Learn how to make money not only investing in a long term portfolio but also trading your long term investments and long term portfolio.

Yesterday my trades in Nestle India were as follows.

Trades in Nestle India on 8th Nov 2011

And if you just look at the trade details you may think I shorted Nestle India at around 10:30 AM in the morning and covered it back at around 2 PM but that is actually not true. Why it is not short selling, let me first tell you some background about Nestle India.

Background

Nestle India is one of my preferred forever stock and it is never ever recommend to short Nestle. (See my list of forever stocks). Nestle India is one of those kind of stock that I have in my portfolio all the time but that does not mean I don’t trade in it. Every time I see weakness in the stock, I reduce my position and then re-enter in it once again at levels I think can be more beneficial to me. (See here where I was out of Nestle and then back again pretty much at the same pricing).

Nestle India has been reporting good results for last 19 quarters (or 5 years) and each good result declaration is followed by profit booking. I anticipated profit booking yesterday because same thing happened in May 2011 as well.

Now you can understand what type of trade I did in Nestle India. I actually offloaded my investment position in Nestle India at around 10:30 AM and got into my investment mode once again at 2PM and in the process pocketing few thousands.

Why the trades?

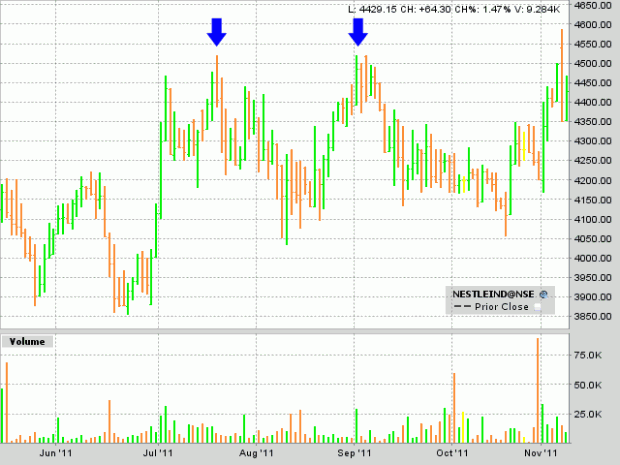

You may be wondering why I why I was out of my forever stock? The reason I was out because I knew 4500 has been a resistance for Nestle India for quite sometime now and it has retraced back from 4500 many times.

Nestle India Last 6 Months

Yesterday also it hit the resistance in the opening trade and tried breaking out above the key resistance level of 4500. So I was actively watching the stock to see how it performed at the break out with a stop loss of 4470. Once it was below 4470 at around 10:30AM I was out of the stock.

When I was thinking about stop loss I had couple of plans in my mind.

- Get back into Nestle at around support levels once again.

- Re-enter in Nestle India when it can decisively close above 4500 and shows a clear breakout pattern.

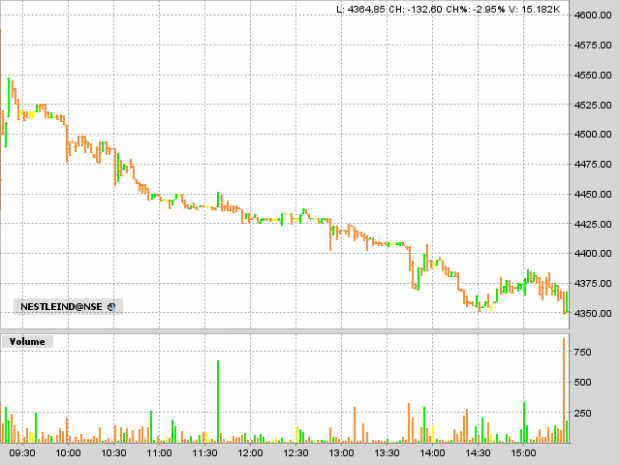

So I was actively watching the stock and it was under pressure for each 25 Rs with almost no recovery whatsoever.

Nestle India on 8th Nov 2011

At 1 PM I was very keen to get back into Nestle India but as late as I preferably can hold myself. Ideally around 3PM.

As I was actively watching the stock, I saw a spike in the stock from 4370 to above 4400 levels and I jumped into the trade. Actually it was a panic from my end where I wanted to protect my gains. No regrets and yet another lesson learnt.

Final Thoughts

Long term investing does not mean you cannot make money from your investment trading those stocks and at times intraday. Make sure you watch your investment and grab the opportunity that comes your way.

Share your views and feedback in comments below.

Chart by Interactive Broker’s Trader Workstation

Hi Shabbir

I really like your blog and soon will get in touch with you to have your e-book.Just updated an article on Retail investors (Food for thought), if you get time please comment.

Well the article is small and not too detailed. Just updated as markets are closed and nothing to do today

Thank you

Hi Aasif, left the comment and probably you are a very patient trader but when I am trading I am very scary. I am patient when I have an investment objective like I have in Gold bars or in some penny stocks.

Hi Shabbir

Really nice article. I too use this strategy quite often,for last one month I have been playing with same strategy in my holdings of TATA Power. Investors should learn this skill before they trade.

Thank you

Hi Aasif, yes anything that you do should be done with education and practice. Though I knew what needed to be done, when you have prices doing everything in front of you, you can be prone to lot of mistakes. The idea is to learn from those mistakes.