December 15 is the last date for quarter’s Advance Tax Filling and this time I thought of registering myself at Income Tax India e-filling to view my fillings online.

When you click on the register link it asks for a PAN Number. Once you provide a valid PAN number you can proceed further.

The shock comes after proceeding further.

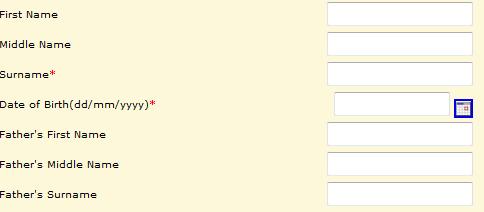

The details they ask for registration are present on the PAN Card itself.

So if you have someone’s PAN Card Xerox who is not registered with incometaxindiaefiling, you can register and see all his income tax filing records.

I could not find any link to claim a PAN card i.e. steps to follow if someone has already registered your PAN card.

So before anybody does it for you go get yourself registered at Income Tax India e-filling because your PAN Xerox is given to lot of people as Identity proof.

Hi Shabbir,

I have my mom’s PAN card. but her income is only in form of interest on bank acc and FD. so in my case i should still register my mom for e-filling?

No unless she plans to invest some money or you plan to get some money from her account into your account and plan on some investments jointly in future.

Thanks for sharing this greate article on

income tax return.

Can we start a new thread about how to fill up the ITR form ONLINE. Lets share the problem faces during filling up the form online, and how to overcome them.

Sachin, The idea is fine but I am not doing that personally and so I cannot help in that regard. I am making a post about ITax slabs and what options you have in general based on your email.

If you have the issues with resolutions you can email me an Article and I will be more than happy to have your article published.

Oops!

Looks too unsecured procedures in Govt. of India’s web! 🙁

Now what about others who are not qualified for Income Tax? They should register or not?

If you have a PAN card you can register and so you should register.