I was convinced that Portfolio management service or PMS can perform better than mutual funds. Yes that’s right. Now I share why I was convinced for PMS and why PMS cannot live upto your expectations.

Last week I shared my views on Sharekhan PMS Service and I am sure one question may be bugging your mind – Why On earth did I go for a PMS? Not for writing a review of-course. Jokes apart the real answer is: I was convinced that PMS can perform better than mutual funds. Yes you are heard it right. I was convinced that PMS can do better than mutual funds.

Let us first see why I was convinced.

1. PMS Fund manager can completely liquidate but mutual funds can’t

When I talked with the PMS sales people they told me one clear advantage of PMS over mutual fund is, if market tumbles then PMS can liquidate your complete equity exposure but when it comes to mutual funds they have to remain invested in equity for minimum possible levels depending on the fund type. An example equity based funds have to have an equity exposure of close to 80% no matter how much danger they foresee in the equity market.

2. PMS have the leverage for higher margins

I am not talking about the few times leverage margin available when trading in futures market but what I am talking about is the debt instrument allocation part.

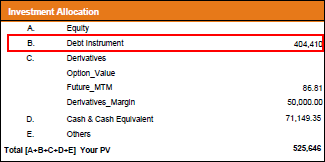

Image Source: Sharekhan PMS Quarterly Report @ Sharekhan PMS Review

You can see that 400,000 i.e. 80% of 500,000 were invested in a debt fund i.e. Birla Sun Life Savings Fund and rest 100,000 was left for equity trading. This way corpus can actually trade for 5 lakhs of rupees yet exposing only 1 lakh to equity. I looked at this as an advantage to mutual funds where mutual funds do not have the leverage of investing in some other debt funds 80% of money and still work with 100% of the investment amount.

Apart from that I also believed that this actually means an advantage of capital protection. If market collapse by a shocking 10% in a day then also the maximum I can loose is one lakh theoretically (i.e. all my margin money) and fifty thousand practically i.e. 10% of 5 lakh. Such thoughts actually made me to continue the PMS service after the initial issues with the sales team.

3. PMS are for big boys

Aren’t we all fascinated to try a PMS? PMS has an entry barrier of few lakhs and so not many individuals and retail investors are able to go for it. It is mainly for HNI’s or High net worth individuals who have in spare few lakhs of Rupees. This makes many retail investors (including me) think that if I can make an investment portfolio of few lakhs I can go for PMS.

Now the question comes why in reality PMS does not perform as expected?

Note: Now we are talking about PMS’s in general and not Sharekhan.

1. Lack of Good Fund Manager’s

In general the mutual fund manager’s of good fund houses are more skilled and follow a standard allocation patterns than the PMS fund manager’s. If you are inclined towards PMS you should always know who will be managing your fund and try to get more information about his/her experience in the market and see how long the fund manager has been there with the brokerage house.

Apart from that I have read in many forums and blogs that at times PMS are not managed by humans and is done by auto trading software’s but I cannot confirm about this information for sure.

2. Aim to generate more brokerage

Like any other trading account, the highest priority for any PMS is mainly to generate more brokerage income and not return on the PMS where as for mutual funds highest priority is performance.

3. Lack of proper regulation

Lack’s of detailed regulation to judge a PMS service or performance. If some sales person tells us some performance numbers we cannot challenge those numbers to the extent we prefer nor can we can ask for a proof because answer will always be – our research & numbers are confidential.

Over to you

Share your Investment story in comments below. We can ALL benefit from shared wisdom 😀

Dear Expert, I need urgent help and solution for the big problem in my life bec. of share market you suggestion and guidelines will be highly appreciated.

Problem: I invested my money with X person (whom i meet through advt. he convinced me and opened a franchise/Remiser kind of thing with ABC in my name than i opened my account with all my life saving + bank loan as he promised me returns of 4-5% pm + the brokerage his job is to use so called expert knowledge and make above returns and share 60:40 40% being for him, after some month i referred to some of my know people who also invested in same 60:40% ratio. But for past few month the amt. as come to 30% of capital and my friend or people who are reffered are behind my back asking for the loss amt. as he never meet these people they are asking me for the money.

I lost my complete amt + now i am asked for paying for the other people also bec. of the third person did traded. But i took the person to this people and told that he trade but they are considering me responsible and want money from me. I just want to run from it as I have to pay my loan things and also for others it is not possible, but this guy say he will make up for some of the loss but never does any thing as he doesn’t have any thing with him.

How do i resolve the issue can they take me to court. I have few solution i don’t know how it works in market (some times i feel like committing suicide for my such big mistake as i have never cheated people in life.

Total my amt inv. was

X–7 lac———bal-2.1L

y–3.5 L———bal-1L

Z–7 L———bal-1L

A–5 L———bal-0.75L

Solution i see is:

A) Forget my money and others and run of from the situation (but franchise in my name and they know me so they can take me to court and police

B) Partial settlement which will take years (on basis of 60:40) sharing ratio, 40 loss shared my me

C) Tell the clients i can’t pay and talk with the trading person responsibly (he doesn’t have any permanent place he can run easily)

Now my question to all friends is how to get out of the situation and make the person responsible to also take most of the at least some responsibilities. Also what are the legal ways and how this is solved in market. People who have this kind of knowledge wish to talk with them urgently if possible.

Thanks for your support.

Hi Vinay, as discussed over the phone I hope I have tried to help you to the extent I could but I think you have done a big mess and so now you should be getting things sorted slowly but surely.

Yes, it was really helpful give me lots of emotional support as well as idea to how to go about the thing.

The pleasure is all mine Vinay

Dear Shabbir,

what shd i do; get out with the loss OR wait for a little while for things to improve (as probably the market is on a ‘uptrend’)

Or shd i go to the consumer court ????

Pls suggest

Ashish, Not sure what can be done but I think if you plan to go for consumer court, you should do that only once you have rest of your money in your bank account.

@ashish : do you think that if they had any sort of real expertise, they would really need your money to invest ?

Hi,

I had invested in Karvy PMS in Oct 2010 with a corpus of Rs. 5 lac.

They had made a lot of promises, however presently the value of my portfolio is less than 2.5 lacs.

I have observed that they buy a scrip at an x cost and then sell it at a much lower price rather than holding or averaging it. i know that it is sometimes better to get out with a loss, but it is not true in almost all cases. what i mean is that if they claim to be a PMS service provider, do they not have enough expertise not to buy such shares. Also they must invest in a few blue chip companies to ensure that in bad times the erosion is not huge and only minimal.

ANY COMMENTS !!!

Ashish, if they just keep your money in blue chip companies, they would not make the brokerage needed and so that is more often not the case with PMS.

Apart from that there is no limit to the amount of money Karvy has and your 5L is just too small for company like them and if they offer you returns for your money, why they are not doing it for themselves with their own money?

I think the above questions would answer everything.

Whatever u said is right Shabbir. I got screwd up by Karvy PMS guys. They totally F***ked up my portfolio and all the managers are As* Ho**s. They are so unprofessional. really bad experience and worst company for PMS. PMS itself is a joke. Guys stay away from it.

Investing in mutual funds provides diversification for smaller investors as funds are pooled with other investors. This means the pooled funds are then invested in different asset classes, depending on the type of fund that has been chosen. It also means that smaller investors can then have the same diversification as investors with large sums of money.

sir, Do you expect this stock cross 540 in the near future?

Tough

Hello Sir,

Thanks for your reply.

I think I did a mistake by picking this stock at this higher level (Rs.540 per share). No idea how long i need to wait to see this stock crossing that level.

You have mentined that this scrip is trading way below its 50 DMA.

Kindly explain:

What is this DMA?

How to find the same? Kindly excuse me for asking this question becuase I am still learnig things.

Thanks and regards.

50 DMA means 50 Day moving average and you can find those in the Yahoo Finance charts.

Hello sir,

In fact, I picked this stock (HPCL) for 540/share few weeks back. I wrongly typed the figure, sorry.

From 540 ( the price I bought) it came down all the way down to 470- 480 range. I wonder, will this stock will correct again.

Should I,

–Exit from this and book loss to avoid stuck with this scrip at the moment?

OR

–Should I accumulate more stocks at the lower price? If that is the case, what is the approximate time frame for this scrip?

OR

Should I simply hold on to this stock until it come up? I am confused. I have no technical report about this scrip.

If you know the Stop loss, next target figure or resistance figures of this scrip kindly let me know.

Thanks

I will share with you my views.

1. Market is very near to its 52 week peak but HPCL has a long way to go.

2. It is trading way below its 50 DMA

Now 450 is a good support for this stock.

I will not exit currently but a pop in the pricing can be a good point for exit.

I invested HPCL at 440 per share few weeks back. Soon after that its price started falling to the 480 level.

Shabir sir, any idea about this stock? Should hold on this? Or book loss and get away from it? I am just confused. I am tempted to buy more at this lower price but again worrying about further falling of its price. Please help!

To be frank, I do know how to read charts properly. I only check financial results and balance sheet to pick my stocks. How do yu see this stock’s chart for future prospects?

Usalman

440 to 480 is not a fall buddy.

Shabir,

Sorry for the trouble caused.

Thanks for your feedback about KRBL. Can you please tell when its rally is likely to begin? Are you anticipating any reason for the same rally you have mentioned for this stock?

Waiting for your reply.

Thanks

Salman

I am not a fan of guessing the rallies but I guess charts tell me that.

Shabbir,

What is your call on KRBL? In fact, I have few stocks of this and it is already appreciated.

This stock is trading at Rs.48 now. People says this stock has already touched its peak Rs. 55/- two days back becasue the reason for this stock’s momentum is over (This stock was peaked to this level becuase of rice scarcity in Pakistan on account of natural disaster happened recently)

Do you have any view on this scrip? Should hold on this stock or exit? It is coming down now. I did not find any website that came out with a research report about this stock. Please suggest a good website that offer analysis report about a stock of one’s choice.

How do I track a scrip which is not being tracked by any of those research teams?

Thanks

Salma

Salma,

I don’t track KRBL based on fundamentals but I can suggest you technically what the charts looks like.

The charts tell me that this is not the stock you should be holding as of now. 200 DMA and 50 DMA are stacked upside down and so I see either more potential downside or sideways movement for time being before it can start its rally.

Hello Shabir,

Actually, there was some problem with your site at that time. None of the comment I posted was not appearing in the list and break in between.

But I saw all your comments. 4 of them but they all were flagged as spam.

Hello Shabir,

Greetings!.

Is there any reliable website that offers the current resistance and support prices on regular basis? ( These information are very important in this current volatile market where most of the stocks are very expensive!)

I would like to consider mid cap stocks now as they are very promising now. Which website do you suggest for reliable reference. Which are the most promising mid cap stocks at present?

Thanks in advance.

Regards

Salman

Salm, You posted the same question in 4 articles and try avoiding that.

Also support and resistance can only be provided by people who suggest stocks and so your stock broker’s daily tips can help. I use Motilal Oswal’s such tips to get lot of those levels as well as use my own trading skills.

Also check http://shabbir.in/calculate-stop-loss-target-level/

Dear Mr. Shabbir,

Thanks for all your articles and detailed reply. I just want go thru KARVY PMS with 500000 Rs. as they havent any lockin period. is it recomanded??? pls guide

Ajay, I have no personal experience with them and so cannot comment on them but if you can share some previous performance of the PMS I may be able to help. Remember PMS has never worked for anybody I know off till date.

Good educative article for investors.

Shabbir,

Reliance pms inform me that I would have to close the pms a/c managed by them, perhaps then the option would be to buy shares which are star performers and get rid of the dogs.

For e.g Reliance Industries was bought at 133.69 – trading around 1061.00. Worst performers are; ISMT, Aditya Birla Nuvo, and HEG.

Although the P/e ratio for ISMT looks attractive at around 10.

Perfect option I must say.

I think we should pass this on to our regulators.

2. Yes, I have seen that as well. Usually they do that b/c they know the won’t be able to make money on the profit sharing and hence at least in brokerage they will make some money

3. True. Agreed it should be more open like AMFI but the original thinking of PMS products was that they would be targeted at HNI savvy investors.

PMS to savvy investor’s is actually true but returns are not that savvy. 🙂

Hi Shabbir,

As the shares are held in a Demat account and the pms manager has the investor’s authorisation to buy and sell shares, could one withdraw this permission and just keep the good shares in the demat a/c, at least this way one is not incurring fees.

Depends if the fund house provides such PMS service or not because there is not much you can do once you go for PMS

If you do that , what is the point is opting for a PMS account. You might as well invest the money yourself .

Besides , there could be different reasons / time frames for which the PMS originally bought the stock. If you now block them from selling it , it defeats the whole purpose.

If a stock was bought for short term upside or was bought based on some news etc. , hanging on it it might result in losses.

You never buy a stock because of some news outcome in future. Do you

I don’t . But the PMSs sure do. And so do a lot of traders. I’ve also noticed , that they buy stocks for dividend stripping.

Can you suggest some real world examples.

I did not understood your first point .

1) PMS Fund manager can completely liquidate but mutual funds can’t

how does it matter for you ? You just need your liquidity and if you can get liquidity for your 5 lacs invested , this point should not be considered at all ..

All equity funds which are not tax saving funds are liquid only ?

Manish

No this is not related to that. You can liquidate your investment from open ended funds but if you are not a regular in market then your fund manager in mutual fund cannot cash out all his assets but PMS fund manager can.

I hope it makes things clear.

Shabbir

Its still not clear to me . What situation are you talking about when I have invested in open ended mutual funds (non-tax-saving), but still I cant liquidate my full investments ? please clarify in detail .

manish

Manish, This is not when customer himself wants to liquidate but from point of view of fund manager. Customer is not always tracking the markets but fund manager is. Now there is a situation where fund manager is not very bullish in his outlook and wants to remain cash heavy. Mutual fund manager cannot be as cash heavy as a PMS fund manager.

ok got it

Having been involved in the PMS space back in 2005-2007 I believe I can shed some light and respond to some of your points.

1. Lack of good fund managers – many PMS schemes use new fund managers and once they show they great results they get moved to either the institutional or mutual fund side (where there is much more money). Auto trading or algo trading is probably not being used by anyone at the moment, it will definately happen but right now most are testing their algo’s with proprietary capital.

2. Generate brokerage – Although it may appear that way, but when a PMS scheme can charge 1% or 2% of the AUM and take a % of the profits the focus for the PMS scheme is to perform. If you look at the math the brokerage amount is very small considering what the other charges are.

3. Lack of regulation – In 2005 when we launched SEBI was regulating the PMS managers but i 2007 they got very active and changed things like every account had to be an individual account no more “pooled” accounts. My advice if someone said they can’t share numbers or research then you should walk away.

Overall the PMS scheme was a good idea but it ended up being misused by many brokers and giving it a bad name.

Hi Manish,

Thanks for your views and here is what I meant in more details.

2. Generate brokerage – I was not talking about my issue but in general. I have read few articles and comments where even people are charged 10% of existing value and investment is 9%. Check out the comments by Shrirang M Kulkarni here. This is one such examples for PMS.

3. Lack of regulations – Like mutual funds we have performance charts for year after year at amfiindia.com and I can understand how a fund has performed for last 3 years but can I look for the same for PMS. I don’t think so or at least I am not sure where. Even the official site (site of brokerage houses) does not talk about performance where as for mutual funds you can find the nav on the official sites (Site of fund houses) as well.

I think regulators should come into picture to handle issues with PMS but I think they will come when we see something as big as Harshad Mehta.