We will find the best value-oriented mutual fund to invest in 2019. A new category for mutual fund investor that didn’t exist in 2018.

We will find the best value-oriented mutual fund to invest in 2019. We didn’t have the best value-oriented fund for 2018.

A mutual fund that can invest irrespective of the market cap in companies where the fund manager finds value is known as a value-oriented mutual fund. The advantage of investing in a value-oriented fund over other funds is – it invests in companies where the fund manager finds stocks price provides a value.

As an investor, the decision of choosing value stocks is with the fund manager. If he gets the study right, there are more chances of fund doing very well compared to others.

Also, check out: The Best Large Cap Funds To Invest in 2019 & The Best Midcap Fund to Invest in 2019.

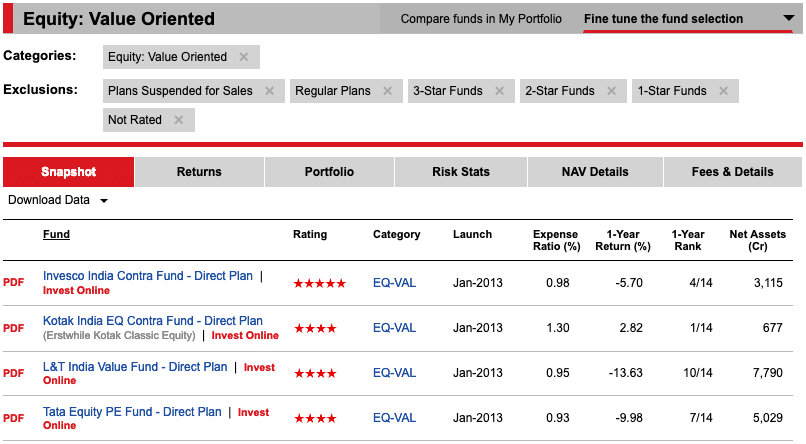

Top Value-Oriented Funds

The process we will use is- from the best rated direct value-oriented funds by VRO, we will choose the funds that can outperform.

Best Value-Oriented Funds To Invest in 2019

We nail down to a fund that has given stable returns in the volatile market of last year.

Kotak India EQ Contra Fund

Kotak India EQ Contra Fund has managed to provide positive returns where all the other funds have given negative returns in this category.

Invesco India Contra Fund

If we have to select more than one fund from the category, it has to be Invesco India Contra Fund. Though the returns are slightly negative but not too much. On top of that, it has a very stable expense ratio in the direct fund as well.

Final Thoughts

In case you have not selected a better performing fund earlier or want to move to a new fund for any other reason (move to regular to direct funds). Don’t exit the investment in the old fund. Just stop the SIP and let the invested amount remain and grow over time in the old fund. Create a new SIP in the new funds.

As always this isn’t an endorsement of the above fund. The emphasis is on the process to select the best mutual funds using tools like ValueResearchOnline as and when you want to invest in 2019.

My view for stock market have a look

1. First early sign of stock market crash is increase in speculation activity in stocks and index.

Whenever there is heavy buying in futures – options derivatives , Only buying Index stocks which creates a bubble and the valuation of these stock are not justified with their earning.

2. Second sign of stock market crash is slowdown in economy.

Economy and stock market performance is directly prepositional. If country GDP growth is slow and unemployment is increasing, inflation is increasing it indicates the macro economy of country which is directly effect the stock market . Whenever there is a divergence in growth and stock market performance it will lead to the crash in future.

Thanks Sir for letting we awared about new value Funds. Kotak India EQ Contra Fund seems good as it has given positive return where as all the others fund seems negative. It will be always nice to invest in direct fund rather than regular.

Whatever today I have learned, this is because of your blogs. By today I have invested around 8-9 Lacs in mutual fund and still 26K monthly are being invested monthly in different-different mutual funds as SIP as per my understanding based on your blogs 2016-2018.Thanks sir..

The pleasure is all mine. Good to see you are building wealth your own way at your own pace and understanding things. It is the right way forward.