The best strategy for saving tax is to invest with minimum locked in period and save maximum tax with minimum possible to zero investment.

Every year I have been sharing the tax saving options that I opt for. I always focus on very very simple principle for saving tax.

- Get the investment back in minimum possible time.

- Save maximum tax with minimum possible investment.

So let us see what tax saving options we can avail and see what best fits the above criteria.

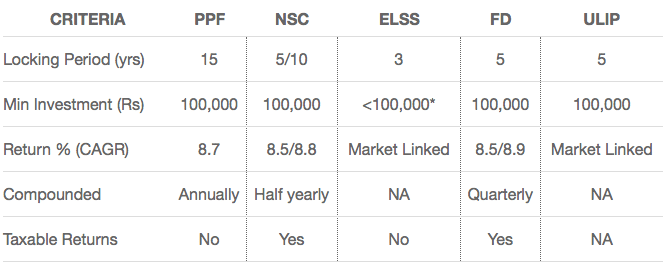

Tax Saving Investment Options

Looking at the above chart, we see that ELSS is the only option that has minimum locking period of 3 years for saving tax. The 5-year locking period tax saving options either has taxable returns or is an ULIP (More about ULIPs here). So the only investment option that suits my style of tax saving is ELSS (Equity Linked Savings Scheme)

Now we have seen that ELSS as best time criteria investment option. Now let us see how it is one of the best amount criteria option as well. It will also explain the * that you see in the above table.

Full Tax Saving Without Investing Full Amount

The limit under Section 80C for saving tax is Rs 100,000. It means if you invest anything upto Rs 100,000, you don’t need to pay any tax on the amount invested. So if you invest the full amount of Rs 100,000 and if you tax slab is 10%, you save Rs 10,000+ (+ is for CESS and other amount along with tax) but if you are in tax slab of 20% or 30%, you save Rs 20,000+ or Rs 30,000+ respectively.

So now we will see how we can save full tax and still don’t invest the full amount. Opt for “Dividend Option Payout” when investing in the ELSS fund that has a good track record of paying dividend each year but has not payed dividend yet.

Let us put the some actual numbers and funds. Last year I suggested and opted for HDFC Tax Saver Dividend Fund. I was not very comfortable investing and so had to wait really long to get that final investment done. It was on 28th March 2013 i.e. after the yearly dividend being paid out on 14th March.

But for the sake of our an investing example of lesser amount for full tax benefit, we take the NAV of 8th March. So on 8th March 2013 if

| I invested in HDFC Tax Saver Fund for | 70,000 |

| The nav of HDFC TAX SAVER – DIV PLAN was | 54.037 |

| Number of Units received would have been | 1,295.4087 |

A Dividend of 6 Rs was announced on 14th March 2013 and so I could have got back Rs. 7772.45 as Tax Free Dividend. So the net investment would have been 70,000 – 7772.45 = 62227.55. So with the investment of 62227.55, you get the Tax benefit of 70,000.

Note: I only need to invest 70,000 because I have two kids where the tuition fees paid helps me save tax under section 80C. If you are paying PF, your contribution to the PF becomes part of section 80C for saving tax.

Note: I missed the dividend last year but I am expecting dividend for the investment in next few weeks.

The Absolute Returns

The way I look at my ELSS investment is not always based on returns but still lets look at return on such investment.

| Invested in October 2010 | 92,000 | – |

| Received Dividend on 21 January 2011 | – | 8,066.56 |

| Received Dividend on 18 March 2011 | – | 4,033.28 |

| Received Dividend on 9 March 2012 | – | 4,033.28 |

| Received Dividend on 8 March 2013 | – | 6,049.92 |

| Withdrawn in November 2013 | – | 73,728.36 |

| Totals | 92,000 | 95,911.40 |

Not even average returns and just managed to break even in positively. Now put the same into the perspective of tax saving. No I am not talking about the tax I saved in 2010 which is normal for any tax saving investment options but the tax I will be saving this year.

- I made a loss of roughly 18,000 on my investment of 92,000, so a counter gain of 18,000 from trading in market will not be taxed.

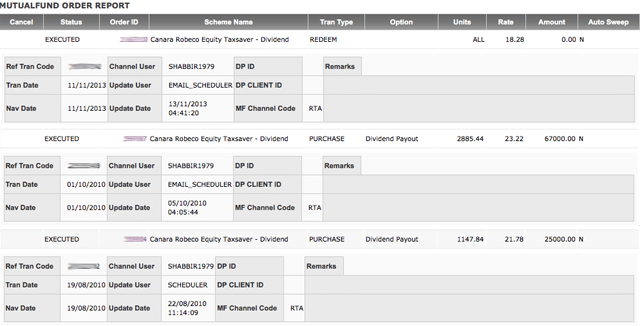

- The tax I will be saving this year without any further investment but just switching funds. 😀 I have withdrawn 78,000 in November from Canara Robeco Fund and may invest in few days time in Edelweiss ELSS.

My Top 3 ELSS Funds for 2014

I don’t feel comfortable investing with 3 year as locking period when Nifty is hovering around 6000. I have been waiting for couple of months now for a crash but I am not seeing the crack that I expect. Nifty at around 5500 has a good reason for me to invest but not at 10% higher than my comfortable level.

As of now the preferred fund is Edelweiss ELSS then ICICI Prudential Tax Plan Reg and then Franklin India Taxshield but as we approach March 31st, the preference can change based on how the market unfolds.

- Edelweiss ELSS

- ICICI Prudential Tax Plan Reg

- Franklin India Taxshield

Final Thoughts

Do you think this article will be helpful to your friend? Why not share it with them and help them out.

There is a different suggestion:

1. Enter into a monthly SIP in an ELSS for an extended period, say 10 years. Growth or dividend option does not matter.

2. Redeem monthly the investment amount each month after the lock in period to roll over the investment.

3. Gain from rupee cost averaging apart from other benefits.

There is a different suggestion:

1. Enter into a monthly SIP in an ELSS for an extended period, say 10 years. Growth or dividend option does not matter.

2. Redeem monthly the investment amount each month after the lock in period to roll over the investment.

3. Gain from rupee cost averaging apart from other benefits.

I have taken sbi magnum tax saver growth. So as per your article my returns will be taxable ?

Tax saving ELSS fund has a locking period of 3 years which is more than one year of minimum investment needed for returns in equity to be tax free and so any returns in ELSS funds is always tax free.

I have taken sbi magnum tax saver growth. So as per your article my returns will be taxable ?

Tax saving ELSS fund has a locking period of 3 years which is more than one year of minimum investment needed for returns in equity to be tax free and so any returns in ELSS funds is always tax free.

Hello Shabbir,

Thanks for the article, re-affirmed my preference to ELSS funds. I just had a question – Why not opt for growth plans in ELSS funds ? I suppose they will give superior returns over 3 years. In any case, one is mandated to stay invested for 3 years so market returns will mostly be good. Am I missing something here ?

3 years giving good returns in a locked in fund is something that at times may not work and with one objective, it is always better targeted. With saving tax, save tax and with other funds, you can always build wealth and returns. I prefer it that way Nick

Dear sir,

Plz suggest me best mutual fund for money growth.

I want to invest 10000/month. And I take the risk for equity market.

Chandan kumar, there are few more things I need to know before I can suggest you a fund. What is your time frame and what is your risk appetite. What are your liabilities?

Hi Shabbir,

It is a definitely very informative article. Thanks for sharing with us.

I would like to know, On what parameters you have narrowed down to these ‘3 Dividend Paying ELSS’?

Thanks,

Abhishek

Abhishek, the better funds are the ones that has performed better as well as have investment in sectors that I think will have better going forward.

Canara Robeco is there, yet to declare dividend. They declare in March and December every year. We can invest directly online. It is for your kind information. I am also short time equity trader. Can ur book help me in trading or investing as well as ur membership. Please guide.

Yes they declare the Dividend in last moments but then you can see why I have not selected that fund in the article itself. I have just came out of that fund.

Respected Sir,

I read ur article. It was very informative to me because I have planned to invest in ELSS . I was not knowing that Dividend option works well. Presently, I do not know, which is the best performing ELSS with Dividend option and yet not given dividend recently. If u guide and help in this matter.

Regards,

PRASAD MADHAV

Hi Shabbir,

You had made things clear long time back and I’ve followed your way since then. So I’m sorry, I don’t see anything new. Happy to have learnt this from you quite some time back. In the above comment, everything is Growth plan and I suppose you are against the same while coming to ELSS.

Your list seems good to me as always. No comments

Thanks

Naveen

Naveen, yes the idea behind the investment is not new but the way you can save tax without any investment is new because earlier it was with less investment and now with few years, I managed to make it complete tax saving without any investment.

Glad you like my list of funds where I invest into.

Hi Shabbir

Following was my list based on your previous blog

1.Edelweiss ELSS

2.ICICI Prudential Tax Plan Reg

3.Franklin India Taxshield

4. Hdfc long term advantage fund

But what i found was that for Ethical Investment ( islamic Shariah screening ) only 2 funds can be qualified ie

.ICICI Prudential Tax Plan

Hdfc long term advantage fund

I have invested 30,000 this year on 31-jan-2014 2013-14 In Hdfc long term advantage fund

and Already got dividend yield of 10.72 % ie Rs 3356 ..

It will be really good if you incorporate shariah compliaint investment or Tax saving .

for shariah based screening i used criteria mentioned in http://www.islamitijara.com

Azeez, I am not an expert at Shariah law and so I may not be the right person to suggests those funds which are complaince with Shariah law or not but yes your investment to save tax has been great.

Totally Agreed with you. Need not be shariah expert. Need to just evalute the fund based on the guidelines given in the above said website

Also we have BSE shariah index (S&P BSE TASIS SHARIAH INDEX)

This was just my suggestion, so that it will give added advantage to your profile as well as for people like me

Sure Azeez, will keep that in mind. Thanks for the suggestions.

how it is sharia compliant, I see ICICI prudential has portfolio of 26% in banking sector..?

Hi,

My Top 3 ELSS Funds for 2014 are gven below.

1) ICICI Pru Tax Plan (G)

2) Axis Long Term Equity Fund (G)

3) Canara Robeco Equity Tax Saver (G)

Nice list Soma, Axis long term plan was in my list as well because it has performed really well in last 3 years but then could not make it to the top 3 funds because it has less investments in Energy sector and my bet is it would do better in the next 3 years. Canara Robeco is one of the fund that I have just came out of and so will be in my list of funds next year.

Hi,

It is very helpful article. Thanks for sharing.

Based on my analysis, Edelweiss ELSS is not a good fund.