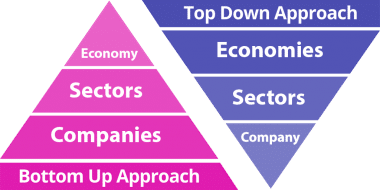

The top-down approach identifies the broadest option first and drills down to the sectors and companies. With the bottom-up approach, it’s the companies first.

How to Read Critical Information in the Annual Reports Faster?

What critical information to look in the annual reports before investing in any company and how to judge the management and the future outlook of the company.

ROCE – Understand Financial Efficiency of Management

ROCE stands for return on capital employed, which helps us understand the financial efficiency of the business and the management.

What is PE Ratio & Why It Is An Important Factor in Valuing a Stock?

Understanding the PE ratio and how to calculate forward PE ratio. Why the growth outlook doesn’t help even the long-term investors make money from the market?

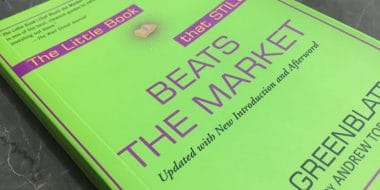

The Little Book That Still Beats the Market

The screener query to the Joel Greenblatt’s magical formula from the book “The Little Book That Still Beats the Market” along with my view on the magical formula.

How to Know if A Stock is Overvalued or Undervalued?

Is there any process to judge if the company is overvalued or undervalued? The answer is yes. I share my complete process to find out if the company is overvalued or undervalued.

Why So Many People Invest In Real Estate?

No financial advisor advises investing in real estate because it hasn’t performed as good as the equity investment. So why people invest in real estate? Why have the financial advisors invested in real estate?

7 Real Benefits of Investing in Mutual Funds Over Real Estate or Gold?

There is so much hype about the mutual fund as an asset class and so let us analyze to see if are there any real benefits of investing in mutual funds over other asset class?

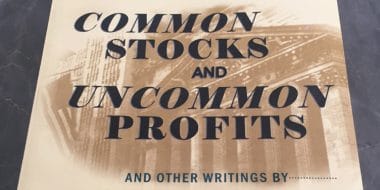

Common Stocks And Uncommon Profits And Other Writings Of Philip Fisher

Reading Common Stocks And Uncommon Profits once is not enough and have already read it twice. It is a book that should be read more than once by every investor.

10 Lessons I Learned Being in the Market for A Decade

The 10 important lessons I learned being in the market for a decade now since 2007 where I made a transition from a newbie to a pro trader to an investor.

Average Up Or Average Down – When One Should Do What?

Averaging down means buying more when the share price is down. Similarly averaging up means buying more when the stock price has gone up.

The Best Gold Exchange Traded Fund or Gold ETF To Invest in 2017

I am all biased towards investment in equity but Gold ETFs can be considered as an asset class in 2017 for diversification for not so aggressive investor.

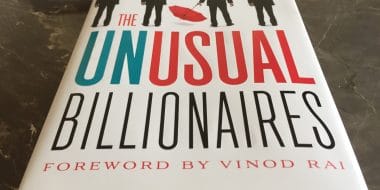

The UnUsual Billionaires – A Must Read Book For Investors & Entrepreneurs

Which stocks are covered by Saurabh Mukherjea of Ambit capital in his book The UnUsual Billionaires and how you can form your coffee can portfolio using the same analysis

What is: Exchange Traded Fund – ETF Vs Mutual Fund

What’s the difference between exchange-traded funds or ETFs and mutual funds? Which is the right one for investor investing for the short, medium and long term?

9 Investment Checklist I Follow Before Investing In Any Stock

Here is my ultimate checklist that I always follow before considering any business for investing.

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 8

- Next Page »