I lost Rs 32,322 on my trading portfolio of 800,000 because of two successive stop losses. Roughly 4% and as of now I am all cash. I lost in

When I made 50,000 Rs In One Trade I shared it with my readers. So it would be unfair if I don’t share my losses.

I lost Rs 32,322 on my trading portfolio of 800,000 because of two successive stop losses. Roughly 4% (2% in each stop loss) and as of now I am all cash.

Note:- The loss does not include ELSS mutual fund losses.

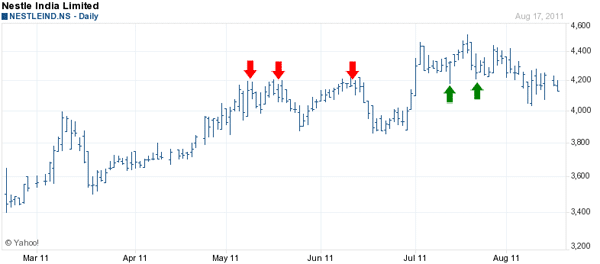

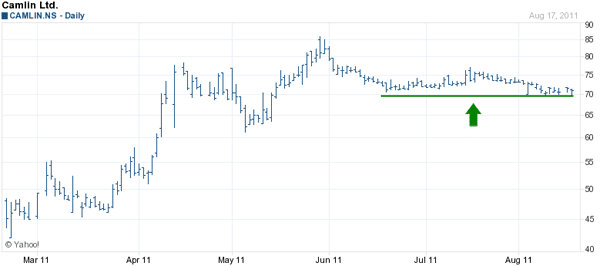

The stocks I was holding were Neslte and Camlin and stop loss for them was 4200 and 70 respectively.

Why Stoploss for Nestle was 4200?

4200 was key resistance which was taken out and was behaving as support. 4200 was my stoploss this time.

Why Camlin stoploss was 70?

We see stock consolidating around 70 on the back of open offer news. The level of 70 was not breach decisively for long time and was my stop loss.

Are you holding any stock in this downtrend? How much did you loose in the current market crash and in which stocks? Share your thoughts in comments below.

According to Jujunjunwala the markets are unlikely to go really northwards in a great hurry.The first world brand is not in good shape either.Uncle Sam and the Euro debt zone, are also not very optimistic financially. The socialist policies of the west and the recession of the US, too are negative factors.Chinese balance sheets being a mystery; the story is simple—-Hold your shares and hope for the best!!!

In the above scenario the same logic would apply to ELSS after april 2012.If one encashes the eligible ELSS, in mid 2012, he would lose.Perhaps a better bet would be to stay invested in ELSS for 5 years??Your comments please.

We also hope the Govt. would come out with an innovative scheme, as a substitute for ELSS post April 2012?? Your comments please??

ajay mehra

For ELSS I don’t invest for huge return but focus on less return but maximum dividend but yes returns would be tight going forward and so it would be better to remain liquid and play shorting.

Thankfully, I have not yet lost money in this crash.

Except that I exited SBI as per your suggestion. And it was a wise decision.

So right now, I just have Hero Honda, HDFC in my current portfolio of 10 Lakhs!

Great to see that Chaitanya 😀

:-)Thanks!

Do you see the markets bottomed-out completely or ?

I have received a bonus of 30 Lakhs for good performance at work and I wish to know whats the best way to invest or allocate this bonus. This is surplus – over and above my immediate requirements.

I have high risk-appetite so I am willing for stocks. Hence how much should I keep the maximum loss-provision in case I do intra-day as well as ultra short-term positions ?

But what percentage of it should be in equity ? And where should one invest the rest ?

Thanks.

No Chaitanya, bottom out is far from reaching because still the fall is on and the pause are short covering. I would like to see Nifty either spending time in a tight range to even think about fall is over.

What about Hitechplast?

That is pretty much in the investment account and actually I have even forgotten that because it is an investment for more than 1 year+ and some time after November is when I would look into it. Thanks for reminding and there I am down 1.6 lacs