I hardly could find any information or review about the portfolio management services online and so I was only left with doing the experimentation myself. In my recent review about stock brokers my top pick was ShareKhan and so I thought let us experiment a PMS with them and see.

Being from a non-finance background I always look for making more money in equity and so I thought of going for a portfolio management service or PMS. I hardly could find any information or review about the portfolio management services and so I was only left with doing the experimentation myself. In my recent review about stock brokers my top pick was ShareKhan and so I thought let us experiment a PMS with them and see.

The process started when I called up the ShareKhan customer care numbers and left the message that I am interested in doing a portfolio management service with ShareKhan and soon the sales team gave me a call. I verified that this call is directly from the ShareKhan team by asking some details about my account in Sharekhan and I was certain that I am talking directly with the Sharekhan in-house people and not to any sub-broker. You will soon realize why I mentioned this here.

I will share with you all my numbers and account statement as I think I should be as transparent as possible.

To start with Sharekhan offers 2 PMS products –

- Fundamental PMS – Brokerage of 0.5% with 20% profit sharing after 15% profit hurdle is crossed and a 2.5% per annum AMC charges.

- Technical PMS – Brokerage of 0.05% and flat 20% profit sharing.

Now looking at the fees I was certain that by no means I will opt for fundamental PMS. If I opt for fundamental PMS I need to pay AMC of 2.5% but will save 20% on the 15% profit. So doing the maths 15% profit on 5 lakh is 75,000. Now assume that if I make a profit of 15% then for technical PMS 20% of 75,000 is what they will charge me i.e. 15,000 and for fundamental PMS I will pay 14,375 (roughly as charges are deducted quarterly) AMC charges no matter what I gain. Market was at 5400 Nifty and I was not sure if the correction was on the cards and so I opted for a technical PMS where they assured me that charges are only on profit sharing and for losses they charge nothing and you loose just the small brokerage amount.

Apart from the fees fundamental PMS has high brokerage because it mainly deals in delivery based whereas technical PMS is more of a trading PMS. As I had the feeling of market correction I thought of trading PMS will be a better option than an investment based PMS.

So there was no doubt in my mind that I will opt for technical PMS and on July 21st 2010 my account started and as expected I started to see major issues and things told by sales people were all wrong.

Issue 1. Wrong Information

The sales person who visited my house (and including the customer care people who gave me a call from Mumbai after my interest in PMS) told me that I will be given a username and password to see my portfolio online. After everything is done I got a welcome email with only userid and no password. After calling every possible number I could I realized that this facility is not available for technical PMS account type and is only available for fundamental PMS.

I confirmed the same with the person who visited my house for account opening procedures and she confirmed that in training she was told that customers are given username and password for all PMS type. The more experienced guy explained to me everything on why username and password cannot be given for trading PMS and though I could not agree much to it I was left with no choice.

The only service they could provide me was to change my technical PMS to fundamental PMS if I insisted on having a login details but I was more than certain that I will never opt for fundamental PMS and so finally I settled without login details. Can you imaging I could not check what is happening to my money.

Issue No 2. No one knows the product in detail

The sales people who visited my house told me that I will be able to give my inputs as to which sector and stocks I am more inclined to but then as expected nothing like that happened and when I asked the answer was same again – this facility is not available for technical PMS and is only available for fundamental PMS.

The sales people even told me that I will be able to meet the fund manager in a month’s time and I never expected that to happen but this made me to believe that my inputs may be taken. The only concern I had here is I wanted to avoid investing in companies dealing in alcohol and tobacco but I could not control that by any means.

Issue No 3. Lock-in Period

My account started on July 21st and in few days I had all sorts of issues and wanted to close my account the next day but I was told that this is not possible and you have to be with us for next 6 months (read: forced to be with us) as there is a lock-in period. I had idea about the lock-in period before hand but I think having an exit load is better option than a lock-in period. I was ready to pay anything at that time to close on my account but I just could not.

Issue No 4. No Clarity with Charges and Deductions

Sharekhan PMS web page clearly tells that ShareKhan books profit on quarterly basis but sales person I talked with emphasized that Sharekhan charges 20% whenever I withdraw my profit. When I told about the statement they have online is not matching with what they telling I got variety of answers. One was that this is new product (actually not true because technical PMS sub products are new but not technical PMS as a whole is new) and other was that it is after every 3 months from the inception of your fund you will be charged but the actual fact is they charge you fiscal quarterly i.e March, June, September & December

One more thing which I think I should mention is that you can only withdraw in multiples of 50% of 25k profit but they charge every quarter on total profit.

Issue No 5. Double Demat Account

With the kind of issues I had with my PMS account I found that for fundamental PMS you have to have a second demat account and you cannot use your existing trading account linked demat account.

Issue No 6. Performance of PMS

The 5 issues I mentioned above could have been easily digested by me provided I got good returns, but to my surprise I could do better than what they could do for me.

Let us take some actual numbers and deal in some maths.

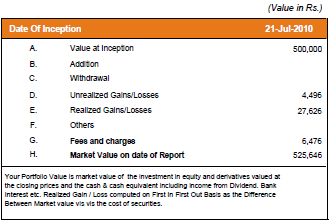

The above screenshot is from the official Sharekhan PMS report and you can also look at the complete report here.

I invested 5 lakh Rupees on 21st July 2010 and the on 30th September 2010 it is 525,646. So I got an absolute return of 5.13%.

Now let us compare the same with Nifty and Sensex returns.

| Indices/Performance | 21st July 2010 | 30 Sep 2010 | Gain |

|---|---|---|---|

| Nifty | 5400 | 6030 | More than 10% |

| Sensex | 18000 | 20050 | More than 10% |

Aren’t the numbers speaking for themselves? A 50% less return than the index but yet let us see what I could have got if I invested in my preferred (or diversified) mutual funds.

| Mutual Fund/Performance | Nav on 21st July 2010 | Nav on 30 Sep 2010 | Gain |

|---|---|---|---|

| DSPBR Small and Midcap | 17.258 | 19.2 | 11.25275235 |

| Fidelity Equity | 33.968 | 37.639 | 10.80723033 |

| Canara Robeco Infrastructure | 22.5 | 24.42 | 8.533333333 |

| Sundaram BNP Paribas Select Small Cap | 146.9 | 164.0462 | 11.67202178 |

| Birla Midcap | 111.61 | 119.72 | 7.266373981 |

| Fidelity India Special Situation | 17.985 | 19.779 | 9.974979149 |

| HDFC Top 200 | 198.468 | 224.764 | 13.2494911 |

| Reliance Growth | 470.2571 | 509.5282 | 8.350985025 |

| Reliance Vision | 271.1358 | 298.7151 | 10.17176633 |

*Nav are taken from Historical Date from AMFIIndia for growth option

All of my preferred funds outperforms the PMS numbers by a big big margin and guess what; they charge you 20% of your profit for this crappy services and performance.

Drop a comment if you have any queries or questions and don’t forget to share your views and feedback.

I hope this will help lot of fellow investors and blog readers.

Hi Shabhir,

You have again impressed me with your Blog . First by your Internet marketing blog and now with this.

I have an account with INDIABULLS and ASIT C MEHTA. I was panning to close one and go for self analysis as suggested in your blog.

Kindly comment on INDIABULLS vs ASIT c MEHTA or EDELWISE.

Regards

Veren Mitter

Veren, I don’t have account with either of IndiaBulls or Edelwise or Asit C Mehta and so not sure I will be able to comment on their services.

Hi Shabbir,

I am following your blog for the last 2years. My experience with Sharekhan pms is fairly +ve and different than yours.

I have selected PMS pro tech with NIfty Thrifty, So You Earn and you take 20% share is the deal with very less trading charges hardly 2-300 per month.

I have invested on 26th Oct 2010 when market is at 6300. So i took a lot of risk.

So far till Aug 2012 i have withdrawn 1.4L. and my current value is ~ at 5L(thats what i have invested).

I have seen most of money 4.25 to 4.5 is in debt funds. thats guaranteed to be back 🙂

Issue is till starting of this year its showing almost 10k/month. for the last few months it went down to 4.4 and now back ~5.

My mantra is, as soon you see 5.3 withdraw 25k and give 5k to sharekhan. and no upfront yearly charges…

I can say its far better than fds and other investment. even if i could have invested my self in safe bets. if market falls from 6300 to current levels i could have seen 20% loss atleast. So my judgement for protech Nifty thrifty is fairly good.

Atal, glad to see some positives on PMS as well and yes I have also made 45k from what you could see on my investment of 5L Rs but then that was not something that satisfied me because I could have done better. If you bench mark things with FD and 80% of your investment is in debt funds, I am damn sure you can handle yourself the investments if you try to do it yourself and you will also save on profit share they are charging.

Hi Shabbir,

in first 1year 3 months i have withdrawn 1.4L so for me its around 20+% returns. So i am very positive. Its with full peace of mind getting serious returns… Next is i started this when nifty is around 6300. If i want to gain at par with my pms i need to do very risky derivative trading or short selling…. I dont think normal equity investment would give good returns if market falls from 6300 to current levels.

Interestingly when it fell from 6300 pms showed immediate return of 50k (10%)to me, but for the last few months its not able to show returns, it fell down and returning to baseline now….

Atal, you cannot make money going long in falling market is wrong concept which we retail investors grab from news channels and actually most of my members have been making lot of money out of the falling market as well. They have shared the trades as well.

Now coming back to your PMS, I think it could be that it is made to work in falling market. This may be just my assumption but looks like it is the case.

Hi All,

I was scouring the net about some other victims of ShareKhan and well, I didn’t have to search hard!!I might say gentlemen, that with two and half years and almost 55% losses , I will make you guys realize that there is another level to which some of us have been duped!!.

Now as I said, I invested Rs. 10 Lakh in ShareKhan fundamental PMS in the June of 2010, Today , my PV is almost 4 Lakh 60,000, although I am at fault too since I didn’t really watch this PMS well enough and was always thinking that some super smart fund manager is going to give me a surprise sooner or later, today I feel like a fool and in good measure.

Now , although it says in the fineprint that all capital markets have intrinsic financial risks, I fail to understand what kind of an “expert” fund manager would invest in such stocks which would return minus 55 percent in two years , much , much below the indices…

I feel stupid and disgusted to even imagine that somebody at Sharekhan has made me a guinea pig and is swindling my money , I tried to speak to their call centre representatives and seems they know less about their product than I do…. I was promised a call by my fund manager too. That was three months back …. If anybody wants , I will be more than happy to share my portfolio with them , if somebody can help me get out of this soup, I will be thankful… I now know that a 20% profit day will never come with Sharekhan , But their charges even otherwise seem to be ridiculous…

Vikas, I will tell you one person who can get this done for you and it is only you. You have to learn the art of trading and investing and come out of this mess and believe me, there is no one on this planet apart from you, who would work for you as you would.

Hi Shabbir,

A very good blog … thanks for that.

I too had invested in Sharekhan Technical PMS in August 2011. They traded primarily in futures (with bulk of the money parked in term deposits). First month or two things were ok, but later I started realising that there were a lot of ameturish trades happening. There were repeated patterns of buying high, selling low for the same underlying stock within a fortnight. It got so bad that by Dec I was staring at about 20K loss, when I decided to quit. It was the returns on the term deposits that was actually shoring up the valuation of the portfolio as a whole. Thankfully by mid Jan the market moved up a bit and I could exit with a small gain.

I experienced a number of issues that you have mentioned in the blog. I would say though that the charges were fairly applied as stated, and I was told upfront that I will NOT get a login / password. However I was promised a meeting with the fund manager that never happend. I was also told that a daily NAV would be shared via SMS which too never happened. More importantly, no one could explain why certain losing trades were done in the first place. That one thing really resulted in me losing the faith and trust on the PMS team and I took the decision to quit the PMS.

I have tried other services like Equity Master and MoneyWorks4me for short durations and I havent liked them either … so here I am still searching for that one site that can give me complete and consolidated information of stocks and MFs so that I can take informed decisions. Any pointers would be very helpful.

Thanks for sharing your experience Hemant.

Hi

I will post my experience with Angel as i already requested to close my account in angel.

Regards

Vishy

Hi Edumudi, I would love to publish that as an article if you want.

Dear Mr Roshan

First I would like to appreciate Mr Shabbir that he is not biased, if you read http://shabbir.in/sharekhan-review/

Mr. GAJANAN

First Mr. Shabbir will advise you to close the dmat account which you have in sharekhan

second see with your pms in sharekhan will not give me my bread and butter yes company will be in profit but it will not be mine. Third its not the only thing of sharkhan PMS whichaever company who offers PMS client first need to know the risk capacity of himself and the waiting period most of the client here(in this blogs )are invested in Equity based portfolio here i dont need to say performance of the sensex . the main thing i want to show you pick up randomly any client from sharekhan who opted Prtoech Diversified PMS or Nifty thrifty and ask him the profit for the Year 11-12 figure will be more than 30% so point is whatever sales person will show you it is your responsibility toward your hard earn money that what risk u r taking and for what period u r ready to wait . after that u select the product and invest same goes with the trading segment . because SEBI is not FOOL to allow all broking companies to start PMS for people and the other thing is that Mr. Gajanan insaan famous tabhi hota hai jab vo koi aisa kaam kare jo taarif ke kabil ho ya phir successful insan ko crtisies karke need to tell you this thing for Mr. Shabbir is the enterprenure who generate revenue by online marketing stuff and selling his books online (right Mr. Shabbir as per ur interview in some kind of news paper ) so this is the right platform for people like Mr. Shabbir (it appriciated in ur comment ) one more thing Mr. Gajanan in universe no one can time the market but yes u can earn in flow of the market . dont to u have ur grey cells to compare the both companies product and take the decision. if u have then good if not then there r lots of people on earth like Mr. Shabbir who can take u for there journey…….

bye …. use ur knowledge for the improvement

Ohh is it. First i have already suggested that you don’t need to close the account and try to read the replies as well before replying.

Second I need traffic to my blogs and sites and you people need to sell your PMS services and so i don’t think there is any difference but thanks for reading my interview.

Also I would like to thank you for confirming that your product was a piece of junk for the year 11-12 at least. Better late than never. It takes a big heart to confirm that.

After reading this blog Mr Roshan might have came to know the reality of sharekhan PMS, …

Any how its matter of bread and butter for him cause he is Employee of SHAREKHAN…

At least readers have trust on Mr Shabbir only by reading blogs.. this itself justify his honesty egerness to literate people in personal finance.

Mr Shabbir.. 1 question

I have two DMAT ACs in ICICIDIRECT and in SHAREKHAN which should I close… pl advice

Hi Gajanan, when it comes to trading and demat account, Sharekhan has better service for online platform with low fees and better interface. ICICIDirect has very high fees for what they call it as very superior interface but according to me they are better avoided for trading and investments. You can read more about ICICI and Sharekhan here

http://shabbir.in/icicidirect-review/

http://shabbir.in/sharekhan-review/

dear sabbir,

suggest me how to recover the money which i have lost in sharekhan pms.if u do so i will be grateful to you.

I would suggest you to learn to trade in market before trying to recover your money because your money in your hand is the safest possible option.

dear sabbir,

you have advised me to with draw from sharekhan pms.when to withdraw now or wait for some more time

Anand, that would be completely your choice and I would advise you to learn the market technicals to get to a point of minimum loss.

Dear shabir,

I started share khan pms 1 year back.invested 5lakh and it has come down to 2.7 lakh.please guide me to wheather i should continue or exit from it.please give u r valuable suggestion regarding this.one of u r fan asking for help from you.

Not sure I can suggest you anything but to withdraw.

send me details for pms invest in stock markets

What kind of details?

PMS could only work well if you are on personal good-terms with the management of the company handling your money.

Otherwise its like parking your money with STRANGERS !!

I personally would never use or recommend any PMS coz I do not like anyone else handling my money and learning the ropes of the trade using my money 😛

Just coz someone opened up a service called PMS does not mean we have to try it out over our wisdom !

Very well said Chaitanya.

I also had a similar experience with Religare & it was a horrible experience. Would advise readers to not subscribe to PMS.

Regards,

Vinod

Dear OM,

Please remember 1st rule of Investing: Never Blame other if you want to earn in the market. and you have violated this rule , who asked you to put your money in sharekhan PMS… no one forced you , it was your decision.

Hi Shabbir

I have invested 5 lacs in PMS in Oct 2010 and today present fund value is 2.3 lacs , They gave me huge losses.

Could you please suggest me how to proceed further. Shall i close this account….plesae advice.

Regards

OM

What other option do you have OM?

all i want to know that is there any way from which i can recover my money from sherkhan or shall i immediately close my account…i have been seeing continuous downfall in my account…..i have no faith in sherkan anymore…also want to warn other people that they dont invest hard earn money in any sherkhan Account….they are frauders…….

OM

Recover in what sense? You can try contacting some news channels and see what happens. No hope otherwise.

Shabbir, your blog is interesting ! i was about to go with Sharekhan but now have changed my mind after reading this blog.

I have a portfolio, investment value of 11 lacs, current market valur 5 lacs. most of the stocks were bought during the peak of 2008.

This porfolio actually belonged to my dad who passed away a month ago.

I want to atleast recover my capital, need some suggestions from you guys :

1) which PMS service do u recommend?

2) is it recommended to sell the current stocks and use the 5 lacs for trading to generate profits (but, there is a huge downside risk too)

3) i want a PMS co’z i am a sailor and i cannot track Indian markets or act as required when i am outside India.

Thanks Harsh for the feedback and answer to your question are

1. None

2. Depends on what stocks you have in your Portfolio.

3. If you cannot track PMS is not for you but I will suggest Mutual Funds as they work better and are more regulated.

Dear Shabbir your reviews are really worthy..

The pleasure is all mine Malkera

Do u have any blog for options writing strategy.. if not then pls start it.

No I don’t have it and as I don’t very much in options I have no plans to start as well.

thanks Dear Shabbir… Keep it up,i really appreciate by your views.

Dear Shabbir, if you can gain 40%annualy then why you did not start your company to manage the investotor fund if you really want to help the people.

Guru, I have always thought about that but then becoming a fund house comes with lot of headache’s. Let me tell you what the headache’s are as far as I have inquired.

1. If you are registered as fund house you have to remain invested in some stock but my way of trading needs me to remain in cash.

2. Funds are not allowed to short sell and you can only play on long only. I trade on both side.

So have no plans to go that route. Yes I had a plan and so I know the pro’s and cons of it. Apart from that one more thing that can hinder my style of trading is it works for retail investor pattern of say 10L but it may not work for 1 Crore as an investment in one stock because the way I trade is not scalable to infinite levels.

As an example breakout pattern works if I invest in a stock that has a volume of 1/10th of my investment and if I invest very huge quantity in that stock I myself may generate the breakout. This made me to decide against such stock and this is one more reason I don’t give stock tips but help people understand how to play the tips they receive from elsewhere.

Hi,

Sorry shabbir i know u really dont like me here,but what made me to write again on ur blog is the fresh question ask by GURU ….

See Mr. GURU all the Top Brokers In India Are need to have Expert like Mr. Shabbir , Who always beat INDEX . Many (100s)People have got the Index Beating Returns by sudying the books written By Expert Mr. Shabbir .

See Mr. Guru You can make Profit by going with the market . You will never earn penny by trying to beat Index (Market).

Now Choice is yours

No Roshan, you are wrong and I like you very much. It is just that we have difference of opinion in few things because you are biased by your employer and I am biased towards my way of trading and there are far better trader than me who have been doing more than 100% and showing it publicly as well. Check out http://www.timothysykes.com/

Now coming back to my figure of over 40% and I will suggest Mr GURU to see the returns best mutual fund in any category has generated and if you cannot be better than the best it is better to be with the best mutual fund. You should opt for PMS if they can beat the best fund you can invest into or else you should be with MFs only.

As Roshan said choice is all yours.

Dear Shabbir,

According you what will you expect average retun per year on your portfolio. AS i came to know the data almost all the top brokers of india give only 15-19% annual Return on PMS.

I make more than 40%.

shabbir plz suggest me what is the process of get sub broker ship ?

is there any branch in jharkhand ?

I am not the right person to answer your question Imtiyaz.

Just think simple….

If ANY PMS were that good, would they need to advertise ?!

If I like some service, I will come to that on my own….sooner or later!

ShareKhan pushes as well as ICICI…

Direct equity gives better return than any PMS paying all their employees!

Being an internet marketeer I would say that you would come to that and word of mouth would help it to advertise itself but still advertisement is a must for anything these days or else product like of ShareKhan and ICICI will rule. So yes I think marketing is important if you don’t have good product but even if you have good product marketing can do wonders to you.

I have invested 5 Lac in PMS in the month june-2010. In 2 months they have shown good profit and forced me to invest in 2 insurance scheme of ICICI in which I have to invest 50000 every year for span of 11 year. Now after 15 months my 5 Lac are depreciated to 3.5Lac . I am in opinion that one should not invest in sharekhan’s PMS- Jignesh

Thanks Shabbir,

This is very valuable information abt sharekhan PMS. I was also thinking to go for it but now will consider any other option. Kindly let me know if you can guide of better alternatives.

In case you have any idea on Sharekhan’s Adviseline service you can publish that also. They have multiple products. I dont know how godd they are?

The best alternative which I have found is to learn the art of investing yourself and managing your funds yourself. There is nobody on this planet who would work for few thousands to make you millions.

Does anyone here have any experience with ICICI PMS. Do they seems to generate better profits. The sales guy said they use some fancy techniques to decide the portfolio

YES ALLIED DIGITAL IS THE STOCK WHICH THEY STILL HOLD IN THE PORTFOLIO AND THEY SAY IT WILL DO WILL IN THE NEXT 3 YEARS, MAY BE WE SHOULD WAIT FOR THAT DAY. IF SOMEONE IS REALLY INTRESTED IN SHAREKHAN PMS THEN I WILL PROVIDE YOU WITH UPTO DATE STATEMENT OR YOU CAN LOOK IN TO SCREEN SHOT OF THE SAME…BUT MY EXPERIENCE OF LOOSING MONEY WITH THEM SHOULD NOT HAPPEN TO OTHERS

I had the same feeling and though I did not loose my capital but return on my equity was as horrible as their service.

SHAREKHAN PMS IS A DUPE, JUST A GIMIC TO MANUPLATE THE STOCKS THAT THE FUND MANAGER HOLDS..I DID A 5 LAC PMS ON JAN AND A SINGLE STOCK CALLED ALLIED DIGITAL WHICH IS IN THE PORTFOLIO IS GIVING A 50% LOSS AMOUNTING TO 5OOOO RS,,,AND MY PORTFOLIO IS NOW WORTH 3.10 LACS IN JUST 6MNTS,,,NO ONE THERE GIVES YOU ANY VALID REASONS ON HOW THEY DO IT AND THEY EVEN TRADE INTRADAY IN THE PORTFOLIO WITHOUT ANY REASON TO GENERATE BROKERAGE,,

JUST BETTER TO BUY NIFTY BEES OR JUNIOR BEES RATHER THEN GIVING MONEY TO THEM WHO ARE WEALTH DISTROYERS.

Allied Digital in a PMS? Are you kidding. It is one such stock like Punj Lloyed which you should never be buying. Yes if you know how to play them it is fine playing on long and short.

Hi,

I opened DP acct as well as Trading acct with http://www.ventura1.com.

they are providing services like below.

1. Mobile trading(best among peers)

2. web trading

3. pointer software for desktop.

4. online MF account

5. online IPO account

ha ha ha ha ha ah

Hi ,

I had commented earlier on my investment in Birla PMS. I’ve now exited the investment at a loss. I’ll be happy to share the transactions or balance sheet with anyone who is interested.

Never invest in any PMS . They are all a bunch of monkeys.

Hi All,

Latest update from me: my 5 Lac has become 3.7 Lac as of today even if sensex is 3 to 4% up compared to when the investment started. Also they have blocked the report card summary on their site which was giving clear picture of how the performance of my PMS is in last month, since inception, vis-a-vis sensex etc. This clearly indicates their greedy intentions. If they are superior in terms of performance, this report card itself should speaks. No need of any other separate advertisement. But since this is exposing their poor performance they have blocked. But they forget that all Humans have something called as brain.

Take care.

Regards

Shailendra

Dear All,

Thanks a tonne. you saved my money, i will not invest my money in any PMS, best way is believe in yourself and invest in good companies.

rgds,

mahesh

Guys, Never opt for sharekhan PMS service.

hi

can u share u experience

so i cannot apply for any more

Could not understand.

Has anyone evaluated / invested in ING BSE 200 PMS ?

Ha ha ha ha !!!!

You are so funny Mr. Shabbir Really …….

I think you need to check again what you wrote in your BLOG….

Why don’t you quote something you found so Funny. 😀

Thanks for the excellent writeup on PMS.

I have invested ING PMS quant and I have to say its the same story at ING.

The charges are very high, and performance is even wors ie. I am losing more than a lakh in six months.

So my advise to anyone thinking of PMS, don’t, put your money in good MF houses.

Sad to see your losses and its time to take control of your investment yourself.

Hi,

Yes Mr. Smallwhale you can open the account with Mr. Shabbir (so called Expert)

He always beat to Index …..

and wrote lots of Books on that and use that type of blog for Marketing kind of stuff

see Mr. Smallwhale my suggstion is first know yous requierments with boking account and then select the

service provider ..

because every coin is having 2 sides (Expect Mr. Shabbir who thinks that whatever he speaks is the universal truth)

so use your Graycells which situated in your brain and then go for it !!! Best of Luck !!!

At least I don’t provide crappy service and with 100s of copies of my e-book sold I am yet to see a refund request.

right .. they would have informed you about all these before opening the acocunt. This is one thing I don’t like about these businesses.

Anyway .. I am planning to open a brokerage account and would like to use PMS. Any advise would be greatly appreciated.

Definitely not Sharekhan PMS.

Excellent post. I like the way you pointed your concerns. I don’t want to comment on the issue # 6, as the technical indicators do fail sometimes. But it certainly brings up the questions like what kind of technical indicators sharekhan is using. Do they disclose what kind of technical indicators they are using ? I guess not.

I can understand why they are not willing to disclose the all the details about where and how they are investing or possibly giving a online access to the account 24/7. Probably they are thinking that people can use those information to invest more money by themselves using some other brokerage account.

Delayed information like say end of day can be done so I cannot use the information and still be informed.

i have opened acc. with sharekahn.its charges are 7 paisa for intrady & 40 paisa for delivery(both side).please tell me how to calculate brokerage & one example on at what price my profit starts on particular share in intraday/delevery.

help required,

regards

prashant

shabbir

pls explian the things i have mailed you if you are so specialised and famous pls

Let me try to explain your queries you emailed me.

How to calculate dcf since every one is not finance guy. If you want to know DCF formula please refer http://en.wikipedia.org/wiki/Discounted_cash_flow and for working sample of what could be the output when you input some params see http://shabbir.in/dcf-to-calculate-fair-value-of-share-price/

Your second question was how to calculate projected value of share in simple way.

There are lot of algorithms and ways to calculate and estimates movement of shares. One of them is DCF but it is not the only method. Fibonacci is one more. Bollinger bands is yet one more and lot of others and so first you should try to understand what each of those mathematically means and then apply the same on stocks.

Re I find Trade Tiger sinple and also they have a beta log in site which gives historical charts.It is much better than others.But their calls are most of the times a failure. That seems to be the main behind their failure in managing better PMS returns.

Thanks

Dear Sir,

I am also using Trade Tiger software for traing. I may also tell you that I had opened a/c two more brokerage houses.Let me tell they had been much worse. For Anand Rathi Ihad to resort to complain to SEBI.Their trading software is very bad.Networth also was bad. At least Trde Tiger is easy to work. Recently a salesman from Angel Broking also approached me. If any body had any experience with this broker may kindly post something through you. I als tried to purchase ur book but i did not find any quotaion in Rupee term. I have noted your address. Can I approch you through normal post. Thanks

Hi Shabbir!!

Hey Man!!! I can understand Your Feelings Please Carry on !! Best wishes For Your BOOK

And……….. Forget It…….

You Are Panic Now So …………Just Chill!!!

Am I? or you are expressing yourself after the post by Shailendra.

Hi,

I told that writing this types of blog is the perfect way to promot your services insted of this book Shabbir I will reccomond you go for the Trade tiger you will get all this in the same software . with the option to learn & use so the person who is not familiar with Technical can also become the Expert

Your Well Wisher

Roshan Jain

Roshan, I am already using trade tiger and if you want to know about the charts in Trade Tiger they are horrible and BTW I don’t offer any service.

Also my aim is not to sell the book anyway because it is already selling like hell with very little effort from my end.

Dear Shabbir,

i would personally wish to thank you in person but since i cannot i would like to express my sincer thank you to you and your web site as well as the comments of your followers particular the one posted on the 14th oct 2010 related review MY EXPERIMENT WITH 500,000/-RUPEES.It was luck that i happened to come upon your web site while looking up investment details on gooogle and after reading the posted articles i have saved myself a lot of grief and money because if i had not discovered your web page i was on the verge of investing Rs 500,000/- with SHARE KHAN PMS,THE WAY THEY ADVERTISE THERE PRODUCT ON TRUSTED PORTALS like MONEY CONTROL.COM I was completly convinced that SHARE KHAN PMS was a trusted and capable investment company who i could trust to take care of my money but thanks to you i’ve been saved in time and will never ever think of trusting my money to small timers like share khan who fraudulantly float their products on web sites and not standing by their commint to their investors.thank you once again and God bless the person who took the time to post his most valuable and unfourtunate experience,its definetely HELPED ME.

Roger, the main aim of this post was only to help other people like you and great to see that it is achieving its target.

Hey Shailendra,

Thanks for the details . As you said that you pot it on Aug.2010 so that means you have not withdraw it , now as per sharekhan PMS if you got the loss in a qrt then they will not charge you any single charge except brokerage and they will deduct this ammount (your loss amount)from the next profit and after deducting this amount whatever amount remains if that amount is more than 15% of your investment amount then only they will charge you profit sharing and that means its indirect loss sharing . For Example..

Your Investment is 5Lakhs and on first qrt you got the loss of 60k so on the next qrt if profit goes more than 60k then they will deduct your loss amount of 60k and on remaining amount they will charge you

if your next qrt amount is not more that 60k then they will deduct remaining amount on next qrt so be sure that Sharekhan will clear the loss and then they will start earning on your profit .

And one more thing that if you will withdraw it after 6 months then it may be possible that you will get loss as per your current condition but if you keep that money atleast for 1 year so for sure you will calculate nie % of the returns

So don’t get panic just keep it the way you thought

Thanking You

Roshan Jain

I hope your doubts will get clear through this if any querry you have then please mail me . waiting for your reply

Hi Roshan,

Don’t get me wrong but are you the same Roshan from this link?

http://in.linkedin.com/pub/roshan-jain/21/836/23b

Regards

Shailendra

Hi,

Shabbir, thanks for sharing such a valuable information. Lesson to learn before opted for PMS service.

Thank you,

Hello Roshan

My investment started in Aug-10. It is in Fundamental option of sharekhan PMS.

The losses are so huge that I dont bother about the charges now.

My 5 Lac has become 4 lac 14 thousand as of today and still losing.

Worst part is index has gained compared to when investment started.

Here is the report card:

Timeframe——————PMS returns—————Index returns

1 Month————— -6.68 ————— -4.95

3 Month————— -16.72 ————— -6.38

6 Month

1 Year

Since Inception———– -16.86————— 2.57

Numbers themselves should speak.

I want to ask them:

1. Whether they share 20% loss as well in this case?

2. Why do charge fees for making losses?

Regards

Shailendra