The best multi-cap fund for 2018 is a must-have mutual fund of every portfolio for a well-diversified portfolio and want to avoid the volatility of the Indian market which is expected in 2018 and 2019 as the election year.

A mutual fund that can invest irrespective of the market cap of the companies is known as multi-cap mutual funds.

The biggest advantage a multi-cap fund has over a large-cap or mid-cap fund is – it doesn’t have a limitation to the amount of exposure it can take to midcap stocks in a rising market or a limitation of a mid-cap fund which can’t move to large-cap stocks in a falling market to limit its fall.

Read: The Best Large Cap Funds To Invest in 2018 & The Best Midcap Fund to Invest in 2018.

A multi-cap fund can change its nature according to the market condition but more importantly, some of the multi-cap funds also invest in the overseas market making them even more attractive investment destination in 2018.

Top Multicap Funds

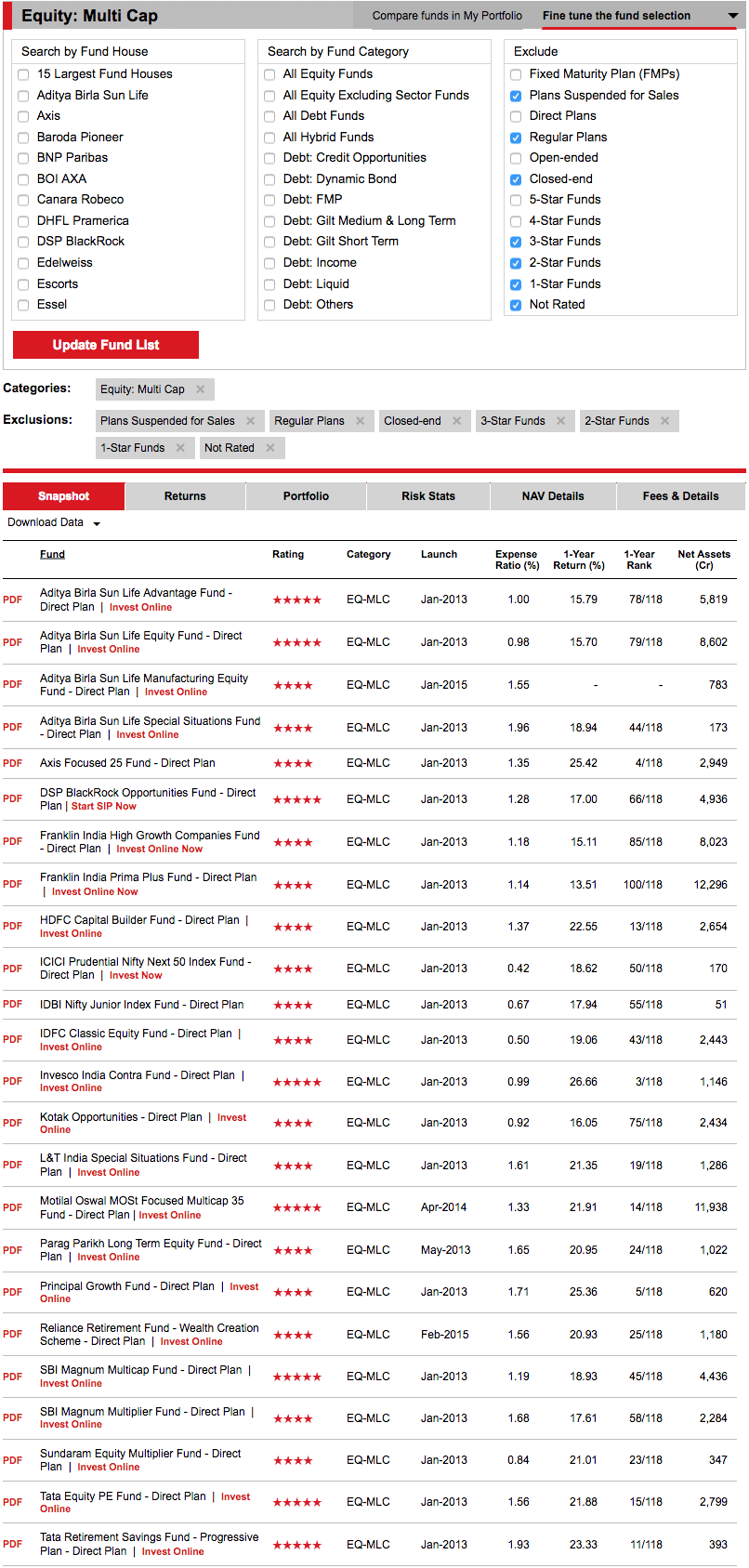

Typically we start with the top-rated multi-cap funds from ValueResearchOnline and then select one or two funds that can perform the best based on criteria that we think will outperform in the near future.

I started with the 4 and 5 star rated multi-cap funds from ValueResearchOnline and then I went through the top holdings of each of those funds.

I found a striking difference in a fund and it is the possibly the best multi-cap fund of 2018 for me.

The Best Multicap Fund of 2018

The fund that has exposure to the companies listed in the US.

Parag Parikh Long Term Equity Fund

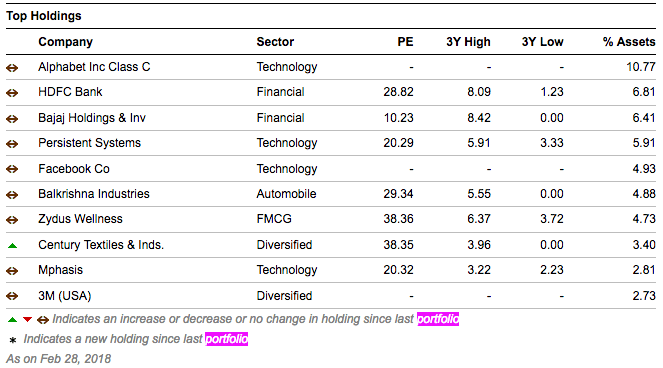

It is the only fund I found has investments in companies in the US. It has 3 large investments in Google (Alphabet Inc), Facebook and 3M.

I also read some user comments for the fund on VLO. Some users have mentioned that the fund has invested in Suzuki motors which have been quoted as Maruti Suzuki and others have commented that the fund has exited IBM but it still shows as an investment.

Again I am not pointing out the mistakes of VLO in reporting or updates but it is to point out that fund is active in its investment in the best companies of the US and there are a lot of retail investors who are also following the same.

If you follow the discussion thread, you will find that there has been some discussion about returns from this fund as well but investment in such funds has more reasons than just the return.

- Diversification – If you really want to diversify, this is one fund where you can invest in the companies you use on a daily basis. Google and Facebook. It is my ways to find investment ideas where I am more than a happy customer of the product.

- Innovation – We all know about Google’s other products like YouTube and Andriod but we all may not know is, Google is very actively working towards self-driving cars. If anyone can succeed in, there is no company better than Google. Similarly, we all know about Facebook’s projects like Internet.org. So they are a good choice of investment for the next decade.

- Hedge – Market has run up too much in 2017 and so 2018 has to be a bumpy ride in the Indian market. An allocation in a fund that is global in nature can provide the much-needed hedge that any portfolio needs.

The fund in a portfolio can mitigate the risk and safeguard the portfolio from the volatility of the market in 2018.

Read: The Best Small Cap Funds To Invest in 2018.

I did go through all the Multicap funds (rated and non-rated) to find if there are any other funds with international exposure. I found SBI Contra Fund has an investment in Cognizant Technology Solutions Corp. and Templeton India Equity Income Fund has in Medytox Inc. and Stock Spirits Group PLC. The exposure of these funds to these International companies is very small.

I think it is early days and I expect other fund house will follow and we will have more mutual funds with international exposure for retail investors.

Final Thoughts

The risk of investing in Parag Parikh Long Term Equity Fund is high because there are many moving parts including the USD-INR but as I read in comments, the currency fluctuation is hedged. Still having a lot of exposure to such a fund is never recommended.

Hi Shabbir

I’ve following 3 multicap funds in my portfolio-

1. Mirae Asset India Equity Fund

2. Kotak Standard Multicap Fund

3. Motilal Oswal Multicap 35 Fund

Which one should I select from above three? Actually first two funds are now part of MultiCap category and I wan only one MultiCap fund in my portfolio

What is your investment objective and time horizon.

Hi Shabbir,

My time horizon is 10 years and objective is to raise fund for my child.

Regards,

Samir

For that kind of view, I will prefer Motilal then because the fund manager is Gautam Sinha Roy who has an awesome track record. On top of that I like to invest with more focused approach than a diversified one.

Thanks for giving complete analysis on best multicap funds of 2018. Keep sharing more posts.

RESPECTED SIR

I have active SIP of

Reliance small cap fund—1000

SBI Blue chip fund—-500

UTI Regular Saving Fund—500

Tata Equity P/E fund—-1000

ABSL Tax saver—-1000

MOSL tax saver–1000

Reliance Pharma–500

I want to stop MOSL tax saver and add to of existing SIP

My time horizon 15 year for welth cereation

Please review my funds

thanks

I think you have too many funds under the same category. Like for example couple of tax saving scheme where as one fund is enough for saving tax. Also you have a pharma fund and one should only deal in sectoral funds but for a very long time, it may not be a better decision to have it in the portfolio. Read https://shabbir.in/identify-best-funds/

Thanks sir for giving time

yes sir i am agree with you thats way i have removed MOSL Tax saver fund (totally) also reliance Pharma fund (Just keep 100 sip as buying Pharma stock horizon 15 year)

I am little bit confused with SBI Blue chip fund as its AUM is high because i have started this fund just before 2 month and selected because of it is underperform fund last couple of year and market also in correction mode.

to stick with this large cap fund or switch to other large cap like Axis Bluechip…thanks

hi shabbir sir

how is icici us blue chip equity fund. like parag parikh fund it also invests In alphabet google.

It is under the equity international category of fund. https://www.valueresearchonline.com/funds/newsnapshot.asp?schemecode=14998&utm_source=direct-click&utm_medium=funds&utm_term=&utm_content=ICICI+Pru+US+Bluechip+Equity&utm_campaign=vro-search

So yes if you wish t go all out international investment, it is a good choice of fund but as a multi cap fund investing slightly in International stock, the parag parikh fund is better choice.

Thank you sir for replying so fast. appreciate your response

The pleasure is all mine.

Thanks Shabbir for your analysis.

I just looked at the peer comparison and its returns are much lower compared to others for all periods.

Is it just the potential returns in future we are looking at ignoring past performance?

https://uploads.disquscdn.com/images/a00426ed16ff3fbdbdbc1b9fcf75fecbefd0f9d6f6569e5fdcd0fb9ce34217d8.png

Peers are not always a good comparison because those other funds doesn’t invest outside of India.

Eventual goal of investor is to see his corpus grow. Doesnt matter if it invests in India or even outside India.

If other funds are garnering profit from India market for consecutive years then those should be preferred over this one. Or we just look at potential returns ignoring past returns? That was my point.

That is only looking at one dimension. If that is the case no one will ever invest in anything but a small cap fund. There are aspect of diversification as well as risk aversion to consider as well.

I am a govt employee,aged 42. Investment horizon 15 years. Plz go through my portfolio.

1. KOTAK SELECT FOCUS FUND = 3000

2. MOTILAL OSWAL 35 MULTICAP = 3000

3. HDFC BALANCED FUND = 2000

Plz review my portfolio. For last few months KOTAK SELECT had not been performing well.

Whether i should continue in the same funds or change..

Thanks in advance

Few months isn’t the right time to judge the performance of the fund. The funds are good but your investment objective also is a factor. What is the corpus you want to be generating after 15 years and for what may also decide how much you should allocate and where.

Again I am not a financial advisor but an equity cash market investor. So my suggestion will be to get a financial advisor and you can get in touch with Manish Chauhan of JagoInvestor who has provided great financial advisory services to many of my blog readers in the past. So I have asked him now to offer a discount and he has agreed to provide a 15% discount to my blog readers. You can check out the details here –

https://www.jagoinvestor.com/financial-planning-page-for-shabbir

You have selected best fund.But there are other multicap funds which are doing well.I will like if you tell 2-3 good multicap funds more.

There are other top Multicap funds as well but the view of 2018 is growth in US and so if we can have some exposure in that, it is good for diversification as well as risk. So I choose this fund. The same process can be applied to other portfolio of stock and invest in a fund that has better exposure to sectors you consider will do well in 2018.

The idea is not I share the fund but we find funds. If you have a view on any fund and want my opinion, ask me.