Is your portfolio bleeding in the current market fall? Here is a list of 40 stocks that every investor should invest in this fall.

My book talks about 3-dimensional investment philosophy for stocks – Invest in the Right stock, at the Right Price, and for the Right time.

We know this is the right time to be investing, but the question I keep getting in my inbox is, what are some of the right stocks? Here is one such query and I quote:

Every one talks about investing in the right stocks. However, what are right stocks? Can you share some right stocks to invest now?

And it is true. Everyone says this is the right time to invest in the market. We even discuss how to spot the bull run leader last week where we discuss the sectors, but as a retail investor, we need the name of the company to invest in.

Again, as a disclaimer, this is not a stock recommendation. I am yet again suggesting a process to find these right stock to invest. I found 40.

My favorite site for analysis is screener.in, and I have used it to find 40 wealth builder stocks.

Let me explain the query first and feel free to modify it as per your convenience.

- Sales growth 10Years > 10 AND

- Market Capitalization > 5000 AND

- Return on capital employed > 15 AND

- Debt to equity < 0.25 AND

- Dividend yield > 0.40 AND

- Promoter holding > 25 AND

- OPM last year > 10 AND

- Price to Earning > 10

Each line has a meaning and lets me dive deep into each and what it means

Compounder

Sales growth 10Years > 10 means the company has been able to generate a compounded annual sales growth of more than 10% for the past decade.

When companies can demonstrate strong sales growth for a decade, more likely, they will be able to withstand a year or two of no growth or even no sales.

Market Leader

Market Capitalization > 5000 means the company is big enough to be called the market leader. May not be a sectorial leader, but within the sector where the company operates, it may be the market leader.

The smaller companies may not be able to withstand the current market conditions, and so it is better to be investing in significantly bigger companies.

Efficient Use of Cash

Return on capital employed > 15 is a touchstone to test how well the company can use its cash.

We weed out companies who aren’t able to use the cash at a rate much better than the money market rate.

Saurabh Mukherjee, in his book, the Unusual Billionaire, has explained why ROCE and growth are the most critical factors to consider when investing.

Debt Free

Debt to equity < 0.25 does mean the company is practically debt-free.

Investment checklist, Business Checklist, or Fundamental analysis, everywhere I recommend avoiding companies with debt, and this time, it is no different.

Good Cash Flow

Dividend yield > 0.40 means the company has been paying dividends. I take it as the company has no issues with cash flow and is willing to share the profits with its shareholders.

Promoter Stake

Promoter holding > 25 means the promoters have a significant holding in the company.

My Rule of Thumb for Promoter Holding is it should not have less than a 25% stake in the company; otherwise, they can lose interest in the business. For small-cap and mid-cap companies, the promoter should have a much larger holding to fuel growth in the future.

Operational Efficiency

OPM last year > 10 means the company has an excellent operating profit margin. It means the company has a pricing power as well as can perform the operations efficiently.

Isn’t Dirt Cheap on PE

Price to Earning > 10. Investors generally prefer a lower PE ratio to invest in, but I have a different view.

The price to earnings ratio should not be meager but higher.

Sounds a little unconventional, but we are not investing for the next quarter or next year. We are investing in companies that are resilient to the current fall.

So once the Corona is over (whenever it is), the leaders will gain the momentum for sure.

The Stock List

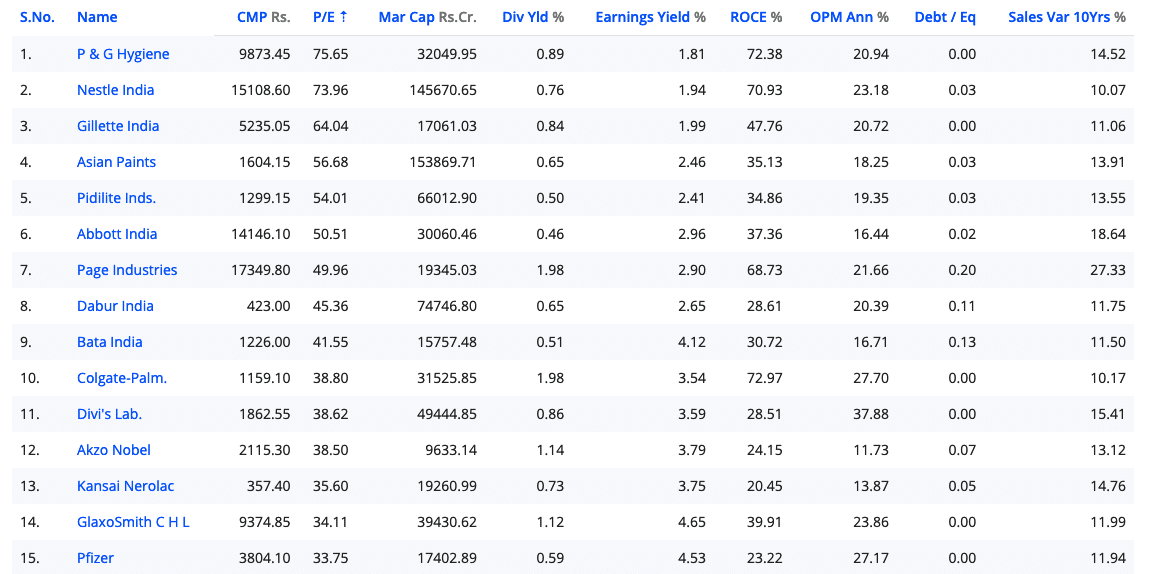

Click on the image to view the complete list of stocks at screener.in.

The list is sorted higher PE ratio at the top. The list will change over time, but here is what we currently have.

- P & G Hygiene

- Nestle India

- Gillette India

- Asian Paints

- Pidilite Inds

- Abbott India

- Page Industries

- Dabur India

- Bata India

- Colgate-Palm

- Divi’s Lab

- Akzo Nobel

- Kansai Nerolac

- GlaxoSmith C H L

- Pfizer

- Schaeffler India

- Sanofi India

- TTK Prestige

- Grindwell Norton

- CRISIL

- Marico

- Ajanta Pharma

- Vinati Organics

- Bosch

- Maruti Suzuki

- Indraprastha Gas

- Mindtree

- TCS

- Emami

- AIA Engg

- Eicher Motors

- Balkrishna Inds

- Natco Pharma

- Ambuja Cem

- Exide Inds

- Amara Raja Batt

- Bajaj Auto

- Tech Mahindra

- Deepak Nitrite

- Mahanagar Gas

The stocks like P & G Hygiene, Nestle India, Gillette India, Asian Paints, Pidilite Inds, Abbott India, Page Industries will fall. The price can even fall another 30, 40, or even 50 percent from here if the survival fears grip the world.

The investment is in the companies which can compound sales, are market leaders, efficiently managed, so on, and so forth. So when the dust settles, and I am sure it will, the question is when one should invest in stocks which can withstand the dust.

What is Financial Emergency?

What will happen if govt declared Financial Emergency

I don’t see it happening but even if there is something like this, I see it as an opportunity to invest further. The reason is simple, financial emergency will not last forever.

I can understand picking Nestle above HUL but to altogether omit HUL – there must be very strong reasons. Can you kindly share? Thanks

The sales growth of HUL is not that high as what I have set for the query in screener.

Hi,

Is there any specific reason that we hardly see any financial companies to this list? Why is that you have not used metrics like ROE and loan book growth for financial service companies?

Can we select in random just a few companies from this list out of every sector rather than selecting all the forty companies given that the initial investment (for retail investors) may not be as large as a PMS portfolio investor? Is this portfolio as a good as a Cofee can portfolio construct recommended by Saurabh Mukerjee?

Thanks and appreciate your valuable contribution.

Crisil and Indraprastha Gas would be my choice.

Abott got the nod for coronavirus testing. Uptick for Abott.

The 5Min Corona Virus Testing is by Abbott and not Abbott India. Just to be clear.

Thanks for the clarification. Nice Article.