Stocks and mutual fund positions added to wealth building portfolio, plans for the upcoming month along with portfolio performance and lessons learned.

A report I share each month of the progress to my wealth building portfolio of stocks and mutual fund position added with reasons and contract notes to remain fully transparent. I also share the important lessons I learn along with the plans for the upcoming month.

In February, I invested majorly in Tata Steel, very little in Infosys and rest in Birla Sun Life Tax Plan mutual fund.

Tata Steel

In the month of Feb, my plan was to mostly invest in Tax saving ELSS fund but market gave such a great opportunity in Tata Steel that I decided to delay tax saving investment.

11 Feb 2016 when Sensex was down by 800 pts and Nifty by almost 250 I purchased metal sector Tata Steel in the closing hour of trade. Contract notes here. If you would like to read the technicals and fundamentals of why I preferred Tata Steel, you can check my February 2016 portfolio update.

Metal sector gloom and doom is known to everybody in market but in one month Tata Steel has given me a return of 30%. Though it feels good as far as performance of portfolio is, I would have prefer Tata steel to not run so much and provide me more opportunities to invest more in this stock at lower levels of under 250 but above 200 support zone in next few months.

I will keep a keen eye on it and hope it corrects in the results season the where result is expected to be subdued and hope Tata Steel to remain in correction mode for the next quarter or so where we could invest more.

Infosys Accumulation continues

Correction in Infosys has never been too sharp and so is the up move and so it is one of those stock that you should always be accumulating and I added yet another 5 units of Infosys on 7th Feb 2016 to my wealth building portfolio. Contract notes here. Again the fundamentals and technicals of Infosys are shared in my February 2016 portfolio update.

Tax Saving ELSS

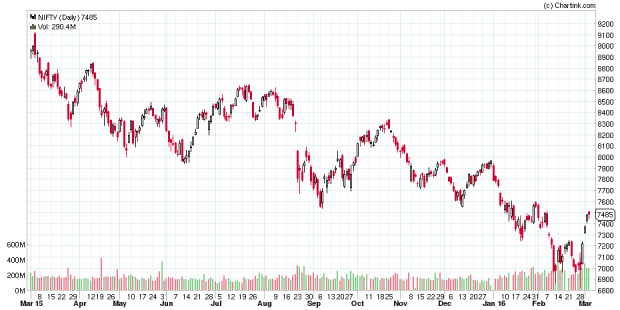

In Feb I wanted to invest majorly in Tax Saving ELSS Scheme but market unfolded in such a manner that I had to make choice of investing in Tata Steel at 230ish levels which was above the major support levels of 200 or investing in index based ELSS mutual fund with Nifty forming a lower top lower bottom Since it touched 9100 and was cracking all support levels and formed a new low of 6869.

The obvious choice was Tata Steel.

Still I allocated 40% or Rs 20,000 of my total investment in Feb to an ELSS mutual fund.

As always, I prefer to invest in dividend heavy fund to save Tax so I can invest less and get full tax savings.

I opted for Birla Sun Life tax Plan as they have been giving very good dividends and performance of the fund is great as well. Order details here.

Portfolio update

Performance of portfolio we have built so far.

Stocks

- Infosys: 35,120

- Invested: 34,069

- Profit: +1,051

- Tata Steel: 57,710

- Invested: 46,822

- Profit: +10,888

- Zydus Wellness: 35,015

- Invested: 43,423

- Loss: -8,408

- Total Stocks: 1,27,844

- Invested: 1,24,313

- Profit: +3,531

Mutual Funds

- Birla SL Tax Plan-D: 20,446

- Invested: 20,000

- Profit: +446

Overall

- Portfolio: 1,48,291

- Invested: 1,44,313

- Profit: +3,977

Lessons learned

Zydus Wellness

It was wait and watch in the last month and I continue to hold the same view. It has formed a good support at above 600 which is also a long term support but I would like to see it being tested more than once and holding before accumulating more into it.

Investing too early in a month

I am accumulating Infosys slowly but I invested too early in Infosys in the month of Feb and could have managed better price if I could have remained more systematic in my approach.

What’s next?

It has been a roller coaster ride in the market where we have seen Nifty touching 6825 and 7506 in the same week. The runup in the market was so quick that I decided to remain cautious.

I plan to invest in ELSS tax saving mutual funds and there will be very less choice of delaying my investment in March. So a moderate correction in market from 7500 Nifty levels and I will invest in Birla SL Tax Plan.

Over to you

As always I’d love to respond to any questions or comments that you may have. Thanks!

Charts by chartink.com

Hi shabbir ,

thanks you very much for sharing in detail .This stock how many years you are planing to hold approxmimately .

More than 3 years for sure @Muthukrishnan Sambandam:disqus

Hi Shabbir… I have following your articles from quite some time, but replying to your post for the very first time. I like your style of investment. I also follow pretty much similar style in my investments. I take short term cues from their technicals and take that as as opportunity to accumulate in sound business. I give lot of emphasis to promoters with exceptionally great track record of managing the business. If management is great, I don’t even mind giving little premium to that. That being said, I then look at valuations (DCF, multiples etc). Usually businesses which are managed by quality management is usually aggressively valued. If some for short term technical reasons, I see decline in their prices, I usually start accumulating those stocks.

Coming back to you stocks, Tata Steel is definitely a great quality business gong thru painful time due to the commodity crash. This is one reason, I have not considered it into my investment radar. But I do agree that, from a little long term perspective, It can be even be a multibagger.

Regarding Infosys, it is again an undisputed leader in IT space (by the way, I work into IT… n I believe, u r into IT too, if I can recollect from some of ur past posts). I am also invested in Infosys like you are. I plan to increase my stake in Infosys gradually.

Below are my stocks from my very very long term portfolio 🙂

Stocks Quantity

Asian Paints 134

ICICI Bank 202

Axis Bank 308

Force Motors 114

Gebriel India 241

Lupin 109

Maruti Suzuki 6

Sun Pharma 141

Tata Motors 143

Motherson Sumi 638

HDFC Bank 7

HCL Technologies 188

Colgate 30

DHFL 298

ITC 228

HDFC 28

Britannia 19

Aurobindo Pharma 139

Infosys 31

I am accumulating more in the above businesses as and when I get opportunity.

I have plans to add cement sector, Infra, Defence (I have no stock from any of these sectors)

Love to hear comments, if any.

Thanks

Jameel

Jameel, Glad I could get you to comment on my blog.

Coming back to the process that you are following, I think it is great and the best process to build wealth. Yes Tata Steel and Infosys has been my pick currently along with Zydus wellness as well.

Coming back to your list, I think you are too heavy on certain sectors like in bank I see you have Axis, ICICI and HDFC and I would prefer to consolidate on the one that I think is the best.

In automobiles I see you are missing Hero moto corp and is that intentional and if it is can you share why?

I would avoid ITC as I don’t like company profit is always a discussion for taxation.

Rest everything looks great and Gabriel India is something I did not had in my list of stocks and so have added for tracking and future investments.

Hope it helps.

Shabbir, Thanks for your inputs in my portfolio. Well I agree that, I have multiple banks in my portfolio and there is a reason behind it. I am not just looking for diversification across sectors, but within

too, and that is the reason why you might see multiple businesses from

the same sector within my portfolio (banking is one which you were able to spot). This approach so far as given me

decent protection of my overall portfolio may be due to company specific

headwinds which always exists and unavoidable, no matter how smart one becomes (my personal exp). E.g. recent volkswagen

issue with Motherson sumi, Nestle’s maggi issue. I am sure, you would

agree with me with the fact that, these businesses (MSSL and/or Nestle)

are leaders in their respective sectors, but due to recent issues, their

stock prices had cracked. This is where I am trying to mitigate the

risk of not betting on one single specific business.

Coming back to your point about Hero MotoCorp, well, it is very much on my radar, but have not been able to grab it yet. Any bad day in market and a meaning full correction in Hero moto Corp, I will definately shop for it. Eicher is another business which I am very closely tracking (though I don’t own it yet) but it seems like every single day, it is being more and more costlier. Even though demand for their product continues to increase m-o-m, q-o-q, y-o-y. If India Inc earning improves going forward (which I am quite hopeful it would), eicher’s earning might explode and what i looking costly today might look cheap. I understand, there are too much of assumptions here and that is why I am Eicher with both the eyes open 😀

Regarding your comment on ITC, well I agree to all the points you mentioned regarding taxation, I still like management and their aggressive plan to get into FMCG business with a bang by FY 2020. If I purely look ITC from FMCG perspective, it looks little cheaper among its peers. I understand ITC has long way to go as far as building up their FMCG business is concerned. Look at Dabur, HUL etc they are way too aggressively valued. I cant’t even touch Dabur HUL etc. ITC Management is vary much capable of turning the business into a full blown FMCG business even though it is not an easy job by any standards. Lets see how it pans out..

All the best to your portfolio building exercise 🙂

Regards

Jameel

Hi Shabbir,

I thought of sharing a thought on your portfolio since I was going through it. I feel you should think about considering sugar companies. They are the ones which are right at green spot for spurge. In fact they have already started and I am delayed by a day. I just thought of sharing this view so that you can be benefited if your analysis convinces you because you have been caring for others by sharing your knowledge. Just thought of giving something back to you.

All the best

Regards

Hi John,

Glad you like what I share and also I am glad you found my articles caring and helpful to you.

When you are building a long term portfolio with views of 3 to 5 years, you should avoid news based sectors and focus on stocks that can do well in those time because of the fundamentals of the companies. Sugar sector is more of a technical play.

On top of that, I invest in stocks which has a very unique business proposition and so I don’t see anything unique about any particular stock in the sugar sector. Apart from that investing in stock based on govt intervention is avoided. You can see all the points of my fundamental analysis here – http://shabbir.in/fundamental-analysis/

Sir, that’s why large cap stock is good for investment…. And averaging is good for invest..

Sapan, I think you are trying to read between the lines and there is nothing like large cap that is good for investment. ICICI Bank, SBI Bharti Airtel and Reliance Industries are all large cap.

It is not about averaging but it is about buying in staggered manner that is food for investment.

In fact Infosys is also large cap and so the profit in Tata steel cannot be generalized as averaging or large cap only. I would even prefer to not have such profits when I am just starting to build my portfolio as more time it takes to get higher, more chances I have to invest more. The point also is it should not crack support which Zydus did.

Sir, you are right but my question is that those who

Are Are want to averinging each month like sbi at this level, for one year or one and half year… 30/share per month , then really it is good for long run … It touches 360…also number of trade is not not important but butin four to five years only one to to proftoable e trade is very important.. For those who wants built long longterm wealth…

Yes that is quite acceptable but then you have to be selecting the right stock as well.

Reliance Industries or Bharti Airtel has not done anything in last 8 years. You may not loose money but there is no gains either. Read – http://shabbir.in/long-term/