When I read this question the initial reaction is always SIP but when I compared the returns, I realized that it is not always SIP that is better.

When I read this question the initial reaction is always SIP but when I compared the returns, I realized that it is not always SIP that is better.

Why SIP?

SIP or systematic investment plan has multiple advantages and it is one of the preferred methods of investing for Indian retail investors.

- Habit of Regular Investing – Helps in building wealth by making investment a habit. It is tough for some people to invest large money in one go but isn’t so tough to be investing a small amount every month. Slowly over time, capital invested increases and investor develops a habit of investing.

- Rupee cost averaging – Rupee cost averaging or RCA is one of the biggest advantage of SIP investor. Investor ends up buying more units when markets go down and fewer units when the market goes up which nullifies the ups and downs of the market. As more units are bought for the same price when market was down, it pays off many folds when market rises.

- Compounding effect – As the time given to investment increases, the wealth accumulates at an accelerated pace because of compounding effect and higher corpus is accumulated at the end of the tenor.

Clearly, it is one of the better methods of investing in equity markets but what one should do when he or she has a large chunk of money lying in the bank account?

Compare to Lump sum

When your view is 10+ years, markets are never down for such a long period of time.

In the history of mutual funds, there has never been a 10 year period when mutual funds have given a negative return. In fact, mutual funds outperform in the long run making the lump sum investment a better choice.

The biggest advantage of lump sum investment is, more money remains invested in the market for a longer period of time providing more equity exposure to beat returns from SIP method.

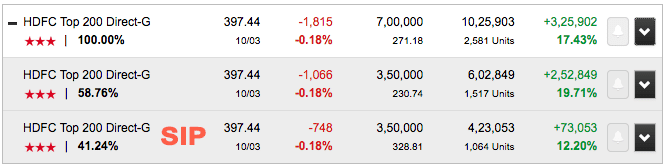

Let us see how a SIP of ₹10,000 for 35 months when compared to lumpsum investment of ₹3.5L 1st March 2014 pans out.

Large cap fund

Let us select one of the best large cap fund of 2017 for comparison.

12% compounded annual growth rate or CAGR for SIP investment and compare that to a lump sum and it provides close to 20%.

Percentages are fine for comparison and charts but corpus value can’t be neglected. ₹6L+ compared to 4.23L

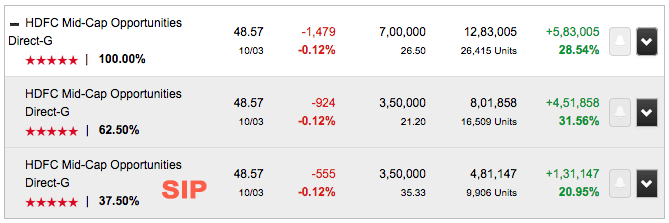

Midcap Fund

Now let us see similar investment for the best midcap fund of 2017.

Again lump sum investment outperforms by 31% CAGR when compared to only 20% CAGR in SIP and corpus of 8L when it is under 5L in SIP.

SIP Vs Lumpsum?

There are 2 main reasons for the lump sum investment to outperform.

The first being the most basic which is more amount of money is exposed to equity investment for a longer period of time giving much better returns.

What I mean is at the end of the first year, only 1.2L is invested in equity for SIP investor. Compare that to a lump sum and it has its full corpus exposed to equity which allows the lump sum investor to outperform.

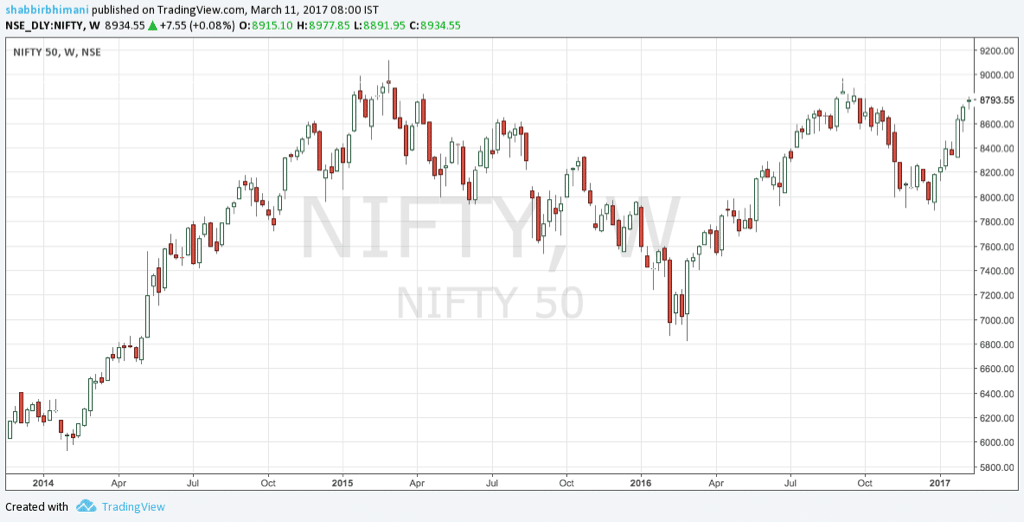

The second important factor for such an outperformance is the market. It has gone up quite a bit from the investment date of 1st March 2014.

So let us make the investment date as 2nd March 2015 instead of 1st March 2014. 2nd March 2015 is when Nifty hits its peak of 9119.

Clearly SIP outperforms in both large cap and midcap funds.

Key Observation

There are couple of key observations that we have

- When market is going up, lump sum outperforms SIP returns.

- When market is sideways, SIP returns outperforms lump sum investment.

I am not here to compare SIP Vs lump sum investment and conclude what works and what doesn’t. We are investors and would like to take the best of both methods of investing to build wealth.

Practical approach to Invest?

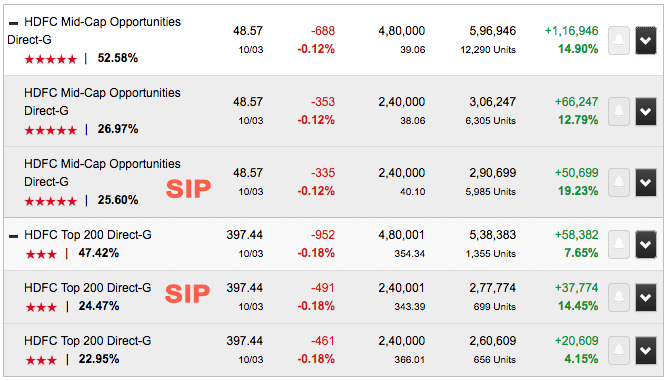

In a large cap fund, we invested a lump sum amount at the market peak. As of today 12th March 2017, we are yet to cross that peak in Nifty but the fund is giving more than 4% CAGR tax-free returns.

Adding SIP to the same fund, the returns are above 7% CAGR.

Shorter time duration with flat market and invested in a large-cap fund with large part of our investment at the peak of the market and yet we managed a 7.5% CAGR when we split the investment into SIP and lump sum investment.

Applying the same to a midcap fund return is 12% CAGR to lump sum investment and with a SIP, the returns are close to 15% CAGR.

So if you have an option to invest a lump sum and has a long-term view, it is always advisable to let the money remain invested in an equity fund.

For lump sum investment, the best an investor can do is split the amount in 3 to 4 tranches over a period of 6 months or create a large SIP for 6 months.

Nice & informative article . I also felt SIP ONLY is not good for wealth creation.Wealth creation is slow ONLY with SIP.

So what is the right time for lump sum and SIP ? Ideally lumpsum shd be when market is down but timing is not possible. So how to execute lumpsum amount.

Let say I have 15 lac and want to invest in Mutual fund. what should be startegy for lump sum investment if I want to invest in 5 MF. 3 lac in each fund .

50K monthly per fund investment for over 8-10 mnths. It wont be risky rite?

Let say market goes down after 8-10 mnths and we have consumed 15lac already then it will take some time even to see positive returns .

Yogesh,

You are assuming the perfect bad timing of market tanks after you are fully invested and even if that is the case, some part of your money has already grown in the past 6 months due to market rise.

On top of that my suggestion will be to use mix of SIP and lumpsum and so ideally you can put 10 to 12L or 70% to 80% as big SIP and then use the small SIP for a more longer period of time. Again don’t take my words because I am an aggressive investor and if you aren’t you can reduce the % as per your risk appetite.

Hope it helps.

Well miare bluechip and DSP black rock stopped taking lumpsum so I think putting large SIP in these month would be good !

Yes. That should be a good option

Shabbir, this is quite an eye opening for me because I always preferred a SIP method even when I had funds to add little more.

Actually it was an eye opener for me as well and even STP (systematic transfer plan) is recommended by others and that too can’t beat lumpsum investment.