Some experts recommend a buying Coal India because of Indian Government links and I ask them why they not recommend buying NTPC or NHPC or even REC (which has given some handsome returns). All have good fundamentals and Indian Government link and this is what we see for the last one year performance.

Today one stock is in the news and that is Coal India. It did far better than what I expected and is trading almost 30% above its issue price. I subscribed for it but sold at close to 310. My objective was mainly for the listing gains and I am really happy to make some handsome money with it.

Now I am very concerned for those investors who are still asking question on TV, Is Coal India an Investment Opportunity after listing and at current market price of 330+?

I saw on CNBC Awaz that some house views and expert are still recommending Coal India as buy call if you have a 1 to 2 year investment time horizon but I totally disagree with it. I think it is by no means an investment call at current levels. Trading is fine but not an investment call at all.

Let me tell you why I do not agree with the investment opportunity.

Many experts suggest that it is an investment call because of the fact that it has very good fundamentals with good cash levels as well as some good acquisition lined up in next few months especially the one in Africa.

To those so called experts I will like to remind them that acquisitions always dampens the share price and we have seen things like that happen for Tata Steel or even for Bharti Airtel. So if acquisition is your base for recommending a buy call I think it should be when the IPO sentiments cool off. I am sure more positive sentiments can lead to yet higher prices but that means it is a trading call and not an investment call.

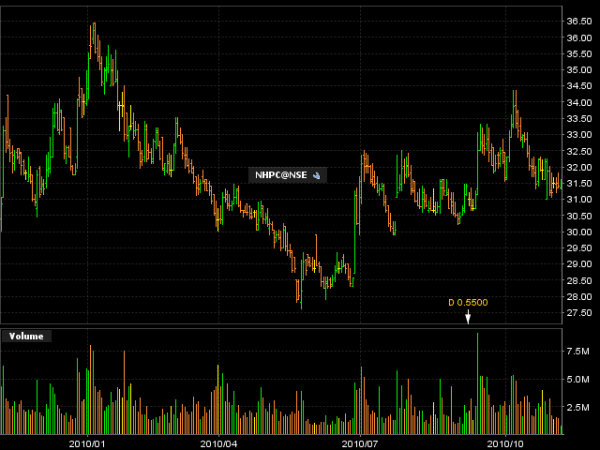

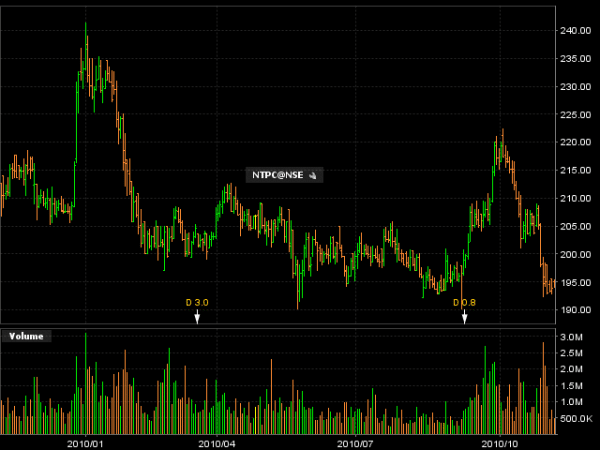

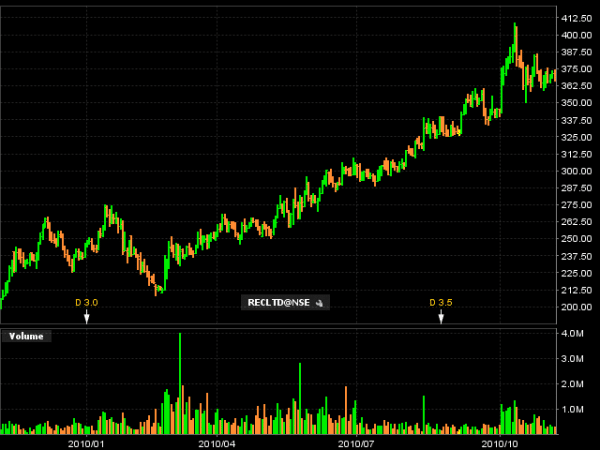

Some experts recommend a buying Coal India because of Indian Government links and I ask them why they not recommend buying NTPC or NHPC or even REC (which has given some handsome returns). All have good fundamentals and Indian Government link and this is what we see for the last one year performance.

So according to me Coal India is not an investment opportunity as of now but once it cools down we can take a call then. What are your views on Coal India? Share your views in comments below because we can all gain from the shared wisdom

Thanks for the informative insight. Helped a lot!

Just wanted to check is coal India a good buy at 376.70, the current rate, plainly for trading purpose.Also, do you think it’d cross Rs400?

Yes I think it is a good trading buy above 370 but make sure if you are trading you have a good stop loss.

sir, can you tell me the difference between close ended mutual fund and open ended mutual fund.

See http://shabbir.in/all-about-mutual-funds/

CIL is still a buy call as company planning to sell washed coals which would be surging profit margin up to 50 %..

Also TC shows company had increased its profit margins by leaps and bounce…If you see past results u urself would come to know..

Thanks for this opportunity to write a blog and presenting opinions.

PG IPO is also a ,must buy call from my side for at least 15% profit..

Further Retails also to get 5% discount, so why not to take a leap…

sir can u suggest about the POWER GRIP FPO that opened today?

I am not applying for it.

coal india is really gold india so why to fear let it be hold as a long term investment

Hi Shabbir,

Thanks for your excellent review. Yes, I completely agree on your point of view and the kinda shares you picked to compare. I am the one among who burnt his fingures with NHPC. At this moment, defently not an investment oppurtunity.

In my experince, I have seen many such cases where people so called Experts will give long-term call with listing shoot-up; later it would come down even to listing price. Personally I had this sore experince when MundraPort was listing. It went to almost 200%, but I kept holding as the expert told its perfect long-term stock. But later it came down to even less than listing price, now its quoting some decent price. But never touched 200%, so far… 🙂

Thanks for yyour sharing!!!

Even I am surprised with the extent of listing gains of Coal India on listing day. I am also in a bit of dilemma as to hold or sell especially at 340 now. But if folks here can throw us more reasons as why we should hold probably it makes sense, otherwise planning to have a stop loss of 330.