Which is the best large-cap fund to invest in 2023, and which is better for the long-term, a large-cap fund or an index ETF?

Which is the best large-cap fund to invest in 2023, and which is better for the long-term, a large-cap fund or an index ETF?

Before we answer whether we should invest in an ETF or a large-cap fund, let’s first find the best large-cap fund and compare its performance to the benchmark indices.

It will give us a clear answer. So let’s begin.

The Top Large-Cap Funds for 2022

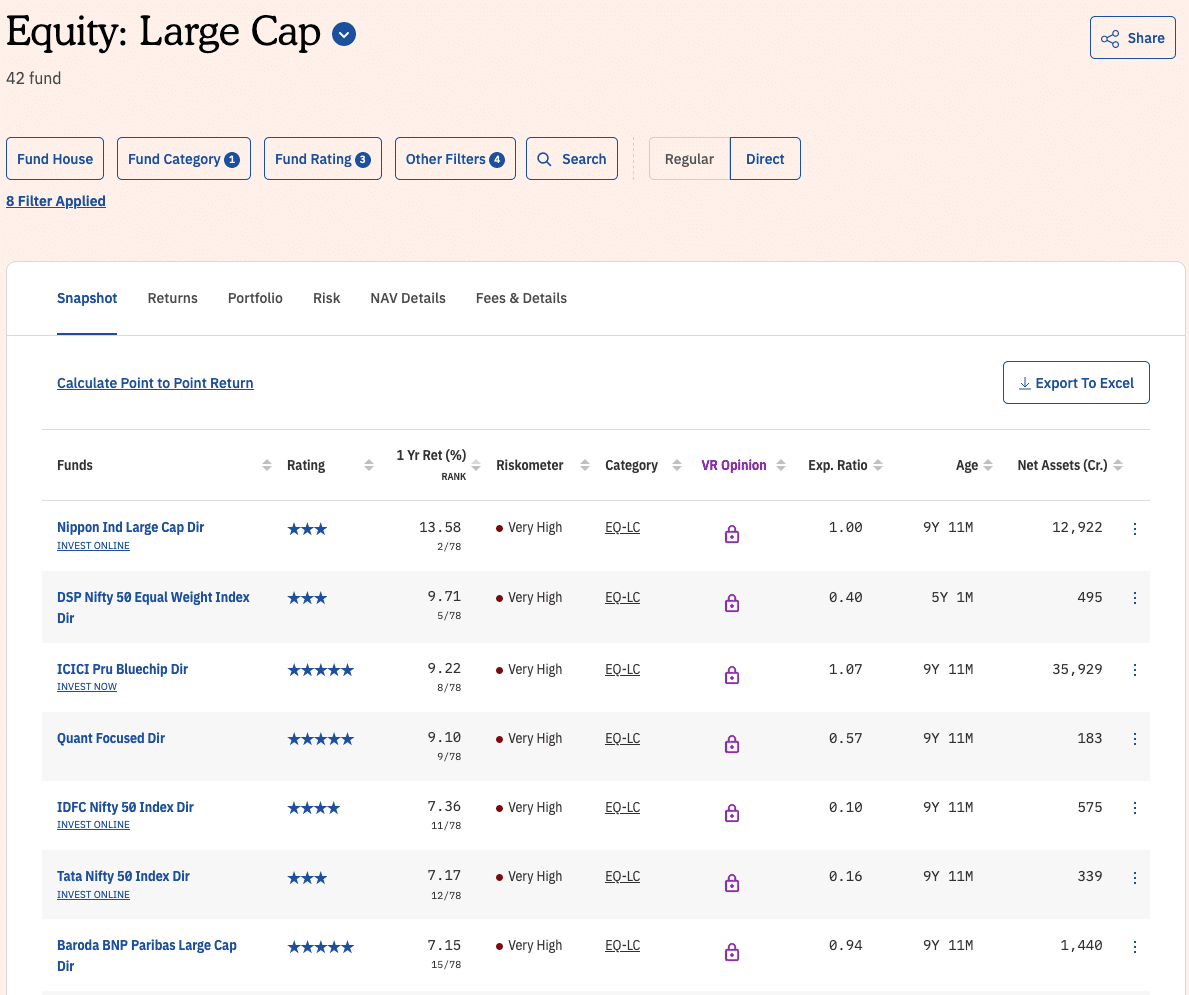

We will use the process to come to the best large-cap fund for 2023 from the 3, 4, and 5-star rated direct large-cap funds by ValueResearchOnline, and sort them based on 1-year return.

In the last year, Nifty has given a return of 7%. So let the funds that have been able to outperform the Nifty.

We see Nippon India Large Cap Fund, ICICI Pru Blue Chip Fund, Quant focused Fund and Baroda BNP Paribas Large cap fund.

The other funds you can see in the above screenshots are index ETFs. So we are not considering them for now.

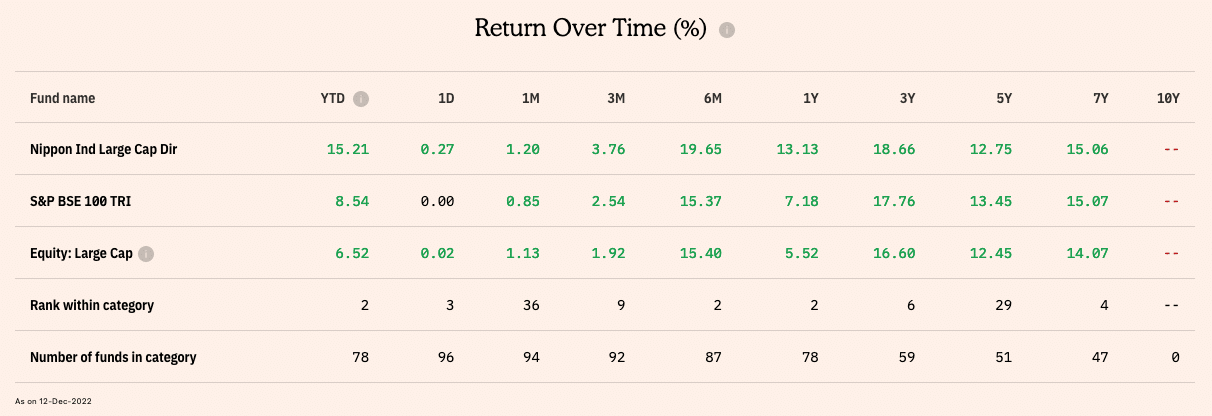

Now for Nippon India large-cap fund, we see this table if you go to the funds returns tabs.

So on a seven-year basis, the fund’s return is in line with S&P BSE 100 TRI, the benchmark index for the Large Cap fund.

In the last five years, the return has been 13 per cent. In the previous three years, the return was close to 17 or 18 per cent, and in the last year, the fund has outperformed, and the return is almost doubled to 13 per cent as compared to the benchmark return of 7%.

So the fund, on a longer-term basis, is in line performing with the S&P BSE 100 TRI, but it is outperforming majorly on a one-year and three-year basis.

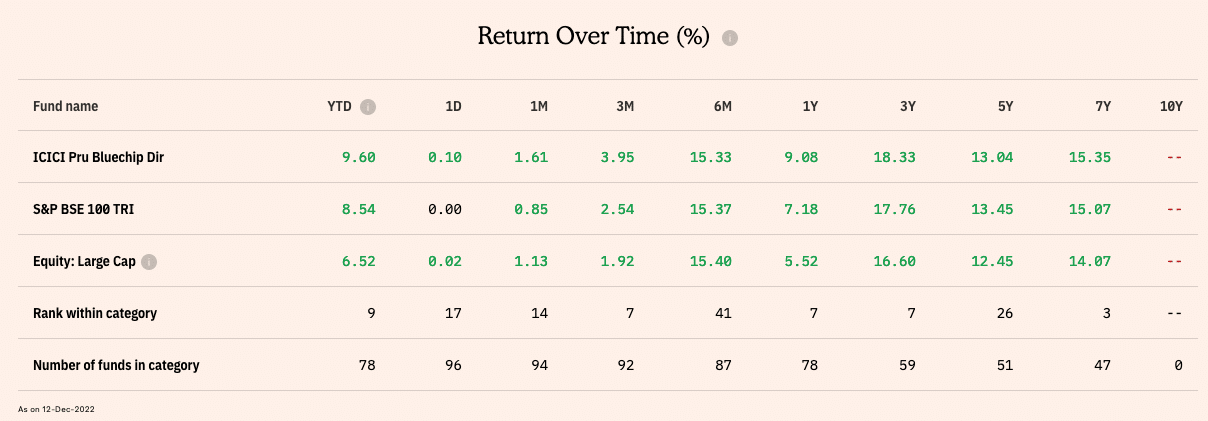

If you look at the second fund, ICICI Prudential BlueChip fund and go to its return tab, this is what we see.

A pretty similar picture in seven-year and five years, it is in line with the S&P BSE 100 index, but on three years and one-year basis, it has outperformed.

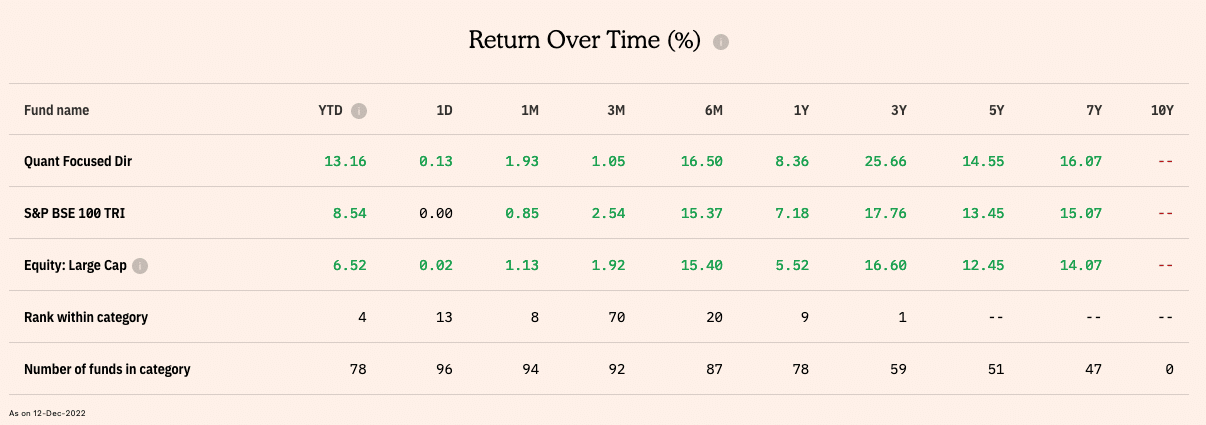

Quant Focused fund has outperformed on a seven-year basis, five-year basis, three-year basis and one-year basis.

So this fund is continuously outperforming the benchmark.

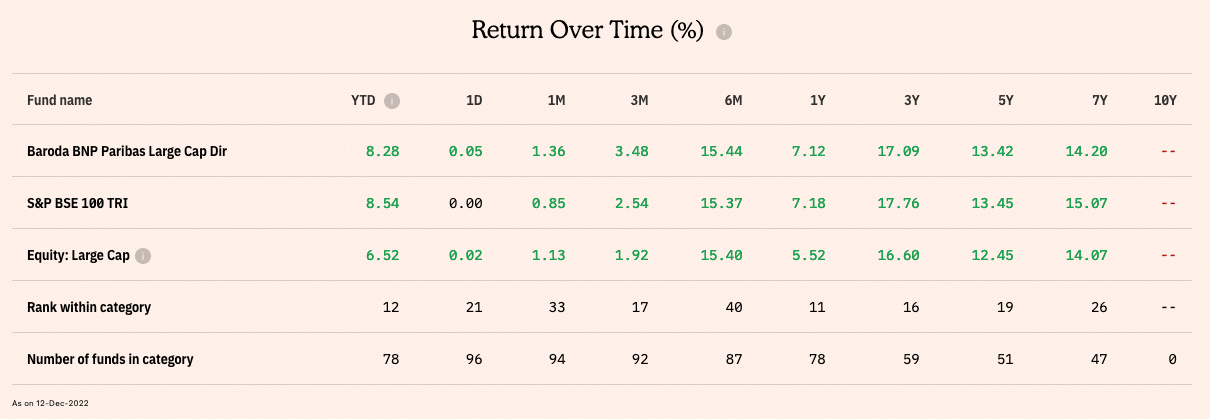

Baroda BNP Paribas has underperformed on a seven-year basis, but it is in line with the index for five years, three years and one year.

Best Large-Cap Funds for 2022

Only one fund has been able to outperform continuously.

However, most of the funds have outperformed in some periods, but the average over a long-term time is in inline with the benchmark indices.

So if you have to choose one fund to invest in, it must be Quant-focused.

Large Cap Fund or Index ETFs

We have to answer whether we should invest in an index ETF or a large-cap fund.

First, understand that Nifty ETFs are for the top 50 companies.

So if you have to choose an ETF over a large-cap fund, you must select two. The first is the Nifty 50 ETF and the second is the Nifty Next 50 ETF.

If you combine both, the investment will be in the same top 100 companies that are part of the large-cap fund universe.

So the return from both ETFs will be in line with the large-cap fund.

However, if you can choose a better large-cap fund like we have Quant Focused Fund now, you can outperform the index but not otherwise.

There are high chances that you will underperform because once the fund outperforms in some period, it has to underperform in another period for the average to be in line with the benchmark.

It is one of the main reasons why Warren Buffet suggests an index ETF over an actively managed fund.

So in a mutual fund, if you invest for a decade, it can so happen that it can outperform for the next three years but then underperform for the next seven years to give you an inline return in the longer term.

So follow Warren Buffett and invest in two ETFs; that way, you don’t underperform the large-cap fund.

Final Thoughts

This review is neither a sponsored one nor an endorsement that you should invest only in the funds mentioned above.

I have shared the complete process to find the best-performing large-cap fund for 2023. Feel free to apply your choice of criteria that gives you comfort while investing.

Make sure to invest in direct funds. And finally, don’t invest in mutual funds because someone has recommended it to you, including me. Instead, always apply your investment logic to each of your investments.

Thanks shabbir for sharing the funds.