How profit from short term investment i.e. investment for under 1 year in equity market can still save lot of tax that may need to be paid otherwise.

Let me share with you an innovative way to Save Tax from the profits trading in market. I am not talk about investing for 1 year and making the profits tax-free for long term investing.

Remember that you need to be consulting a CA for making the final decision of how you are creating your accounting but then I have been doing this.

1. Long Term Returns On Equity Investments

Any return on equity investment for more than 1 year is tax-free and I have shared this many times in the blog like here but any equity investment tax related article will cover this and so I have added it here as well. Any profit in equity investment (stock or mutual fund) longer than 1 year is tax-free.

2. Brokerage and STT Paid is an Expense to Profit

Let’s consider a profit of 1000 Rs on a single trade in one stock. For the sake calculation we assume that tax is calculated each quarter (It can be each month or even for the complete year) and you have only 3 trades in this quarter. First and third trades were no loss no profit trade for you but each of those trade had a brokerage of Rs 10, 12 and 13 respectively. So your actual profit for taxation is 1000 Rs less the brokerage paid which is 35 Rs (10 + 12 + 13).

Depending on the volume of your trades, you will opt for monthly, quarterly or yearly calculation but each time you make a trade, the brokerage and STT paid will reduce the taxable income.

3. Carry Forward Losses

The tax you pay is on net profit but if you have submitted previous years financial early enough (before 31st July), you can claim losses for the next 8 years.

There is a loss of 10,000 in last five fiscals each. Assuming submission of returns was always before time, a profit of 50,000 this year would be completely tax-free. Yet another reason to be filing your IT returns.

4. Use Dividend To Convert Taxable Profit into Non-Taxable Profit

We have not invested long enough but if there is a good profit that we have booked and so now we may want to be saving tax on the profit booked and this is where Dividend can come in handy to convert the profit into less profit or even a loss without actually making a loss.

So you have a profit of 10,000 in your investment after deducting all your previous losses and brokerages including STT, as you are left with 10,000 as profit and so you may need to pay 1500 Rs as tax (15% of the net profit).

To save this tax, you can invest in some stock that has declared dividend, grab the dividend and sell the stock for a loss.

So let us take some dummy example of investment in stock A at a price of 100 Rs. For calculation sake we assume investment of 100,000 Rs and so number of shares is 1000. Stock A paid dividend of Rs 2 and so we cashed in Rs 2000 and then sold all the 1000 units at 99 Rs making a loss of Rs 1000. The profit of on 10,000 is now reduced to 9000 because of the loss of 1000 Rs in Stock A but actually you have made a profit of 1000 in Stock A if you include the dividend but it is recorded as a loss in books for profit calculation.

So the tax of Rs 1500 is reduced to Rs 1350

Even if Stock A is sold for 98 Rs, there is no profit no loss scenario but your overall profit of 10,000 is reduced to 8,000 in your books for profit calculation reducing the tax needed to be paid as Rs 1200.

Note that trading in Stock A comes with brokerage as well as STT and other charges being paid and so the actual tax may even reduce further for those charges.

This is one of the main reasons for stock price skyrocket when there is a dividend being declared. Retail investors start to assume that the stock is very good for investment and company is very good fundamentally as they are declaring dividend and large investors are investing but actually those big investments may not always be for the sake of investments in the companies fundamental but could be for saving tax on previous profits.

One more thing I observed is: Dividend in stocks are never declared in first quarter but quite often it is in second quarter and record date is normally in third or fourth quarter. One of the reason that I assume for this could be that if they declare dividend as late as possible means more large investors would be interested in buying the stock to reduce the profits. Normally companies can make dividend declaration along with the full years results submission in the first quarter but they never do that. I may be completely wrong here in assuming the reason for dividend being declared late and there may be some other factors, which I may not be aware of.

5. Use Equity Mutual Fund Dividend to Save Tax

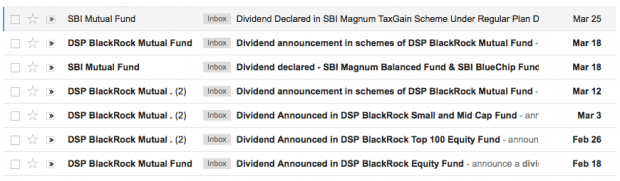

Tracking Dividend on Stocks can be tough but for mutual funds it’s quite easy. You can subscribe to each mutual fund house notifications about the declaration of dividend.

So now you can invest in the mutual fund just before they declare dividend. Take the dividend and then sell the mutual fund recording a loss to reduce the tax on your profit. Remember you pay be charged Entry and Exit loads.

Note that mutual fund dividend declaration is in the last quarter.

Final Thoughts

Remember I am not your tax consultant and you should consult tax expert for calculating your personal taxable income. I am just providing ways that can help you understand where and how tax can be saved.

Just wanted to know that Which online platform you are using for investing in mutual funds ??

Thanks.

I use Sharekhan but I have plans to move to ZeroDha as well. Review of both are here

http://shabbir.in/sharekhan-review/

http://shabbir.in/zerodha-review/

Just wanted to know that Which online platform you are using for investing in mutual funds ??

Thanks.

I use Sharekhan but I have plans to move to ZeroDha as well. Review of both are here

http://shabbir.in/sharekhan-review/

http://shabbir.in/zerodha-review/

Hi Shabbir..the info shared here is so crisp and incomplete to be useful for anybody. I feel most of your articles are same, which tend to attract people by title to your site resulting adsense money to yoiu…after reading a lot in your blogs, i came to this conclusion.. Its my opinion.. need not to be true.

Hi, I don’t have any Adsense on my blog. In fact I don’t have any ads on my blog but thanks for such honest feedback. I really appreciate it.

Hi Shabbir..the info shared here is so crisp and incomplete to be useful for anybody. I feel most of your articles are same, which tend to attract people by title to your site resulting adsense money to yoiu…after reading a lot in your blogs, i came to this conclusion.. Its my opinion.. need not to be true.

Hi, I don’t have any Adsense on my blog. In fact I don’t have any ads on my blog but thanks for such honest feedback. I really appreciate it.

Respected Sir,

Regarding 4th Point above that is to convert taxable profit into exempt income (dividend). It is a good idea. However the government is more cunning and smart.

There is a section 94(7) of Income Tax Act, 1961 (known as Dividend Stripping) and 94(8) for bonus stripping for prevention of such tax avoidance practises.

When shares / units are bought within 3 months prior to record date and sold within 3 months after record date (for shares) or 9 months after record date (for units), loss on sale of the same shall be ignored (in other words) disallowed to the extent of dividend received. (Similar treatment in case of units).

Even though assessing officers may fail to notice such minor issues, but doing so will still tantamount to evasion of tax (since it is clear non-compliance with provisions in place).

Thanks. Good day.

Kulbhushan, thanks for the clarifications but I think that is for the shares but what about mutual funds?

Sir, there is section 94(8). I have mentioned it already. “Units” mean units of Mutual Funds, I think.

Respected Sir,

Regarding 4th Point above that is to convert taxable profit into exempt income (dividend). It is a good idea. However the government is more cunning and smart.

There is a section 94(7) of Income Tax Act, 1961 (known as Dividend Stripping) and 94(8) for bonus stripping for prevention of such tax avoidance practises.

When shares / units are bought within 3 months prior to record date and sold within 3 months after record date (for shares) or 9 months after record date (for units), loss on sale of the same shall be ignored (in other words) disallowed to the extent of dividend received. (Similar treatment in case of units).

Even though assessing officers may fail to notice such minor issues, but doing so will still tantamount to evasion of tax (since it is clear non-compliance with provisions in place).

Thanks. Good day.

Kulbhushan, thanks for the clarifications but I think that is for the shares but what about mutual funds?

Sir, there is section 94(8). I have mentioned it already. “Units” mean units of Mutual Funds, I think.

Thanks Shabbir for the useful information.

To be honest I’d pay the tax and spend more efforts in identifying stocks that will give good capital appreciation instead of booking loss to avoid tax though it is my personal opinion 🙂

Raviraj, you are not making loss but actually moving your profits to the tax free slab provided in the form of dividend.

Ok understood thanks

Thanks Shabbir for the useful information.

To be honest I’d pay the tax and spend more efforts in identifying stocks that will give good capital appreciation instead of booking loss to avoid tax though it is my personal opinion 🙂

Raviraj, you are not making loss but actually moving your profits to the tax free slab provided in the form of dividend.

Ok understood thanks