I did share my views and experience with Religare, AnandRathi, Reliance Money, Indiabulls, HDFC Securities, Motilal Oswal, ICICIDirect and today I will share my views and experiences with ShareKhan.

![sklogo[1]](https://d1ip8y7yws0fph.cloudfront.net/wp-content/uploads/sklogo1.gif)

and today I will share my views and experiences with ShareKhan.

Positives

- Brokerage – If you have an account with some other broking house they will offer you better brokerage rate. Brokerage depends on your ability to negotiate.

- Very sound Online platform as well as the Windows application “Trade Tiger”. You can do everything using the online system or Trade Tiger application.

- Integrates well with your existing bank account and you do not need any extra bank account to maintain.

- Mutual Funds / IPO all can be done online without any hassle.

- Mutual Fund Fees is NIL. Yes you heard it right. There is no fees to transact in mutual funds online with ShareKhan.

- If you have a portfolio of over 500k you can get a Relationship Manager which is as good as Motilal Oswal’s Offline account facilities.

There is hardly any negatives that I am experiencing and this is one of the main reason to move all my equity based investment and trading into ShareKhan.

If you have more to share please do share them in comments. Your views not only help me with my decision to move everything to ShareKhan but also help other fellow readers.

Update 4th December 2016

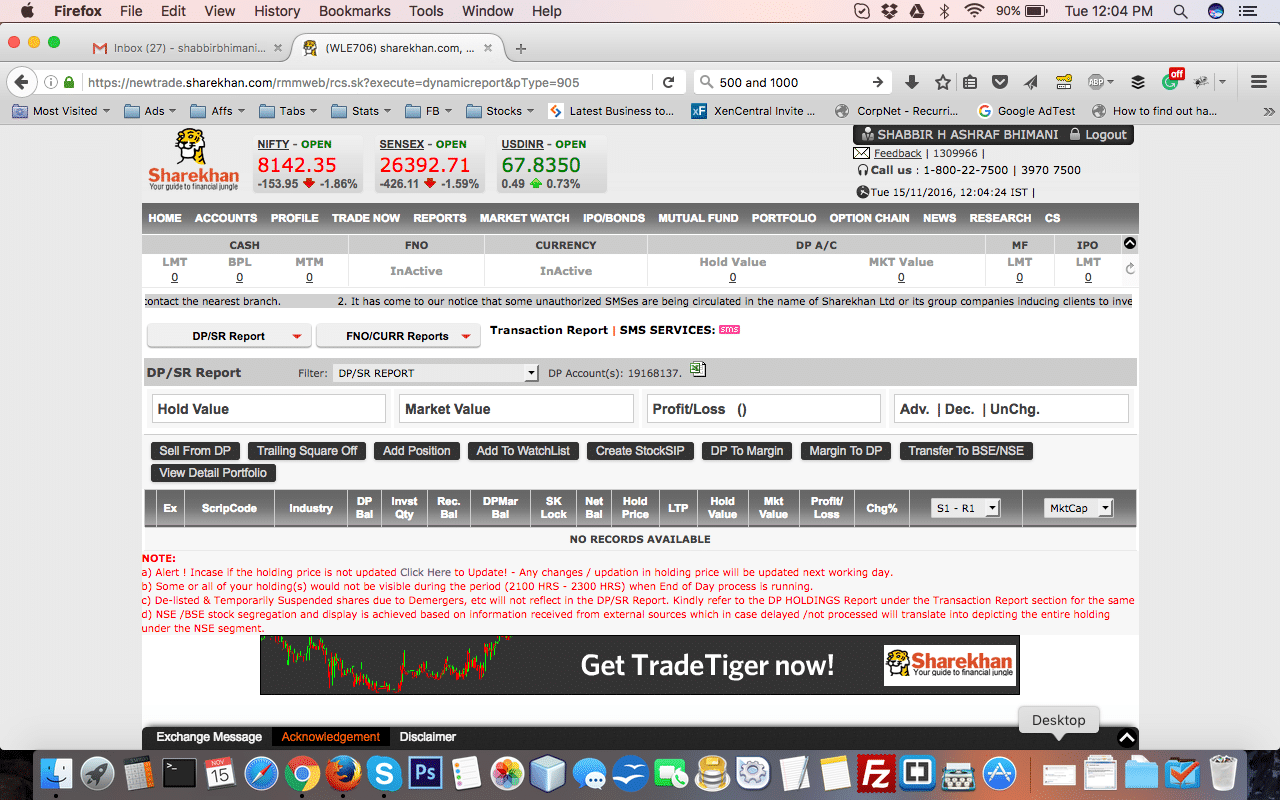

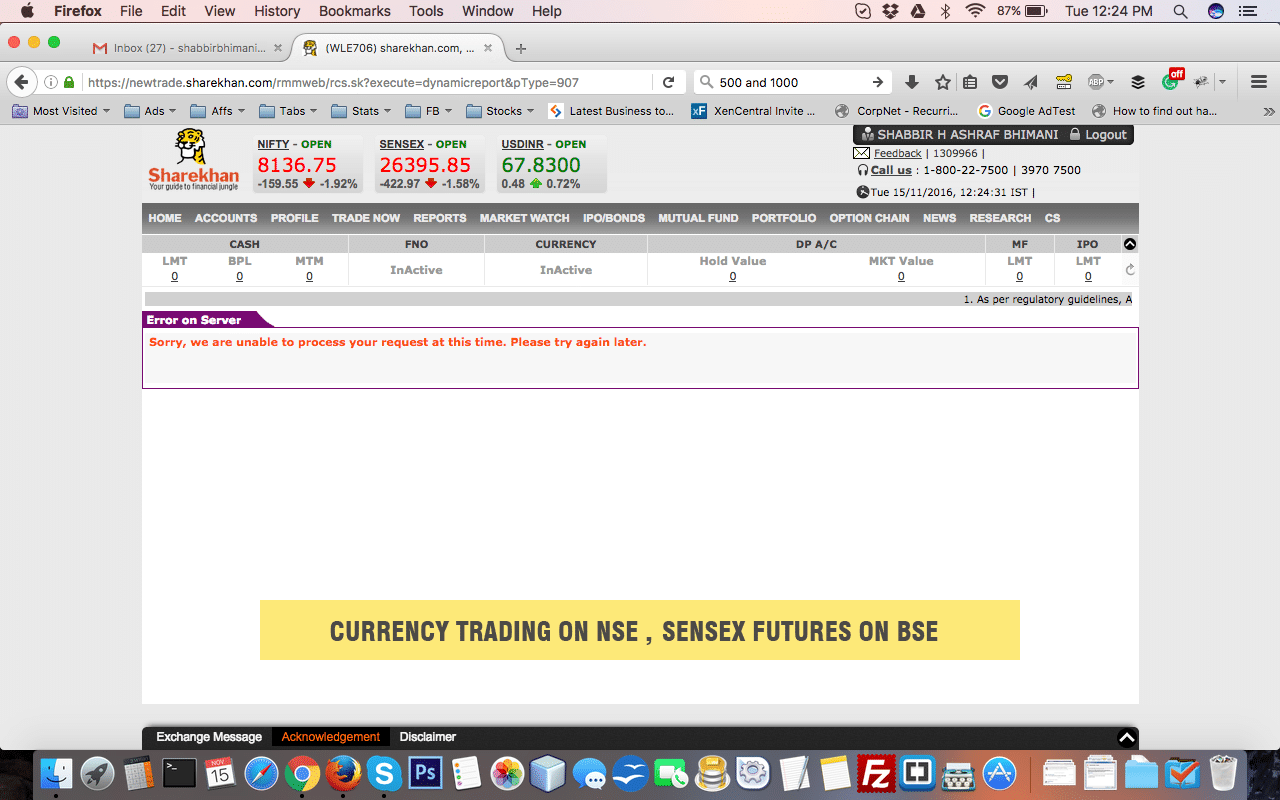

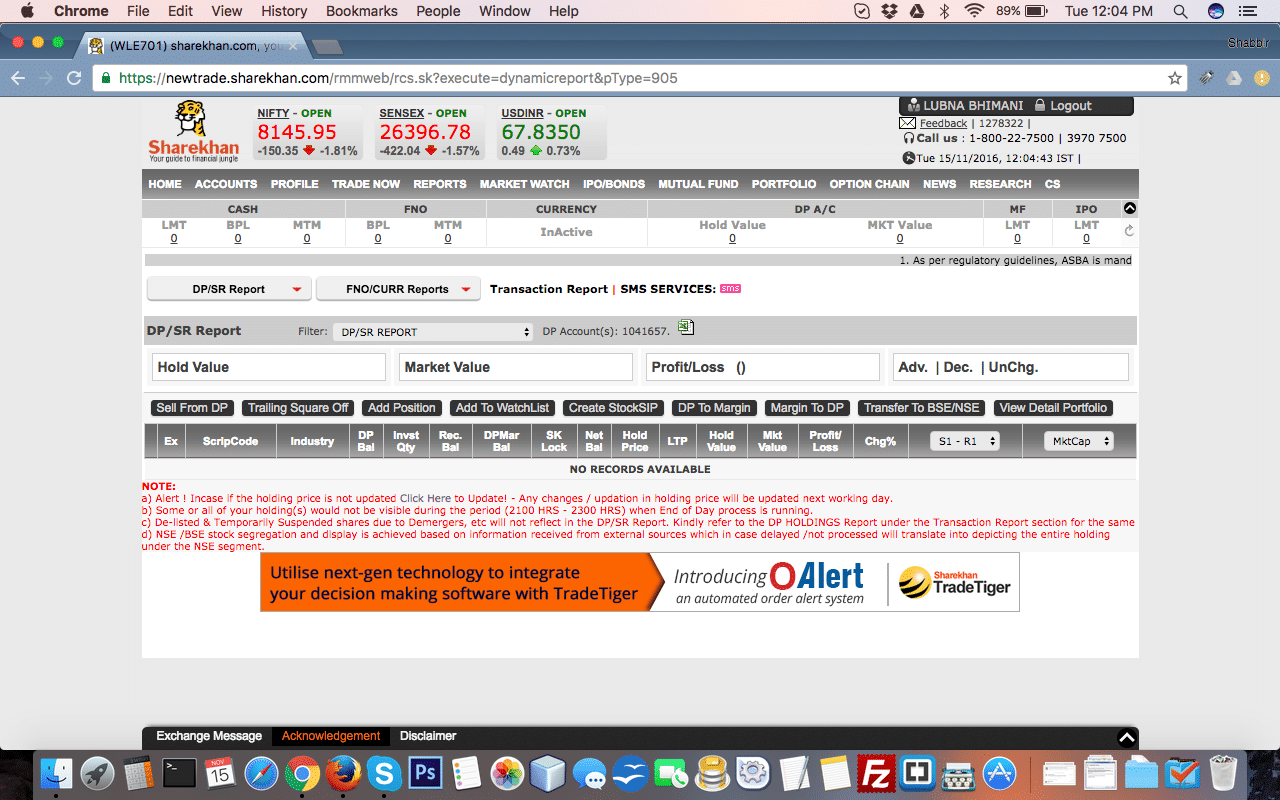

In my December portfolio report, few readers noticed that for the first time I invested and shared the contract note of Zerodha as opposed to Sharekhan it is because ShareKhan on 15th of November had a horrible day.

I was blocked out of the market for a complete day.

I could not view my portfolio, could not place orders and could not trade for the full day.

This not only happen to my account but it also happened with my wife’s account as well.

This happened not only on the web end but my relationship manager could not place orders and told me it is system issue and Mumbai has been notified about it.

I just saw my stock falling and getting at levels I always wanted to buy and tried and tried and tried but all in vain.

I even transferred funds but just could not do anything after that and the funds did not reflect into my account till next day.

Few of my friends who have ShareKhan account had a similar issue.

This happens on the back of when I have invest 15Lakh Rs in a year and they have earned handsome brokerage for my investment.

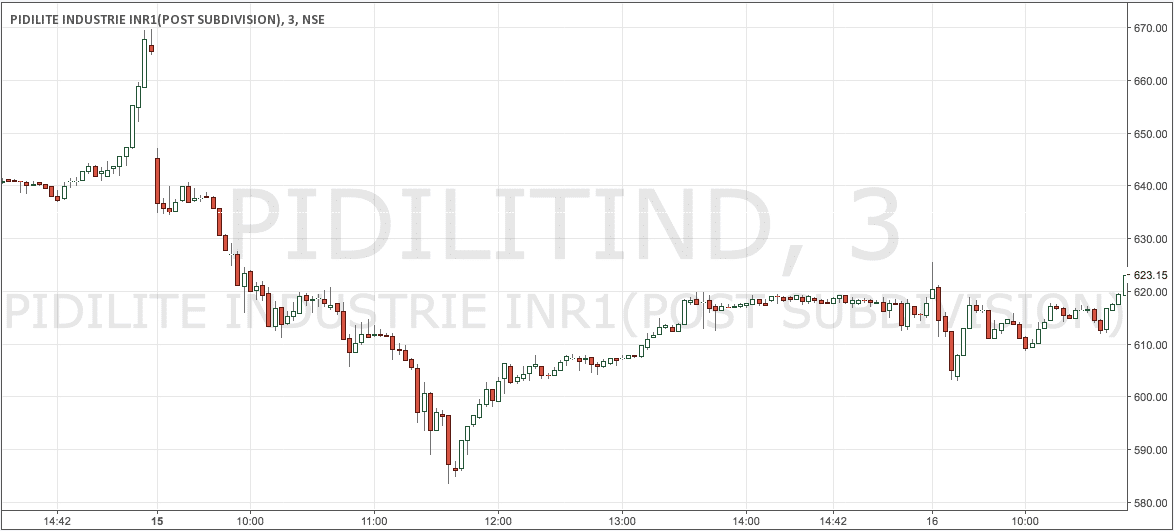

It was a day when Pidilite hit a low of 585ish and I wanted to place an order to buy as close as possible to my lower band of my buying range which was 620 to 580 for me.

After such a horrible experience and not being able to trade for a complete day, ShareKhan management did not bother to email about what happened.

This is when I decided to switch back to Zerodha.

Zerodha had similar hiccups in the past but for few hours and not for the complete day and are brave enough to accept they had issues.

When you are charging 30 times more brokerage (Yes ShareKhan brokerage is 30 times more than Zerodha), you expect much better technical services and cannot have days when you just are blocked out of the market.

I was willing to add more to my portfolio but imagine those who are stuck in positions and want to square off as soon as possible to minimize losses?

sir, i have no idea about it , i don’t know about ABCD in share smart , but i want to know about it , please guide me , which full time broker is best for me , which guide me to buy a share and sell a share at right time .

I have answered to your same comment here – http://shabbir.in/stock-brokers-review/#comment-1863782706

What I’m saying might really sound untrue but this is happening repeatedly.

I’m trading with Sharekhan.. and observed that..

What happens is whenever I place an order for an amount say 3.00, I see another order piling up triple the quantity at 3.05.

It happens instantaneously and all the time with ALL the scripts in derivative. Can anyone tell me what is that about..

I changed the orders 10-20 times and could see another buyer all that time. Whats happening ?

This is not just one script but almost all. evenif I’m not the first in buyer… i.e. even if I lower down price to 0.95.. there comes one buyer at 1.00. Its also for derivative scripts that are heavily traded.

Is that some sort of track ?

E.g. NSEFO – IRB 29May2014 CE 135

Buy Market Depth

Order Qty Price

1 4000 2.65

1 4000 2.60 <– ME

1 4000 1.05

1 48000 0.20

0 0 0.00

Sell Market Depth

Order Qty Price

1 4000 4.80

1 4000 6.90

0 0 0.00

0 0 0.00

0 0 0.00

I don’t think so but you can try placing orders on stocks that are low floaters and not actively traded but for other stocks there has to be orders being piled in the exchanged all the time.

thanks for this review. I just had a talk with sharekhan representative and he has following pls. Please let me know if these make sense or should i negotiate further? currently i am using ICICI direct for 5 paise intraday.

a. either pay margin of Rs. 25000 or advance brokerage Rs. 2000 for 0.07% intraday & 0.40% for delivery.

b. Either pay margin of Rs. 50000/ or advance brokerage of Rs. 6000 for 0.05% margin intraday & .25 for delivery.

And other plans follow accordingly with increased margin amount or advance brokerage.

I am not convinced with the margin amount that i need to pay. Please suggest what can i negotiate here.

He is asking for too much. Tell him 2 paise 20 paise as brokerage or else don’t call me please. I have better deals from other broking firms. Then opt for 3 paise 30 paise.

thanks for the reply…by the way what about the margin…what should i go for? margin or advance brokerage?

Never for margins. See why here.

You don’t need to opt for advance brokerage either and just opt for 3 paise 30 paise option.

thank you for this.

The pleasure is all mine Sandy.

so finally the guy said he cannot offer me these rates.

my question is where can i open an demat account without paying any margin or advance brokerage and at the above rates?

this sharekhan guy gave me only two options either pay some margin or advance brokerage.

also if not margin trading, how do you do intraday?

Pay some margin is fine and that will be credited in your account right? That is the option you have to be going for Sandy.

i have also tried angel broking. their brokerage rate seems to be good (3 paise, 30 paise), but they want me to deposit Rs. 25000/ for trading and it will be locked for one month.

can you recommend me any reputed and good online broker that can let me open the trading account with minimum deposit and low brokerage rates?

Sharekhan allows that and normally I deposit good amount but then it is never locked in Sharekhan. Atleast it did not used to be that way.

Can i take the tips they provide in shareknan on shares and trade.? Is it a wise idea for beginners? Are their judgement is like 80% correct?

No my personal experience with their tips are not that accurate.

Nice information. After reading this I tried to negotiate with sharekhan and ended up getting a better deal. Just to let everyone know, if you say that you are interested in F&O, they end up giving you better deal even if later you dont trade in it much.

Hi Shabbir,

Like to know your opinion on this broker.

http://www.dynamiclevels.com

http://www.tradesimply.co.in

Jaya

I don’t have any personal experience with them and so cannot comment on their services. On top of that they are not stock brokers either.

What is settlement date??

What if i do not sell share till settlement date???

Plz help me

Date when the trades are settled.

hello shabbir

i want to know that how do i put stop loss in trade tiger

I never put a stop loss into the software and it is always in my head when trading. Putting that into the software means others are able to see them.

i want to know what is intraday margin cash in limit statement

AND INTRADAY LIMIT

ACTUALLY I just bought myself 25 shares of POLARIS and under cash report in limit statement there has been a deduction of rs 1258.50 in “intraday margin cash” and in intraday limit under ‘scrips margin’,i am trying to understand what does this mean ? what was this deduction about ?

plz help me

Sharekhan do not deduct the whole amount from your account and once the trade is settled in T+2, they will deduct the complete amount.

Read this http://shabbir.in/no-margin-trading/

Can i trade in NYSE with sharekhan ?

I don’t think so Sami but it is better to be asking the official support.

m new in trading i have an account in sharekhan so i wanna know classic is good for beginner or trade tiger app plz help me out

You need charts but the app does not provide any useful charts and so I don’t think it matters at all.

thanks for the information sir but now what do i do for the charts

thanks

You have to be using chartnexus.com which is free for end of day charts.

thanks sir

In sharekhan, is it possible to buy in nse, convert it to delivery and then sell it at bse? I mean to take advantage of price difference if any

Yes but not on the same day. Check – http://shabbir.in/arbitrage-trading/

Currently I have icicidirect account and planning to move to sharekhan account.

1. Does sharekhan offer investing in company deposits like Mahindra, Dewan housing etc?

2. Does sharekhan offer giving offline order for executing it in next business day? e.g. giving order on weekends so it will get executed when market opens.

3. Agent told me there is no mutual fund transaction charges. is it true?

4. Is there any postpaid account option? Agent has given me only prepaid option.

The problem is I am not getting any authentic document from sharekhan which explains me all the charges/fees.

Agent is taking weeks to answer my queries so want to know from someone who actually has the account opened.

Thanks,

Vivek

Let me answer them to my knowledge but best is any sharekhan representative answer them.

1. Yes.

2. Have never tried it.

3. Yes. No charges.

4. No idea on that front but there is per transaction brokerage thing and if you mean that as postpaid option.

Thanks Shabbir. It’s helpful.

abt 4: yes I am looking for something per transaction brokerage as I am not a frequent trader now a days. I do 1-2 transactions per month so comparing for cost effective option available.

Yes there is an option for that and make sure you tell the Sales person that you want brokerage plan of 2 paise / 20 paise or else you don’t need the account and then they will give you that brokerage as well as the plan.

I am using sharekhan Classic account.

1)Need to know ,can I sell shares before buy in bearish market.

2)Can I put orders before market open.

1. Shorting is not allowed in cash market in India and you can only do that in futures market.

2. Yes you can.

hi guys,

I have sharekhan trading classic account ,for 2nd yr what will be the total charge for account maintenance. As per i know it will be 400 rs. can any body clarify ?

i want to know the total maintenance charges for both trading and demat?

Yes should be around 400 Rs but the best option is to call customer care people and get the details about the maintenance charges

Thanks

The pleasure is all mine Rakesh

I plan to invest 10 lakh into share market and provide the power of attorney to best stock brokers.

Please advise me regarding this.

It is more about understanding the market than about giving power of attorney to stock brokers.

Hi shabbir,

Does share khan provide automated portfolio updation as the stock is bought or sold?

Also do they reflect overall gain or loss stock wise as what moneycontrol n icici direct shows?

Thanks n regards

Veren

Yes they have auto portfolio update as well as reflection of overall gain and loss for the stocks in your portfolio.

I have recently opened and Account with Sharekhan Bangalore branch, hence wanted to know your review on them ? I am new into trading and investment in share market .

Shreya, you are already posting this question in an article where I have reviewed Sharekhan and so not sure I am able to understand your query.

Hi Shabbir,

I have come across few websites like puntercalls, pay2gain etc where we need to pay some money to get sureshot tips to earn good money. I would like to know if these websites are reliable….. If yes, may I know which website is the best….

Kindly advice…

Thanks

Mohamed Ismail, See http://shabbir.in/poweryourtrade-review/ which would clear lot of your doubts about paying those stock tippers.

thank you for your quick advice…. I plan to go for Sharekhran and also considering to subscribe for power your trade… I have plans to do intraday trading…… I want to take things slow and learn the trick of the trade…… I can afford upto 2 L, may I know how much is the capital i should start with to be on a safer side…..

Also I would like to know, If i trade with 2L (efficiently), how much is the return I can expect?

Thanks in advance

Ismail, your earnings would depend on how much you know about trading and how much you are able to learn from your mistakes and how fast. With 2L I would suggest that 5 to 8k per month should be very easily achievable for anybody just starting out provided he buys the right stock, at the right time and price. You want to take things slowly and so it means you are new in market and so first I will suggest you to do paper trading or trade with money you are fine loosing it completely.

Hi Shabbir,

I was reading a book on trading in Options and the US based author relies heavily on Option Calculators and Probability calculators to choose a call or put option. Do we have any such software/website which can assist one in the Indian scenario?

Regards

Venu

Hi Venu,

I prefer Price Action Strategy and not on futures and option data strategy and so I have not tested reliability of such data on any website and so will not be able to comment on them.

I also see that you are already member of my forum and so I will suggest you to ask them in forum because your question is not related to the post topic.

Thanks

Shabbir

Dear Shabbir,

Have been listening to Tim Sykes on his free videos. I guess the the most crucial job for an investor, before arriving at a ‘buy’ or ‘sell’ decision is to build a watch list of stocks. Tim talks about the sites he visits each day-‘Yahoo! Finance ‘and ‘ClearSation.com’ ,the popular blogs/message boards he visits and the software he uses to help him narrow down/filter his list.

Can we have your recommendations for a fresh investor like me?

Regards

Venu

We have very few sites to make it a list and it is only MoneyControl and Yahoo and Google Finance and so it is not a list but few sites.

I am yet to see very good blogs on market technicals and there are good blogs like http://www.onemint.com and http://www.jagoinvestor.com on investment as a whole.

1. Can we have more than one brokerage / demat account ? In case we can have only one demat a/c can that be linked to multiple brokerage a/c ?

2. When we shift to a new broker (i.e. eg from MOSL to SK); can we request a new demat + brokerage a/c or use the same demat a/c allocated from MOSL or can do either?

3. Can we really trade on stocks in NYSE ? Which brokers provide this service . Will there be different tax norms for these gains / losses?

ijay, for your question 1 and 2, I have not tried that and so will not be comment on them but for 3, you have to open an account with brokers in US like scott trade or Interactive brokers. Taxation is income slab on individual income.

Hi Shabir,

You had mentioned Tim Sykes in one of your posts. I received some of his free videos and thought they were good viewing. However I am not too sure whether it is worth investing in his material -does his teachings have any relevance to our markets. What is your experience>?

Regards

Venu

Venu, his teachings in pure form are not applicable to Indian markets and there has been modifications done to patterns that I have used with lot of success in Indian markets. So unless you plan to trade in US like I do, it would not be advisable to purchase his DVDs. If you want to learn about what he teaches, they are worth the price.

Thanx Shabbir.

The pleasure is all mine. 😀

HI, They say they need a minimum initial amount (cheque) of Rs 1L for low broking charges. However, there is no balance amt that needs to be maintained :-o.

What would happen if I’d do a payout after some time ? I mean I’d keep 30-40K that I want to invest and pull back the remaining in my savings a/c. In any case, I dont think I’m as big trader as you & rather beginner.

Thanks

You can do that but then it may have an impact that your account brokerage can go higher. I think it is better to be asking the customer care and clarify those points.

hi,

Read your blogs..they are really helpful.I have finalized sharekhan for opening a demat & stock trading account. Today met the sales exec. & for classic account he is asking for rs.10,000 as margin money(refundable).Is it required as same is no where mentioned, & he was also not very confident.Also,talked with his manager, he was also saying the same thing, but saying not to talk with the customer care.I am in Hyderabad. Pls confirm,if the same is required or what should be done?

Thanks,

Dipti

Dipti, margin money is required because if you want a trading account, you may trade or invest some money and that is what 10k may be referred as by the sales person. It is like money that you need to deposit when you open a new bank account. It is nothing like refundable but it remains in your account to be used and can even be withdrawn.

Just make sure you clarify that this 10,000 Rs would be in your account for trading.

Gud Morning Shabbir, Thanx for the reply.

Yes, the sales person said that the whole 10k wud be available for trading.But, he is not giving any reciept/ acknowledgement for this amount.

A reciept should be given for any money taken,Right?

Thanx,

Dipti

Dipti, Not sure if any acknowledgement can be given for this but the cheque that you give should be account payee in the name of Sharekhan and that should help.

I am stuck at the same place. I believe we are also giving them a Power Of Attorney with the margin money. Does this mean that until I get my account access, they can do anything with this margin money ?

Is it practical if I would refrain from giving any margin money or may be limit it to 5K/10K ? In any case, I am never going to indulge in phone trading.. I’ll want to do everything myself. Can you pls suggest on what is the best way to proceed.

Thanks,

Not sure because I have done the same way and so you should be asking them how you can proceed without margin money.

Regarding POA, Our exchanges still don’t understand that we are doing the trading and it is not our brokers and they still require all that BS to have a demat account.

SK is charging a brokerage of .40 (Dly) 🙁 Is there anything lower that can be settled on? I’m trying to get in touch with MOSL but there is one more broker (Comfort securities) that is charging 10p for delivery… What is a good figure to arrive with at SK ?

Tell them you have offer from other broker of 2 paise 20 paise and it will be reduced to half.

Thank you. Just one more query, does SK charge anything on per month basis for the tool ? I have come across some brokers who do that.

No they don’t charge for the tool for my account but it can vary from account type to account type and so you should re-confirm this with the official team.

Also, Any clue on difference in two a/cs offered by them: Classic & Trade tiger? Their website says Trade Tiger allows investing in NSE & BSE … but I believe that should be allowed in both.

I am not sure but what I think may be is Trade Tiger is a desktop application and so it could be that Trade Tiger offers you to use the application but classic account may only use the online interface.

Sorry if this sounds too novice… I am trying to get some concepts verified…

“Turnover Tax 0.00335% for Cash Segment (0.00325% + 0.0001% Sebi Turnover Fees) and 0.002% for Futures on actual rate (0.0019% + 0.0001% Sebi Turnover Fees) and 0.0501 on premium ( 0.05% + 0.0001% Sebi Turnover Fees). ”

1. I know that I dont want to invest in futures (where I suppose, I guarantee to purchase / sell stock at a future date/time). I dont what is options i.e. in F&O ? Is it the same?

2. Any clue what is Cash segment and when is turnover tax is applicable ?

Ijay, can you explain where you found those numbers because I haven’t done the break down of the brokerage+tax numbers.

got these numbers from customer care. Numbers are too small to need to be calculated.. I’m just interested to know what they mean ? Options / Cash segment / Turnover tax. Any clue ?

No clue but I guess they are breakdown of the brokerage and I just calculate brokerage like this

Does sharekhan have any restriction that says some minimum number of transactions / volume / amount of trading needs to be done per year or additional charges ?

No nothing like that and my wife’s account is in Sharekhan without transaction for very long time now.

Did you now find any negatives with Sharekhan ? Is it not risky if I link my ICICI account with sharekhan… Can I not link any account .. is there any other way i.e. transferring funds manually to sharekhan etc ?

What kind of risks are you talking about? Investing in equity has the risk but associating account with Sharekhan does not have any risk as far as I know but yes you can always transfer money offline with a cheque.

Thank you, It might have sounded novice question as I’ve never been into trading.

I raised this because I have heard of brokerage firms (ICICI Direct) transferring / debitting money from linked savings account upon purchases without authorization etc. This should happen from the funds that are reserved in the trading a/c. That is what I’ve been concerned about… I’ve wanted any sort of payment to be manual and electronic. Thanks.

I haven’t heard of anything like that but yes ICICI Demat account charges are debited from ICICI Bank account but that is not the case with ShareKhan.

The yearly fees needs to be paid and so they may debit this from your funds with Sharekhan but they cannot do that from your bank account.

Hi Shabbir,

This is Sundeep(Hyderbad), As I can see lot of our friends are new the Stock market for which you are giving good valluable suggestions which are quiet inspriation for me, so i’m also willing to get into this Stock World.

Request to let me know which Trading Account(Motilal Oswal or ShareKhan or any other ) should I prefer..?? what would be the brokarage charges(menction hidden once also incase any ) for them etc..

I want know which bank account (like I have CITI, AXIS and SBI savings accounts) is very useful and user friendly to map the Trading account ..

Thanks in Advance Shabbir

— Sundeep

Sundeep, ShareKhan and Motilal Oswal used to work for me but I have plans to stop using MOSL because of deteriorating services of them lately. Still have the account but not being used to the level I was using before. So I think the best option for trading as of now is only ShareKhan account but possibly when I say I would be closing the account I may see some activity in my MOSL account as well.

Regarding bank I would have recommended you HDFC Bank and AXIS bank because those can be integrated with Sharekhan or many other brokerage houses but don’t forget to read my HDFC Bank Review as well.

I have my HDFC Bank account mapped to my ShareKhan as well as MOSL account and the mapping work flawlessly as far as my operations goes.

Shabbir ,

Nice review . Very helpful to me . Going to open share khan after tortured/cheated/harassed by India info line since 2009 :(.

Thanks for the feedback for review Jay

Hi Shabbir,

Thanks for this useful post. I will be opening a sharekhan account soon.

Could you elaborate more on your comment regarding negotiating the brokerage charges. I am curious as to how it works. I was under the impression that these slabs are fixed and dont vary from person to person.

Ankit, just tell them that you have an offer from other broker of much less brokerage.

Thanks! it worked.

The pleasure is all mine Ankit. 😀

sir , I heard in sharekhan They do not provide facility to book limit order trades during after-hours. it is correct or wrong

There are some time frames where they limit the orders you can punch but that is well defined before hand and so I don’t think it is an issue.

Shabbir da,

Please share your comments/review on the quality of research (equity) by Motilal Oswal. In your opinion, ShareKhan or Motilal – which one is better in this regard.

Rishi, I think MOSL has an edge over Sharekhan when it comes to tips.

I’m very scared after found forged signature made by folks of ICICI Direct on my ATS 3-in-1 account opening form.

Is there any brokerage house at whom I can trust in INDIA?

Forged sign? Launch a police complain because it is a crime.

hi, firstly at d tim of contract with sharekhan they said intrady brokerage wud b 0.1paisa but nw while trading i noticed they charge high.whn contacted RM he said no it is o.3% or min 3 paisa.what to do.if i earn 400 profit i get only nearly 110.

second i need to refresh moneycontrol as well as mmb to get updates.can u help

MMB people can help and not me.

I want to contact you . Can you please share your number with me ?

hi,

i am completely new to this world of investing, at first i was thinking to open a 3 in 1 a/c from icici because all the things were available there at one place but u have criticized it a lot, so a bit confused. i want to invest slowly for long term and i am not going to start with a huge investment in market, starting with 40k-50k, so which would be best for me. and also trading offline would be better for me or online trading.

Hi,

Who is the best broker where I can trade with minimum brokerage and good service? I also want low option brokerage.

How much Sharekhan Charges??

Can anyone give the details please.

For me it is Motilal Oswal and ShareKhan

today while searching i found a website named EDELWEISS…it provides trading in equity and in mutual fund online without requesting necessary documents….what`s your review abt this site

Without documents is virtually not possible or else it may be actually used by black money people.

k….

k…r u on facebook..

Yes but not in chat mode. See the icons in the sidebar.

no ..i hate yahoo finance..the MACD signal they provide is not correct and also they not provide KDJ indicater…too much slow and data not update automatically while google finance update automatically…do u know any charting software or website..so i can analyze stocks

I use Google and Yahoo Finance along with my IB Trader workstation application.

really,even sensex’s chart shows only of the 2’o clock,..pls. Look at the chart

Ohh that is because market is closed for today and probably some issues they have with some data. Try Yahoo Finance.

i got my money in trading account after 3 day delay….one more thing..can u checkout a thing on your pc…actually i`m not getting data of indian stocks on google finance after 2 pm of yesterday…..pls. checkout once in your pc..thanx

Any particular stock or company. I am getting them fine.

k…one more thing,i transact money on saturday 18:50,,,today is sunday,so not able to contact them,,after 4:00 pm of saturday,we can’t contack to sk support,and so may be transact couldn’t take place and may be in pending,what do u say

Check your bank account and see if the amount is debited from your account or not?

one more question yesterday ,for the first time i transferred 100 rs. To trading account and instatly withdraw it,and i got that 100rs in my bankaccount,then today.i transferred 9000 frm my bank account to trading account,transfered sucessfull frm my bank account and 9000 subtract frm my bank account,but in sharekhan trading account transaction showed unsucessfull,,,,now what to do,,,do u think i’ll get my money back in my bank account…becauz sometimes transaction takes around 24 hrs,pls. Share ur experience,hv u ever faced that kind of prblm..

Call customer and verify what is the issue. Don’t assume money will come back automatically.

k…thanx,main dhyan rakhunga

The pleasure is all mine.

thanx…hi how r u bro?…yesterday i got my kit…..and frm monday i’ll start trade,i’m quite nervous,any advice 4 me…

Don’t jump into trade but wait for the trade setups to give you the right signals.