Do you withdraw money from savings bank account just before the need and not few days in advance to make few extra bucks for the money lying in your savings account?

Do you withdraw money from savings bank account just before the need and not few days in advance to make few extra bucks for the money lying in your savings account? If your answer is YES you are actually trapped mentally by your savings bank account features.

Let me try to help you come out of such mental trap.

Let me ask you one question. Do you know anyone who has made a fortune with his savings bank account? If your answer is NO read further.

Many of us park a large chunk of money in a savings bank account just because of not enough investment awareness. We should realize that this chunk of money parked in a savings account is actually termed as dead money in financial terms and will never make us a fortune. The actual use of bank account should be for safety and security purpose only and not for a return on your capital.

If you can make that as your motto for bank accounts, you will not need any further action but if you cannot then you need to come out of the trap by taking some actions.

To come out of the trap of return from a savings account, I use a personal current bank account instead of savings account where I don’t get anything for parking my money into my bank account.

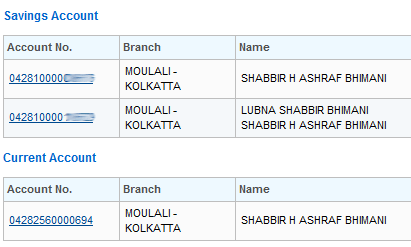

Yes, I do have a savings account with my bank and this is because I have linked my savings bank account with my demat accounts and other mutual funds. I keep only minimum balance in my savings account and everything else is in my current account.

I know it is difficult to get a current account just for the sake of having a current account but there are other options as well to make yourself mentally prepared of not parking your money into a savings account.

Fixed deposits as an investment option are not my favorite and so don’t expect that as an option for me. I don’t even prefer a debt fund or a liquid fund for any of my investment.

I like to keep money unparked than to part it for meager returns so it is always in the back of my mind to find some good stock investment. Once I have my eyes and ears open, I can find better investment opportunities.

Where do you park your money? Share your views in comments below.

Hi,

Liquid Funds are a kind of mutual fund or debt fund, it can be redeemed in 24 hours. liquid fund invest in money market debt instruments which are cd, cp and treasury bills. lock in period ranges from 3 days to week or month or more according to funds.

There is no entry load but it has exit load if you redeemed before lock in period. I don’t have idea about exit load. It has great tax benefit and liquidity. In short i. tenure is short ii. returns are not fixed. iii. depend on market performance iv. if you opt for dividend paying option, dividend is tax free. My investment is mostly in equity mutual funds through sip. but liquid funds are far much better than FD.

Hi,

If I exit the liquid funds after 6-7 months, will I have to pay taxes for the same. And how will it differ from equity/debt funds for the same period?

Chirag, taxation will not be lot different for 5-7 months time frame on both category of funds but still don’t take my word on this because I am not a tax expert nor have invested in both funds to the extent of paying tax.

Have been parking my surplus funds in liquid and liquid plus schemes for over a year now . It gives one the option of moving into equity at short notice to take advantage of lower prices. And personally, though would not advise anyone to do this, I am all for equities . No gold, no land in my portfolio. Risky but market cycles will always give you an opportunity to make good profits. Just love stocks and would always say that one has to always invest with passion

Why are liquid plus funds more risky than liquid funds?

Can you shed some light on these two types of funds.

Also in the present high interest rate scenario – does a short term FD of around 7 % have a really inferior return to a liquid fund (viz a viz the risk profile)?

Gaurav, FD has a locking period and if you break the FD prematurely you never know what to expect but liquid funds have no locking period and so they are good when it comes to liquidity.

About the more risk in liquid plus fund see http://www.valueresearchonline.com/story/h2_storyView.asp?str=12873

Your ideal portfolio would have been a few bricks of Gold and just quite a few kgs of Silver bricks; and you would have been laughing your way to the bank and to the travel agents trying to book your world tour tickets to venice/London/chicago/ and switzerland.

Unfortunately; neither saving nor current nor mutual funds nor shares could have matched the above strategy for the past few years!!!

Of course everyone can be a wizard in hindsight!!!

ajay mehra

Hi..Amazing article written above..Which is best mutal fund according to u among variety of fund available in order to invest for 3 to 5 years?Please b specific..Thanks a lot…

Shilpa, the best fund for me may not be best fund for your investment objective. So instead of being specific about name of fund you should take that decision of the best fund for your investment objective.

Sir,

It is an interesting article, but I wish to throw some light on FD of bank. If the funds required is after say 20-25 days then parking the funds in FD is a good option. SBI gives around 7% which is more than 4%. Your comments please.

Regards,

Venkatesh

Venkatesh, let us do some real mathematics and see what we make out of 7% and 4% on one lakh

For 4% we make for 20 days – ((100000×4/100)/365)*20 = 219 Rs

For 7% we make for 20 days – ((100000×7/100)/365)*20 = 383 Rs

I am fine if I don’t make anything but see how you hardly make 160 bucks on 1 lakh.

Interesting article. Can you throw some light on liquid and Liquid plus funds available in market?

Check out ValueResearchOnline for list of Liquid funds

Really interesting but this kind of motivation is hard to find 🙂

Also, in case I am nearing my planned goal (e.g. Car/House) I would move my money back to Savings Account from Equity; 4 % return is always better than no return.

I prefer no return because that would mean I am looking for active investment and more financial awareness than become lazy that I am making something from my dead capital.

This is certainly very interesting and I’ve never heard of this before. So you actually opened a current account so that it motivates you to move your surplus cash to other better yielding investments?

Actually yes Manshu. I have created Current account just to make sure I am not trapped for 4% return and I work on things that make me more money.