I hardly could find any information or review about the portfolio management services online and so I was only left with doing the experimentation myself. In my recent review about stock brokers my top pick was ShareKhan and so I thought let us experiment a PMS with them and see.

Being from a non-finance background I always look for making more money in equity and so I thought of going for a portfolio management service or PMS. I hardly could find any information or review about the portfolio management services and so I was only left with doing the experimentation myself. In my recent review about stock brokers my top pick was ShareKhan and so I thought let us experiment a PMS with them and see.

The process started when I called up the ShareKhan customer care numbers and left the message that I am interested in doing a portfolio management service with ShareKhan and soon the sales team gave me a call. I verified that this call is directly from the ShareKhan team by asking some details about my account in Sharekhan and I was certain that I am talking directly with the Sharekhan in-house people and not to any sub-broker. You will soon realize why I mentioned this here.

I will share with you all my numbers and account statement as I think I should be as transparent as possible.

To start with Sharekhan offers 2 PMS products –

- Fundamental PMS – Brokerage of 0.5% with 20% profit sharing after 15% profit hurdle is crossed and a 2.5% per annum AMC charges.

- Technical PMS – Brokerage of 0.05% and flat 20% profit sharing.

Now looking at the fees I was certain that by no means I will opt for fundamental PMS. If I opt for fundamental PMS I need to pay AMC of 2.5% but will save 20% on the 15% profit. So doing the maths 15% profit on 5 lakh is 75,000. Now assume that if I make a profit of 15% then for technical PMS 20% of 75,000 is what they will charge me i.e. 15,000 and for fundamental PMS I will pay 14,375 (roughly as charges are deducted quarterly) AMC charges no matter what I gain. Market was at 5400 Nifty and I was not sure if the correction was on the cards and so I opted for a technical PMS where they assured me that charges are only on profit sharing and for losses they charge nothing and you loose just the small brokerage amount.

Apart from the fees fundamental PMS has high brokerage because it mainly deals in delivery based whereas technical PMS is more of a trading PMS. As I had the feeling of market correction I thought of trading PMS will be a better option than an investment based PMS.

So there was no doubt in my mind that I will opt for technical PMS and on July 21st 2010 my account started and as expected I started to see major issues and things told by sales people were all wrong.

Issue 1. Wrong Information

The sales person who visited my house (and including the customer care people who gave me a call from Mumbai after my interest in PMS) told me that I will be given a username and password to see my portfolio online. After everything is done I got a welcome email with only userid and no password. After calling every possible number I could I realized that this facility is not available for technical PMS account type and is only available for fundamental PMS.

I confirmed the same with the person who visited my house for account opening procedures and she confirmed that in training she was told that customers are given username and password for all PMS type. The more experienced guy explained to me everything on why username and password cannot be given for trading PMS and though I could not agree much to it I was left with no choice.

The only service they could provide me was to change my technical PMS to fundamental PMS if I insisted on having a login details but I was more than certain that I will never opt for fundamental PMS and so finally I settled without login details. Can you imaging I could not check what is happening to my money.

Issue No 2. No one knows the product in detail

The sales people who visited my house told me that I will be able to give my inputs as to which sector and stocks I am more inclined to but then as expected nothing like that happened and when I asked the answer was same again – this facility is not available for technical PMS and is only available for fundamental PMS.

The sales people even told me that I will be able to meet the fund manager in a month’s time and I never expected that to happen but this made me to believe that my inputs may be taken. The only concern I had here is I wanted to avoid investing in companies dealing in alcohol and tobacco but I could not control that by any means.

Issue No 3. Lock-in Period

My account started on July 21st and in few days I had all sorts of issues and wanted to close my account the next day but I was told that this is not possible and you have to be with us for next 6 months (read: forced to be with us) as there is a lock-in period. I had idea about the lock-in period before hand but I think having an exit load is better option than a lock-in period. I was ready to pay anything at that time to close on my account but I just could not.

Issue No 4. No Clarity with Charges and Deductions

Sharekhan PMS web page clearly tells that ShareKhan books profit on quarterly basis but sales person I talked with emphasized that Sharekhan charges 20% whenever I withdraw my profit. When I told about the statement they have online is not matching with what they telling I got variety of answers. One was that this is new product (actually not true because technical PMS sub products are new but not technical PMS as a whole is new) and other was that it is after every 3 months from the inception of your fund you will be charged but the actual fact is they charge you fiscal quarterly i.e March, June, September & December

One more thing which I think I should mention is that you can only withdraw in multiples of 50% of 25k profit but they charge every quarter on total profit.

Issue No 5. Double Demat Account

With the kind of issues I had with my PMS account I found that for fundamental PMS you have to have a second demat account and you cannot use your existing trading account linked demat account.

Issue No 6. Performance of PMS

The 5 issues I mentioned above could have been easily digested by me provided I got good returns, but to my surprise I could do better than what they could do for me.

Let us take some actual numbers and deal in some maths.

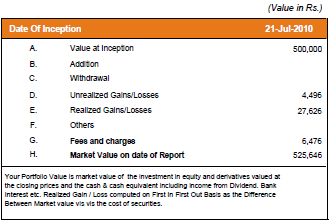

The above screenshot is from the official Sharekhan PMS report and you can also look at the complete report here.

I invested 5 lakh Rupees on 21st July 2010 and the on 30th September 2010 it is 525,646. So I got an absolute return of 5.13%.

Now let us compare the same with Nifty and Sensex returns.

| Indices/Performance | 21st July 2010 | 30 Sep 2010 | Gain |

|---|---|---|---|

| Nifty | 5400 | 6030 | More than 10% |

| Sensex | 18000 | 20050 | More than 10% |

Aren’t the numbers speaking for themselves? A 50% less return than the index but yet let us see what I could have got if I invested in my preferred (or diversified) mutual funds.

| Mutual Fund/Performance | Nav on 21st July 2010 | Nav on 30 Sep 2010 | Gain |

|---|---|---|---|

| DSPBR Small and Midcap | 17.258 | 19.2 | 11.25275235 |

| Fidelity Equity | 33.968 | 37.639 | 10.80723033 |

| Canara Robeco Infrastructure | 22.5 | 24.42 | 8.533333333 |

| Sundaram BNP Paribas Select Small Cap | 146.9 | 164.0462 | 11.67202178 |

| Birla Midcap | 111.61 | 119.72 | 7.266373981 |

| Fidelity India Special Situation | 17.985 | 19.779 | 9.974979149 |

| HDFC Top 200 | 198.468 | 224.764 | 13.2494911 |

| Reliance Growth | 470.2571 | 509.5282 | 8.350985025 |

| Reliance Vision | 271.1358 | 298.7151 | 10.17176633 |

*Nav are taken from Historical Date from AMFIIndia for growth option

All of my preferred funds outperforms the PMS numbers by a big big margin and guess what; they charge you 20% of your profit for this crappy services and performance.

Drop a comment if you have any queries or questions and don’t forget to share your views and feedback.

I hope this will help lot of fellow investors and blog readers.

Dear Shailendra,

100% Agree with your comment but can please make it quite clear so i will be able to understand

please clear that where you invest and what charges they apply and Duration …etc….

Thanking You

Thanx for ur reply,i know that there are hidden charges by way of

1.Minimum sell brokerage(arround 20Rs)

2.Annual maintenance charge(they’ll say it as 400 &charge u 400+ other chargesi.e arround 450)

could u please add on other points,which i and others are not known in sharekhan, This will help investors to choose a best option..

Hi Shabbir,

First of all I expected a good healthy discussion over here, please I must say you should mind your language.

For your information I am not a sales person of sharekhan or somthing. I do run my own business and have a good number of clients. I do run my own PMS and for that I can tell you that what ever PMS you opt for you should go to them and ask in detail about their product,where they are going to invest and charges and take it in written ( In short I want to say you have to do your homework before putting in your money, if you cant then put your money into FD)

I did invest in sharekhan PMS( of technical Nifty Thifty ) and got around 30% return post their commission, which clearly outperformed Nifty index ( ofcourse this can not happen all the time, but you need to understand in which product you have invested and what is their style of investing/trading). Further for your information I have taken out money from this and put into another PMS, and I will not tell you where otherwise you might call me a salesperson of that firm too!!

and also I do not agree with your last point, when people earn they say they are investing and when they lose they start blaming the markets and say its gambling and manipulation all around.

Ankur,

I did mind my language but it looks like you seems to be reading a lot in between the lines.

You are not a person from ShareKhan but for some reason your email address ends with @bp.sharekhan.com.

You have your own PMS and that is perfectly fine. I also have my other blogs and forums. About my homework – I did with 5 lacs of Rs in ShareKhan and sharing my homework so other people don’t need to re-inventing the wheel.

You mentioned that you did this and that but why don’t you show us proof. You can show proof here ( http://shabbir.in/share-pms-experience/ ) I will be more than happy to even promote your PMS product after you can show me good things. How about that? But here is what I don’t understand from your comments. You have your own PMS product and you are saying ShareKhan’s PMS is very good. If your PMS is that great you should be investing in your PMS and if ShareKhan’s is that good I think you should be working more on bettering your PMS service.

Lastly you may not agree on some points and that is purely human nature. What people say at times I also don’t agree and if everybody agrees on something ideally markets will seize to exist. Someone sales and that is why other one can buy. Isn’t it.

Dear Ankur,

Do not waste your Energy man!! because in market there is one undisclosed Rule that is Who looses Money in Market he always shout with the company name or with product name but anyone gets Profit then he will never come and even whisper that he got the Good Returns .

And another thing is i think Mr. Shabbir is Financial consultant and writer also on same subject so if he will not write such kind of blog then how he will run his business and how his book will get sale.

So Relax !!!!!!!!@@@@@ Because Mr. Shabbir done the so called Experiment with PMS . i just know one thing that if you are Investor or trader also then you will never go for Experiment with your hard earn money … and i think as per Mr. Shabbir he got the 50k profit in less than 3 months on 5 lakhs which means 10% profit in 3 months and again he never given the answer of my One question that how he got his money refund in less than 6 months ?????? if you studied Ankur Sharekhan PMS then You know that noone will get Refund in less than 6 Months As LOck In period … So Ankur i hope You got the Idea Behind this BLOG so Please Do not waste your valuable time on this and Best of LUCK To you AND TO MR SHABBIR ALSO FOR HIS UPCOMING BOOK !!!

Thanking You

Roshan

Hi Roshan,

Few things.

I am not a financial consultant but mainly an online entrepreneurs. See my other blog http://imtips.co to know even more about me.

I did not invest 5Lacs for experimentation but did definitely for returns but then when I saw things not going my way I did a review.

Next is about how I got my money out before 6 months and I did mention how but somehow you missed it. It was based on financial grounds that I am in need of funds to some very urgent reasons.

I hope I have made things a bit more clear.

Also about people not shouting about money made and money lost is complete reverse of what you say.

People will shout to the fullest that equity is something they should opt for and never talk about their losses.

Dear Roshan

I don’t agree to your view that whoever makes losses make noise.

I have investments in MFs and I am making good profit. I did not found any forum like this to get informed about this particular product so sharing the experience so that others are warned.

Ultimately what one expects from this kind of service is invested money back with profit beating the index. But that is not observed.

After-all they are experts and they should be well informed about the crisis, mkt directions etc. If not making good profit atleast they should not put us in losses. In Shabbir’s case this has not occurred but in my case this has happened and there is a difference of minus 18% between the sensex v/s PMS performance.

Even though the product I have invested according to them is “Fundamental” I do not see any research out there. I have seen selling in the stocks invested at much more losses in short time even though Fundamental investment should have been there for longer time.

Forums like these would make the investor more aware that is all I want to tell.

Regards

Shailendra

Roshan, My Book is live for you to grab just in case you want to. http://shabbir.in/ucp-book/

Spectacular information Shabbir, well-gathered information you got there. I agree with some of your points.

Salam Mr. Shabbir,

I want to invest some money say abt 50k in islamic equity shares..Kindly suggest me where to invest..

W/Salaam Ibrahim and I am not the right person to suggest you Islamic shares.

Hi,

Charges are very clear,

On which PMS product of sharekhan you have invested. I do have a PMS presentation, which gives the returns we have given and we have outperformed the market by a good % ( even after deducing all the charges). And yes in Pro tech PMS you will not be able to see your holdings as it is calculated on NAV basis, so you can see your NAV.

I myself have invested in the PMS and got good return. Important thing is to understand the product features , see its past performance and then only apply.

Happy Trading

Ankur

Ankur, Why don’t you share the numbers if you think it is that good. You are just one of those sales person by ShareKhan to spam blogs about their worst possible product.

Dear Shabbir, I absolutely agree with your comment, Ankur appears to be a salesman for the nearly extinct king of the jungle.

Earlier a similar comment was posted in response to my comment about a month ago by a man named Anand – who is employed by Reliance PMS. He is Anand Saigal, and works in their Bombay office.

Thanks for spotting it. Regards. Vijay

He even mentioned we have outperformed the market by good % and unless you are an employee you would not say we have outperformed.

Hi,im Uday, doing a project @ sharekhan ltd(chennai)

could u give me more details on charge structure

You should ask them because as a customer all the charges are not known to us.

Uday, what possible use is a project at sharekhan, what value addition will such an endeavour bring. Any pms option will only make money for the fund manager and his bunch of sales thieves. PMS is legalised robbery, the irony is that if one is caught stealing onions,garlic or dal, given the huge price increases, he faces a prison sentence plus a fine, however these PMS goons get away scot free, and blame free, moreover if you contact SEBI you will not even get a reply – as has ben my experience. All PMS related issues are supposed to be regulated by a Maninder Cheema at Bombay, whos is on 022 26449754 email maninderc@sebi.gov.in or HER (yes Punjabi names are not gender specific) boss the GM of SEBI Bombay; B. Rajendran rejendranb@sebi.gov.in on 022 2644 9188/9199/9610. I suspect many investors in PMS are well educated, well travelled with overseas links etc, so they are not keen on exposing the PMS scams as it may reflect badly on their poor judgment and choice of investment. On the other hand, those who are lacking in a formal education have been winners, because they have had to think, analyse, and use common sense. Using the onion and garlic analogy, I know of people who have profited from trading in such commodities, alternatively if you are not fond of the smell of the two, then invest in gold. Think, would you want $1400 in your bank or 1 ounce of gold as an investment with a 10 year horizon.

Good luck – Remember tigers are nearly extinct. Consequently, sharekhan – King of the jungle – is an oxymoron. Now there is a subliminal message for all investors thinking of choosing fancy PMS, derivatives, futures, or employing “experts”.

Incidentally Reliance PMS charged us 4% initial, 2% annual, and 15% on performance, plus charges for trading, for the demat a/c etc. On 50 lakhs the fees etc came to nearly 4 lakhs, now that is 8%

Please be informed that investing in Reliance pms run by Anil Ambani will lose you money. The goon running the fund Nikunj Sharma, Nikunj.Sharma@relianceada.com will not refund money invested even though he claims that it is an open ended scheme. Currently around 50 crores – as per his claim – is stuck in Sai Rayalaseema Paper Mills. This is a non existent company who do not have the funds to pay back. So Caveat Emptor Buyer beware applies to anyone investing in Reliance PMS. You will lose money, you will be overcharged, they will trade unnecessarily in order to gain from brokerage etc.

Reliance PMS is a fraudulent business organisation who ply their devious trade on unsuspecting individuals.

Hello,

Thanks for sharing your experience regarding PMS in details. It will help the investors who are searching for PMS Service, now will get some idea what is to look for before going for PMS Service.

Thanks,

Praveen M

Dear shabbir,

There are n no of books available. So r no. of web posts.I’m sure u will b able to provide something better and workable. Best of luck.

Unfortunately but definitely the experience with PMS is the common for everybody.I’m not sure about the MF return but my SIP returns r better.

One thing I found lacking in ur blog. Is it possible to have a discussion cum training in NIFTY trend analyses for mutual benefits?

Hi Pradip, I am coming up with a new book about chart patterns in few months and it will help what you are suggesting.

Excellent review on Sharekhan’s PMS. Particularly appreciate the detailing of the entire breadth of issues. The devil is in the details, for sure.

Despite the red flags by a number of posters, I still am considering investing in ING BSE quant pms.

Would appreciate if anyone can post experiences vis a vis returns, service and other metrics.

Thanks Shabbir for sharing this with us. Thanks indeed. I was just planning to invest Rs 5 lacs in the PMS that you have invested in and fortunately, while searching on google, I found that you have already burnt your fingers with it.

I will not at all invest now in any PMS, however good it may be. I wish you get out of this PMS safely and get good returns on your investment.

Do let us know when you exit totally from this PMS.

Thanks.

I am already out with 45k as profit. I posted this one after I was out 😀

Reliance promise to double your investment when taking your money yet they cannot be bothered to respond when asked about calculations:

nikunj.sharma@relianceada.com

anil.ambani@relianceada.com

Complaint regarding your PMS

I am not happy with your response:

Your staff Manoj obtained the signature on the said documents fraudulently, so I am surprised that you keep referring to this.

It is the industry practice, that from the date of redemption request – 25.10.10 NO charges or fees might occur. So you need to refund the money.

The Investor is eligible to get the money back as soon as we exit. So settle up on Rayalaseema.

I have repeatedly asked for a letter about the fact that you owe us money on Rayalaseema, yet you have not sent me this letter, is this not deceitful on your part.

Your unprofessional behaviour was demonstrated on numerous occasions, most of which have been reported. These include:

1. The delay in transfer of over 7 months, this was done after many emails, visits and phone calls to you and Manoj.

2. It was after we visited and met Nitin Gupta that you responded, under extreme pressure.

3. You continued to charge at around 2% even though you had agreed to reduce the fees. Your excuse was most feeble.

4. I have sent you at least 40 emails since June 2010 and have made numerous visits to get our money back.

5. I am in Bangalore on 19th. Kindly ensure that Manoj brings a cheque for 2.20 Lakhs towards Rayalaseema on Monday 20th December to our office.

6. The shortfall at the time of transfer has not been explained, kindly do so.

7. I have not received details of how your fees have been calculated.

On this point I note that @1.5% the fee charged on 27th October is based on a portfolio valued at around Rs 46 Lakhs, yet you have transferred only 40 Lakhs.

These are points that need immediate clarification, but I note your reticence to provide detailed responses to my emails.

You have not replied to my emails from 3rd November. I await your refund and reply.

Vijay Kumar

Folks – The PMS must define the universe in which they invest. That is a key for us to look at (apart from charges)

If Reliance PMS said they will invest in Private Equity (non listed companies) then you are to be blamed for the risk for accepting it. If not please approach SEBI.

ING BSE 200 claims to invest only in BSE 200 stocks with sector exposure not to exceed 20% above benchmark weight. Means if Banking is 5% of BSE 200 then the PMS will not exceed 25% expousre to the sector. I am not advocating ING PMS (yes, after several thoughts/research I have decided to invest in it in a few days from now when liquidity improves!) here – but I at least know what I am getting into. If I see any transaction outside the defined boundaries I hope I will have some recourse.

Nothing guaranteed – not even sure if I take a recourse it will help in this mangled democratic country! But the point I am trying to make is the PMS game boundaries must be defined.

Historically Quant funds have not performed over a long period of time. My plan is this. Assuming this PMS makes decent money I will pay myself every year (book profits) and move the earnings into Diversified Balanced Mutual Funds

Anand, If you are clear with your objectives it is always fine. I was clear to take the risk to gain maximum and I did not see that. Some thinks I made good money but I make that much money in almost one trade using 500k at times.

I think we would love to see your portfolio performance as well as your experience.

I recently came across your blog and have been reading along. I thought I would leave my first comment. I don’t know what to say except that I have enjoyed reading. Nice blog. I will keep visiting this blog very often.

Hello

See if you can put this comment somewhere on top so that others are guided.

I started the PMS in Aug-2010, when sensex was around 18K.

This is the report card and getting worse day by day.

Overall PortFolio Performance (As of 07-Dec-2010)

Horizon Portfolio Returns (%) Benchmark Returns (%)

1 Month -10.60 -4.87

3 Month -7.53 7.17

Since Inception -6.62 8.54

Regards

Shailendra

I don’t mind doing that but can you provide more details with some attachments and proof so readers can very well relate and even verify the numbers.

Please post this so that people STAY clear of Reliance PMS:

To summarise the problems since 2008:

1. Loss in value of more than 25%

2. Lack of clarity in your calculations

3. Fees being charged on dead investments

4. Poor choice of shares.

5. Ignoring the three cardinal rules of investment. Capital protection, tax efficiency, inflation proofing.

6. Fraudulent obtaining of the holders signature on a pre-printed letter.

7. Continuing to trade and earn obscene amounts of money after January 2010.

8. Fee calculation not revealed.

9. Correspondence not being replied to. Excuse by Anand was “ I am on holiday”. Even though he knew about this fraud.

10. Loss of 10 Lakhs in absolute terms and around Rs 22 Lakhs in nominal terms. As detailed in previous emails.

11. anil.ambani@relianceada.com not replying to genuine concerns.

12. Shortfall between the valuation and actual transfer.

13. No explanation of how you arrived at approx 46 Lakhs to base your fees but on the SAME date the actual transfer was 6 Lakhs short.

14. This implies you have clearly charged excessive fees.

15. Printed statement at the time of closure indicated Rs 46 Lakhs plus, yet the actual transfer is 6 lakhs short.

16. We have been visiting your office, emailing you and phoning you since June 2010, yet seven months have elapsed and there is no solution in sight.

I suggest you close your fraudulent operation at Manipal Centre in Bangalore and send the fraudsters Nitin Gupta and Manoj.K.Singh to prison.

Dear readers, please tell everyone you know that PMS providers are a bunch of crooks, Reliance PMS have lost me Rs 10 lakhs on an investment of Rs 50Lakhs, their fees came to around Rs 3.50 Lakhs, Nikunj Sharma who is supposed to be managing the PMS does not have the courtesy to reply to my emails, or return phone calls. I have closed the PMS on 25 October 2010, but they continued charging until November.

He has invested 2.19 Lakhs in a certain Sai Rayalaseema Paper mills, the company is non existent yet he has charged a fee, now he will not return the money, as he claims to be waiting for an IPO to release the funds. Well a sucker is born every day.

Reliance PMS on the whole are expensive, they have not performed yet they make money while they get paid to lose investors’ money.

This is legalised robbery, all of us have a duty to inform potential investors to STOP handing over their money to any PMS.

Further, PMS is not tax efficient, the fees and charges are excessive and they do not beat the market, when things go wrong, the companies fob you off and do not return the money. Stay safe from these crooks.

Hello Shabbir,

Thank you so much for opening my eyes to the pitfalls of PMS products. I am a retail investor with a equity exposure of about 4 lakhs (all stocks managed by me). I was approached for ING’s BSE 200 Quant PMS with minimum investment of 10L. Here are the charges:

1. Upfront Entry load: 2.5%

2. Management Fee: 2.83% p.a. of portfolio value deducted daily from portfolio’s cash balance (i.e. 2.83/365 per day deduction)

3. Account opening and demat charges: 1650/-

5. Exit load for less than 365 days: 1.25%

6. Tax liability: On actuals (i.e. short term tax applicable if a stock was purchased and sold within a year even if I stay with the PMS for full 1 year)

Other Points:

– Universe of investing: BSE 200 equity stocks only (long positions only)

– Online user id and password provided for me to monitor performance

– Claimed returns over last 1 year 44% (vs BSE200 of 20%)

– “Emotionless” automated portfolio management (system generates millions of portfolio combinations and the PMS Manager just selects one with least risk)

– Portfolio rebalanced every 40 Days

– Email id of PMS Manager given in case I wish to communicate anything with him (no direct discussion/meetings provided)

Overall the PMS appears professional, except that the costs are exhorbitant in my opinion. This was for information of all…for myself I will spend more time before making a decision (especially having read the above).

Thanks to all!

~Ramanand

Quant Funds don’t have a very long track record in India. So it’s really difficult to estimate their future performance. However , if you would still like to invest in them at a lower cost , you can opt for one of the quant mutual funds [open-ended] . Reliance has a pretty decent one [Reliance Quant Fund]. Religare has quite a crappy one. [Religare Agile].

Dear Shabbir

i understand ur concern of peoples educating but can you tell me one thing as per my information i u got the loss in any quarter the on next quarter Sharekhan PMS team first reduce ur loss fron the profit then they apply the charges on remaining amount so it is ultimately means that they are giving u the Loss sharing also indirectly. and ur 2nd point whether your portfolio is trading or investment it is only for atleast 2 years .and u have not commented on the question that how u got the amount refund before ending up the lock in period ?

& Shabbir there are 2 sides to every coin as per u there are many who got the loss in PMS . but as per me there are lots of people who have took relly wonderful returns in investing PMS .

and Sharekhan is the only company who provides the PMS in which fund manager can takes the LONG & Short position so u can have profit in draw down also but not in MF anf not even individual trading also . and if you invest in the any damm business if you het the 20% profit annually then i think it really good returns but if you are getting 45k in 2 months so on average if consider it 60k profit in quarter so you will be having 240k profit annually which is near to atleast 30% profit Including the charges and Losses .

so i think it is really good bet .

and shabbir nothing can be perfect but it can be near to perfect .

in your total posts i seen the some lack of information about all which you suffer so it dosent mean that it is fault of any Fund houses . and as you post that you got the call from Sharekhan HO about the clarification for the post so come on man no one company is going to ask you clarification because they are having lots of important work than this and not atleast fund house like Sharekhan Because its MULTINATIONAL company and they will not get affected by this kind of POSTS .

By the way i hope you will have the answer on this.

Show me few cases where people have benefited from a PMS and I am still waiting to read those. I can share with you many if you aren’t able to find. If you don’t find any such why don’t you yourself get a PMS of 500k and share your returns and I will be more than happy to have your review get online as well here on my blog.

Also if ShareKhan cannot provide the services like you have mentioned by doing other important task let them do the task and we do the investing. Isn’t that better.

I just missed one point. You mentioned Sharekhan is the only company who provides the PMS in which fund manager can takes the LONG & Short position and I don’t mind any position. I only consider returns as the bench mark. Don’t you.

Thanks for posting your experience. I have been thinking of investing in a PMS in the hopes that it will give me better returns. But now I think I can do a much better job by myself 🙂

and as per my information Sharekhan is not able to allow to withdraw he amount before ending the Lock In Period just because they have to answer to so many authorities like sebi etc…

and the screen shot which u provided there were i am not able to see ur name anywhere but i am believing u just the suggestion is don’t do the experiment again like this

Check the pdf file and you can see my name. I am not mad to post such a thing with my 500k with ShareKhan. 🙂

Dear Shabbir,

Its nice to see that some people are veremuch aware to educate other people .People Like you it is really Great work,but can u tell me one thing that the way u are publishing this & i think u are very much aware to do this didn’t u aware at the time of signing up for PMS . because if u ask me then 5 lacs really mean to me and i will crosscheck each & every info before going for the same . & After that u got the 52k profit which means they were given u the nice results because they r having such systems which generate the calls for trading in PMS and i am sure ig u seat to take profit as per what to shown the NIFTY & sensex Results then of cource u can have more profit (as u mention)but then u were not able to look after to ur other income source and the PMS itsellf means that is the design for the people who are not having time to get fully involve in the trading or such investment & they arehaving MONEY in proportion . & lastly if u think that u can earn the big amount in short tme span then why u gone for PMS Because PMS is for the LONG term not for the short term Profit if you go for the Short term of cource u will see the charges & other Fees as a big amount.

I hope u got the idea what i want to say & where I am From

& for ur Info. Sebi is having strict regulation on PMS that any other EXCHANG & Related to the same Field & about the MF data which u provided here Just give me answer that are u sure that u can exit immediate from MF if market get Crashed and can u protect ur capital if u are maintaning ur trading ur account at the time of draw down .

I think u will think on it & will reply me Soon waiting For ur reply

My mail id id jain.roshan0@gmail.com

Roshan, I did check everything and I have also mentioned the same in the post that I confirmed lot of things but then you cannot see everything before hand.

Now about your point PMS is for those who cannot track and I certainly agree to this point but then those who have left PMS to the fund houses have lost a lot and so I think for those who don’t understand there is no point in risking 500k. Don’t you think so. Would you invest in any business where you don’t understand anything into it. I guess it is better to be getting educated. Also if you read my book I keep people’s expectation very down to earth. I have a line mentioned where if you make money good but if you loose consider that to be a cost of eduction to market.

Again PMS is not for long or short term but the PMS products decide your term. Trading PMS which I have opted can never be a long term bet and also if you read some of the comments here you will see that even after few years people are not getting capital back and still charges sucks.

Now every person on this earth tells SEBI has xyz but then why so many people are scammed.

With trading I don’t think you can make huge losses because you most of the time are in cash.

Now about the profit of 45k in 2 months on 5 lac and on days I make 30k as profit on 500k investment. Equity market is all about making an educated guess.

Hi,

I too had same experience. People came and gave all rosy pictures. Finally i decided to invest in sharekhan PMS. I invested in Jan 2010. Till date my returns are in negative! Against investment of 5Lacs, now market value is 4.87Lacs. When i contacted them, they say market is not stable. Thsi is the precise reason we come to So called experts. If they go by market trend, then why we need such cheaters so called experts for investment? I am struggling to get all my money back.

Please share as many as people in order to save others to trap in this kind of cheats.

They even dont share where they are investing. Thsi means, they might be making money and where ever they incur loss, they will pass it on to customer.

This is for the review for this person and comments

Hi,

I checked your detailed report at:

http://shabbir.in/wp-content/uploads/SK-PMS-InvSum.pdf

Approximate values mentioned there are:

Unrealized gains 4.5 K

Fees 6K

Realized 27.5K

Mkt value 5.25 Lac

It means you have got 52K profit which is more than 10% and fees included. You are in good profit. I started the same 1 month later, I am in loss 🙁

Regards,

Shailendra

Yes Shailendra I made some money but have I not invested that money with PMS I could have made more than that and so according to me I also made a loss but yes it was not capital or earnings loss but more of a less gain.

BTW before this post went live I am out of this PMS as well with a gain of net 45k.

Hello Shabbir

You said you got out of the scheme. I could see that you started in Jul-2010. Still 6 months are not over. Did they charge you anything extra? How fast is the closing procedure?

I mean if I tell them to close today, whether the account is frozen the same day or will it keep going down further with the mkt and their choice of poor stocks for another 5-7 days?

Regards

Shailendra

Shailendra, Reading the comments you will realize that I closed the account before six months by telling that I had a financial problems and on that ground they accepted my cancellation without any charges. Also after this review they called me up to ensure better services if I wanted to resume my account again.

Finally after 3 years I have got out of the clutches of Reliance PMS, they have charged 3.5 lakhs in fees etc and an initial investment of Rs 50lakhs in Jan 2008 is now worth around 41 lakhs. Moreover they have invested in a non existent company Sai Rayalaseema Paper Mills, and the money is as good as being lost. Never ever go down the Portfolio management Services route. Three questions one should ask before any investment. 1. Is my capital guaranteed. 2. Will the return beat inflation and 3. Is it tax efficient. Otherwise stick to Fixed Deposits.

Good to see that you are out after a loss and many people are not able to do that. Congrats.

Hello

I invested about same time and have similar experience.

I invested in fundamental Pro-prime and got 2.5% gain till now.

Additional thing I observed is, these guys don’r respond to queries I posted. It is really Pathetic and don’t go for this.

Regards

Shailendra

Hey Shabbir,

Thanks for the insights dude, i am sure this post of ur encounter with the specified PMS personnels will surely make the readers think more than twice before they think of making a lump sum investment.

Cheers,

Sandeep

I hope they make services better and they should realize they are in the services sector.

Hi,

I am new to trading (MF) and want to start through a management service. I am planning to take the servcies for 1-2 years and then will start doing at at my own. I was about to go with ShareKhan and then I got this.

Is there any good PMS service which you can suggest which can help me?

Nope. No great PMS services I know off currently

Hey Ankush,

Any specific reason you want to go for PMS services? I mean you could start on your own. Just curious!!

KM

Very good review Shabbir. This will ofcourse help many investors. Thanks.

Pleasure is all mine Hansa.

thanks a lot for the insight. I almost fell for the sales talk. savd by the skin of my teeth!!

Hi Shabbir, I have an account with sharekhan since 2006, but the staff has not been able to link my bank account till date. They are all useless, no one knows anything and staff keeps changing. Thanks for sharing your experience. Lately they have started with daily fortune finder which is also useless only increases their brokerage.

Very true. I never look at any reports by any broker apart from Motilal

Dear Seema,

I also trade through sharekhan. They also send tips on Mobile whose failure rate is 100%. I just ignore them. And Fortune Finder is a useless tool.It generates buy or sell signal only after the action has already happened. It is devoid of outside factors like Global trends and Company’s action. Afterall it is a machine only which have no human intelligence.

Your complaint about their staff is true of any brokerage house.I any other experience with the pl do share.

Thanks

Dear Shabbir,

You have done me and other retail investors a great favour taking pains to explain everything step by step.

I was making up my mind not to apply for a PMS. I really love to thanks to you for sharing as i thought our own experience will help a lot and not to take risk and believe to take friends experince.

with warm regards

dinesh

The pleasure is all mine.

Gr8 article Shabbir,

PMS and PE funds lack transperancy and should be avoided by retails investorat any cost.

Even Rakesh Jhunjhunwala said in recent interview that he lost gr8 amount of money ($80Mn, if I’m not mistaken) in PE funds.

There are very few PMS in market which have gr8 track record and they dont market themselevs and their ticket size is quite big.

Very true. One I know has the ticket size of 25Lakhs

Khalid,

Any one with more sense than money will stay with buying shares whose P/E ration is less than 15. And invest in top performing mutual funds.

Good decision to stay clear of any pms they are rubbish, and only benefit the fund house.

Shabbir,

Good review..thanks

I too toyed with PMS in 2005 with India Infoline and it was fairly hassle free and got decent returns ( definitely sub market) ..now I do my own investing

I totally agree that it is not worth your while till you have 1 Crore plus

I really appreciate your blog which gives me a lot of awareness massage. I can see that you have spent a lot of effort to write the blog. I really love to thanks to you for sharing.

Hi Shabbir

I was planning to have PMS service for myself but after reading your review, I would thought twice to opt for this. Its very detailed review you shared with us. One more thing I got out of this post is list of your preferred mutual funds.

Thanks for sharing.

I always share my preferred funds but yes good that you found.

I am very impressed with your bold step in spreading awareness message for layman like me. I whole heartily thank you for your hard work which I am sure will definitely save number of innocent investors from so-called unwanted misleaders with big names.

Thanks for a kind piece of Advice.I have to share a thing or two about me. I am retired IAF officer who has gone through all the pain of this world since the age of six months as I lost parents at that age.But then you will ask why I am in this world of sharemarket which is always filled of anxiety which many say is not for senior citizens taking. I confess I am here for passing my time and learning till I die. I was not able to differnciate betwwen debit and credit till sometime back. Now also I cann’t understand many terminoloy of market as I am from a science background. But now I a member of community who will be able to educate me by following your blog.

Thanks

Hi and welcome to my blog and I am really impressed with the kind of enthusiasm and excitement you have for learning. Check out http://shabbir.in/stock-market-terms/

i think, one more alternative to manage direct equity is with help of (only) advisory services for long term investments with fixed fee irrespective the size of portfolio from reliable, trustworthy concern. though i did not try, but one organisation , i have come across , is http://www.personfn.com. /www.equitymaster.com. in that case, the actual implementation is to be carried out by investor himself. the moot point is that the lay investor can not have large data required for such selection, that can be got from such advisory fascility. on other side it could be less expensive than mutual fund, and no limitations like a mutual fund sheme

Your link seems to be broken.

Thanks Shabbir,for all your articles.they all are like a learning kit.

I am somehow agree with Mr. Bharat as I am trying this.I have subscribed for technical traders of india(Mr. M.B.Singh’s), and I must say that 75 % of their calls are working.But I want to add one more thing during this time market was itself in bull phase.So I will have to see some more time for the overall performance.

Regards

Kaushal

@kaushal

thank you for agreement to my view. however i like to confess while writing i had in mind only long term investment for wealth creation. short term trading etc. i don’t like.

Dear Shabbir,

You have done me and other retail investors a great favour taking pains to explain everything step by step.

I was making up my mind to apply for a PMS. But my friend and neighbour told how his nephew lost a huge amount of more than two lakh Rupees on a PMS of Rs/- 5,00,000 in jan 2008. He told me they continued making money when the market was gung ho prior to jan 2008 and continued investing back in the market and could not when everything was lost in one stroke.

Thanks once again.

I think everyone lost money in Jan 2008 including me but the important thing is how and what you learn out of it so it does not repeat again. Again loosing 200k on a 500k portfolio in one month does mean your PMS is all crap because fund manager should and must always go with stop losses. Retail investors can loose lot of money because they at times know less about it but not the fund managers. They are paid for that.

Great article. I signed up for a Birla PMS service in june/July this year. Since I did it through my bank , the process was quite effortless. I’m not sure how easy it would be to go to them directly.

Though the returns I’ve been getting are better than the ShareKhan returns , I’m still not sure whether the returns are actually worth the management fees. Maybe 6 months is a very short time to gauge a portfolios performance , but at best , the returns are at par with the NIFTY/SENSEX.

For these kind of returns , I guess investing in a low cost ETF is a much better option. I’m going to see how it goes for a year or so and then I’m going to take a call on whether its worth it or not.

I’ve included a link to an image of the performance if anyone is interested.

http://img841.imageshack.us/img841/9285/pmsc.jpg

Hi Sam, Last 3 Months at par Nifty means good returns and do let us know your returns and experiences.

I’ve included a screenshot of my returns in the previous comment . My portfolio generated returns of 2.25% in the last month and 10.49% in the last three months.

The minimum investment amount for the PMS is 15 L.

http://wmdeveloper.wordpress.com

VirtualTrade 3.5 Virtual Trading and Portfolio for Windows Mobile and Desktop USA and INDIA

You can play now virtual trade in your windows mobile touch phones and in Desktop.USA Quotes will be updated every min from yahoo finance.INDIA Quotes will be updated almost realtime (maximum 2 min delay).Total USA market symbols available are 3230. Total INDIA market symbols available are 1447.

Thanks a lot for this review. It is unfortunate that there is no easy method to fight with any of cheaters in India…. thanks for making everyone aware. I am tweeting your post…

I admit that there is no easy way until you don’t blog. See my post about ICICI Bank and soon I got a call and comments from the official help desk about the issues. They tried to at least work on it.

Oh great… so at least blogging is of some help 🙂

Actually a lot more than that. I got a call as well from the ShareKhan’s head office to clarify on this post.

I have never heard or read about someone’s experience with PMS before, so this was really good for me. Thanks for sharing, and I must say that’s really quite an experiment

My pleasure and I must say that you also have a very nice blog and I do follow it but not all posts but few of them definitely

Thanks for your kind words. In fact, someone emailed me the other day asking about PMS and I told them that I have no experience, but will keep an eye out if I see something related to it. I am going to send out this to him, and will tweet and share on Facebook as well.

That is so nice of you.

Dear Shabbir, I absolutely agree with your experience, we have posted a loss of around 5 lakhs on an investment of 50 Lakhs in Reliance PMS. During the same time Reliance have charged us around 4 lakhs in fees.

Never ever invest with any portfolio management service, they cannot beat the best funds, and often a simple fixed deposit will give better returns.

I hope ShareKhan people are not reading this or you may not get anything back.

thanks shabbir for sharing and i must say right timing for me..I have also shared with my friends..

I went to ICICIDirect to complete my KYC and there sales person was selling me ING PMS service(from the options like hdfc,birla,icici prudential) so i got interested and listened to them carefully.

they have sent me details of one of the customer (obvious that name is removed from report) which shows 25% returns since May2010.

some highlights of ING

-Min kitty required is 10lac

-AMC charge is 2.5%

-one time entry load of 2.5%

-transaction charge is 0.10%

-Investments will be mostly in large caps from BSE 200 stocks

-Can top-up without any extra charge

-Will provide login id and password to view details of portfolio

However i haven’t decided either to go for it or not, since it requires minimum 10lacs

my another friend is talking to angel broking house they have minimum kitty requirement of 5lacs..

but as i said this post has provided us more information before taking PMS services.. however are there any successfully stories of PMS, i know subramoney recommends PMS quite often.

Hi Marshal, I am yet to hear a PMS success story from savvy investors. I think my story can be given a success story provided I don’t know the returns of other options. 5% return in less than a quarter actually means good returns who are not aware what more they could have got and so investors who know good investing option to compare will never opt for PMS services.

i think, recently in one of article on his blog site, subramoney advised not to take service of pms for less than 2-3 crores’ portfolio

This is really nice shabbir from you. I think it takes a lot of courage to experiment such things and then even make it public and help others.

I have shared this with my friends and I will suggest all of you to do the same.

Keep it up

Thanks for such a wonderful feedback

This is one of the best articles exposing the inefficiency of PMS touted by the companies with lots of ads. I feel SEBI should tighten the reigns on the PMS. Thanks a lot for sharing which will certainly help me to avoid the pitfalls in the guise of PMS.

Thanks and regards.