It is that time of the year when I share a process to find the best tax saving ELSS fund for 2019 as well as look back on the past best funds to learn something new.

It is that time of the year when I share a process to find the best tax saving ELSS fund for 2019 as well as look back on the past best funds to learn something new.

Let me kick off this series with the best ELSS tax saving fund of 2019.

But before we begin the process to find the best fund to invest in 2019 for tax saving purpose, one crucial point question among my blog readers and other retail investors is:

What Happens to ELSS Fund Which is Closed and Doesn’t Accept New Investments?

Many fund houses had more than one fund in the Tax saving ELSS fund category. Out of those funds, one of the funds has to stop accepting new investments. Slowly over time with redemptions from an existing investor in the fund will allow the fund house to close the fund.

If you have invested in such a fund which isn’t taking new investment, there is nothing to worry. As long as an investor wants, he or she can remain invested with the existing units allocated.

But it is recommended to redeem from the funds that aren’t accepting new investment as and when one has a plan for redemption.

So how an investor can redeem in ELSS tax saving fund when it has a locking period of 3 years?

You won’t be able to redeem.

Again, there is no hurry as the units allocated to you will remain and NAV will continue to perform.

When the locking period is over, if you redeem and switch to other funds of the same fund house, it is still a redeem and invest. So the investment is a fresh investment for tax saving purpose in that particular financial year in the new fund.

I know this is slightly confusing. So let me try to explain this with an example.

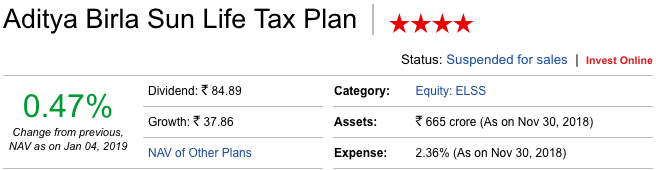

In March 2016, I invested in Aditya Birla Sun Life Tax Plan. It isn’t accepting new investment. My investment in the fund will remain as long as I don’t redeem.

In March of 2019, the fund locking period gets over, and I can redeem. I have plans to withdraw in April, so for the sake of argument assume I am going to do it.

Now, I can invest the same amount for tax saving purpose without making any new capital investment. It is a strategy I use To Save Tax Under Section 80C Without Any Investment.

One more point to consider is the asset under management. As per the data from ValueResearchOnline.The fund Aditya Birla Sun Life Tax Plan, AUM is ₹ 655 Crores

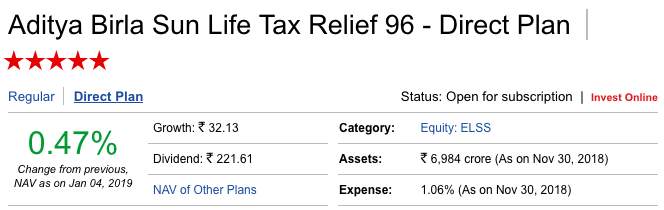

Whereas for Aditya Birla Sun Life Tax Relief 96 it is around 7000 Crore.

So as the fund has less asset under management, the expense ratio can have an impact. I am not sure if it is the reason for a fund to have a higher expense ratio, but it is indeed the case with few funds.

For the Aditya Birla Sun Life Tax Plan, it is way above 2%. For the Aditya Birla Sun Life Tax Relief 96 it is close to 1% in direct funds.

So, as an investor, it is a wise decision to switch based on expense ration if one isn’t paying exit load or Long Term Capital Gains Tax.

The Top ELSS Funds for 2019

Let us get back to the process of best tax saving fund for 2019.

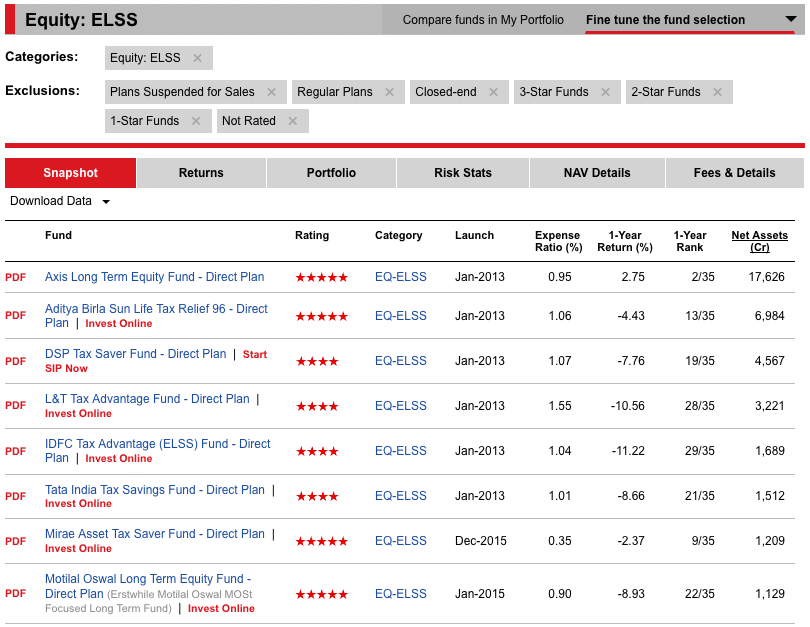

We start with ValueResearchOnline’s 4 and 5 star rated direct ELSS funds. Arrange them in decreasing order of the asset under management by each fund. Now we have the top ELSS tax saving funds:

For me, the best fund is the one that has the least expense ratio. The next thing to consider is, in 2019 and beyond, I expect Pharma, IT and FMCG sector to do well. So funds with more exposure to IT, Pharma and FMCG sector.

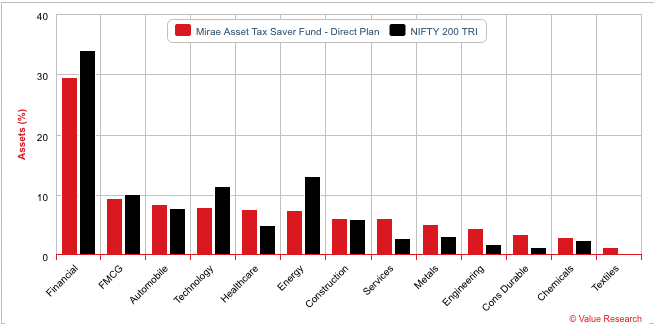

Mirae Asset Tax Saver Fund

Mirae Asset Tax Saver Fund – Direct has the lowest expense ratio and is the preferred choice of fund for investing in 2019. Because of tighter guidelines for the funds to stick to the benchmark as well as defining the parameters of benchmarking, expense ratio will be one of the critical factors in the fund’s performance going forward.

On top of that, it has good exposure to the FMCG sector which I expect to do well in the coming months and years to come.

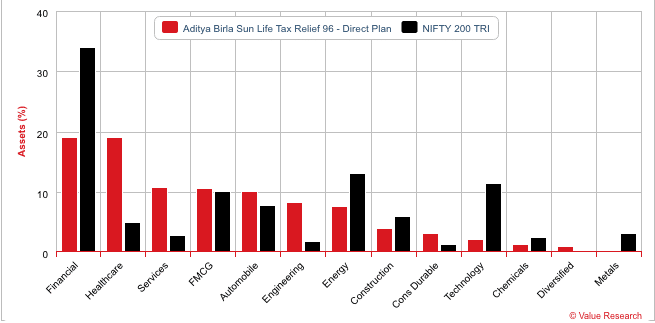

Aditya Birla Sun Life Tax Relief 96

The next best fund is Aditya Birla Sun Life Tax Relief 96 because it aligns to my view of more exposure to the healthcare sector allocation.

It was my preferred choice of the fund in 2018 it continues to be part of my best ELSS tax saving fund list.

How has The Best ELSS Tax Saving Funds for 2018 Performed?

My choices of funds were:

- Aditya Birla Sun Life Tax Relief 96: It has been slightly less than the benchmark indices, but it is because the healthcare sector which was expected to perform well in 2018 hasn’t. But I am hopeful it will happen in 2019.

- Motilal Oswal MOSt Focused Long-Term Fund: It is merged with Motilal Oswal Long-Term Equity Fund now. Hasn’t performed well and has given a negative return for the past year of close to 9%.

Though the best 2018 ELSS funds have underperformed, the underperformance hasn’t been very negative in 2018. So going forward, the investment done in 2018 is going to perform in the next couple of years for sure.

Final Thoughts

My choice of fund is not an endorsement that you should invest only in the above mention funds. I have shared the complete process I used to find the best performing ELSS tax saving fund for 2019 which aligns with my views. Feel free to apply your opinions or any other criteria of your choice.

Just make sure to invest in the direct funds and aren’t selecting a fund because someone has recommended it to you.

Shabbir – what is your take on Axis. The fund did very well in the bull run and not too badly in the slump. The large corpus is worrying but i am presuming that the impact in ELSS will be lesser than an open ended fund because the fund manger has a better sense of th max redemption pressure that he can be subject to. I have refrained from withdrawing from this fund though my 03 years is over because the preformanceis above average

It’s good if you don’t redeem and the fund is good but then it all depends on the sectoral exposure of the fund and your views about those sectors. If they align, it is worth investing.

I am eagerly waiting for your other articles discussing best Large cap, mid cap, multi cap fund etc for 2019. Please publish those issues asap. I want to make changes in my ecisting MF portfolio, so your articles will help.

Thats the plan in the coming weeks. Stay tuned.