SEBI has mandated Mutual Fund Houses to come out with two varying options for all their schemes, namely Standard and Direct. The standard version of all mutual fund schemes will incur a charge which will be treated as an agent fee or commission and the direct plan is free from any charges.

3 Simple Tips to Make Your Money Work for You

It is not about how much money you make, but it is more about developing a habit of saving and investing your money to make it work for you in best possible manner.

Golden Rules To Picking Best Stocks For Newbies

You don’t need to be a financial expert to make money from market. This is what I have been telling everybody but one question that I get quite often in my mail as well as in Do It Yourself Technical Analysis Members Forum area is – How do I pick the right stocks from thousands of stocks that are being traded in the market.

Hidden Charges When Buying a Property in India

We all want to buy a property isn’t it? But have you ever wondered about the hidden charges when buying a property? Let me help you understand what are the hidden charges to consider when buying a property in India.

Is It Right Time To Increase Your Allocation To Gold?

Gold is always a safe option for investors and there have been lots of positives about investment in gold but do all those hold true in the current scenario? What should be your ideal allocation to gold? What are the major factor that attracts investment in gold? What would you opt for if you have an investment option as good as gold? Let me answer all these questions.

3 Lessons To Every Indian Investor Willing to Invest in 2013

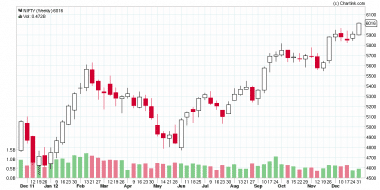

Year 2012 was full of surprises for the Indian investors. Looking at the weekly charts for Nifty in 2012 we clearly see it had something for every body be it trader or investor. Nifty has shown good support in 2012 around 4500, 4800, 5000, 5200, 5550, 5850 and so it does look like 2013 will be a year where there will be lot of support for market and so if you are keen to invest your money in 2013, there are three things that you need to know.

Why You Should Invest in Mutual Funds?

An article by Vinay Kumar for making his friends understand why it is important to invest in mutual funds and how mutual funds delivers inflation beating returns that not only saves tax under 80C but returns are tax free as well.

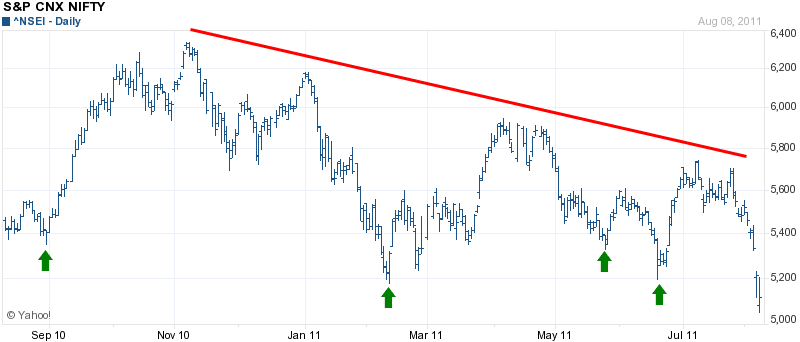

Why 4700 is Nifty Support and What to Expect From Market Ahead?

Why strong Nifty support is around 4700 along with what is an expected roadmap ahead in market with action items for each type of investment objective.

How I Formed My List of Forever Stocks

My list of forever stocks along with reasons for selecting those forever stocks as well as criteria for selecting forever stocks for yourself.

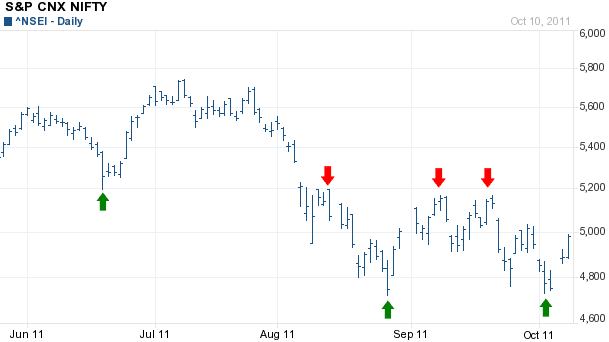

When to Buy In Market Crashes

Let me answering the questions that I am getting quite often these days which is when is the right time to buy in market crashes.

Understanding Signals of Market Crash & Sentiments of Retail Investors

Let us understands the signals that market crash is coming as well as understand the sentiments and reactions of retail investors. Are you being trapped?

Is Savings Bank Account Actually Saving Or Killing Your Money?

Do you withdraw money from savings bank account just before the need and not few days in advance to make few extra bucks for the money lying in your savings account?

Who’s Your Mentor – Biased Investor or Unbiased Non-Investor?

Who do you prefer as a mentor – slightly biased yet an investor in stock or unbiased yet no risk taken of his own money?

How to Invest In Mutual Funds Online?

There are many ways you can invest in mutual funds online. I will share the one that I use myself as well as other methods of investing in mutual funds online.

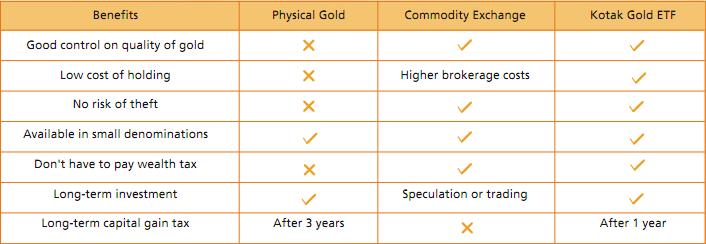

Physical Gold Or Gold ETF – Which is Right for You?

Gold ETF or physical Gold. Let me share positive and negative aspect of investing in each of them so you can decide which one is right for you.

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- 8

- Next Page »