Let us take a top-down approach to the top-performing mutual funds for the past 1 year and come up with the best ELSS tax saving fund to invest in 2018.

Let us take a top-down approach to the top-performing mutual funds for the past 1 year and come up with the best ELSS tax saving fund to invest in 2018.

The Top ELSS Funds for 2018

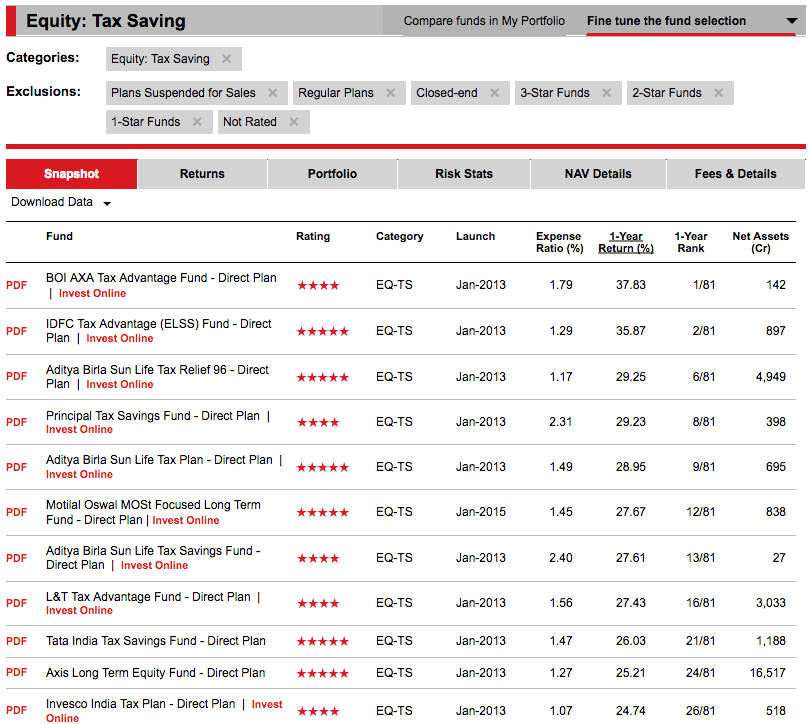

We start with ValueResearchOnline’s 4 and 5 star rated direct ELSS funds. Using the criteria we get the top funds for the past 1 year as follows:

Now we narrow down to find the best-performing ELSS funds from the top ELSS tax saving funds. Among the top funds, we ignore the following 3 funds

- BOI AXA Tax Advantage Fund – Very low asset under management. Only 142Cr.

- Principal Tax Savings Fund – Very high expense ratio. Doesn’t make sense of such high expense ratio for a direct fund.

- Aditya Birla Sun Life Tax Plan – Multiple funds in the same category by the same fund house. Only considering the other fund with higher asset under management.

So from the other top funds, we nail down further as follows.

The Best ELSS Tax Saving Fund for 2018

ELSS funds have a lock-in period of 3 years. So we have to choose a fund which can outperform in the coming 3 years.

Based on the company results and management interviews that I have been following, pharma sector will have pain for the next few quarters but is more likely to outperform in the time frame of next 3 years.

A fund having more weightage on Pharma sector will be my preferred choice of tax saving fund for 2018.

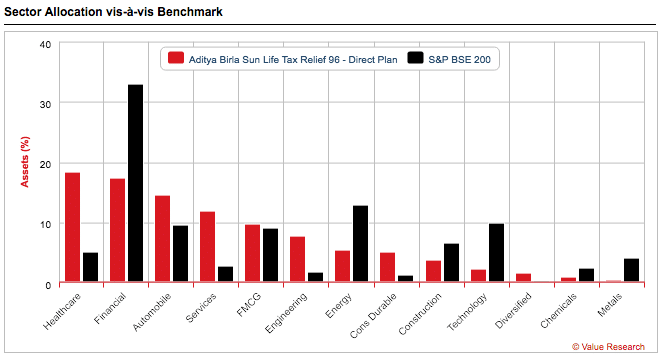

Aditya Birla Sun Life Tax Relief 96

Aditya Birla Sun Life Tax Relief 96 is a fund among the top-rated ELSS tax saving fund that has higher weightage on Pharma and automobile sector and has lower weightage on financials.

It aligns with my views of the market where I believe the financial sector will not outperform the market to the same extent it did earlier. Pharma and automobile have higher chances of outperformance.

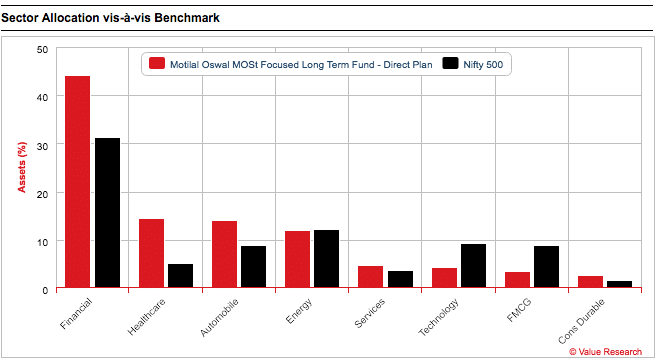

Motilal Oswal MOSt Focused Long-Term Fund

The other best ELSS tax saving fund I like is the focused fund by Motilal Oswal where they invest in fewer companies taking a focused approach to investing.

I am more inclined to the focused approach to investing. I believe in the tough time for the market in 2018, focus investing is more likely to outperform.

On top of it, Motilal Oswal MOSt Focused Long Term Fund also has higher weightage on healthcare and automobile sector.

How The Best ELSS Tax Saving Funds for 2017 Performed?

In 2017 the performance of the all the indices has been more than 30% which makes the performance of the best tax saving funds of 2017 look not that good.

- DSP BlackRock Tax Saver Fund – The performance of the fund hasn’t been as impressive as one would have liked it to be. It has managed to give a return of 20% for the past one year which is in line with its benchmark as of now as well as inline to its own 5-year performance.

Fund managed to do well though slightly better returns would have been awesome.

Final Thoughts

This is not an endorsement that you should invest only in the above mention funds. I have shared the complete process I used to find the best performing ELSS tax saving fund for 2018 which aligns with my views. Feel free to apply your own views or any other criteria of your choice.

Just make sure to invest in the direct funds and aren’t selecting a fund because someone has recommended it to you.

Good Post! 🙂 I like this post. Thank you for sharing.

Please do your analysis on Invesco India Tax Plan. It has good long term track record. And the last 10 year cagr is 16.5% which is the second best. And the Invesco mutual fund process of stock selection is also robust

Yes they have good stock selection. The idea of this post isn’t what I recommend as the best fund but the process. You can adapt the process of best 10 year performing fund and select a fund that is best.

I recently started reading your blogs…..Very nice. Thanks a lot.

I am working as full time employee as a fashion designer and also taking work in my part time. I am income from job is more than 10 lakh and part time income is more than 3 lakh total.

Which form should I use for return – ITR 2 , ITR 3, or ITR 4 S. Please help not getting any right answer after searching so much.

Also, one of my part time employer is doing TDS at 10% then do I still need to pay taxes at 30%? Please tell me.

Thanks a lot.

I am not a tax consultant and so can’t answer those questions for you. Consult a CA or a tax consultant for that matter.

Dear Shabbir,

Thanks for tax saving information. If I want to pay tax 200 k for e.g. and I invest 150 k in tax saving MF then I need to pay only 50 k as tax ?

No. If your taxable income is 200k and if you invest 150k, your taxable income becomes 50k. The calculation is not on the tax but on the taxable income.

Thank you.. it’s clear

Motilal Oswal Multicap and tax saver fund has almost same portfolio.

Well spotted.

Will ELSS fund also come under LTCG TAX .

The return should but then 1L per year is free and so some returns can be free from LTCG tax when withdrawn. Apart from that if you select Dividend option, the dividend exemptions is 10L and so the returns can be lowered when invested in a dividend option. I always prefer dividend option when investing for saving tax. You can read why in this article here – https://shabbir.in/full-tax-saving-without-investing-one-lac/

Past Performance is not a guarantee for future, I think we need to look at more holistic approach than just looking at past performance. If you have suggested DSPBR Fund as the best fund to invest last year based on the previous year’s returns, it has not achieved it this year, right?

So true Hariprasad. Past performance doesn’t guarantee anything but using the past performance and what may work in the future is what we are to look for.

Fund with 20CAGR returns doesn’t make it to the top fund and this is because market was unidirectional in 2017. I think 2018 will test the skills of the fund manager for sure.

On top of that, I am not guru and so my process isn’t full proof either. I just share the process that I use for investing. Ideally you are free to use the process but if your views doesn’t match with mine like if you don’t see Pharma outperforming for the next year you can choose a different fund.