How I Create a List of Forever Stocks. How my List of Forever Stock of 2011 has performed with lessons I learned. My list of evergreen stocks to invest in 2019.

Stocks tips providers are in abundance but no one is suggesting the best stock to invest now and forget forever. Will will consider such stocks that you can buy in any dips and keep on forgetting but before we begin a rant for stock tippers.

The most crucial aspect to consider a stock tips provider is the success ratio, and the CAGR one can make following them.

My view has always been; all stock tippers are a fraud. It never adds up.

If you find a great stock to invest, will you invest or let others invest and make money?

Moreover, how can someone come up with a stock idea daily?

But, we see people come up with 3 to 4 trading or investment ideas everyday.

The reason they give the stock ideas is, they follow the standard disclaimer. Moreover, no one verifies how many times they hit the stop loss versus the target.

So randomly choose any stock with a target and stop loss level, and it is all ok because no one is going to put a success ratio on the tips.

But what if we do …

What about ethics?

Is it ethical to share stock tips with a standard disclaimer?

My List of Forever Stocks of 2011

I don’t provide stock recommendations because I believe in:

Give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime.- Maimonides

But from time to time, there are companies that we discuss. Not from a suggestion point of view to understand the investing process.

In 2011, I was beginning to learn the process of investing. I am still learning but have come a long way. I still want to full proof of the method to eliminate the dark horses that get into my portfolio now and then. Force Motor is one such in my current portfolio.

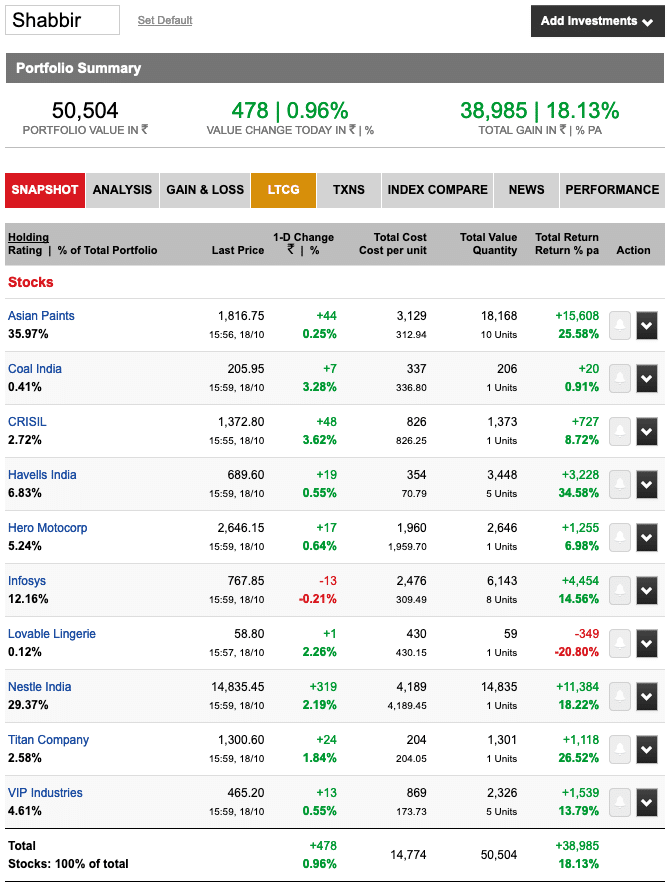

If we had purchased 1 unit each from my forever stock list of 2011, this is how the portfolio would have shaped considering the dividends, bonus, and splits.

The CAGR return of 18%+ for the past eight years is great for me.

The reason I am sharing is not that I want to boost what I did or want to share stock tips.

The main reason for sharing is there are a few key lessons we can learn from the above portfolio. However, we can create our list of forever stocks in 2019, as well.

So if you read the above article, you will find the gist to form the list was based on India’s growth story.

The Performance of 2011 Forever Stocks

Now looking at the performance, We find a clear distinction among the stocks. Let us classify the above stocks into three categories.

1. Not Acceptable Returns

So definitely the companies like

- Coal India

- Lovable Lingerie

Didn’t generate acceptable returns.

So if you analyze my investment checklist, fundamental analysis, and business checklist, you will find I emphasize highly to avoid PSU companies.

The reason is quite apparent. They didn’t perform well enough for a very long time now. One may argue the current news flows of divestment can make PSU stocks perform. The question is, we are trying to guess which company will be divested first. And few will jump 20% as well.

I consider that as a noise for investors, and one should invest in companies that have growth potential for the next decade.

Similarly, we always look for the next Page Industries; I did the same in 2011. However, there is never the next, which I realized lately. I have explained it in detail in the OPM article here.

2. Ok CAGR Returns

Not so good return but a still OK type of returns.

- Infosys

- VIP Industries

- CRISIL

- Hero Motocorp

These companies were investors’ favorite pre-2011 – Infosys in the correction of 2008 or Hero MotoCorp for growing Rural demand in India or CRISIL the darling of every investor in 2011.

Each only managed ok return for the investor.

3. Better Than Average Returns

- Havells India

- Titan Company

- Asian Paints

- Nestle India

Gave better than 18% CAGR returns.

The real money is investing in the companies that will be able to grow in the next decade.

The book, One Up on Wall Street, has a process to find such stocks taking cues from outside the market.

I follow the same method to find my list of stocks now.

Moreover, The UnUsual Billionaires have shared the complete process to find such companies.

My List of Evergreen Stocks in 2019

Based on the above strategies, if I had to pick and choose companies, to invest in, they are:

- Page Industries

- Lupin

- Zydus Wellness

- Amara Raja Batteries

- Divi’s Laboratories

- Pidilite

- Marico

- Britannia Inds

- Balkrishna Inds

Companies like Titan Company, Asian Paints, Nestle India will remain on the list forever. As the market cap of such companies is over 1 Lac crore, I don’t prefer fresh investment in them.

They are huge companies that will give stable returns, but I am more of a mid-cap investor, where I am fine, even losing 50% of my portfolio for better performance.

Final Thoughts

I have nine companies on my list. Can you help me find one more company that should get be in the list of forever mid-cap stock in 2019?

Share your list of forever stocks in the comments below.

Dear Shabbir Sir,

I would like to know your view on Castrol from an investor perpestive. Holding period can be 4-5 yrs. I have seen it has robust ROE and roce although the sales and profit cagr seem flat.

I will prefer not to comment on individual stock but as a general rule, if you see a future growth coming back in the stock, it can be worth holding but not otherwise. So take your call if you see a growth in coming quarters.

Hi, Shabbir, Asian paint, nestle cross one lakh crore market cap. So u don’t want to Fresh investment ,ie growth will be less.. my question.. u will consider large cap company if market cap more than hundred crore.. I mean this is the criteria for large cap .?

That is my criteria. That is not the criteria for the large cap guidelines of SEBI.

I had Balkrishna Ind few days ago

Tata elaxi also add in Auto space.

Agree.

Finance field

HDFC bank

HDFC AMC

Kotak Mahindra bank

Auto ancillary is beaten up now I think following stock have

good future;

India Nippon

Bosch

Motherson sumi

Lumax industires

Schaeffler

Subros

Let me know your view for above auto stock and this this right

time to enter I think .

Finance one are fine but not convinced over the others.

Relaxo : Footwear having

good future potential

Berger Paint : next Asian paint

Astral poly: construction having good scope

Venkey: poultry business

Honeywell automation: in future all will be atomized

Avenue supermarket: supermarket journey still stated only good

future scope

Trent: same as above

Pls let me know your think on above stocks ?

The list looks good. I have a keen eye on Venkys.

What are your thoughts on Jubilant Foodworks, Shabbir? (I have always been unsure about Godrej Consumer!)

And I see that you have not added any stock from the Finance space. Possibly due to the current situation. Bajaj Finance seems to be on the top of the list.

Jubilant Food has too much competition to handle from Zomato and Swiggy. Moreover, I am not very upbeat on the management after announcement of royalty for the Jubilant name and then retracting it.

U can check icici pru or berger paint

Good choice.

Sure. I will be more than happy to look at it. Email me using the email https://shabbir.in/contact/

Sent

I havr prepared technical charts for my invedtment purposes, want to share those with you

My List (Shadab)

——-FEMG-DUO——-

Havells India

Polycab India

————————

——-Cons.Durable———-

Voltas

Blue Star

————————-

———FMCG-DUO———

Tata Global

Godrej Consumer

————————–

———-IT-TRIO————–

Tech Mahindra

MindTree

Infosys

———————————

———MISC.PICK———

Future Supply

Indraprastha Gas

Deepak Nitrite

————————–

Awesome list.