We will find the best mid-cap mutual fund to invest in 2019 and review the performance of our choice of best mid-cap fund of 2018.

We will find the best mid-cap mutual fund to invest in 2019 and review the performance of our choice of best mid-cap fund of 2018.

So let’s begin.

The year 2018 was a great learning year for a midcap investor.

Though the index hasn’t done much in the whole of 2018, some of the midcap stocks have gone on to become small cap.

Investing in the right funds in 2018 made sure there is less red in the portfolio.

So 2018, was the year where investors realized, markets don’t move in a straight line. Still, I believe the amount invested in 2018, SIP or otherwise in a mid-cap fund, will surely be more beneficial for a passive long-term investor.

The approach for mid-cap in 2018 was cautious for me, and it played out very well.

The Top Midcap Funds for 2019

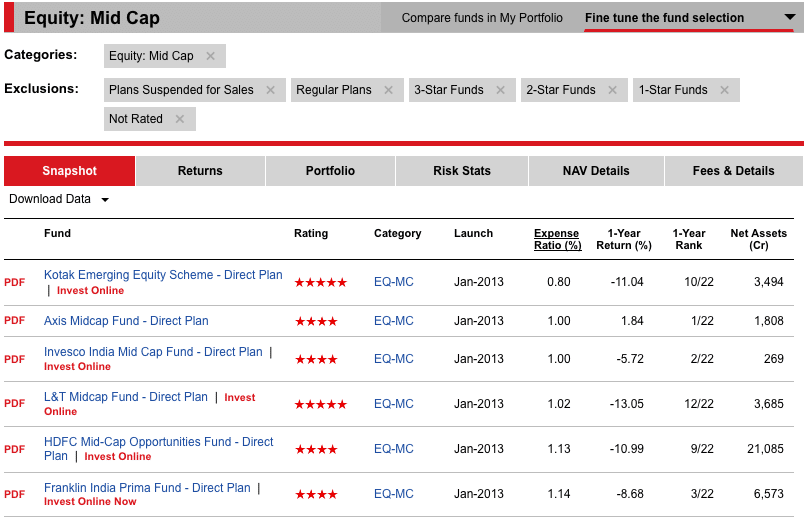

The process we will use is- from the 4 and 5-star rated mid-cap fund by ValueResearchOnline, we will compare the performance for the past year, compare expense ratio and asset under management to get best mid-cap fund for 2019.

I do agree one year is very less time for fund performance comparison. But the idea is if the fund can perform well in 2018 and beat the underlying benchmark – it has the right process to select better stocks in the fund. So the money will be managed by the fund manager who can continue doing it in the upcoming years to maintain the outperformance.

Best Mid-Cap Funds To Invest in 2019

We nail down to the funds that have neither very high nor under 1000 Crore of assets under management as well as the lower expense ratio.

Axis Midcap Fund

Axis Midcap Fund has scored well on both the fronts – one-year performance in the falling mid-caps as well as the expense ratio. Without a doubt, it is the best mid-cap fund to invest in 2019.

Just to add one more aspect, CRISIL also lists Axis Midcap fund as the top mid-cap fund of 2019.

Kotak Emerging Equity

If we have to select more than one best mid-cap fund, it has to be Kotak Emerging Equity. Though it hasn’t been able to keep returns in last one year positive, it has fairly large asset under management and is low on expense ratio as well.

How The Best Mid-Cap Funds of 2018 Performed?

The funds we selected as the best mid-cap fund of 2018, a couple of funds has moved out of the mid-cap fund category because of the well defined new SEBI’s guideline for fund categorization

- L&T Midcap Fund – Though the returns in the fund has been in negative 13%, it has still outperformed the benchmark as it is at a negative 16% returns.

- Mirae Asset Emerging Bluechip Fund – Has moved out of being the purely mid-cap fund into large and mid-cap fund category.

- Aditya Birla Sun Life Pure Value Fund – Has moved from mid-cap fund to Value Fund.

Apart from Aditya Birla Sun Life Pure Value Fund, the other two funds has either beaten the new underlying benchmark index or is in line with its performance.

Final Thoughts

Do not switch funds every year and pay the entry and exit load or long term capital gains tax.

In case you have not selected a better performing fund earlier or want to move to a new fund for any other reason (move to regular to direct funds). Don’t exit the investment in the old fund. Just stop the SIP and let the invested amount remain and grow over time in the past funds. Create a new SIP in the new funds.

As always this isn’t an endorsement of the above fund. The emphasis is on the process to select the best mutual funds using ValueResearchOnline and CRISIL data as and when you want to invest in 2019.

And don’t forget to have the right mix of allocation in the large-cap funds for 2019 as well.

I really appreciate this wonderful post that you have provided for us. I assure this would be beneficial for most of the people. Good post. I was searched for this topic. Finally, I got the information on this blog. Thanks for posting such a nice article.-

Sir. I often compare prospective funds using the facility on

fundo ( http://www.thefundoo.com/Compare ) and

rupeevest ( https://www.rupeevest.com/Mutual-Fund-Comparison ) .

Without fail, the two websites rate each fund quite differently.

For eg, Axis Bluechip and Rel Large cap are rated 5 star on one but 4 and 3star on other. The second site rates HDFC Top 100 and ICICIBluechip as 5 star , while the first site does not

Any views on this and more importantly how to use this information

Hi Shabbir,

I’m currently having below SIPs running.

1) Large Cap (Goal 12-14 yrs)

Axis Bluechip Fund – 5000 per month

DSP Focus Fund – 9000 per month

2) Mid Cap (Goal 8-10 yrs)

DSP Mid Cap Fund – 9000 per month

3) Small Cap (Goal 5-7 yrs)

SBI Small Cap Fund – 5000 per month

Do you suggest I should stop current SIP and start new SIP based on the Best Large/MidCap Fund to Invest in 2019?

Sorry for spamming 🙂

Thanks,

Anand

Hi Sabbir,

Thank you so much for such an informative article. Can you please also post an article on Index funds? Specially Nifty 50 and Nifty Next 50?

Regards,

Samir

Samir, Index funds all have same performance. So one has to choose the one that has least expense ratio. There isn’t any other parameter for Index funds.