Let’s do some number crunching to see when is real estate a better choice than equity for small investors like you and me.

One of my blog readers asked me if he should be investing in real estate or equity/stocks.

Suppose you ask a predominantly an equity investor. In that case, the answer can be biased, but today I will do some number crunching to help you understand which is more beneficial and when one should consider what.

So without much ado, let’s begin. You can watch the video or read the answer as text.

Real Estate and Time to Double

The key to investing is always the returns. So the data I have seen in my area, it takes a decade for the property prices to double.

Further, residential property rent is between 3% to 4% annually. So on a property of 1 Crore, you get a rental income of 3Lacs to 4Lacs per year.

However, commercial property rent is close to 5% to 6% annually. So for the same 1 Crore, you get a rental income of 5Lacs to 6Lacs per year.

So if you add the rental income for a decade, the amount becomes close to 70 Lacs.

However, some expenses come along with property. So first, let’s look at those.

Major Expenses with Real Estate

So when you want to invest in property, you have to consider the following expenses that come along with it.

- Initial Registration Cost – The property registration cost is close to 10%. Depending on your state, there are 5 to 7% Government Fees. Then we have lawyer fees and other expenses (Municipal Registration, Electricity Transfer, etc.) that add up to 10%.

- Property Tax – Each year, one has to pay a property tax.

- Maintenance – The association for the building will charge maintenance fees for paying the gatekeepers and maintaining the lifts, garden, GYM etc.

- Brokerage and Rental Agreement – If you want to rent out, you must pay the brokers. Further, a rental agreement costs money.

- Painting and Other Misc Expenses – If you want to rent out, your flat has to be painted every few years. Moreover, the association may ask you to pay for external painting once every few years.

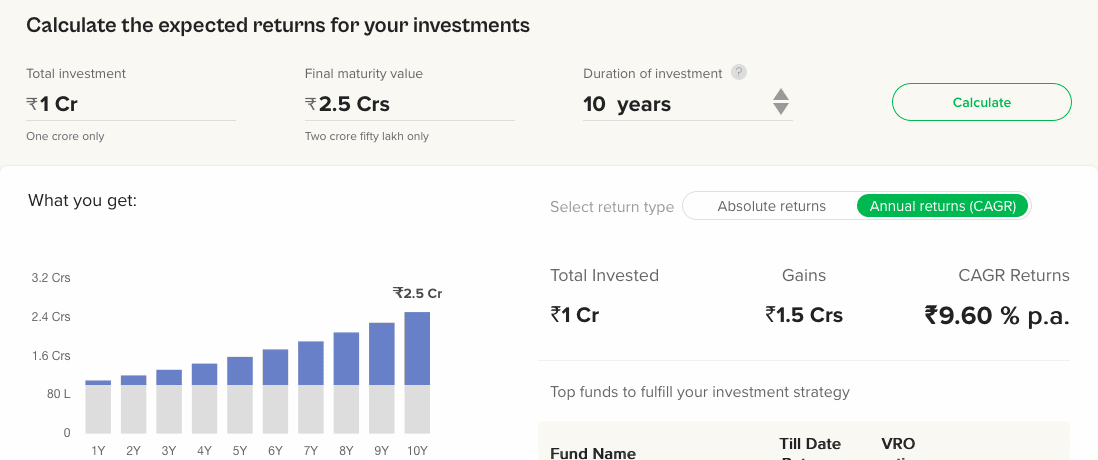

Real Estate Returns

Considering the above expenses, Let’s deduct ₹20 Lac from the rental income of close to 70 Lacs that we had for the property of 1Crore.

So if the property value doubles after a decade, we make 2.5x returns on the initial investment.

Using the online CAGR Calculator, we see the return is close to 10% or 9.6%.

Long Term Returns from Nifty

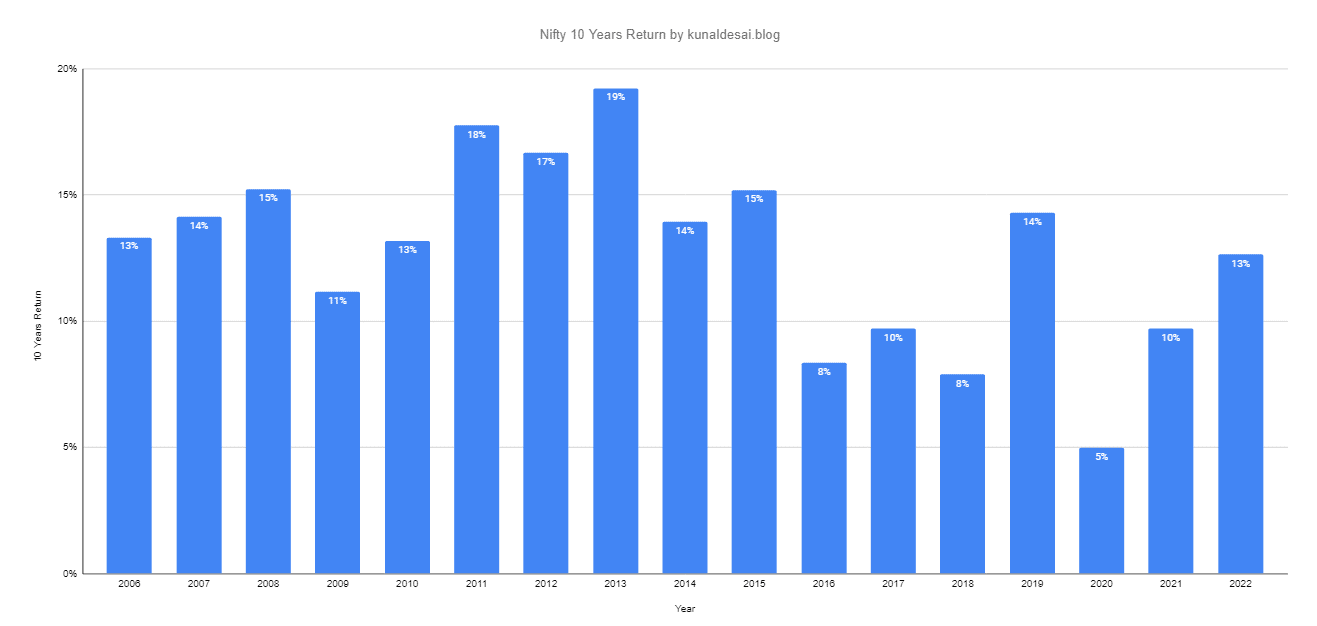

For equity investments, let’s use Nifty for the sake of calculations.

Nifty has given an average return of 12% to 15% for a decade. Here is a beautiful chart of Nifty’s rolling return since 2008 from Kunal Desai’s Blog

Nifty in the 17-year timeframe, the ten-year rolling return of 10% or less has been five times. Similarly, there were five occasions when the returns were 15% or more.

On average, Nifty becomes 3.5o 4x in 10 years, clearly beating real estate returns by a significant margin.

When Real Estate Investment in Beneficial

Absolute return from real estate is significantly lower than Nifty. Further, one also has mutual funds that even outperform the Nifty.

So if you only consider returns, equity wins all out. However, in some cases, real estate becomes beneficial as well.

Let me share 3 cases when real estate investment makes sense.

- Passive income – Rental income is passive. So you don’t have to work very actively to generate a regular monthly income. The dividend is either annually or at the most quarterly, but it is never monthly.

- Diversification – When you have significant equity exposure and want to diversify, real estate is a better choice to diversify your asset allocation.

- Rent as SIP in Equity – We saw the return from equity much higher than real estate. However, one can generate an income every month from real estate and use that income as SIP to ETF or mutual funds and start generating returns.

Final Thoughts

The best part about real estate returns is that you can start earning rental income right away.

So finally, I have to ask, What is your preferred investment choice? Are you focusing on return or like rental income to use as SIP?

Share your thoughts in the comments below.

In India the main reason which you have not even bothered to touch of why people invest in real estate is due to the black money component whereas in stocks investing with black money is very very difficult – even today inspite of whatever anybody says the prices of real estate always have a black money or cash component which can be very very high.. More so in case of agricultural lands, farm houses etc etc Request you to include the same in your articles to make it comprehensive..

Agree with you on this and will surely try to add it to my new video and in the article.