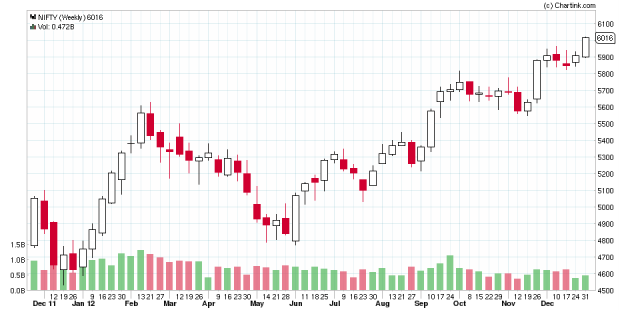

Year 2012 was full of surprises for the Indian investors. Looking at the weekly charts for Nifty in 2012 we clearly see it had something for every body be it trader or investor. Nifty has shown good support in 2012 around 4500, 4800, 5000, 5200, 5550, 5850 and so it does look like 2013 will be a year where there will be lot of support for market and so if you are keen to invest your money in 2013, there are three things that you need to know.

Year 2012 was full of surprises for the Indian investors. Looking at the weekly charts for Nifty in 2012 we clearly see it had something for every body be it trader or investor.

Nifty has shown good support in 2012 around 4500, 4800, 5000, 5200, 5550, 5850 and so it does look like 2013 will be a year where there will be lot of support for market and so if you are keen to invest your money in 2013, there are three things that you need to know.

Lesson #1 – Identify Your Investment Vehicles

Are you an investor who prefer investing in Mutual funds, or you prefer Investing in Gold / Gold ETF or investing in market directly by picking good stocks yourself or you prefer investing in properties and other asset class? Choose your investment vehicles and try to invest as early as possible to your best-suited investment vehicle. Identify your financial goals and take the help from your financial planner to sort out the funds from different assets that can help you to reach your goal. Not all the investments will give you equal profits and some might take a longer time. But, that is how the market performs.

Lesson #2 – Overcome Your Greed

Investments require a specific strategy. If you have surplus cash without any confined financial goals, you are free to experiment your funds through various channels. If the markets have performed in 2012, it does not mean similar things will happen in 2013 as well but chances of market doing good in 2013 are high but you should invest in market with stop losses at the support levels if you aren’t sure when market can take a down turn.

Lesson #3 – Market Is Not To Get Rich Quick

No investments can make you richer overnight. Every financial instrument will take its own time to give back the returns. All you have to do is to understand the basic principles and start investing in the funds. Systematic approach and the right strategy can help you to milk the profits in the long run. Make sure your investments will cover up funds from small, mid and large caps so as to diversify the asset allocation. See why it is important to start investing early.

If you are a mutual fund investor it is right time to monitor the performance of your funds because if they have not out performed the market, its time to analyze them and get them rid of them and get into funds that are able to outperform the market in 2012.

Invest for better returns and not spectacular returns from market. Share your investment views of 2013 in comments below.

Insurance against unforseen circumstances is an intelligent safeguard and therefore; one should get a term Insurance before age 30.However; a common mistake made by many is to look upon Insurance as a vehicle to make money.I lot of people have lost on a plethora of shadyfly by night schemes like ULIP etc and they regret, when it is too late. So lesson no 1 is to get term insurance and second lesson is to avoid thinking insurance as an investment.

The third important lesson is that it is a fact that equity investment is good, but dont think that u can get rich in a short time.Its a long term game plan, done wisely ,judiciously and with patience.If u have the resilence and patience and your age allows it, delve in it otherwise be wise , go for fixed investments and enjoy guaranted returns.

Views on my comments are welcome.

Perfect and I have been saying those things on the top of my lungs for quite some time now Ajay.

Hi

Market is very volatile.Invest only in IT and Pharmaceutical like;

Dr Reddy,Lupin,Divis lab,Cipla

TCs,Infosys,Wipro,HCL & Satyam Computer

Hi sir,

Im 19 years old and I am running an agency of Britannia biscuits and dairy. I’ve just spend money like flow of a water. Its high time now that I should save money for my better future. Please suggest me some investment plans through which I can get good returns and hopefully invest into good business line after 5 to 6 years.

Regards

Aditya dhingra

Aditya, I know very little about you to suggest you investment option. Contact me with information about your assets, loans and other details and I can suggest you better investment choices based on them.

Dear Shabbir:

Read your email and what you are telling is 100% correct. The Retired persons should be very careful in Share Market. My opinion is that they need not do Day Trading; instead, they can buy shares of good companies that are fundamentally strong, at low

levels, keep them for a period of say one year and sell them at high levels, getting a

desired profit. Trading is not suitable for Retired persons, because they cannot withstand

the losses, if they lose their hard earned money.

As far as Mutual Funds are concerned, they can invest in Good Mutual Funds, monitor

them, once in 6 months and come out from them, if they are underperforming. They

should select only OPEN ENDED SCHEMES.

Thanks & Regards.

S. Sridharan

Madipakkam, Chennai-600091.

S. Sridharan, what you say is partially true but then when it comes to investing after retirement means your time horizon for investment is considerably low and that acts as a disadvantage as well and so that needs to be considered as well.

Sir

I am retired person without pension I got some saving now I want to play in stock market kindly advise me.

thanking you

anupam

Anupam, I will suggest you to learn the trading before jumping in market because if you don’t do that then it would be tough for you to make money from markets

Dear Shabbir:

Seen your email about 2013 lessons. Really, it is an excellent one.

Your views are very much practical and hats off to you. This reflects your practical

experience,

Thanks & Regards.

S. Sridharan

Madipakkam, Chennai-600091.

Glad to see that you really like it S. Sridharan