have the ideal setups because few ideal setup trades in a year can make you lot more money than trading for every stock tips.

Mr sabbie

U know

short sell

Sell before buying but how possible witch function I am use for sell

No you cannot short sell in cash market and only in futures and options

Hi Shabbir,

Can this trick be applied in reverse?

I mean if a stock has a gap up opening and it’s following the Infosys graph in reverse, can we buy it for intra day?

Yes it can be for sure and I do the same many a times.

Dear Shabbir,

Thanks for all the information that you are posting here. I have one doubt if you could clear it please. It is difficult to find whether we are making profits as broker accounts are obscure. They always show as if we are making a profit!

To find my networth on any day on the broker account, is it enough to substract the market value of my share holdings from the outstanding balance?

Broker account showing as profits. I am not sure I am able to get you Sudheer. Why it would always show as profits when you are not making profits.

Hi Shabbir,

Thanks for the reply.

Sharekhan has a my portfolio section where they show profit/loss based on today’s market price. This is not the correct figure because I may be holding some stocks in delivery and profit/loss is based on their price that I bought and holding costs. is there any way of knowing directly whether I am making a profit/loss on each trade (both intraday and delivery). Now I am taking the data each day (Balance minus market value of holdings). Turns out I have been losing money all the while.

Ohh ok. You mean to say you have purchase share X at 90 Rs few months to year back and now you have been trading in the same stock when it is at 190 odd Rs and your trades at 190 Odd Rs shows as consolidated in your portfolio.

If this is what you meant then you should be look for order reports and trade reports because Portfolio is something which is overall of your account.

Thanks, Shabbir.

The pleasure is all mine Sudheer.

I suppose position sizing is very important. One should allocate not more than 20 percent of one’s total

capital in the stock market initially, till some level of expertise in technical analysis with proven

trades is gained, so that in the learning phase even if you lose the money you are not affected psychologically. Everyone has his/her’s own learning curve.

Hello Sir,

I hve invested in the banking sector, but all of them are going down.

Is it wise to hold ST and wait opportunity to book profit.

Or should I exit with loss.

Can you advice please.

I am not a good intraday trader. Cud u suggest some scrips which can be purchased for short term or long term basis.

Rgds

Anappally

anappally@gmail.com

Anappally, this is not the right time to be investing and the market going up is more of a investor trap than anything else and we have been discussing the same in the members forum area.

Dear Shabbir,

The data is costing a fortune for small traders like me ….

I am in search of any free data provider…

You can direct me that way if u have any known…

Sunil, you can scrap data from NSE website by parsing HTML.

Also, i have a request….

Do we have any preveliage to get individual stocks live data during market hours into an Excel???????

atleast for NSE stocks…

Yes you can provided you know the Excel Backend Coding of vBScript.

Thanks for the prompt message sir….

I have one of my frnd who knows VB script..

but can u guide me where in NSE we shud refer to for getting live tickers into excel..

sorry for troubling you soo much…

i wanted to get knowledge so that i can be able to generate and trade my own calls…

just show me a way from where should i get and i will do the rest…

Sunil, See the following and that would help you get data into your software or even Excel – http://nseindia.com/supra_global/content/dotex/data_products.htm

Let me know if you have more questions and I will be more than happy to help.

Thanks for your reply shabbir.

I face a problem on how to screen stocks…

Do you recommend any software (may be in a reasnable price) so that i can screen and then get few stocks for analyzing… and out of analyzing i can get 1 or 2 for next days trade or may be for next 5-6 days…

Do you know any websites which provide such screeners….

Sunil, I don’t recommend any stock screeners software because I don’t use them myself. Yes I do see the list of stocks hitting 52 week high as a screener for me.

Dear Shabbir,

I was directde here from Jagoinvestor.com, i initially thought of closing this without reading any page (same trading e-book shared etc etc)…. but wait a minute the analysis u gave on Power your trade is wonderful… yes i tell many people that what is shown is not what had really happened and alas! they never bleive (not before they loose some money).

I have a problem, i cant trust anyone so i design my own strategies to counter the markets…. the main problem i face is how do i screen stocks first so that i get a handful to analyze… Beleive me no one answered this to me satisfactorily…..

I mean there are various tools for screening but to keep it simple and straight forward i haven’t got any such combination that worked….

Can you let me know what should be the parameters to screen stocks for choosing them for DELIVERY and INTRADAY…….

and where do they belong (i mean can i get them and design in my excels)….

Thanks in Anticipation,

Sunil.

Sunil,

Yes I have seen the link on JagoInvestor about credit cards and now if you want to convince anybody who want to try PYT, you can refer them here. 😀 After bit of self promotion and marketing, let me also answer your question.

When in equity market, I also have the same problem of trusting anyone from finance domain and this is because our brain is tuned to see too much more frauds and scams too often.

Now for your initial list of stocks that you want to analyze would start with stocks that are doing good for last 6 months to one year manually. This means you are screening those stocks that are in an uptrend for quite some time. List of 52 weeks high stocks.

Once you start the process of screening then you should apply the patterns that you think works best for you. For me it is Break Out Chart pattern, Formation of W pattern and Higher top higher bottom pattern and I teach the same to my readers but you can apply your own.

Apart from that the words DELIVERY and INTRADAY is a fake terms used by TV experts.

When you trade in stock, you don’t trade based on timeline but you trade based on target and stops. If you get target (or stop loss) the same day you may exit the same day and if not, you hold it. So intraday and delivery is something where I prefer to call targets and stops.

So now still your question of choosing the stocks. It should be based on pattern. If stock is forming a pattern I am comfortable investing, I would get it into my list of stock manually.

My ebook buyers have learnt the pattern and soon they realized that this is something that actually is working in market and now in the private forum many members are sharing stocks that they think would make them money. They have nailed trades in stocks like DCM, Den Networks and lot more.

I hope I have answered your question but if you have any more questions do let me know and I will be more than happy to try answering them all.

Dear sir, i want to ask some basic question, it may feel u bad but want to ask, i have lost 3 lakhs in this market, however i want to recover this money, does really this charts or TE ll help me to recover my money? or just it predicting wasting time and money?? please give me sensible answer.

Hrishikesh, you have lost money in market because you took decisions based on suggestions but not validating those decision based on any theory that really works in market and this has made you to believe that everything in market is wasting time and money but that is not true or else so many people would not have been in market.

it is just that few people in market actually make money because they have a strategy for markets that has been tested over times and Technical Analysis is one such strategy.

Ok, ya i have traded based on some calls, but my question is do really one can do mastery in TE, ya i know no can predict 100%. But just wanted to ask how muc percentage it works. I read ur free chapter it was good and informative.

For me it is 80 to 85% and that comes with experience but even with 60% success ratio, you can make lot of money in market.

I’d like to know one thing from you Shabbir..

How much %age (of capital invested but using whatever leverage), would a ‘good trader’ earn ?

I know it depends on a number of factors but what is the outlook ? Do most traders really fail or make losses ? Or would the good trader make 20% / 100% of returns in a year ??

Akash, the best of the traders and investors make money but those type of traders and investors will never share the numbers but those who are in market just because someone has made a fortune loose money most of the time because they are in market without knowing any stuff.

>>those who are in market just because someone has made a fortune loose money most of the time because they are in market without knowing any stuff.

Agreed ! But the discussion is going in a different direction.

The purpose here is to channelize & divide my investments along with setting up expectations in each area (like FD, Mutual Funds, Equity, Others). So, I was looking forward to derive at something like, what %age of capital is ‘generally’ good to expect from the stock for a good trader..

I’m not looking for numbers but I believed since you are so experienced, you’d be able to suggest based on your experiences, that “among those people who make money”, you believe most good traders making X %age of capital in a year.

Akash, I will be more than happy to suggest you a number but then those numbers does not happen instantly and it takes time to learn. I make roughly 30 to 50% on my investment and this number is based on few years of trading and experience.

But for new trader and investment it is better not to expect return but learn from the trades and then you can expect numbers like 25%+

How would you do the technical analysis to find the correct time to enter /exit an intraday short ? Usual EMA for 11/26 might not help here.

Ijay, that is what I have explained in my ebook

Pl. send me trading book

I already see that you have my ebook.

If I short for example Infosys, do I need to buy back the stock the same day,or can

I be in short position for few days if the charts permit.Could you please clarify

Thanks,

Lakshmi

Lakshmi, If you are shorting infosys in Cash market, you have to buy back on the same day but if you are shorting infosys in futures market, you can keep your position open until expiry.

I always thought there are 2 types of people in market. One of them who actually make money but never say how they do it and others those who boost about their expertise in market and can make lot of money for us without they doing it for themselves. I always thought you are among the second group. I have your ebook and I confess that I was wrong in putting your blog in the second category.

Hi Ajay, thanks for your ebook and yes I do agree that there is too much noise the finance domain and that is one of the main reason for my blog. I am sure the other strategies in the ebook will also help you trade and invest more wisely. Do share your feed back about the ebook as well.