The best tax saving ELSS fund to invest in 2022 and checking the performance and the process for selecting the best fund for 2020 as well.

It is that time of the year when I share the process to find the best tax-saving ELSS fund one should invest in 2022 and look back on the past best tax-saving funds to learn something new.

As every year, let me kick off the 2022 series with the best ELSS tax-saving fund.

The Top ELSS Funds for 2022

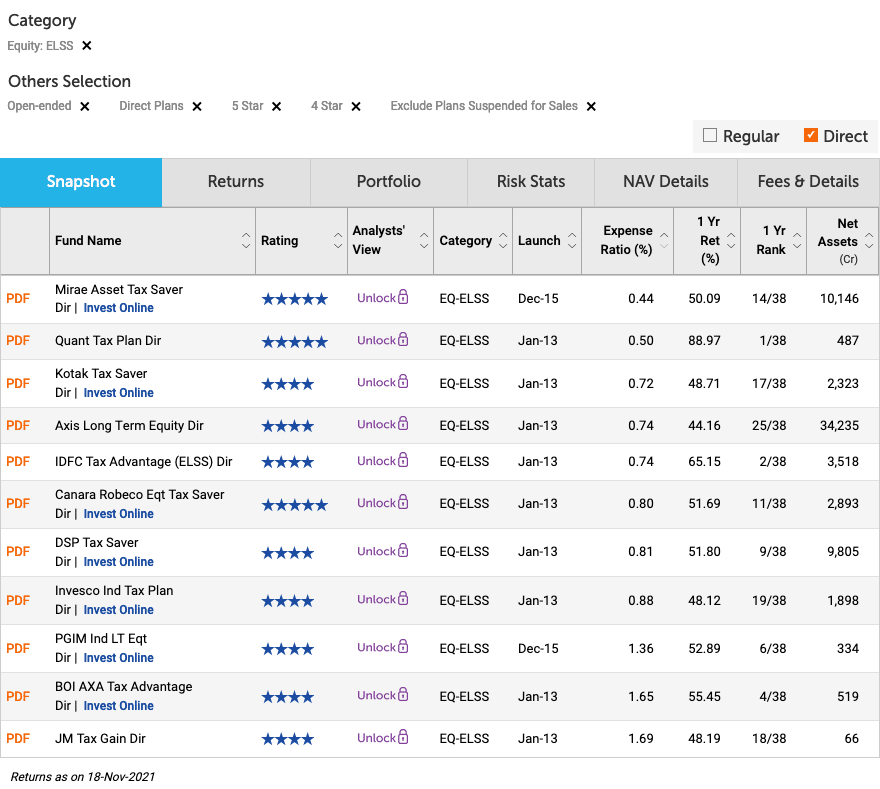

We start with ValueResearchOnline’s 4 and 5-star rated direct ELSS funds. Arrange them in decreasing order of the expense ratio. Now we have the ELSS tax-saving funds as follows:

We are moving from the top funds to the best funds based on the expense ratio alone.

Best Tax Saving ELSS funds for 2022

For me, the best fund is the one that has the least expense ratio. If a fund can keep the expense ratio under check, it will get good returns in the long term.

Quant Tax Plan

After Mirae Asset Tax Saver, the second-lowest expense ratio is for the fund Quant Tax. The best part is, that the asset under management for this fund has increased 20 times from meagre 23 Crores to 487 crores in one year.

I predicted last year that Still, such a low AUM and still a low expense ratio can mean the fund can move in and out of stock very quickly, and that is the reason it has given a whopping 88% return in the last year when the Nifty is up by 40+% only.

AUM is growing, average expense ratio and a better performing fund is my choice of the best ELSS fund for 2022.

Mirae Asset Tax Saver

Mirae Asset Tax Saver has the lowest expense ratio. However, the expense ratio from 2021 has jumped from 0.36 to 0.44 despite the AUM growing from 5k Cr to 10k Cr.

It is my choice of a fund in 2019, 2020, and 2021 but for 2022, it is my second choice.

Mirae Asset Tax Saver Fund is performing consistently well, and I expect the fund to be doing good in the future. However, Quant can outperform but if there is a correction, expect it to underperform as well.

How have The Best ELSS Tax Saving Funds for 2022 Performed?

In 2021, my choices of funds were:

- Mirae Asset Tax Saver Fund is one of the better performing funds in the ELSS tax saving category. Over 50% return in 2021 is remarkable and has outperformed the Nifty.

- Quant Tax Plan is the best performing fund in the ELSS tax saving category, with over 88% return in 2021. Moreover, it is now the choice of my fund for 2022 as well.

- Axis Long Term Equity Fund performed in line with the Nifty and has given returns close to 44% in the past year. However, considering the performance of peer funds, it hasn’t underperformed them.

Final Thoughts

This review is neither a sponsored one nor an endorsement that you should invest only in the funds mentioned above.

I have shared the complete process to find the best-performing ELSS tax saving fund for 2021. Feel free to apply your choice of criteria that gives you comfort while investing like the use of 3 or 5-year returns to judge a better-performing fund.

Make sure to invest in direct funds. And finally, don’t invest in a fund because someone has recommended it to you, including me. Instead, always apply your investment logic to each of your investments.

Sirjee,Please guide regarding investment in Debet Fund 2022 too.

I am an equity investor. I don’t invest in debt fund and so will not be able to comment or recommend much on them.