Let me share with you my secret to How I Made 50,000 Last Week In Just One Trade.

In Sharekhan PMS Review I raised a point about the performance of PMS compared to Nifty and few of the best funds.

Many reader’s had the question – why I was complaining on a 45,000 Rupees gain in couple of months on an investment of 500,000 Rupees. The answer was (and is) – I could easily beat that. So today I will share with you how.

Let me first show my trades. I Purchased 615 share’s of TTK Prestige around price range of 1995.

Click on images to enlarge.

Hold for a day and sold off at close to 2080.

I thought I purchased 600 units only and did not realized that I had few more in my account and so finally sold rest of my shares the next day. You can see the date and time for my trades.

How and Why?

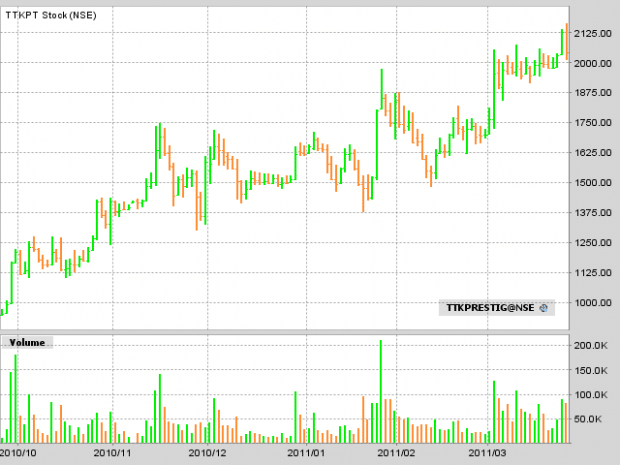

Reason for my purchase of TTK Prestige was purely technical. Look at the 6 months chart of TTK Prestige. Shows a break out chart pattern above 1974 and was consolidating above the breakout level. So I took an anticipated trade (You know how to handle anticipated trades from my chart pattern book). I saw positive sentiments in the market especially the consumer durables sectors and timed my entry into the stock almost perfectly.

I could not time my exit well enough or else my profit would have been 50% more but I was not ready to risk my huge profit.

Performance

When I reviewed Sharekhan PMS I did a lot of performance comparison and so it would be unfair if I don’t compare my own performance.

I made a gain of roughly 4%. Nifty for the complete week Nifty was up by almost 4.8% and though I did not trade much on the Friday still I would say I could not better Nifty for the week yet was not very far behind but still a miss mainly because of a huge upswing on Nifty on Friday.

Let us compare my performance with one of the best performing fund i.e. DSPBR Small and Mid Cap Fund Growth. It had a NAV of 16.31 on 22nd March and 16.82 on 25th of March i.e. I would have gained 38k on my investment whereas I made more than 50k for myself. I would also have been charged an exit load of 12k as well. Clear an out-performance by a BIG BIG margin.

Final Thoughts

Remember I am not a full time trader and my main job is online blogging and so If I could perform in the market better than the best fund then anybody who is willing to learn can. There is lot of money to be made provided you are willing to learn.

Charts by Interactive Broker’s Trader Workstation.

reallly i like to read that…i have 200 share of kwality dairy and also have stock arss infrastucture… so,, plz tell me its a best or not?

I would not buy into that stock technically. There are so many other better options.

I want to start trading please give me the procedure & proper guidance .

Sure why not. What kind of guidance you are looking for.

Thankyou for your answer i meant pattern as in H&S , Double bottom/top etc . From what i understand of your answer do u mean tht once it tested a new high n fell , the 2nd time it tested the old (which was earlier new) , but did not fall but stayed there for quite sum time before breaking upwards , if yes , then how do u calculate targets in such a brakout !

In such a break out the target is calculated based on stop loss.

If my stop loss is 100 Rs, My target could be multiple of 100 i.e. 100, 200, 300 or even 400 Rs from my purchase price.

Hello Mr Shabbir , I am a silent observer of your site . I have a query in this chart uve put , u mentioned “””Reason for my purchase of TTK Prestige was purely technical. Look at the 6 months chart of TTK Prestige. Shows a break out chart pattern above 1974 and was consolidating above the breakout level.””””

Which breakout pattern r u referring to here ?

Gulshan, good to see that you are following the blog but I am not sure I understand your question completely but I will try to add what I meant by Breakout pattern.

If you look at the chart until the line 2011/03 you will see a spike. This high was around 1974. After touching 1974 the stock fell back to 1500 odd levels but then after few days the peak of 1974 was tested but then this time the test of high did not create a sharp fall in the stock but it consolidated.

I hope I am more clear now and do let me know if you have more queries.

Dear Shabbir,

Your analysis and charts descriptions are very good and the way you present it its highly appreciable by keeping it simple and easy to comprehend. I m a newcomer in the field of technical analysis and the sample chapters of your book which you sent to me were the building blocks to my study.

Thanks again.

Chandramouli

The pleasure is all mine Chandramouli

Dear Shabbir,

I just want to know systematic process to evaluate share price. I am investing last one year and have mixed experience of share market. how can I know that current price of a stock is good to buy as per fundamental and technical aspect. according to you what should be taken care before buy share of a company.

Ashish See http://shabbir.in/find-good-stock-investing/

Arre… sorry bhai…. my mistake….. its 4%

😉

Assalamualaykum.

The gain of 50K is verily exciting.

Generally large companies have high priced shares, and any fluctuation on it, will bring large returns or losses.

As for your gain on 50K, it is about 0.04% gain on your investment.

Some people believe 0.04% is a small gain, but still I believe when you earn something, it is always better than nothing.

I am a CS Graduate, and had dabbled in lots of offline trade during my education years.

I have been a great proponent of Technical Analysis, and it really coincides with my views on Equity.

I am new , but inshaAllah I will try to gain something great soon, and share the same with you guys.

I congratulate you on your honest initiative to empower investors with your Technical Analysis.

Islam says, “When you seek something good for your brethren, Angels pray that you get the same good as them.”

Assalamualaykum

W/Salaam and Is it 0.04% or 4% Miya Bhai?

sir thanx for your reply.i really happy.sir mere kahne ka matlab ye tha ki share market me in nse bse me rate diffrence hota hai. uski trading ho payegi ya nahi.means asian paint ki aaj 21 sept.2011 ka rate in nse at9.34 3100 and in bse 3105.what possible i buy in nse and sell in bse. this type trading are possible.and what i do….

Prakash, that is arbitrage but first you have to understand lot of things to get the trade executed.

1. You cannot buy in one exchange and sell in other exchange unless you have the number of shares in your account. For example if you have 100 shares already bought of Asian Paints yesterday you can buy in NSE and sell in BSE those 100 shares.

2. I am sure you have an account with some brokerage house and this means you are paying a brokerage to your brokerage house which means you are anyway paying minimum of 8-10 Rs as brokerage and so that 5 Rs different is not an arbitrage for you. Yes big investors who have direct trading window in both the exchanges can take that advantage.

3. You also have to understand that you need to have buyers and sellers at the price point difference which means you need to have sellers at 3100 and buyers at 3105 to execute your orders.

Will request you to see my following articles on arbitrage

http://shabbir.in/trading-in-arbitrage/

http://shabbir.in/arbitrage-in-fame-india/

dear shabbir bhai. i want arbitrage trading start in indian equity market.how much minimum capital need in stock arbitrage in cash to cash segment,,,plz reply shabbir bhai.

I don’t understand your definition of arbitrage because as far as I know it is not a factor of capital. Can you tell me Prakash what arbitrage you are looking to trade in Indian market.

This is very important post for all traders !! Thanks for postiong this !! it’s helpful for me too..

I have invested in Ashtavinayak cine vision in view of release of its film Rockstar. Bought it at 6.2, do you think its good investment

Dharmesh, I don’t track that stock and so will not be able to comment much but I see in Jan 2011 it has fallen from 50 Rs to 5 Rs which would not be very comforting for me and at 6 it may have very little downside but not sure about the potential upside and if anybody would be a buyer in such stock apart from the owners.

I would prefer short selling on a day trading peaks just in case If I prefer to do any trading in this stock

sir i want known about the certified coures in nse mcx. please tell me about it

sir,

any course in share market

You can try kredent Academy.

sir,

i want to do any course in share market plz tell me & my last que. is how can i am know that nifty go up and down.

Roshan, each person has his own way of making the judgement and I use Technical Analysis and chart pattern to understand the market. You can see my article a month back here where I anticipated why the Nifty is not fit to be buying at those levels and you can see Nifty is lot down now.

sir,

how i trade in nifty50.

Roshan, I am not sure if I understand your question completely but all I can say is when you anticipate market will go up you should buy and when you see signals of weakness you should go short.

Hi

I am holding ISPAT 980 @26.12,since from last one year

could you please advice me

What more do you expect from ISPAT? I think you should be getting out of it in a spike.

Nice trades hopefully we all will be able to make such money in a day 🙂

Yes I am sure you will and it is not very difficult if you understand the markets.

You are lucky! And of course have adequate knowledge and strong strategies in investment although you are not a full time trader.

Hi Shabbir,

I have buy binani ind. at 214. should i sell or hold this share.

i have to loss in other shares also.

can you guide me?

Regards,

Ronny

Ronny, I can always guide you for any stock on technicals but I would like you to learn how to do technical analysis yourself and that is what my book does. It teaches how to do technical analysis. See here.

Now about your stock Binani Industries I think it is best to come out of this stock in the short term. Your stop should have been 202 which it broke 2 days ago.

so Informative lots of people will get help from this blog thanks for sharing.

Hi Shabbir

Good day to you! I have been reading your blogs since few weeks.

I am very new to share trading.I have been learning tips on trading online . I would like your suggestion as which is the best online share trading account and tips to start fresh. I have been watching SBI and infy share since a month . So please explain how can I go ahead and start trading .I want to begin by investing few thousands till i get the knack of it.

Thanks,

Smitha

Smitha, Thanks for reading my blog but for tips I will suggest use your own broker but make sure you don’t follow their tips blindly but use your own knowledge to see what is right for your way of investment in the market. I will suggest you to read my views on Major Indian brokers and choose the one that suits you the best.