Reader Question Answered: why I sound sceptical on Indian market for last few months. What about the Indian growth story?

My Take on JPMorgan’s view on Unitech

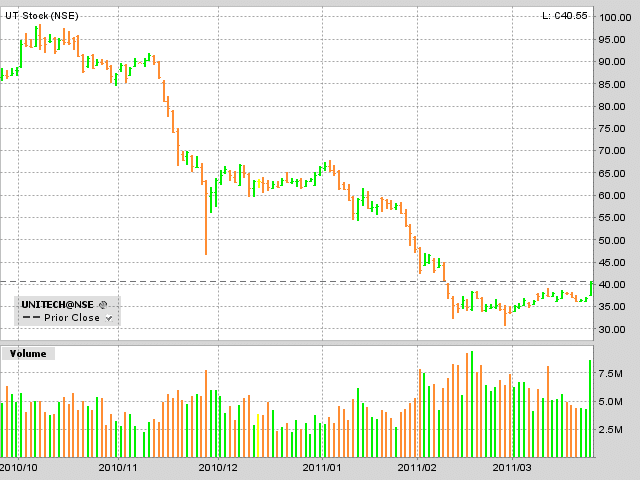

CNBC TV18 I saw a news being reported almost all day – JPMorgan overweight on Unitech. So I could not resist myself in getting my views on such crap research. In my book about Chart Pattern I have made it very clear on how you should be handling such news.

Best of Budget 2011 For Investors

I am sure you have heard and read a lot about Budget 2011 and so I am not going to keep this very very short. Three best things which can really benefits an equity market common man are

Views on Indian Union Budget – Readers Perspective

If you subscribed to my blog before Saturday (Or Friday depending on your time zone) I sent an email asking your views on Indian Union Budget and I got variety of response. So here is a composition of yours and other fellow reader’s views.

All you need to know about Disinvestment

By divesting and making listing will also improve the corporate governance as it increases the pressure on the employees to scrutiny by investors.

First Islamic Bank in India

Islamic Bank cannot be called a Bank because of RBI guidelines but it looks like time has changed and Kerala may have first Islamic Bank Next year.

SEBI’s Guidelines on Exit load

SEBI continues to reward retail mutual fund investors. It slashed Entry load & now stops lower exit loads for big investors.

No More High Value Check Clearing

RBI has, vide its circular dated April 13, 2009, made the following changes in High Value Clearing for metro centers. Following is the roll out plan for RBI

Buffett at Annual General Meeting

Mr Buffet was speaking to shareholders of his Berkshire Hathaway company at their annual general meeting being held in Omaha, Nebraska. The value of Berkshire Hathaway’s investments fell by quite a bit and Mr Buffett’s personal wealth shrank by $25bn (£17bn) and he is now not at the top of the richest person list.

Understanding the consequences of pledging shares

Satyam, India’s number four software services exporter is now caught in a tight spot. Well, it has all happened due to the general practice of the art of pledging shares to raise funds. In India, this act of pledging shares to raise funds is considered as a very common practice.