The 10 important lessons I learned being in the market for a decade now since 2007 where I made a transition from a newbie to a pro trader to an investor.

When the markets were booming in 2007, I did my first trade on 22nd June 2007. The June of 2017 is when I complete my decade-long presence in the market.

There were many highs and lows in the decade gone by and there has been a transition that has come along in me as a trader, as an investor and as a blogger who writes about finance with no finance background.

I had some of the awesome trades by fluke in some of the worst possible companies back in those days like RNRL or Essar Oil. As of today, I wished I did not have those big wins in those trade earlier in my life because those big wins were followed by some of the worst trades.

I must say I am a bit lucky to get out of those and I am grateful that those losses taught me a lot more than the wins in them. Losses helped me stop things and glad I stopped which laid the foundation of trying to learn before jumping into the market.

My journey is quite similar to any retail investors who get into the market because someone has opened them a DEMAT account and we learn the hard way out that market is not for anybody to start milking money and it is for those who know how to play it. Some people take it too far without the knowledge and quit whereas others stop bleeding money and start learning.

If I can break the stereotype process of making losses and then trying to learn, it can help many retail investors immensely and is the sole purpose of my blog.

Because once you make those losses, it is tough, really tough to get back into the winning ways and often we like to play the blame game then. No matter who you name in the blame game, ultimately it was your money and you blew it away.

So here are the 10 lessons I learned being in the market for a decade now where I made a transition from newbie to pro trader to an investor.

1. Price action strategy works for me

When things weren’t working for me, I was convinced that stocks can give you handsome returns. If they didn’t why would so much money flow into the equity market? I started to dig into the process of what works in the market.

I read a lot.

I went one to find all kind of analysis.

On the Internet, information can be overwhelming but I was in no hurry. I read a lot about everything I could

- Technical Analysis

- Fundamental Analysis

- Fractal Analysis

- Volume Analysis

- Open Interest Analysis

You name it and I may have read about it. This is when I moved over to price action strategy which was something I finally settled with.

Price action strategy is really simple to understand and very easy to read on a chart visually and this is something that I could understand and apply.

It could be my lack of knowledge in finance, that I could apply only price action strategy but as I applied the price action patterns, I started to see things turning around in the market. I was not doing things with my money anymore and was only paper trading.

2. Mathematical indicators can be waste of time

I am sure hearing this from a trader who preaches technical analysis can be a tough pill to swallow but then it is true.

What I mean is if you can find someone who uses mathematical indicators and if you follow his rules, it is all good but if someone who doesn’t use those indicators then those indicators can be waste of time.

As an example, I never use MACD or RSI and you will never see me writing about them because I am even below a newbie level when it comes RSI and MACD. I know them only because I read about them in my early days. I don’t use them for trading and now I am only a newbie in them. Some bookish knowledge that I have mostly forgotten.

Some DIYTA members uses Elliot Wave but I couldn’t apply the wave as well as them.

Being a blogger, at times I often pulled to those indicators just to help my readers but as I put my price action strategy alongside, they take a backseat.

Not because they don’t work but the comparison is eminent and it gives me more confident because of the success that I have with price action.

3. Short time frames can be dangerous

When you do technical analysis, you tend to move to shorter and shorter time frame and it is so wrong. Anything under an hourly chart can mean there is so much more noise that even experienced trader can be fooled by it.

At times some of the big traders and market players can trigger your stop loss or can pretend to give an impression the support is broken or there is a breakout above a resistance. If you are always tracking a very short time frame, you will be tempted to believe them.

The longer time frame can help you better predict the market. A stock breaks a major support level for a minute may mean that some large trader is trying to break the support by shorting it but it doesn’t sustain, you can assume it is not a crack of support.

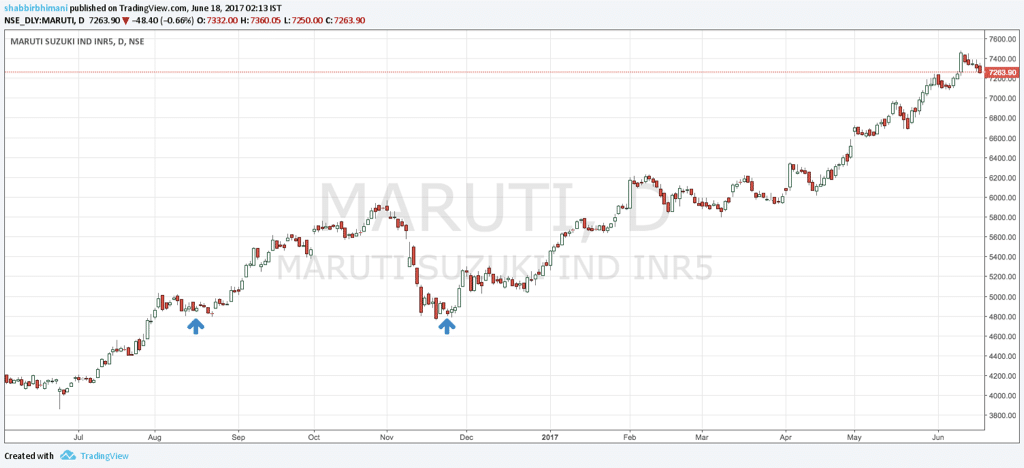

I missed the investment in Maruti for looking at smaller time frame and thinking the support of 4800 was broken.

Demonetization will impact auto industries and a break in the support at around 4800 and even a close below 4800 with a low of 4765 made me believe 4800 support was broken.

I was convinced that support has been broken and so I wanted to wait for the stock to go to its next support of 4200 but that never happened and I missed a great investment opportunity just because I was looking at the smaller time frame chart.

The conviction was so high that I wanted to see the complete impact of demonetization and soon after the demonetization, the stock was higher by 10% and I could never invest in it.

4. Trades comes with losses

When you read Warren Buffet’s way of investing – One of the principles he often refers is to never make a loss but it is an investment principle and you shouldn’t apply it to trading.

Trading has a stop loss and it is there for you to save yourself from disasters. Anybody can be wrong and so every trader should respect that and always trade with stop loss.

Stop loss is not for the sake of a number and it is based on study and gives you the confidence to enter a trade with the worst possible outcome and what is the amount you can lose if nothing works in your favor.

You can’t be right all the time. Don’t trade with the money you can’t loose. Trades will have losses.

5. Trading ROI

When it comes to trading, we often calculate unrealistic returns.

You will hear statements from tele callers like you can make 2 to 4% on intraday trading from their tips. For calculation’s sake, if anybody can make 0.5% per day, he can be the richest person on this planet in just 10 years. See the calculations in an answer on Quora.

So even 0.5% every day isn’t possible.

Trading is not about making a profit on a daily basis but it is about mixing your winning trades with loss-making trades and making sure you outnumber your winning trades to your loss making trades to overall profit from it.

Trading is to outnumber the number of losses with wins and profit from it.

6. Investment is a patience game

When it comes to investment, you will not be able to make an investment on a daily or weekly basis and you will have to play the waiting game and this waiting game can be boring and may test your patience to a great degree even when you are not invested.

If you aren’t patient enough, you may not be able to invest at the right price.

You identify the right stock and identify the price where the stock is a value but then it never trades at the price you are comfortable buying.

So what do you do?

Wait and this wait can be long and painful.

Britannia Industries has always been one of my favorite picks but then I could never get into it at the price I always wanted to but on the BREXIT day I had a golden chance.

I am still waiting to invest in stocks like Page Industries or Marico. Missed them in the Demonetization fall and so the next wait again can be long and boring.

7. Process is more important than profits

I once shared that big win of 50,000 in a single trade but after that, I completely avoided sharing such trades of mine because it is not about me making huge profits or showing off but it is the process that I follow.

Some of my investment has higher profits recently but it is the process that is more important than just the profit numbers.

Are you prefer trading with Elliot Wave or a fractal analysis or price action strategy?

It is the process that any trader should focus on and not the ultimate profit that you can make out of it. Once you know the profit ratio, money can always be found for investment and scale it up.

8. Follow the trend and not the big investors

Yes, I know at times we tend to prefer investing with the assumption that trend will reverse. When you follow investors like Warren Buffet and it may be true for them but if you aren’t a bigger investor, you can wait for the trend to reverse and even buy your investment in the leg up than in the leg down.

I prefer it that way.

Let us assume that stock is being hammered, you assume that stock will be value at the current price now. So instead of making it a buy let it form the bottom and then reverse to come to the price back again where you can make the purchase instead of purchasing in the leg down and seeing the pain of it forming the bottom.

The best example from my portfolio can be Pidilite where I purchased it at 700+ levels when the stock was being hammered from 780 levels. Stock went down to 568ish level. I could have purchased at the same levels of 700 after it formed a bottom at around 600 and not when it started it’s correction from 780 levels.

Big investors need lot more time to take up lot more units in a stock and so they may start investing very early to be able to make the most of the fall and buy them cheaply but for retail investors like you and me, it is better to not see such a sharp fall in a stock as that can shake up your confidence of your research that you may have done on the stock.

9. Avoid over trading

Some of the biggest losses happen on days when you try to force your way into the trade by making them profitable.

Keep a limit to the number of trades you do on a given day and if things aren’t working for you, take your eyes off the screen.

There is always the next day for you when you can make up for it instead of forcing it to work on the exact same day and before the market closes.

10. Never Average Down

Some of my biggest losses have happened in trades where I have averaged down. So I am so horrified with it that I even follow this to my investments.

You will never see me averaging down my investments and this is something that I have made it a rule of thumb.

If something will go up, I will average up but not average down.

There is no rule that you cannot make a loss in a particular stock and make up the loss from other stock. If one of the stock isn’t performing, it is not that you need to make that stock perform by investing more in it. Find a better trade setup in some other stock where you can profit and book a loss in this stock.

If you average down, and if you get back your overall average price, you are actually booking profit on some quantity and loss on others. So if you can book loss on some quantity in the same stock, why not other stock.

You will see that I have never averaged down Jubilant Foodwork in my portfolio and it is for the exact same reason but you have seen me adding Ashok Leyland more to my portfolio when it moved higher.

Final Thoughts

We always try to complicate things when it comes to investing but keeping things really simple should be the mantra for any retail trader or investor.

Great article. Really helpful advises. I would like to add a point- ‘The beginner’s luck’. When people enters the market and see their portfolio up by 30-40%, they start over trading. Intelligent investors should avoid it.

Thanks again for sharing!!

Short Simple Sweet Wisdomful Article. Keep it up.

Glad you liked it.

Very good article

Thanks Milind and glad it was useful.

Shabbir, these are the 10 best trading or investment advice that I have got in my entire life especially trading ROI. I always knew something promised by tele callers wasn’t possible but now I know lot more about it to tell them when they tell such high hopes.

Glad you found it useful Viral