Stocks and mutual fund positions added in August 2016 to my portfolio and plans for September 2016 and detail analysis of why I invested in Jubilant Life Sciences

A report I share each month on the progress of my portfolio of stocks and mutual funds with reasons and contract notes. I also share important lessons I learn along and plan for the coming month.

Note: This is not my complete portfolio of my position in the market and I have open trading positions, old investments prior to Jan 2016 and other small and micro cap risky investments as well.

My expectation was a correction in the month of August but the market has sideways movement in the complete month of August and this is also good for the market. The sideways movement will take a definite direction (up or down) in the month of September.

Though indices has not done much in the month of August, midcaps has done wonders and so is the performance of my portfolio. My total gain has crossed 6 figures now.

Zydus Wellness

It is one stock that is showing good performance on a quarterly number but share price was lingering around the same 800 levels because of not so good market conditions on 4th August and I was up for it. Added 50 more units of it at around 800 level. Contract notes here and detail analysis of Zydus Wellness is in January’s report here.

Jubilant Life Sciences

Jubilant LifeSciences is a new stock added to the portfolio in August after discussing with many of my readers on Whatsapp about investing in Pharma stock. Normally I look at the fundamental analysis for any company before investing but JLS has few exceptions and I would like to highlight them and share why I still considered JLS.

Fundamentals

Unique Business

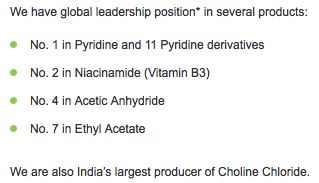

I prefer investing in a business which is unique and I don’t take any exception in uniqueness of the business I am investing. JLS is a market leader in niche drugs and this is what their product page states:

With customers in 85 countries and all key products and technology platforms has in-house R&D gives them an edge.

Why JLS is at lower PE than its peers?

There are certain issues in JLS which I think makes it trading at lower PE than it’s peers and so I would like to highlight them.

Debt levels

JLS had (note had and not has) very high debt but has managed to reduce the debt by almost 40% in last few years but the debt to equity ratio is close to 0.8 still now which is quite ok (just ok and not good) as of now considering it was above 1.4 few years back.

Flat Sales

Sales are flat at around 5800 Crores on a consolidated basis from 2014 to 2016. I will keep a keen eye in the coming quarterly results as I like business with ever growing sales.

Future quarterly results will help analyze if the company sales are growing. If sales don’t grow in a short span of time, I may reconsider my investment.

Loss in March 2015

JLS is in business for more than 15 years and is profitable in most part of their operations and I never like company making losses and promise to make profits in the future.

I need to know what made the company book a loss and JLS made a loss in March 2015 on balance sheet due to increase in inventory (In very simple terms they purchased more raw material than it was needed and may be used in subsequent years).

Why I considered JLS?

From the P&L accounts, it’s quite clear the focus of the management for the last few years has been debt. Debt is on the downward spiral and profits are on the rise despite flat sales. It means management’s focus is on raising productivity and capacity utilization as well as reduce debt.

I expect an increase in sales and still maintain the higher profit margins to ultimately bag bigger profits.

Technicals

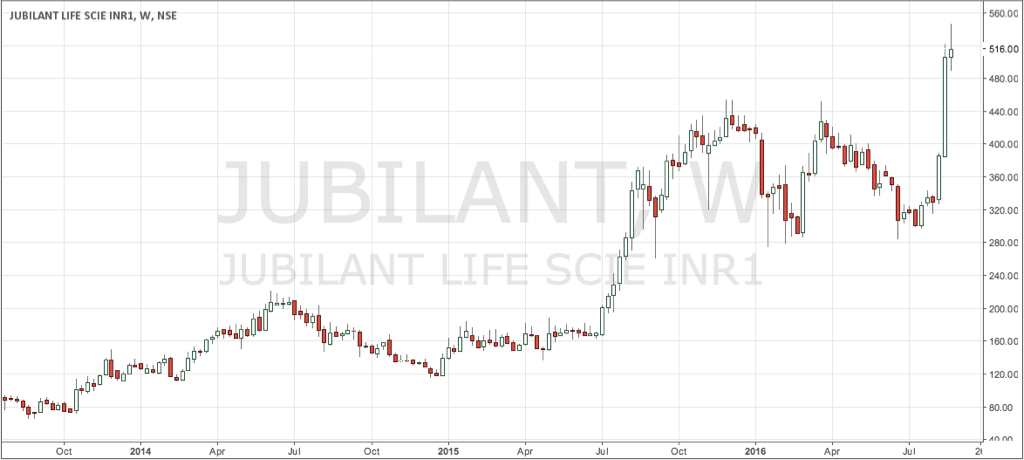

Weekly chart of JLS show a very strong support around 280 levels.

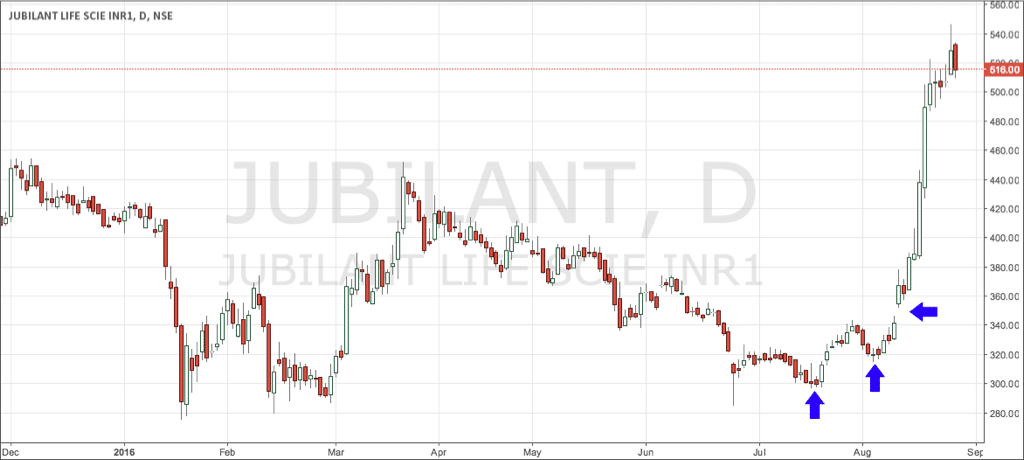

And daily charts of JLS shows the stock climbed from 280 with intermediate support being formed along at around 300, 320 and 340 gap.

So my ultimate stop loss for this investment will be 280.

My Position

I had booked profit in my old portfolio so I purchased JLS 300 units at around 447 level because it was available at 15 PE multiples. Contract notes here. I may accumulate more into this stock if I see a goodish bit of dip but may not consider above 500 for sure.

Portfolio Update

Increased in portfolio investment from ₹4,61,150 to ₹6,34,231 An increase of ₹1,73,081 in the month of August. Let us now see the performance of the portfolio we have built so far.

Profits Realized

- Infosys: 780 (60)

- Average Buy: 1165

- Average Sold: 1178

- Tata Steel: 9,200 (400)

- Average Buy: 280

- Average Sold: 303

Total Profit Realized: 9,980

Dividends

- Zydus Wellness: 325

- Larsen & Toubro: 365

- Jubilant FoodWorks: 250

- Britannia Inds.: 900

- Birla SL Tax Plan: 8,581

Total Dividend Received: 10,421

Stocks

- Britannia Inds. 1,55,725 (45)

- Invested: 1,18,731

- Profit+Dividend: +37,894

- Jubilant FoodWorks 1,17,435 (100)

- Invested: 1,09,503

- Profit+Dividend: +8,182

- Jubilant Life Sciences 1,61,325 (300)

- Invested: 1,34,636

- Profit: +26,689

- Larsen & Toubro 30,259 (20)

- Invested: 24,814

- Profit+Dividend: +5,810

- Zydus Wellness 1,75,800 (200)

- Invested: 1,61,847

- Profit+Dividend: +14,278

- Total Stocks 6,40,544

- Invested: 5,49,532

- Profit: 92,852

Mutual Funds

- Birla SL Tax Plan-D: 1,13,264

- Invested: 1,05,000

- Profit+Dividend: +16,745

Overall

- Portfolio: 7,53,808

- Capital Invested: 6,34,231

- Unrealized Profit: +99,176

- Dividend: +10,421

- Realized Profit: +9,980

Unrealized profits are just under the magical figure of 1 Lakh and all of my investments are in the green now with annualized returns above 30%.

Plans Ahead

We have very little investment in L&T and I see the price of L&T at 1400 levels which is quite attractive for investment but had no plans to invest more in August.

Will try to invest in L&T soon but I plan to focus on Tax Saving Investment in the month of September and will try to stick to it.

I am over invested in the last 8 months than I initially planned but as I have booked profit in an old investment, I am ok with it.

Portfolio returns are stellar so far but such good returns cannot continue and I am prepared to take some correction in September but have no plans to book any profits whatsoever as of now.

Over to you

If you have any questions or comments share them in comments below and I love to respond to them.

Jitu,

Yes I follow screener.in and I am aware of the pros and cons and the way they have book value in pros and cons.

So first thing is book value is not percentage but its times of book value. So VGuard is trading at 11.60 times its book value and not 11.60% of book value.

First book value is the amount of cash any company has and so if any company is trading under 1 book value means it is trading below the cash level the company has which can be used as margin of safety when investing in those companies but it also means that they have issues with business growth and are not able to find good investment opportunity in their business for cash they have.

Rest if the company is trading too many times its book, it may be over valued or anything that a business may offer in next few years is already priced in.

Hope that helps.

And yes those are my other web properties.

Thanks

Shabbir

Sorry that’s typo from my end.

Thanks a lot shabbir sir for prompt revert, and this answer is quite convincing to me. Apart from this i got below information from one of your blog, which helped me to understand more about this –

Ratios and Numbers

L&T is available under 25 times its current year’s earnings. The sales growth for this company has been from 52 thousand crores to 92 thousand crores from Mar 2011 to mar 2015 on a consolidated basis. That’s more than double and you cannot expect anything more.

The company has debt under good control with debt to equity ratio is just 0.33.

In the current market correction, it is now available at under 3 times it books whereas it used to be trading at 5 times its book.

As usually how much should be the ideal BV of stock? or its differ from industry to industry.

—————————————————————————–

While browsing your other article, i got to know as and when you got good chance you had added Infosys @ 1205 even, but what made you not add this @1035 or below current price, just few negative news BREXIT, RBL project they didn’t received and bad quarter result. But fundamental are very strong compare to peers.

Why i am emphasizing on Infosys, i am myself also fan of this stock. Many losses i recovered from this only, so just thought to share with you before adding more at current low price. You might have some strategy towards this particular stock. I am from IT, I closely read article about their upcoming projects, strategies and Management. As of now nothing much Negative though.

Please share your thoughts as and when feasible 🙂

Many thanks,

Jitu Khatri

Jitu,

I added Infy at 1205 and I was out of it not because of BREXIT but because of growth outlook the company will be showing and you can read about all my view on why I exited INFY here – http://shabbir.in/wealth-building-portfolio-jul-2016/

Now coming back to why I am not adding them is opportunity costs. We all have limited amount of money and so we should invest where we see more growth. I don’t want to be making a very diversified portfolio but have focused portfolio where my investment will not be in more than 8 to 10 stocks and the amount invested in each will be high. If I want to be doing diversified investment, I can always go for a mutual fund.

Again my idea was to invest almost 5L in each of those stock as well but at the rate (50k per month) I am investing, it will take me 8 to 10 years to complete investments in them. So to speed up the process I also have plans to switch from some of my old investment to some of my wealth building portfolio stocks and remain more focused in my investments and reduce the number of stocks as of now.

So I have to let go some of the stocks and INFY is one such stock which is good if you have the funds and remain invested and remain put with your investment.

Hope that helps.

Thanks

Shabbir

Hello sir,

Hope you are doing good.

You are holding SL birla tax planner , comparr to Reliance tax saver and Tata tax saver.

Can you please assist what’s your view on this.

The 1 year return of Birla SL is 14% compared to Reliance and Tata India tax saver is 17%. So yes they have outperformed Birla SL.

Hi Shabbir sir,

Heads up –

2 of the question mention below, have been already addressed by your previous blogs, and i am satisfied with the answer.

MF Related –

http://shabbir.in/faq-sip/

Broker related –

http://shabbir.in/review-of-all-stock-brokers/

Please answer the other question at your convenience.

Thanks a ton in advance 🙂

Many thanks,

Jitu

Hi Shabbir sir,

Few consolidated question, help to address please as per your feasibility and time convenience –

Ideally stock should be how much time of its book value?

I wanted to stay invested in mutual fund for at least 3 years; there are many MF in market not sure about charges, performance. However past performance is not assurance about future. I am just asking from which one is better, since i have not started in any of them (Equity, Debt and Balanced, how about Birla SL the one you are holding)

About zydus wellness, is this the good time to stay invested compare to competitor like Shilpa Medicare and Ipca laboratories? This question just came in my mind, because you are holding it still from 800 to 885(I read detail report fundamentals and everything you mentioned in Jan report),as per your report Clearly an indication that 800 is a major support and 900 a breakout level.

From your contract note, i got to know you are using Sharekhan broker, isn’t it costly compare to zerodha? RKSV? Any other reason please share.

Infosys is in your forever stock list, although it’s trailing low – in your September portfolio I can’t see, any specific reason sir? US election? Brexit I mpact? etc

I am unaware about technical analysis, what does this W patter for Zydus wellness mean, you have emphasized.

How do you track/ Decide which gives you very awesome dividend along with appreciation. As mentioned below –

Zydus Wellness: 325

Larsen & Toubro: 365

Jubilant Food Works: 250

Britannia Inds.: 900

Birla SL Tax Plan: 8,581

Is this the right time to invested in Birla SL Tax Plan”- Since i am also working individual, tax saving is the concern as well.

Thanks a lot in advance sir, for the information all you share and your valuable time.

Many thanks,

Jitu khatri

Jitu,

That’s an awesome comment and I like it so much and in such detailed that I have shared with you an invite to join out community for free.

Now coming back to your questions let me answer them one by one

Book value: It can be anything. Its like asking what should be the price of a car. Alto and Nano are available under 5L and there are cars which costs 100 times more than those but then car is a car.

Similarly some business can have better return and more pricing power and so may trade at higher valuations and book value than others.

Zydus Wellness: I don’t see any competition when it comes to products of Zydus like Sugar free sweeteners and what you have mentioned are pharma companies. Can you clarify how you see those companies as competition?

Infosys: Slow growth outlook and I see Indian centric stocks will have much better growth.

W: Technicals are something thats tough to explain in a blog comment and I will recommend you my eBook (Some self promotion 😀 )

Dividend: I don’t invest based on dividends but I like small amounts of money back in my account. On top of that, it helps me keep things check that company is not having cash crunch.

Tax: Yes I will go with the other Birla SL tax plan as returns are quite impressive.

Hope it helps.

Thanks

Shabbir

Thanks a lot shabbir sir for detail answer and invitation for your community.

Regarding technical Analysis, I agree with your point and most of my basic doubt is addressed by your blog –

http://shabbir.in/technical-analysis-fundamental-analysis-or-both-when-to-choose-what/

After reading several blogs, I has to have to order the Ebook, Just now i tried to ordered but in my company back bone due to security issue its not getting opened, I will order from my laptop in evening. what realized me to order that book, example you have mentioned in your blog for Titan.

coming to the point what made me ask you the question regarding book value, while browsing on screener.in , they mentioned two section pros and cons – i am mentioning extracted information below –

EXAMPLES –

————————————————————————————-

V-Guard Industries Ltd

Cons:

– Stock is trading at 11.16 times its book value

————————————————————————————–

Snowman Logistics Ltd

Cons:

– Stock is trading at 2.60 times its book value

————————————————————————————-

Rural Electrification Corporation Ltd

Pros:

– Stock is trading at 0.78 times its book value

– Stock is providing a good dividend yield of 7.17%.

– Company has been maintaining a healthy dividend payout of 23.65%

Concern –

If you see above in case of V-Guard Stock is 11.16 % of book value they mentioned in cons, in case of sun pharam stock is trading at 2.60% of book value they mentioned as cons, but REC LTD stock is trading at 0.78% of book value and this company provides healthy dividened as well.

Does that mean that company not having growth(Saturated business), only provide divined to stake holders? and due to that their stock is trading at low numbers of book value.

Apart from that sir, while browsing your articles i came across few more blogs manage by you, awesome initiative loved it – Definitely recommend same in my circle

http://imtips.co/

http://www.go4expert.com/

http://www.mbaguys.net/

Regards,

Jitu Khatri

Good Pick. you can add Century Enka Also in your profile.

What is the recommendation based on because I don’t see the business to be unique and is Nylon & Polyester Yarns producer.

Good business until and the company is profitful. Good dividend payer of more tha rs 6. Also good EPS. Decent management.

Don’t track that stock and so will not be able to comment much but numbers looks ok to me.

thank you sir, if you have any time just go in detail of that stock and pls inform.