So many mutual funds, so little time. How one can identify the mutual funds that will perform better in future? A checklist to identify the best mutual funds

How to Invest in Direct Mutual Funds – A Step by Step Guide

A step by step guide to investing in direct mutual funds with an example of my investment of Rs. 50,000 along with why Zerodha’s COIN interface is an avoid

7 Vital Reasons Why Every Retail Investor Should Invest Every Month

7 vital reasons why retail investor who wants to build wealth should consider investing every month irrespective of the indices being at all time high

Price Vs Value – Explained Why Stock Trading at Rs50 Isn’t Always Cheaper Than at Rs1000

The stock trading at a lower price (Rs50) isn’t always cheaper than the stock trading at a higher price (Rs1000). We value the stock at a price and not for a value.

How Many SIPs Should An Investor Have?

Answering: What are the ideal number of SIP an investor should have? Should one have a different SIP for each investment objective? How many funds should one SIP in?

Market At It’s Peak – Should One Book Profit In The Long Term Portfolio of Mutual Funds?

Market is forming new high on a daily basis. Is it the right time to book partial profit on the long term SIP portfolio of a mutual funds or remain invested?

SIP or Lump Sum – Which Is Better Investment in Mutual Fund For 10 Years?

When I read this question the initial reaction is always SIP but when I compared the returns, I realized that it is not always SIP that is better.

The Best Gold Exchange Traded Fund or Gold ETF To Invest in 2017

I am all biased towards investment in equity but Gold ETFs can be considered as an asset class in 2017 for diversification for not so aggressive investor.

What is: Acid Test Ratio

Acid Test Ratio is a measure of the ability of a company to pay its liabilities using quick assets by converting them into cash in a very short span of time.

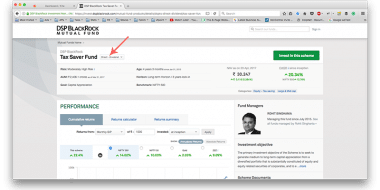

My Last and Final Portfolio Report and Update – March 2017

Why I added all my mutual fund position for tax saving in Feb 2017 to my portfolio and also share why this is the last and final portfolio report update.

- « Previous Page

- 1

- …

- 22

- 23

- 24

- 25

- 26

- …

- 56

- Next Page »