In 2009 I shared Best Tax Saving Funds and though the idea of finding the best tax saving ELSS fund is still valid, it makes sense to be sharing some new insights as well as the look into better option to save tax in 2013.

In 2009 I shared Best Tax Saving Funds and though the idea of finding the best tax saving ELSS fund is still valid, it makes sense to be sharing some new insights as well as the look into better option to save tax.

Before I begin, you have to understand my take on Tax Saving.

My take on Saving TAX

When it comes to saving tax my view is pretty simple. I should be able to

- Save maximum tax.

- Invest minimum possible amount

- Equity linked returns.

If you are not inline with the above 3 points, the rest of the article will not make much sense.

As you are reading further I can safely assume that if you are not agreeing to the above 3 points, you are not against it as well.

To save maximum tax under section 80C, you have an upper cap of investing Rs 1 lakh or 100,000. There is nothing much that can be done to increase that limit.

Now you may think that we need to invest 100,000 to save tax of equal amount as well but that is not true. You can invest less than 100,000 and still can get a tax benefit of full 100,000. It can be done if you use ELSS Dividend funds where you invest 100,000 but invest in those ELSS tax saving funds that pay high dividends each year as well as perform well in market and then you get back some amount in few days to few months time. I have been doing the same for last few years and you can read more about it here – Full tax saving without investing one lac.

I am not a fan of investing money for 3 years in debt related schemes because according to me 3 years is a good enough time to invest in market for averagely good returns.

On top of that the aim of the investment is not to build wealth and so I normally redeem my tax saving investments as soon as I can. So my aim is to redeem my ELSS fund that I have invested 3 years back and then put the same money into a fresh ELSS funds to save tax this year. At times redemption in March is not very fruitful and so I may just invest before and then redeem in a month or two later as well. That is what my plans this year is. Invest in March and may be in April or May I will redeem my ELSS fund that I could have redeemed in March.

So now you have clear idea about my views on ELSS and tax savings and so now the process I follow to

The process I follow to Select ELSS Funds

Most ELSS funds share dividends in the month of March and so I will look for those kinds of funds who has good track record of sharing dividend in the month of March so I can just invest the amount under 80C and get some amount back as tax-free dividend.

I short list funds that I think will perform over the period 3 years. This shortlisting is based on kind of stocks and business they have majority of their investment. Here is the List of Tax Saving Funds by ValueResearchOnline. Sort them based on 1 Years performance and select few funds that have performed averagely for last 1 year or so. We choose average performing funds because they have invested in some under performing midcap stocks which have not performed in the current market rally and so have higher chances of performing later. You can also check similar fund selection criteria by Manish Chauhan – Why you should no go with ‘Past Performance’ in Mutual Funds.

I one line I will say that select those funds that have a good track record but has not been able to perform recently in the market upswing.

My List of Funds for 2013

My final lists of funds for 2013 are as follows.

1. Canara Robeco Tax Saver

I rejected this fund for personal reasons but I think it deserves into my list of Tax saving fund in 2013. I have invested in this fund 3 years ago and so I will be redeeming this fund either in March of may be in April or May. On top of that this fund has an average return of 15% for last 1 year. The fund has recorded the Dividend for this year and the record date is today 8th March 2013. Everything going against this fund personally and so I prefer to choose other funds.

2. Principal Personal TaxSaver and Sundaram TaxSaver

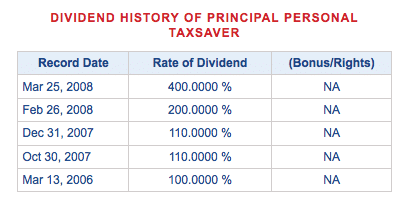

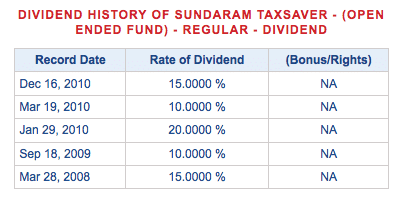

Principal Personal TaxSaver and Sundaram TaxSaver both have an average return of around 13% in last one year but both the above funds has not given any dividend for last few years. I expect some dividend this year because of better returns but then I will go with the track record of this fund of not giving dividend and so rejected them. Dividend History Data from MutualFundsIndia.com

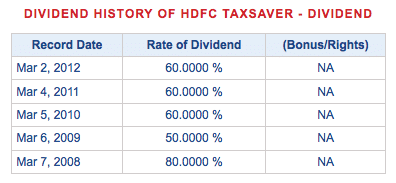

3. HDFC TaxSaver

HDFC TaxSaver is my choice of fund for 2013. I have plans to invest in this fund in next few days. I will invest in next few days because I have invested heavily in Real Estate (Will share once I have the deal sealed) in the current year and am short of fund as of now. The reason I select this fund is because

- Though the fund has given a return of 30% since inception, it has underperformed in last 1 year with average return of below 8% only.

- Dividend is paid regularly and has not been recorded till date in this fiscal. I hope to invest in this fund before the record Dividend date.

- Invests heavily in Finance and technology sector that is more likely to perform in the coming years.

Final Thoughts

Do you agree on my views on saving tax? If you do that is awesome but if you don’t that is perfectly fine and you can share your tax saving ideas that work for you.

If you agree on my views I will suggest you not to follow my fund suggestions of HDFC TaxSaver blindly. Research on your own and come up with a choice of fund. I will be more than happy to change my investment from HDFC Tax saver to your choice of fund.

Update: I have made this article go live on Friday night after 8 PM to make sure you have complete weekend to research and avoid adrenal rush for investing in mutual funds.

Update: Anybody who suggest me a fund with a reason and if it is something that I invest into, I will be giving free access to Do It Yourself Technical Analysis Members area because of his efforts. He will also be rewarded with my eBook absolutely free. Remember you should not only name the fund but also share a reason why you are suggesting that fund. Share your choice of tax saving ELSS fund in comments below.

Update 12 March 2013: Winner of the contest is Sunil and though I have not yet decided to invest in Franklin Tax Shield Fund yet but I think his effort and research deserves a mention.

I want to invest in ELSS , for tax saving, pls confirm me best fund available as of date.. which can outperform for years, my horizon is longer.. much longer..

pls reply asap..as need to buy before 31 march

If you want to invest, why you are opting for investing in ELSS funds, There are other better opportunity where there isn’t any locking period. In this fiscal (2013-2014) I don’t think any further ELSS investment is possible and I would not invest either because Nifty is around 6500+ where I don’t think too many funds can give you good returns in 3 years locking either.

Hi Shabbir

Any ELSS MF recommendations to invest as of now ? Did not do any tax saving for current year and now in a hurry and hence unable to find any good one. If you could point out a few names, would be really helpful

Thanks

Naveen

Normally I do that in the last quarter and so expect my investment details soon. Have put aside the cash for it but not planning to do it as of now.

Hi Shabeer,

Best info around topic Tax saving. I need your advice on saving for long term and save on Tax liability as well.

My earning is around 35K INR per month, i am single and have a liability of Educational loan which i am repaying with an EMI of 5000 INR per month (Rs 1.5 Lacs).

Will you please help me to understand, how do i start my investments, which instruments i should invest in which will give me tax relief and good returns?, what should be the best investment strategy for long term investments?

Your response is appreciated.

Regards,

Pravin

Hi Pravindaud, The first thing first and that is if you want to be saving tax, you should start a SIP into the ELSS funds because as you are young, the amount you invest will be for long enough time to give you better returns and save tax as well. If you prefer to be doing some lumpsum investment then opt for investment time that is conducive to better returns and I have shared how to find such right time here – http://shabbir.in/nifty-technical-analysis/

Hi Shabbir,

At this point in time, which Tax Saver funds would you recommend for considering SIP ?

HDFC Tax Saver(D) is continuing its under performing trend for quite some time now.

Would it be worth considering at current NAV 44.56 since it had decent performance nearly an year back.

Naveen, I have not done the analysis right at this moment but I have shared how to I select funds and so you should be able to find the best funds yourself. In closing days of last fiscal I did go with HDFC Tax Saver though.

Do you prefer investing in ELSS in 1 go or SIP.

since if i take SIP my entire investment holding period would be greater than 3 years

One go most of the time when it comes to ELSS

Hi Shabbir/ Sunil

Although I have been working as a salaried employee since 6 years, have not ever invested in any SIP’s or ELSS. But now, I think it is high time to do the same, and I have invested in PPF.

However, I would like to invest in other tax saving schemes for both wealth building and tax saving. In case my tax saving is been done, what other options are suggested to build wealth.

Request you to please suggest, as I am quite new to this and am being overloaded with information, need some guidance.

How do you consider national pension scheme as a tax saving option?

Hi Eesha,

Glad you prefer building wealth for yourself and the first thing to know before I can advice you are as follows.

Thanks

Shabbir

Hi Shabbir,

Sorry, was out of town so could not reply to your answer.

Following are the answers to your q’s

1. As of now, I have one personal loan which is being repaid in monthly installments of 13,666, and it will be getting over by Mar 2014. Apart from that, I have no liabilities, and no assets too.

2. I am single as of now, but getting married in the month of november, 15th to be precise.

3.Yes, i will need some money next year around march 2014, as we will be shifting houses, so to get settled etc., will need a good amount then.

4. Well, as of now I can say I can save upto 15k a month, but this amount is expected to increase after my marriage. I do expect a high corpus, like 1 cr or something after 20 years. Also, I am looking for some short term schemes mayb like 3yr, 5 yr, 10 yr which can help me when I might need the money.

Looking forward to your reply.

Thanks and Regards,

Eesha Garg

Eesha,

As you have loan ending soon, I will suggest you to get that done and dusted in this fiscal and then you can look for better investment options. As you are just getting married, you should be looking for more equity exposure in your investment and don’t opt for insurance as investment (Why here)

If you want to be in market, I will suggest just don’t get into it without proper knowledge about it.

Thanks

Shabbir

Winner of the contest is Sunil and though I have not yet decided to invest in Franklin Tax Shield Fund yet but I think his effort and research deserves the price.

Thanks a lot Shabbir…

Infact this is all learnt from able bloggers like you.

I am a vivid follower of Jagoinvestor, Onemint, bemoneyaware and your’s (Specially for stocks). And all the information and knowledge gathered from learned people like you gave me the knowledge to analyze and understand things.

I was adviced by an able investor in our group that, When you are investing first study and then go ahead.

By studying i had for true increased my knowledge a lot…

The Book shared by you shall allow me to understand,study and implement the strategies mentioned. I shall share it with you.

Thanks once again for chooing me.

Regards,

Sunil Ramidi.

The pleasure is all mine Sunil and yes those blogs that you have mentioned are all awesome with lot of information.

Congrats Sunil 🙂 . Good writeup and analysis.

Thanks a lot Naveen.

Based on Crisil rating, if we take top three ELSS schemes Axis Long Term Equity Fund (G) ,Can Robeco Eqty TaxSaver (G) and Franklin India Tax Shield (G). The Axis ELSS is not 5 yrs old, when coming to MF investments, the longer the scheme with better performance the better. Remaining are Can Robeco and Franklin. Though Can Robeco has better performance overall, but during sensex bad period also the Franklin ELSS maintained +ve growth compared to Can rebeco. I would suggest Franklin ELSS as the performance of it is good during bad times as well which gives an assurance to investors of a good performance track record.

Also its advisable for an investor to not select one MF ELSS for tax saving only. Spreading his/her invst in a diversified or mid cap prtfolio with ELSS schemes can lead to better progress and a good portfolio as well.

best elss scheme is HDFC Tax plan.

ELSS Are long term because u cant withdraw before 3 years

So one should not go only after pure performance of last year or current year because we cant be sure of the next 3 years

That is why I prefer elss from a stable & reputed amc and that which regularly pay div.

Paying good div is only possible if the fund is managed well

That is the only reason I invest since last 5 years in hdfc tax saver . Just recently I got a mail that They have declared div for 2013 of Rs6 which is tax free.

Too much analysis & research can make decisions difficult so i prefer this simple criteria

Stable & reputed Amc

Good Div paying ells every year

I reccomend Hdfc Tax saver. Just recently It declared rs 6 div

The purpose I support Hdfc Tax saver is because it is a stable div giving fund also from the best amc and I therefore invest in this fund every year since last 5 years

Hi Shabbir,

I find Axis Long Term Equity Fund is a good choice as it is managed by a professional Bank which has a phenominal record in terms of performance in the last 5 years. You can check out all aspects of this fund at the given link. Hope this info serves you better.

http://www.moneycontrol.com/mutual-funds/performance-tracker/returns/elss.html

Thank you,

With regards,

Sivaraman D

This is past performance and we have to look for future performance.

Well Shabbir, nobody can for sure tell about the future performance of anything. We can only look at the management of the risk by the fund in any given situation to minimize losses and maximize profits. One can only speculate/guess about the future. We can only extrapolate the past performance into the future based on some solid analysis of the Market. This is my 2 cents. Thank you for your response.

I agree with you past performance should not be the only criteria, but do we have any other specific data for ordinary retail investors/traders in public domain. Any other privileged information could be termed as insider information. Moreover, we are dealing with the market as a whole and not an individual stock in the ELSS fund which is usually diversified. Hence we should be looking at the overall trend of the market and should be prepared to take risk at our comfortable level. Mutual funds are like elephants and cannot move fast in and out of market, else it would be like an elephant in a china shop, and market would go haywire hurting more the fund itself than anyone else. I have no opinion about the market, and I tend to go with the flow of the market than predicting it. Market has its own way of rewarding and punishing the predictors, it is always a game of give and take.

My humble opinion is if it is for long term in a mutual fund, then one should not try to time the market; up and down are always part of the market play and should be ignored. Time in the market rather than timing the market would be a better way for success in the long run.

Thank your for the link and I would download and read the ebook.

Hi Siva, The ideology (Time in the market rather than timing the market would be a better way for success in the long run.) used by experts on TV who just predict wrongly and then they say it is very good stock and you should remain invested.

If you look at 3 years chart of Punj Lloyd you will see that in 3 years it has done nothing. Time in the market may not help if the stock is not right and then once you have the right stock, it is important to enter and exit at certain levels to make the most money out of it.

Shabbir, my view is on the overall market and for portfolio investment through MF and not in any individual stock, which in itself is a different ball game altogether. Individual stocks are prone by manipulators and operators (both promoters and cartels), sectoral and industry bias and other factors, and there is more chance of planting of news and false info in the public domain to coerce and ultimately cheat hapless people. Punj Llyod is one such example in this instance.

Hi Shabbir,

I think you have chosen the best ELSS (HDFC Tax Saver) as per your requirements. Reasons are pretty clear from your side as well, bringing down the options to ELSS alone. Thinking of alternatives, if one reason goes against your pick, probably at least two solid reasons come in between to choose your bet. Primary reasons that warrant your choice are:

1) May be the primary reason knowingly or unknowingly brought this to your prospective list. Solid performance of the fund in the category of ELSS(D) option, might feature for sure in the top 5 if not top 3 considering many factors. –

Your points – Save maximum tax, Invest the minimum and ELSS. Rough mental calculation achieves at least 90% of your objective

2) Record dividend date – Very very near to your investment date. So no need of highlighting the importance. You get a portion of the money(capital) back to you almost instantly. Another prompting, appealing and attracting factor for sure.

Your points – Save maximum tax, Invest the minimum and ELSS. Rough mental calculation achieves at least 110% of your objective. Believe me, you cant find a better option here. In 3 years lockin period, you are getting pretty high rewards in getting portions of your capital. Proven track records gives credibility and peace of mind.

Go for your choice which i find the best suited to your needs which gives a nice balance between performance and dividend returns.

Had our country been a better place in terms of corruption, governance and politicians, i would have suggested you to factor in our country’s gain as well in this regard while saving tax. Even paying the tax back to the country where we live in could have been a good option and ideal choice. Unfortunately that is not the case and genuinely thinking, I cannot foresee such environments anywhere in the near future as well :(. At times got to live with what we have. Reforms might take ages to take place.

All the best to each and every reader and keep up the good work going. Have good times ahead.

Naveen

Naveen, glad you liked the article as well as my choice of Fund.

I will recommend Franklin India Tax Shield, as this fund has given a reasonable return of 11.4% in the last 3 years with a very good return of 22.8% in the last year. Remember, ELSS funds have lock in period of 3 years. This fund size also compact.

Yes Franklin TaxShield is good choice of fund.

Dear Sir,

I feel Reliance Tax Saver Gr is not typical ELSS offering. Unlike most ELSS funds, which pay more attention to large caps and keep a keen eye on the risk/return trade-off, manager Ashwani Kumar here invests a substantial portion of assets in small/mid-caps. Also, given the three-year lock-in period in the fund, he does not shy from taking big stock/sector bets or investing in less liquid securities. hen choosing stocks, Ashwani largely scouts for companies that he believes are trading at a significant discount to their intrinsic value, while incorporating a strong qualitative overlay. It ranks 3rd in ELSS & have given very good returns since the past 3 years.

Regards,

Manjunath S

Dear Manjunath,

Reliance has significant exposure to Small and Mid Cap companies, nearly more than 80% of the entre portfolio.

This becomes very risky for any investor to par his funds (i am talking about investing solely for tax saving prespective and removing after objective done).

However for people who are having stomach to conatin the risk, this is a good fund. However with High Beta it is a very volatile Fund to be frank.

Though it gave good returns over 1 year period of time, the rate sensitive sectors might drag it down if Inflation doesn’t drop and RBI doesn’t reduce rates.

This is my view.

I will add to Sunil’s reply that fund that has already performed very well may have hard time performing more in future because of the nature of how mutual funds work and so I will not go with it.

Te best ELSS could be Reliance tax saver fund which has fetched 26% return in last year where as Sensex 30 rose by only 9%.

Ravi, one fund that has performed over past may not performing in the coming years. You should read the link in the article.

Some Analysis on why to choose my Funds and why not few Funds described in the post.

First to start with the point of Wealth Creation or Tax saving, i question why not both. When you are going to invest smoewhere, why take only one advantage, take two. Invest for Wealth creation as well as saving Tax.

This point can be argued, debated… but one’s individual choice always takes control. I beleive when you are investing get the best out of it.

Now coming to the one particular fund which has been recommended, “Canara Robeco Tax Saver”, since i am a fan of wealth creation, i shall not opt this anymore. WHY????

Canara Robeco Tax Saver, had a fund manager change recently and all the past performance has happened because of the Old Fund Manager, i can’t take a risk of testing depths of the water with a new Fund Manager. Especially, when you have better and best funds lurking around you.

Now my picks.

I shall go with Franklin Taxshield Quantum Tax Saving

Below are few points of why i ahve opted these,

1. A very well diversified portfolio :

What it does? : This reduces your risk of capital erosion by diversifying the amount across sectors and stocks.

Why this is needed? : Don’t keep all your eggs in one basket, choose to invest among different stocks. This gives you a cushion of not loosing your money.

2. Good AMC Ethics and Investor friendly decisions :

Why it is needed? : Any company or an AMC having good company ethics shall go ahead within its peers. Quantum being a new AMC has already displayed their investor friendly moves, such as low expense ratio.While you are in a process of wealth creation, this difference in the expense ratio plays a major role.

3. Little Overlapping between Funds Choosen

Why it is needed? : Choosing 10 Funds containing same stocks doesn’t do any good for the investor.

Diversification should be at the stocks and sector level not Fund Level.While Franklin and Quantum has little overlapping, this serves best when dealing with these 2 funds. Quantum doesn’t contain any Health sector stocks, and this is very wekll complimented by Franklin.

4. Don’t go by any website ratings :

Why? : The same website might rank it lower tomorrow, so hunting for stars doesn’t do any good.

Apart from the above factors, the Fund Managers style is a little conservative as well, having Cash reserves in Quantum helps the Fund from dipping down in Downside Market conditions. This is very important as it helps for Capital protection as well.

Alpha factors for both the funds are at a higher level, at the same time having a low Bets. This suggests the funds have a high growth stcoks with out having much volatility.

Past retruns are not only the factor to decide on funds, even though these are best in their category, still i suggest don’t go by stars or ratings by any website.

Study, identify the diversification and check the Fund Manager investment style not to mention AMC ethics and their charges.

Tax saving is a great thing, but what is wrong in building wealth along with saving Tax, you get cherry on the cake, that’s always a compliment.

Note : I am personally investing in these two funds.

Just to add on the dividends part.

Dividens are paid from your own money and notany extra as they are done in case of Stocks. The extent of dividend payed is reflected in your NAV, hence that much price is already factored in.

Fund picking based on dividends is only suggested for people who want some income, even for them MIPS’s are the best choice not tax savings which pay out dividends.

Just to add one more point. As per new budget rules dividend tax is increased a lot and every one say it is not taxable in your hand, but it comes after it is taxed at the AMC level… so guys, i prefer to opt for growth options in order to create wealth and not reduce it in due course.

ONE MAIN POINT IS FOR ANY INVESTMENT ATTACH A GOAL and then choosse the best possible FUNDS so as to achieve your GOAL. This works 110 times out of 100 times.

All the best and have a good day.

Sunil,

Let me answer each of your question.

When you try both i.e. wealth creation and tax savings, you actually lack both and that is what I think. If you can manage both in one go, it can be opted for.

Agree on your views of Canara Robeco fund but my article suggest HDFC tax saver and not Canara Robeco Tax Saver.

Your choice of Franklin Taxshield Quantum Tax Saving is very good.

About your view on investment goal, My goal with Tax saving is to save tax and it works for me always.

Your views might be of one’s personal choice, because i have succeeded in creating wealth as well as saving tax …. by investing in ELSS funds.

Completely agree on that.

Dear Shabbir,

Great article as usual. But as far as the selection goes I do have a query – I have always invested in the ELSS funds but in the growth option but I find you have opined for the dividend option. Does it have a significant impact even in case of a small investment which I do monthly (about 3K). Lastly I am invested in the following:

L&T Tax Advantage

Franklin Taxshield

Quantum Tax Saving (big fan bcoz of its low expense ratio)

Do you have any suggestion/views regarding my selection? I would love to hear from you.

Bikram.

Bikram, yes it does make a different. Check how much your fund has given dividend and you could have encashed that amount till date.

shabbir

Very Simple question ” Why Divident option why not Growth”?

Gajanan, I have explained that in the article.

No matter which fund you choose I would suggest you against SBI Tax Saver because it has never given me any positive returns till now for the last 4 years I have invested in it. I would also suggest you HDFC Tax Saver simply for the reason they are most credible MF in industry right now with around 10 funds in top categories and HDFC Tax Saver has been also consistent in declaring dividend in almost all the years in the past. HDFC Tax Saver also follows the style of HDFC Top 200 and Equity fund which in my opinion are the 2 best funds right now.

Siva, Nice fund you have suggest to keep away from. In fact there are very few SBI funds that has performed.

Hi,

I have invested in Reliance Growth opportunity Fund. And in just one yr. I have seen a growth of 20%. With this fund, you not only get the Tax benefit, but also get a Life coverage for free. For details check the fund details.

Thanks…

Reliance Fund has performed well in the past but that should not be the only criteria to select fund for future.

STEPS FOR SELECTING BEST OF BEST OPEN ENDED,

DIVERSIFIED EQUITY MF SCHEMES INCLUDING ELSS.

(1) Obtain the list, only of all 5 & 4 Star rated Diversified Equity MF schemes from http://www.valueresearchonline.com

(2) Club all the MF Schemes from the above lists and arrange it alphabetically, to make one comprehensive list.

(3) Sort this combined list by Fund Style, alphabetically.

(4) Create various different lists (in order to avoid comparing Apples with Oranges) according to Fund Style, out of the above, for intra MF Schemes comparison, within a particular Fund Style.

(5) Ascertain the details of “ Risk & Volatility “ of each MF Scheme arranged in the alphabetical order and then plot respective “Values” of Sharpe Ratio (SR), Standard Deviation (SD), Alfa, R’Square and Beta against each MF Scheme in a tabular form.

(6) Take the simple average of all these plotted Values, so arranged.

(7) Attribute weightage i. e. 50% for SR, 30% for SD, 20% for Alfa respectively and obtain fresh Values. Please be careful while attributing & calculating Values for SD, as less the Value of the same is better while, more the Value of SR and Alfa, is better.

(8) Take the summation of all the new Values horizontally, and arrive at one single Score of each such MF Scheme individually, including that the Score of simple Average of the category.

(9) Get the fresh list of Values {Scores} vis-à-vis each MF Scheme in the category, in the descending order.

(10) Eliminate those MF Schemes having total Score LESS than the simple Average total Score of the category.

(11) Take only top 3 total Score wise MF Schemes from each Fund Style. As far as possible more than one MF Scheme from the same Fund House be not short listed.

(12) In case of tie, use other tools like respective R’Square [only if, its Value is =/> than 0.80] and respective Beta Value. In the falling {bear phase} the MF Scheme having the least Beta Value be given preference & vice versa.

(13) Finalize the MF Schemes in each group of different Fund Style separately and prepare only one consolidated list for suggesting to the prospective Clients which is useful for churning the existing portfolio / making fresh investments. This is useful for Fund Managers of FoF Schemes also for the same purpose.

The above entire exercise is based on the information / data available on web site itself http://www.valueresearchonline.com and I have made a humble attempt in my own way, with certain assumptions which are subject to further brain storming please! And while doing so, I have not taken in to consideration certain subjective / debatable criteria / parameters like Fund Size (AUM), Track Record of Fund Manager / Fund House, % Exposure of the MF Scheme in a particular Industry/ies, Entry \ Exit Loads, Expense Ratio etc…Hence, the entire exercise is purely a statistical / mechanical model based, on the past track record of the respective MF Schemes.

This exercise can preferably be done every month as soon as the said web site is updated at monthly intervals. As per my experience, it gets updated very quickly, immediately after the month end, for which the VRonline team deserves a special appreciation. Now, I would like to request the VRonline team to provide on the web site the aforesaid relevant statistical data i.e. SR ,SD, Alfa, R’Square and Beta for doing the above exercise in respect of all the open ended Diversified Equity MF Schemes and also for all open ended ELSS MF Schemes irrespective of their age of existence and / or rating.

I, now welcome the experienced & knowledgeable readers to deliberate on the contents of the above theory in a most desirable manner.

THANKS!

Prakash P. Joshi.

E-mail:— ppj_2001@yahoo.com

Vile Parle (East), Mumbai 400 057

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Prakash, your way to find the funds is good but then it relies too much on past data which I don’t think is the best possible way to judge an entry point into the fund.

The clarity of this article is wonderful and commendable.The limit of sec 80c can be enhanced within a family by investing in the name of other members, when the main purpose is to save tax. For other essentials like security/child’s education/marriage and retirement, a comprehensive long term plan, sustained investment mix of equity/ term plan/ stocks/fixed income savings plan and risk mitigated and inflation proofed game plan is vital.It is obvious it needs to be tailored made to one’s age and requirements.However; sometimes its best to save and forget also.

Glad you liked the article Ajay and if your other family members are earning above the tax slab then only it makes sense to save taxation in their name.

Hello,

my selection would be canara robeco.however; i shall be much

obliged for your final assessment of the best three elss funds, with

sustained good results.

Ajay

Hi, i take different approach for investment and tax savings. I invest one lac within April and May in ppf, it takes care of the tax savings. Then I start monthly sip in funds like hdfc top 200, ft bluechip, idfc premier equity and diversify between market caps, fund houses.

Mansoor, tax saving getting completed in April and May is always great choice but then at times we tend to avoid it in that time frame. Glad to see that you have been following that and is able to execute that as well.

I am new to tax saving schemes and I got some new ideas from your post. Being a salaried employee for the first time, I have started to learn about 80C and other tax saving options. Need to revisit your article again when I need to give estimated tax saving into to my employer in the beginning of the next financial year.

Deepak, tax saving option for individuals doing business is same as well but don’t tell me you have not done any tax savings till date.

Dear Shabbir,

Nice article; but as you said in the article “On top of that the aim of the investment is not to build wealth and so I normally redeem my tax saving investments as soon as I can.”

Then why do people invest?

everybody has plan to have some hard cash or pool of fund to fulfill their needs like child’s education, buying home, marriage etc. If wealth creation, to fulfill dreams, is not the plan, than why invest. just to beat the inflation,

Moreover, a mutual fund whenever declare dividend, its NAV price drops by same ratio.

i am investing for last 7 years in ELSS for tax saving only in growth plans.

suresh

Suresh the idea is not to invest in 80C ELSS funds to build wealth. The main aim of this investment is to save tax and for investments, there are other better opportunities. So when it comes to saving tax, you primary goal should be to save tax.

So I invest in ELSS to save tax and I am fine with that. Now when the ratio falls by the same ratio but it also means you are liquidating your amount as tax free income and then you can use that amount to buy more tax saving ELSS funds saving more tax in that current year without actually investing any amount from your pocket.